Early payment income tax discount

2005 amendment introduces a tax discount to encourage taxpayers receiving self-employed or partnership income to pay tax in the year before they pay provisional tax.

Subpart MBC of the Income Tax Act 1994 and subpart MBB of the Income Tax Act 2004

Introduction

A 6.7% discount of tax has been introduced to encourage individuals who begin receiving self-employed or partnership income to pay tax voluntarily in the year before they begin paying provisional tax. This will relieve the financial strain they face when they begin paying provisional tax and have two years' worth of tax payments to make, namely, income tax for the prior year and provisional tax for the current year.

Background

As part of the government's growth and innovation strategy, proposals were considered to reduce the costs faced by small businesses in complying with the tax system. One such proposal involved providing a discount of tax to individuals who voluntarily pay tax in the year before that in which they are required to pay provisional tax, thereby aligning the payment of tax with when income is earned. The proposal aims to reduce the number of taxpayers who get into debt with tax payments and thereby reduce the compliance costs incurred.

This proposal was included in the government's 2003 discussion document "Making tax easier for small businesses". Significant support was received for the proposal, from submissions to the discussion document and market research undertaken with small and medium-sized businesses.

Key feature

New subpart MBC has been added to the Income Tax Act 1994 and new subpart MBC has been added to the 2004 Act. They provide a discount of tax to individuals who begin receiving self-employed or partnership income, to encourage them to pay tax voluntarily in the year before they become liable for provisional tax.

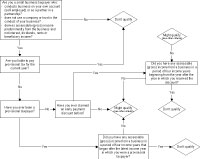

Who qualifies for the discount?

To qualify, individuals have to:

- be either self-employed or a partner in a partnership;

- derive assessable (gross) income predominantly from a business (not being interest, dividends, royalties, rents or beneficiary income);

- not be required to pay provisional tax in the income year;

- make a voluntary payment of income tax before the end of the income year (31 March for a March balance date taxpayer);

- elect to receive the discount within the timeframe for filing a return of income for that income year;

- have not been liable to pay provisional tax in the prior four years; and

- have never received an early payment discount unless they come within the four-year rule outlined below.

Once they have made a voluntary payment they must keep the lesser of the following in their income tax account until terminal tax date for the income year:

- the amount of voluntary payments made before the end of their income year; or

- the amount of terminal tax for the income year.

Those who are provisional taxpayers before they begin receiving self-employed or partnership income will not be entitled to the discount as they do not face two years' tax payments in their second year in business and are already aware of the need to make provisional tax payments.

The discount is not available when a taxpayer merely ceases paying provisional tax. For example, a business that derives assessable (gross) income but is in a tax loss situation would not qualify for the discount.

Do you qualify for the discount?

Four-year rule

A concession in the new legislation enables taxpayers to claim the discount again if they have ceased deriving partnership and self-employed income for a period of four years and then begin a new business. This is because taxpayers who have been out of business for some time, (four years) may be less aware of the problem that two years' worth of tax will become due in their second year in business.

Election

Individuals will be able to choose whether to receive the discount in their first year of business or in a subsequent year, but they must claim the discount before the year in which they begin paying provisional tax, when qualification ceases.

Taxpayers who omit to claim the early payment discount in their tax return will be able to apply to the Commissioner of Inland Revenue to amend their return and claim the discount but must do so before the last date for furnishing the return for the income year in which the early payment discount is claimed.

Calculation

The discount will be calculated at the rate of 6.7% of the amount paid during the year or 105%of the individual's end-of-year residual income tax liability, whichever is the lesser. Any overpaid tax plus the discount will be refunded to the taxpayer or can be offset against other tax owing.

When a taxpayer claims the early payment discount in a tax year and the return is reassessed for that year, the amount of the discount may also be reassessed.

Examples of who will qualify for the discount

Example 1

Angela derives solely business income for a four-year period. The business grows, and in the third year her residual income tax liability (tax not deducted at source) exceeds $2,500, so she becomes a provisional tax payer. She is required to pay provisional tax in her fourth year in business.

| Year 1 | Year 2 | Year 3 | Year 4 | |

|---|---|---|---|---|

| Income | $3,000 | $12,000 | $25,000 | $30,000 |

| Residual income tax liability | $450 | $1,950 | $4,680 | $5,730 |

| Become a provisional tax payer | No | No | Yes | Yes |

| Liable to pay provisional tax | No | No | No | Yes |

| Entitled to discount | Yes | Yes | Yes | No |

Angela can claim the discount once in either of the first three years, as she is not required to pay provisional tax. However, she would maximise the benefit of the discount by claiming it in the third year in business. If the discount has not been claimed before the fourth year entitlement ceases.

Example 2

Denis derives income from two sources, business income of $50,000 and interest income of $30,000. He would meet the test of deriving gross income predominantly from business as his business income is the predominant income. However, if he had salary and wages of $50,000 and business income of $20,000 his assessable (gross) income would be predominantly from salary or wages and he would not qualify for the discount.

Example 3

Sean started business last year and had a residual income tax liability of over $2,500. He qualifies as a provisional tax payer and is required to pay provisional tax in the current year. If at the end of the current income year his residual income tax is less than $2,500 he cannot claim the discount as he was a provisional tax payer last year and is required to make provisional tax payments this year. However, he could have claimed the early payment discount last year because, although he qualified as a provisional tax payer, he did not have to make provisional tax payments last year.

Example 4

John starts up a business and in his second year the business grows. He decides to pay income tax voluntarily during the second year. When he prepares his year 2 tax return his residual income tax is $1,800, and he decides to claim the early payment discount while he still can. In year 3 the business grows again and John becomes a provisional tax payer. However, in year 4 the business loses market share and ceases.

John does not operate a business in years 5 to 8 and begins business again in year 9. He can claim the early payment discount because he has begun business after a four-year gap since he was last in business and last paid provisional tax.

If, however, he had continued to be liable for provisional tax in years 5 to 8 he would not be able to claim the early payment discount.

Example 5

Mary begins as a self-employed consultant and, although she is not liable for provisional tax, makes voluntary payments of income tax in her first year and claims the discount in her end of year return. However, in year 2 her business ceases. Mary is then employed and stays in that job for 5 years. In year 8 she takes up

self-employment again and can claim the discount again in year 8 because she has not derived income from self-employment for four years or been liable for provisional tax for four years.

Example 6

Tom enters a partnership and in the second year he is required to pay provisional tax. In year 3 he leaves the partnership and is no longer required to pay provisional tax in the following years. He takes a five-year break travelling overseas. On returning to New Zealand he decides to become self-employed. He makes voluntary payments of tax in his first year of self-employment and therefore qualifies for the early payment discount.

Application date

This amendment applies from the income year beginning 1 April 2005.