New definitions of "associated persons"

2009 legislation redefines 'associated persons'. The definitions are mainly used in an anti-avoidance capacity to counter non-arm's length transactions.

Sections CB 8(c), CD 5, CD 5(2B), CD 6(1)(a)(ii), CD 22(9), CD 25(4), CD 27(1)(b), CD 27(3)(a)(ii), CD 44(10B), CD 44(10C), CD 44(14B), CX 2(5), CZ 9B, DB 42(2), EB 13(2), EX 20B(5)(a)(i), EX 20B(9)(c), FE 21(3)(d)(ii), FE 21(7)(a)(i) and (ii), FE 21(8), GB 28(2), GB 48(1)(b), GB 48(3)(d) and (e), GC 5(5), HC 15(5)(a)(ii), HC 21(3), HC 27(1)(e), HC 27(3), HC 32(2), HC 35(4)(a), HC 36(5), RF 11, YA 1, YB 1 to YB 16 of the Income Tax Act 2007; sections 17(1C)(a), 89N(1)(c)(iii), 89N(1)(c)(v), 141(7)(c) and 141D(3B)(b) of the Tax Administration Act 1994

The definitions of "associated persons" in the Income Tax Act 2007 have been reformed by strengthening and rationalising them. The definitions are mainly used in an anti-avoidance capacity to counter non-arm’s length transactions that could undermine the intent of the income tax legislation.

The reforms address a number of weaknesses in the previous definitions that posed a risk to the tax base. These weaknesses have significant base maintenance implications in areas such as the taxation of land sales, dividends and fringe benefits. The main changes:

- deal with the weaknesses in the previous definitions in relation to trusts. In particular, there are new tests focusing on a trust’s settlor (that is, the person who provides the trust property);

- provide more robust rules aggregating the interests of associates to prevent the tests relating to companies being circumvented by the fragmentation of interests among close associates; and

- implement a tripartite test associating two persons if they are each associated with the same third person, thereby making the associated persons tests as a whole more difficult to circumvent.

The reforms narrow some current tests. For example, the ambit of the relatives test has been reduced from four to two degrees of blood relationship.

The reforms rationalise the income tax definitions of associated persons and other income tax provisions that employ a similar concept, such as the definition of "related persons" in the dividend rules. This represents a major simplification and makes the associated persons concept in the Income Tax Act more coherent.

The associated persons reforms are consistent with a key theme of the government’s tax policy work programme, which is ensuring that the income tax system is robust.

Background

New Zealand tax law often subjects transactions between associated persons to special scrutiny because these transactions can pose a substantial risk to the tax base. Transactions between associated persons are more likely to lead to tax practices that undermine the intent of our tax laws because of the closeness of the relationships of the persons involved.

The associated persons definitions are used extensively in the Income Tax Act 2007 to determine whether persons are associated for the purposes of operative provisions in the Act. These operative provisions are often of an anti-avoidance nature, and recognise that transactions between related parties are more likely to be non-arm’s length than transactions between independent parties, and that while associated persons are legally separate entities, they may not be economically independent. Because of their relationship to each other, associated persons can often be regarded as single economic entities because of their community of interests. This community of interests may justify these persons not being treated as independent entities for tax purposes.

An important application of the associated persons definitions in the Income Tax Act is in the area of land sales. Parliament’s intent in 1973, when it enacted the current land sale tax rules, was that land dealers, developers and builders should generally be taxed on all gains on property sold within 10 years of acquisition, and they cannot claim to hold non-taxable investment portfolios. This legislative intent is clear from the parliamentary debate. Hon W E Rowling, Minister of Finance, who introduced the relevant legislation, said:

- "Profits and gains from real property will now be assessed when ... the property was acquired by a land dealer and either was held as part of his land dealing business and later sold - in which case the profits will be assessable irrespective of the period between acquisition and sale - or, if it was not held as part of his land dealing business but is sold within 10 years of acquisition, for example, claimed to be held as an investment but sold within this 10-year period."

It was therefore a deliberate decision by Parliament that gains on land sold by property developers within 10 years of acquisition should generally be taxed.

The previous definitions of associated persons had a number of shortcomings. For example, the associated persons definition which applied for land sales contained loopholes which allowed land dealers, developers and builders to escape tax by operating through closely connected entities.

The Income Tax Act previously had no coherent overall scheme for defining associated persons. For example, some definitions did not consider some obviously close relationships as being associated (for example, a trustee and a beneficiary). On the other hand, they treated some remote relationships as being so (for example, fourth-degree relatives). The multiplicity of definitions and other provisions employing a similar concept (such as the company control definition) created unnecessary complexity in the Act.

The new associated persons definitions address the previous shortcomings in the associated persons definitions in the Income Tax Act - first by addressing their weaknesses and, secondly, rationalising these and similar provisions in the Income Tax Act.

Proposals to reform the definitions of associated persons were initially outlined in an officials’ issues paper, Reforming the definitions of associated persons, released in March 2007. The reforms have been the subject of extensive consultation and the new associated persons definitions incorporate various amendments that arose during the policy development process.

This reform of the definitions of associated persons in the Income Tax Act, including the modifications arising from the consultation process, is the first comprehensive review since the inception of a definition of associated persons in the income tax legislation in 1968.

Key features

The reforms to the associated persons definitions in the Income Tax Act 2007 generally involve replacing the definitions with the objective of strengthening them. The other major part of the reforms involves rationalising these definitions and other income tax provisions which employ a similar concept.

The changes aim to give effect to the policy intention of capturing non-arm’s length transactions, while not applying more widely than is necessary to protect the tax base.

The tests of association in the new associated persons definition in subpart YB are as follows:

- two companies;

- a company and a person other than a company;

- two relatives;

- a person and a trustee for a relative;

- a trustee and a beneficiary;

- trustees with a common settlor;

- a trustee and a settlor;

- a settlor and a beneficiary;

- a trustee and a person with the power of appointment or removal of the trustee;

- a partnership and a partner; and

- two persons who are each associated with the same third person (tripartite test).

All 11 associated persons tests generally apply for the purposes of the Income Tax Act. The main exception is in the land provisions where modifications are made so the associated persons definitions cover situations under the effective control of property dealers, developers and builders, but do not apply to other situations.

The tests for determining whether two companies, or a company and a person other than a company, are associated persons include rules that aggregate the interests of associates. This prevents the company-related tests being circumvented by the fragmentation of interests among associated persons.

The test for associating relatives is reduced from four degrees of blood relationship to two degrees only. This test is further limited to spouses and parents and their infant children for the purposes of the land provisions and compliance cost saving provisions relating to low turnover traders and adverse event livestock transfers.

The weaknesses in the previous general associated persons definition in relation to trusts have been addressed by including tests associating a trustee and beneficiary, trustee and settlor, two trustees with common settlor, settlor and beneficiary and a trustee and a person with the power of appointment or removal of the trustee. A number of modifications apply to the trust-based tests to ensure that the associated persons definitions do not apply more widely than is necessary to protect the tax base. They include:

- Not applying the beneficiary-based associated persons tests (the trustee-beneficiary and settlor-beneficiary tests), and the test associating a person and a trustee for a relative in the case of land sales. It is not necessary to apply these tests to catch the type of structures being used to circumvent the land sale tax rules; the structures causing concern can be caught by other associated persons tests - in particular, the settlor-based trust and tripartite tests.

- Not treating charitable organisations as beneficiaries for the purposes of the trustee and beneficiary and settlor and beneficiary tests and excluding charitable trusts from the trustee and settlor test.

- The definition of "settlor" that applies for the purposes of the associated persons tests will not include a person who provides services to a trust for less than market value.

Persons who are married, in a civil union, or in a de facto relationship are treated as the same single person for the purpose of identifying a common settlor under the two trustees with a common settlor test in section YB 7. This treatment prevents the new associated persons definition being circumvented by the use of "mirror trusts".

The new associated persons definition introduces a tripartite test which associates two persons if they are each associated with the same third person, under different associated persons tests. The tripartite test acts as an important buttress to the other associated persons tests and makes the associated persons definition as a whole more difficult to circumvent.

The reforms also rationalise the current income tax definition of associated persons and other income tax provisions that employ a similar concept, such as the definition of "related person" in the dividend rules. This represents a significant simplification and makes the associated persons concept in the Income Tax Act more coherent.

Application date

The general application date for the reforms (excluding those applying for the land provisions) is the 2010-11 and later income years. For the purposes of the land provisions (as defined in section YA 1), except for the section which relates to disposal of land within 10 years of completing improvements (section CB 11), the reforms apply to land acquired on or after 6 October 2009, the date of enactment. Given that association is tested in the land provisions at the time of acquisition, this means that for land acquired before 6 October 2009 the former associated persons definitions are the relevant provisions in determining whether the sale of such land is taxable. For the purposes of section CB 11, the reforms apply to land on which improvements started on or after 6 October 2009. Therefore, in the case of the land provisions, the relevant application date is 6 October 2009 irrespective of a person’s balance date.

Detailed analysis

Subpart YB containing the associated persons definition rules in the Income Tax Act 2007 has been substantially replaced. The new provisions consist of 11 tests of association, which are explained in this article.

New section YB 1(4) states the general rule that the various associated persons tests in subpart YB apply for the purposes of the whole Act unless a provision expressly states otherwise. The main situation where certain exceptions will apply in the new associated persons tests are the land provisions, which are defined in section YA 1. For example, a narrow range of relatives (namely, spouses, civil union partners, de facto partners, and infant children) applies in the new associated persons definitions for the purposes of the land provisions.

New sections YB 1(5) to (8) contain cross-references to several special rules that modify the associated persons definitions for the purpose of specific provisions. These special rules are contained in sections DS 4 (Meaning of film reimbursement scheme), EB 13 (Low-turnover valuation), EX 4 (Limits to requirement to include associated person interests in the controlled foreign company rules), and LP 2 (Tax credits for supplementary dividends). These special rules have not been changed as part of this reform.

Two companies test (section YB 2)

Section YB 2 contains the test for associating two companies. Two companies will be associated if:

- there is a group of persons whose total voting interests in each company are 50% or more - this is the primary test for associating two companies. The concept of voting interests is defined in subpart YC;

- a market value circumstance exists for either company and there is a group of persons whose total market value interests in each company are 50% or more. A "market value circumstance" is defined in section YA 1 and a "market value interest" is defined in subpart YC. Under the measurement of company ownership rules in subpart YC, a person’s interest in a company is generally measured by reference to the person’s voting interests in the company. If these voting interests in certain circumstances - coming within the definition of "market value circumstance" in section YA 1 - do not reflect accurately the person’s economic interest in a company then the person’s interests are also measured by reference to the person’s market value interests in the company; or

- there is a group of persons who control both companies by any other means.

Aggregation rule

The test associating two companies contains a general aggregation rule which provides that in determining whether two companies are associated, a person is treated as holding anything held by persons associated with that person under sections YB 4 to YB 14 (section YB 2(4)). This rule applies for the purposes of the whole Act except the land provisions. The aggregation rule is designed to prevent the two companies test being circumvented by the fragmentation of interests among associated persons, resulting in the 50% interest threshold not being reached.

The two companies test contains a separate rule which aggregates the interests of associates for the purposes of the land provisions (section YB 2(5). Under this rule, a person is treated as holding anything held by persons associated with them under the limited relatives definition in section YB 4 (namely, spouses, civil union partners, de facto partners and infant children) and under the tests in sections YB 7, YB 8, and YB 10 to YB 14. This modification ensures that for the purposes of the land provisions, the general relatives test and the beneficiary-related trust tests do not apply in the aggregation rule for the test associating two companies.

When applying the rules aggregating the interest of associates, the rule is applied afresh to each person and it is irrelevant that a person does not directly hold any shares in a company before the application of the aggregation rule.

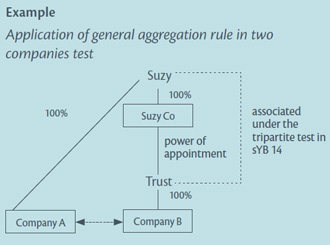

| In this example the aggregation rule, in conjunction with the tripartite test, can be applied to treat Suzy as holding Trust’s shares in Company B. Specifically, Suzy is associated with Suzy Co under the company and person other than a company test in section YB 3, and Suzy Co (with power of appointment of the trustees of Trust) is associated with Trust under section YB 11. Therefore, Suzy and Trust are associated under the tripartite test, and the aggregation rule in section YB 2(4) treats Suzy as holding Trust’s shares in Company B. Taking into account the shares Suzy holds directly in Company A, Company A and Company B are associated under the two companies test in section YB 2. |

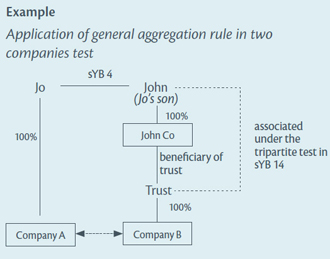

| In this example, the question is whether Company A and Company B are associated. First, in conjunction with the relatives test in section YB 4, the aggregation rule in section YB 2(4) is applied so that John is treated as holding anything held by his associates. In this case, John is treated as holding Jo’s shares in Company A through his association with Jo under the relatives test in section YB 4. Secondly, the aggregation rule, in conjunction with the tripartite test, can also be applied to treat John as holding Trust’s shares in Company B. This is because John is associated with Trust under the tripartite test in section YB 14. Specifically, John is associated with John Co under the company and person other than a company test in section YB 3, and John Co (as beneficiary of Trust) is associated with Trust under the trustee and beneficiary test in section YB 6. Therefore, John and the Trust are associated under the tripartite test, and the aggregation rule in section YB 2(4) treats John as holding Trust’s shares in Company B. As a result, because John is treated as holding all the shares in Company A and Company B under section YB 2(4), Company A and Company B are associated under section YB 2. It is irrelevant that John does not directly hold shares in Company A and Company B before the application of the aggregation rule in section YB 2(4). |

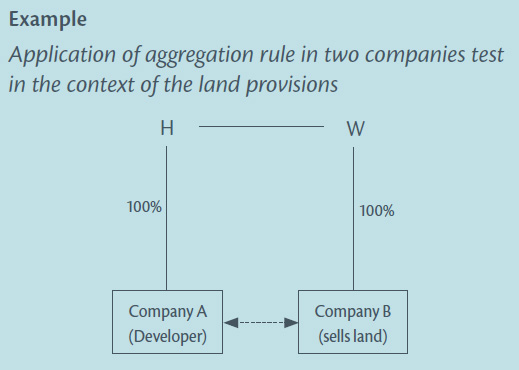

| In this example, the husband owns 100% of the voting interests in Company A, which is a property developer, and his wife holds 100% of the voting interests in Company B, which sells some land within 10 years of acquisition. Without the aggregation rule in section YB 2(5), the two companies would not be associated despite their close community of interests. The application of the aggregation rule ensures that the two companies are associated under section YB 2, resulting in Company B being liable to tax on the sale of the land. |

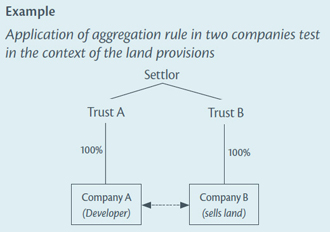

| In this example, Trust A and Trust B are associated under the two trustees with common settlor test in section YB 7. Trust A owns 100% of the voting interests in Company A, which is a property developer, and Trust B owns 100% of the voting interests in Company B, which sells some land within 10 years of acquisition. The two companies are associated under the two companies test through the use of the aggregation rule contained in that test. Applying the aggregation rule to this example, Trust A is treated as holding anything held by persons associated with it. In this case, Trust A and Trust B are associated under the two trustees with common settlor test in section YB 7. Accordingly, taking into account Trust A’s direct shareholding in Company A, Trust A is treated as holding all the voting interests in Company A and Company B, meaning these two companies are associated. The aggregation rule can also be applied to treat the common settlor as holding all the voting interests in Company A and Company B because the settlor is associated with Trust A and Trust B under the trustee-settlor test in section YB 8. This also means the two companies are associated. A result of Company A and Company B being associated is that Company B is liable to tax on the sale of land. Without the aggregation rule, Company A and Company B would not be associated despite their close community of interests. |

Other features

The two companies test provides that the control by any other means limb in the test does not apply to a company that is a state enterprise, Crown Research Institute, Crown health enterprise or a company that is part of the same group of companies as one of these Crown-related entities (section YB 2(6)). It also provides that in the international tax rules (defined in section YA 1) two companies are not associated if one, but not both, is a non-resident (section YB 2(7)).

Additionally, for the purposes of the land provisions, two companies are not associated persons if one is a portfolio investment entity (PIE) or an entity that qualifies for PIE status (section YB 2(8)). This exception ensures that a widely held managed fund is not adversely affected because of the personal land dealings of the directors of the fund.

Company and person other than a company test (section YB 3)

Section YB 3 contains the test for associating a company and a person other than a company.

A company and a person other than a company are associated if:

- the person has a voting interest in the company of 25% or more. The concept of voting interests is defined in subpart YC; or

- a market value circumstance exists for the company and the person has a market value interest in the company of 25% or more. A "market value circumstance" is defined in section YA 1, and a "market value interest" is defined in subpart YC. Under the measurement of company ownership rules in subpart YC, a person’s interest in a company is generally measured by reference to the person’s voting interests in the company. If these voting interests in certain circumstances - coming within the definition of "market value circumstance" in section YA 1 - do not reflect accurately the person’s economic interest in a company then the person’s interests are also measured by reference to the person’s market value interests in the company.

Aggregation rule

The test associating a company and person other than a company test contains a general aggregation rule, which applies for the purposes of the whole Act except the land provisions (section YB 3(3)). Accordingly, for the purposes of determining whether a company and a person other than a company are associated, a person is treated as holding anything held by persons associated with the person under sections YB 4 to YB 14. This aggregation rule is designed to prevent the test associating a company and a person other than a company being circumvented by the fragmentation of interests among associated persons, resulting in the interest threshold of 25% not being reached.

The test associating a company and a person other than a company contains a separate rule which aggregates the interests of associates for the purposes of the land provisions (section YB 3(4)). Under this rule, a person is treated as holding anything held by persons associated with the person under the limited relatives definition in sections YB 4 (namely, spouses, civil union partners, de facto partners, and infant children) and under the tests in sections YB 7, YB 8, and YB 10 to YB 14. This modification ensures that for the purposes of the land provisions, the general relatives test and the beneficiary-related trust tests do not apply in the aggregation rule for the test associating a company and person other than a company.

When applying the rule aggregating the interests of associates, the rule is applied afresh to each person being tested for association with a company and it is irrelevant that a person does not directly hold shares in a company before the application of the aggregation rule.

The aggregation rules are an element of both of the company-based tests in sections YB 2 and YB 3. As noted above, the aggregation rules are designed to prevent these tests being circumvented by the fragmentation of interests among associated persons, resulting in the interest thresholds in these tests not being met. As such, the aggregation rules do not act as separate associated persons tests.

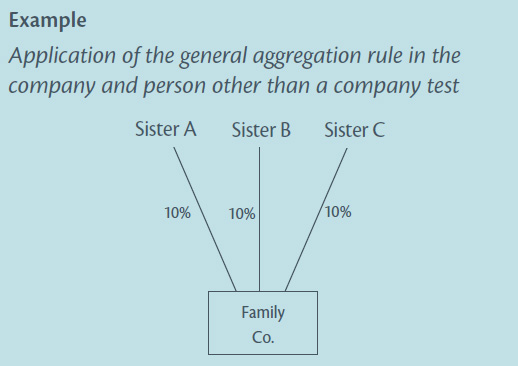

| Without an aggregation rule, neither Sister A, B nor C would be associated with Family Co. under the company and person other than a company test because their respective interests do not meet the required 25% threshold. However, under the aggregation rule in section YB 3(3), each sister would be associated with the company. This is because for the purposes of determining whether Sister A is associated with Family Co. under section YB 3(1), she is treated as holding her sisters’ 20% voting interests in the company (10% each from Sister B and Sister C). This 20%, when aggregated with her own 10% voting interest, means that Sister A is treated as holding a 30% interest and, therefore, is associated with the company. The aggregation rule applies afresh to each person - so similarly, Sister B and Sister C are each treated as holding the other two sisters’ aggregate 20% voting interests in the company. Therefore, when aggregated with the 10% interest they each own in the company, Sister B and Sister C are each associated with Family Co. |

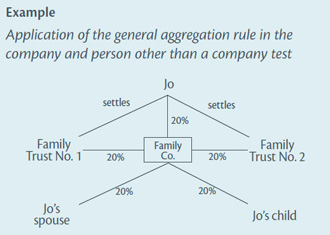

| Jo settles Family Trusts No. 1 and No. 2 and arranges for each of them to hold 20% of the shares in Family Co. Jo also arranges for his spouse and child to hold 20% each in Family Co. Jo directly holds only 20%. Under the aggregation rule in section YB 3(3), Jo is treated as holding the shares in Family Co. held by the family trusts and relatives because they are his associates. Accordingly, Jo is associated with Family Co. Without the rule aggregating the interests held by associated persons Jo would not be associated with Family Co. despite the close community of interests. |

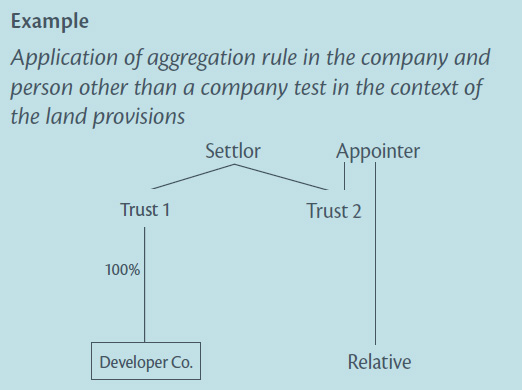

| The question in this case is whether the appointer of the trustee in Trust 2 is associated with Developer Co. under the test in section YB 3 associating a company and a person other than a company. The appointer is associated with Developer Co. under this test because of the application of the aggregation rule for land provisions in section YB 3(4) which treats a person as holding anything held by their associates. The appointer is associated with Trust 1 under the tripartite test in section YB 14. Specifically, the appointer is associated with Trust 2 under the test in section YB 11 associating a trustee and their appointer, and Trust 2 is associated with Trust 1 under the test in section YB 7 associating two trustees with a common settlor. Therefore, under the aggregation rule for land provisions in section YB 3(4) the appointer is treated as holding Trust 1’s shares in Developer Co. Accordingly, the appointer and Developer Co. are associated under section YB 3. Note, however, that the relative of the appointer would not be associated with Developer Co. In particular, the tripartite test does not associate Trust 1 and the relative and therefore the relative is not treated as holding Trust 1’s shares in Developer Co. The aggregation rule is applied afresh to the relative, and not to the appointer, for the purposes of determining whether the relative is associated with Developer Co. Therefore, the fact that the appointer is treated under the aggregation rule as holding Trust 1’s shares when testing for association between the appointer and Developer Co. is disregarded when testing for association between the relative and Developer Co. |

Corporate trustees

In section YB 3, "a person other than a company" includes a company acting in its capacity as a trustee of a trust (section YB 3(5)). This amendment is of a clarifying nature only and is consistent with long-standing policy (Tax Information Bulletin, Vol. 3, No. 7, April 1992 at page 23).

The company look-through rules in subpart YC applying to voting and market value interests do not apply to a corporate trustee; therefore, the voting interests or market value interests held by a corporate trustee are not traced through to the shareholders of that corporate trustee. This treatment is a result of the separate capacity that a trustee (whether a company or natural person) has under the Income Tax Act 2007, and is recognised in the definition of "trustee" in section YA 1 which refers to a trustee "only in the capacity of trustee of the trust". This separate trustee capacity feature of the income tax law has been maintained in the new associated persons definitions.

Therefore the shareholders of a corporate trustee are not relevant when testing for association between that trustee and other persons. This is consistent with the general position under the Income Tax Act, which is that a company acting in its capacity as trustee is treated as a trustee rather than a company. This means that the relevant test for determining association between a corporate trustee and a company in which the corporate trustee is a shareholder is section YB 3.

Relatives test (section YB 4)

There are three limbs to the general relatives test in the new associated persons definitions:

- The first limb associates two persons who are within two degrees of blood relationship (section YB 4(1)(a)). Previously the general relatives test extended to the fourth degree of blood relationship. This means that the blood relationships limb of the general relatives test extends to grandparents and siblings but not to nephews and nieces (third degree) and cousins (fourth degree) as the previous test did.

- The second limb associates two persons who are married, in a civil union, or in a de facto relationship (section YB 4(1)(b)).

- The third limb associates two persons if one person is within two degrees of blood relationship to the other person’s spouse, civil union partner or de facto partner (section YB 4(1)(c)). This limb associates persons with their in-laws and step-children.

For the purposes of the relatives associated persons test, a child by adoption is treated as a natural child of the adoptive parents and not as a natural child of the birth parents (section YB 4(3)).

A new provision (section YB 4(4)) has been added to the test associating two relatives to ensure that a person is not associated with another person if the person cannot reasonably be expected to know that the other person exists or that they are within two degrees of blood relationship to the other person. This exclusion is designed to deal with a small minority of situations such as when siblings are separated at a very young age and do not know of each other’s existence.

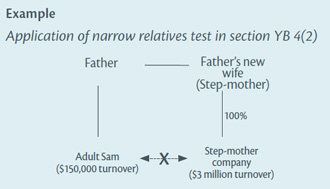

Narrower application of relatives test in certain cases (section YB 4(2))

The first and third limbs (section YB 4(1)(a) and (c)) of the general relatives test of association do not apply for the purposes of the land provisions (defined in section YA 1) or two compliance-cost saving provisions in the Income Tax Act - namely, the low turnover trader provision in section EB 13, and the provision relating to the adverse event livestock transfers in section EC 5. In these circumstances, persons are associated because of a blood relationship only if one is the infant child of the other. An "infant child" is defined in the Age of Majority Act 1970 as a person under 20 years of age.

| Under the trading stock provisions in the Income Tax Act 2007, there are special low-compliance cost rules which apply to a "low-turnover trader". For a person to be a low-turnover trader, the turnover of that person’s business, when aggregated with the turnover of associated persons, must be no more than $3 million. In this example, because a narrow relatives test applies for the purposes of the low-turnover trader rules, Adult Sam and Step-mother company are not associated and therefore Sam is entitled to use the low-turnover trader rules for his business. In particular, because Adult Sam is not treated under the relatives test in section YB 4 as being associated with his step-mother, the aggregation rule in the test in section YB 3 associating a company and a person other than a company does not apply to treat Adult Sam as holding his step-mother’s shares in her company. If the ordinary relatives associated persons test had applied to the low-turnover trader rules Sam would be treated as being associated with Step-mother company under section YB 3 and therefore would not have been entitled to use the low-turnover trader rules. |

Trustee for relative test (section YB 5)

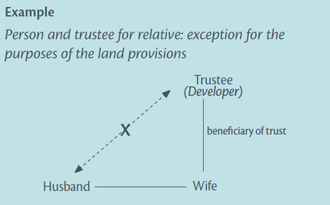

A person (first person) and a trustee of a trust under which a relative (as defined in section YB 4) of the first person has benefited or is eligible to benefit are associated persons under new section YB 5. For example, a husband and a trustee of a trust under which the husband’s wife is a beneficiary would be associated under this test.

The trustee for relative test does not apply for the purposes of the land provisions. This is consistent with the land provision exclusions in the other beneficiary-related tests in section YB 6 (trustee and beneficiary) and YB 9 (settlor and beneficiary).

| Because the trustee for relative test does not apply for the purposes of the land provisions, the husband would not be associated with the trustee of the trust under which his wife is a beneficiary. Under the previous trustee for relative test in former section YB 12, the husband would have been associated with the trustee for the purposes of the land provisions. |

Additionally, as further discussed below, this test does not apply to lines trusts established under the Energy Companies Act 1992 (energy consumer trusts) or the unit trust administering bonus bonds (section YB 16).

Trustee and beneficiary test (section YB 6)

A trustee of a trust and a person who has benefited or is eligible to benefit under the trust are associated persons under new section YB 6. This provision does not apply for the purposes of the land provisions.

Persons have benefited under a trust if they have received a distribution under the trust.

Inland Revenue’s long-standing policy on when a person is eligible to benefit under a trust will continue (Tax Information Bulletin, Vol. 7, No. 9, February 1996 at page 25). In particular, a person is "eligible to benefit" when the person is either:

- named by the trustee as a potential beneficiary; or

- designated as a member of a class of potential beneficiaries, for example, "the children of …".

When trustees have a general power of appointment, persons not already appointed as beneficiaries under the power are not treated as being eligible to benefit.

Therefore, a person who is eligible to benefit under a trust (as described above) does not need to have actually received a distribution (as defined in section HC 14 of the Income Tax Act 2007) under the trust to qualify as a beneficiary.

An exception to the trustee and beneficiary test for certain employee trusts is contained in section YB 15. Additionally, as with section YB 5, this test does not apply to energy consumer trusts or the unit trust administering bonus bonds (section YB 16).

The trustee and beneficiary test (and other trustee-related tests) are not relevant to unit trust investment vehicles. This is because such unit trusts are treated as companies for all income tax purposes. This means that it is the company-related tests - in particular, section YB 3 - that are the relevant associated persons tests. The 25% threshold in section YB 3 would ensure that retail investors would not be associated with widely held public unit trusts.

The trustee and beneficiary test (and other beneficiary-related tests) are not relevant to purpose trusts such as charitable trusts and community trusts referred to in the Community Trusts Act 1999 (these trusts were established to hold the shares in the successor companies to the former trustee banks). This is because purpose trusts do not at law have beneficiaries.

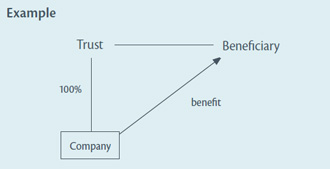

The previous general definition of associated persons did not contain a trustee and beneficiary test. This constituted a significant omission in test coverage and transactions were often structured to take advantage of the loophole. Without a trustee and beneficiary test in the associated persons definitions, many of the operative rules in the Income Tax Act using the general associated persons definition could be readily circumvented by simply interposing a discretionary trust.

| In this example, the company provides a benefit to a beneficiary of its trustee shareholder. The company provides the benefit because the trustee is its sole shareholder. Section CD 6(1)(a)(ii) in the dividend rules treats payments to associated persons of shareholders as dividends. However, without a trustee and beneficiary test, this simple arrangement would avoid the dividend rules. Under the new trustee and beneficiary test, because the company is providing a benefit to an associated person (Beneficiary) of a shareholder in the company (Trust), the company has made a dividend to the beneficiary under section CD 6(1)(a)(ii). |

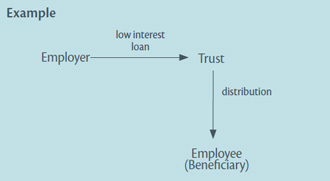

| In this example, an employer provides a low interest loan to a trust under which an employee is a beneficiary. Under section CX 18, fringe benefit tax applies to fringe benefits provided to associated persons of employees. Without the trustee and beneficiary test in section YB 6, this simple arrangement avoids this rule. However, because of the new trustee and beneficiary test, the employer would be providing a fringe benefit (the low interest loan) to an associated person of the employee (the Trust) and would therefore be subject to fringe benefit tax. |

Two trustees with common settlor test (section YB 7)

Under new section YB 7, a trustee of a trust and a trustee of another trust are associated persons if the same person is a settlor of both trusts.

New section YB 10 provides that for the purposes of the new section YB 7, "settlor" has the meaning set out in section HC 27 of the Income Tax Act 2007, but does not include a person who provides services to a trust for less than market value.

An exception to the two trustees with common settlor test for certain employee trusts is contained in section YB 15.

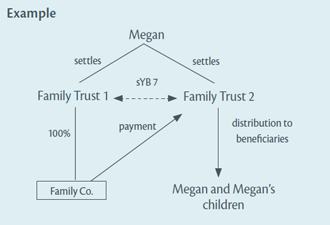

Without a test associating two trustees with a common settlor many of the operative rules in the Income Tax Act which use the associated persons definition, such as the dividend rules, could be circumvented by structures such as the following example.

| In this example, Megan settles Family Trust 1, a trust that owns all of the shares in Family Co. Megan also settles Family Trust 2 whose discretionary beneficiaries include Megan’s children and Megan herself. Family Co. makes a payment to Family Trust 2. Under the dividend rules in sections CD 3 to CD 6 of the Income Tax Act, any payment made by a company to an associated person of a shareholder of the company is treated as a dividend if that payment would have been a dividend if it had been made to the shareholder. In the absence of a two trustees with common settlor test, Family Co. has not made a payment to an associated person of its shareholder (Family Trust 1), in terms of section CD 6(1)(a)(ii). Therefore, the payment from Family Co. to Family Trust 2 would not be treated as a dividend. Under the new two trustees with common settlor test in section YB 7, Family Trust 1 and Family Trust 2 are associated persons as they have a common settlor (Megan). Therefore, the payment from Family Co. to Family Trust 2 (an associated person of Family Co’s shareholder, Family Trust 1) is treated as a dividend. |

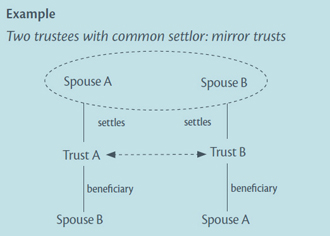

For the purposes of the two trustees with a common settlor test in section YB 7, two persons who are married, in a civil union, or in a de facto relationship are treated as the same single person. This is relevant to identifying a common settlor of two trusts, and prevents the new associated persons definition being circumvented by the use of "mirror trusts". This is illustrated in the following example.

| In this example spouse A settles a family trust (Trust A) for the benefit of spouse B and spouse B settles another family trust (Trust B) for the benefit of spouse A. Without the provision in the two trustees with common settlor test treating two persons who are married, in a civil union, or in a de facto relationship as the same single person, the trustees of Trust A and Trust B would not be associated despite the close community of interests. The trustees of Trust A and Trust B are associated under new section YB 7 because Spouse A and Spouse B are treated as the same single person and therefore the trustees of Trust A and Trust B have a common settlor. |

Trustee and settlor test (section YB 8)

A trustee of a trust and a settlor of the trust are associated persons under new section YB 8.

New section YB 10 provides that for the purposes of new section YB 8, "settlor" has the meaning set out in section HC 27, with the modification that a settlor does not include a person who provides services to a trust for less than market value.

An exception to the trustee and settlor test for certain employee trusts is contained in section YB 15.

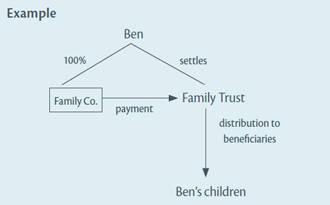

As with the other trustee-related tests, the trustee and settlor test is an important element of the new associated persons definition. Without this test in the associated persons definitions, schemes could be developed to exploit such a loophole. This is illustrated by the following examples.

| In this example, Family Co. makes a payment to Family Trust. Ben is the sole shareholder of Family Co. and the settlor of Family Trust. Without a trustee and settlor test in the associated persons definition the payment from Family Co. to Family Trust is not caught as a dividend despite the close community of interests. This is because Family Trust would not be associated with Ben who is the sole shareholder of Family Co. Under the new trustee and settlor test in section YB 8, Ben and Family Trust are associated persons as Ben is the settlor of Family Trust. The payment from Family Co. to the Family Trust is accordingly treated as a dividend because Family Co. has made a payment to an associated person (Family Trust) of its shareholder (Ben) in terms of section CD 6(1)(a)(ii). |

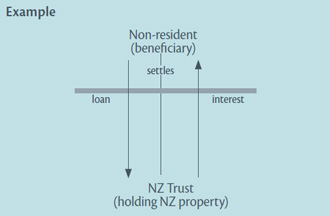

| In this example, a non-resident settles a New Zealand trust (with a New Zealand-incorporated company as trustee) which owns New Zealand land and buildings. This investment by the trustee is funded by a loan from the non-resident settlor. If the non-resident is not associated with the New Zealand trustee, then the interest paid on this loan qualifies for the approved issuer levy (AIL) of 2% instead of being subject to the higher non-resident withholding tax (NRWT) rate. The previous associated persons definition used in the AIL rules was generally deficient in relation to arrangements involving trusts. In this example in particular, without a trustee and settlor test of association, the interest would qualify for AIL treatment despite the in-substance association between the two parties. The new trustee and settlor test in section YB 8 would associate the non-resident with the New Zealand trustee. Accordingly, the interest derived by the non-resident from New Zealand would be subject to a higher rate of NRWT instead of AIL at 2%, which is the appropriate treatment. |

Settlor and beneficiary test (section YB 9)

A settlor of a trust and a person who has benefited or is eligible to benefit under the trust are associated persons under section YB 9. This test does not apply for the purposes of the land provisions (as defined in section YA 1).

The settlor and beneficiary test is the third test of association (the others being the trustees with a common settlor and trustee and settlor tests) that is based on the settlor of a trust. This focus on the settlor is consistent with the settlor-based focus of the trust taxation rules.

Given that there is a sufficient connection between a trustee and a beneficiary, as well as between a trustee and a settlor to justify treating them as associated persons, there is equally a sufficient connection between a settlor and a beneficiary to justify treating them as associated persons as well.

An exception to the settlor and beneficiary test for certain employee trusts is also contained in section YB 15.

Definition of settlor (section YB 10)

As mentioned above, for the purposes of the settlor-based tests in sections YB 7 to YB 9, settlor has the meaning set out in section HC 27, with the modification that a settlor does not include a person who provides services to a trust for less than market value. This modification prevents a professional advisor who provides services to a trust at no charge being treated as a settlor of the trust.

The term "settlor" has a wide meaning under the section HC 27 definition of that term. A settlor of a trust is defined to mean broadly a person who transfers value to a trust. The definition of settlor is further extended by the provisions of section HC 28, the most significant of which are:

- When a company makes a settlement, any shareholder with an interest of 10% or more in that company is treated as a settlor in relation to that settlement as well as the company itself.

- When a trustee of a trust (the first trust) settles another trust (the second trust), the settlor of the second trust is treated as including any person who is a settlor of the first trust.

- When a person has any rights or powers in relation to a trustee or settlor of a trust which enables the person to require the trustee to treat the person (or any nominee) as a beneficiary of the trust, the person is treated as a settlor of that trust.

The definition of "settlor" is used extensively in the Income Tax Act and its wide meaning is consistent with the settlor-based focus of the trust taxation rules in the Income Tax Act.

The definition of "settlor", in conjunction with the nominee look-through rule in section YB 21, does not include professional advisers acting on behalf of clients and other persons such as friends and family members who simply allow their name to be listed as the settlor on a trust deed. The definition of "settlor" that is being used is essentially the same as that originally enacted in 1988 as part of a reform of the trust rules (with the exception that the provision of services at less than market value are excluded). The main focus of this definition is on persons who provide the trust property, and therefore does not include persons who merely allow their name to go on the trust deed as the named settlor.

It is therefore the client of the professional adviser, or the person that the friend or family member is acting for, who is treated as the settlor under the settlor-based tests in sections YB 7 to YB 9.

This position is consistent with Inland Revenue’s long-standing policy. Tax Information Bulletin of November 1989 on the trust rules at paragraph 6.93 states:

- "Often professional advisers or relatives will assist in establishing a trust by settling a nominal sum on trust on behalf of another person. In these circumstances it is not appropriate to expose the professional adviser or relative to a potential tax liability. The professional adviser or relative is not the real settlor of the trust but is in effect only an intermediary or facilitator. The real settlor is the person on whose behalf the professional adviser or relative acted in making the settlement. Thus, s.226(3) [now section YB 21 of the Income Tax Act 2007] treats the person for whom the nominee or the nominal settlor acted as the settlor rather than the nominee or nominal settlor."

Trustee and person with power of appointment or removal test (section YB 11)

A trustee of a trust and person who has a power of appointment or removal of the trustee are associated persons under section YB 11. This test is intended to complement the test associating a trustee and settlor in section YB 8. In many cases, a settlor of a trust, as the author of the instrument creating and governing the administration of the trust, retains the power to appoint or remove trustees. However, this power could be reposed in a separate person.

There is sufficient connection between a trustee of a trust and the person who has the power to appoint or remove the trustee to justify treating them as associated persons.

The situations considered to be caught by the test in section YB 11 associating a trustee and a person with the power of appointment or removal of the trustee include:

- a person who holds a power to appoint or remove trustees jointly with another person; and

- a person who holds a power to appoint or remove trustees only with the consent of another person (often referred to as the "protector").

However, the following situations are not considered to be caught by the test in section YB 11:

- a person who holds a power to appoint or remove trustees only on the happening of certain events in the future (for example, the incapacity of another person) are not treated as currently holding a power of appointment or removal; and

- a person (often referred to as the protector) who holds the power to veto the appointments or removal of a trustee (because they do not hold any positive power).

The requirement in the tripartite test in section YB 14 that two persons must be associated with the same third person under different associated persons tests should obviate any concerns about whether otherwise unrelated trustees are associated under that test merely because a professional advisor acting in their capacity as such has been granted the power to appoint or remove trustees by their clients.

An exception to the test associating a trustee and a person with a power of appointment or removal of the trustee for certain employee trusts is contained in section YB 15.

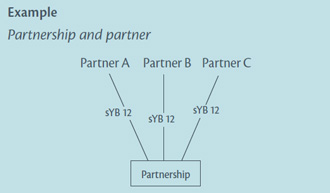

Partnership and partner test (section YB 12)

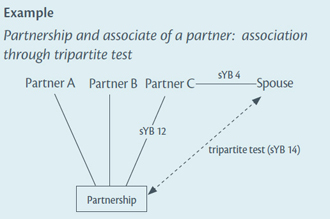

A partnership and a partner in the partnership are associated persons under section YB 12(1).

The tripartite test in section YB 14 - which associates two persons if they are each associated with the same third person under different associated persons tests - will not apply to associate the partners themselves with each other. This is because partners in a partnership would be associated with the same third person (the partnership) under the same associated persons test, namely section YB 12.

| A, B and C are individuals who are partners in a partnership. Under the partnership and partner test in section YB 12, Partners A, B, and C are each associated with the partnership. However, they are not associated with each other under the tripartite test in section YB 14 through their association with the partnership. The partners may still be associated with each other under a different associated persons test. For example, if partners B and C were married they would be associated with each other under the relatives test in section YB 4. |

The test associating a partnership and an associate of a partner in former section YB 17 has been subsumed by the new tripartite test in section YB 14, which associates two persons if they are each associated with the same third person under different associated persons tests. This means that an associate of a partner, such as a spouse of a partner, would still be associated with the partnership itself, as illustrated in the following example.

| In this example, the spouse of Partner C is associated with Partner C under the relatives test in section YB 4, and Partner C and Partnership are associated under the partnership and partner test in section YB 12. Therefore, applying the tripartite test, Spouse and Partnership are associated persons as they are each associated with the same third person (Partner C) under different associated persons tests. |

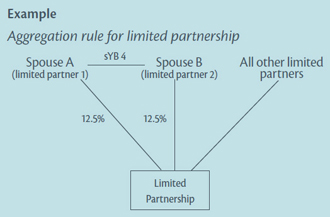

Limited partnerships

There is a separate test for determining if a limited partnership and a limited partner are associated. A limited partnership (as defined in section YA 1 of the Income Tax Act 2007) and a limited partner are associated only if the limited partner has a partnership share of 25% or more in the limited partnership (section YB 12(2)). This treatment is appropriate because a limited partner cannot be involved in the management of the partnership (unlike in a general partnership). It should be noted that section YB 12(2) is limited to the limited partners and not the general partner in a limited partnership. A general partner in a limited partnership will be associated with the limited partnership under section YB 12(1).

Section YB 12(3) and (4) contain aggregation rules for limited partnerships, similar to the aggregation rules in the company and person other than a company test in section YB 3 (the aggregation rule in section YB 12(3) applies for the purposes of the whole Act except the land provisions, and the more limited aggregation rule in section YB 12(4) applies for the purposes of the land provisions). This is appropriate given that a limited partner is more akin to a shareholder in a company and the interest threshold for associating a limited partner in a limited partnership - 25% - is the same as the threshold in section YB 3.

| In this example, in the absence of an aggregation rule, Spouse A and Spouse B would not be associated with Limited Partnership, as their respective shares in the partnership do not meet the required 25% threshold. However, applying the aggregation rule for limited partnerships in section YB 12(3), both Spouse A and Spouse B would be associated with Limited Partnership. This is because for the purposes of determining whether Spouse A is associated with Limited Partnership under section YB 12(2), Spouse A is treated as holding anything held by associates - in this case, Spouse A is associated with Spouse B under the relatives test in section YB 4. When Spouse A’s 12.5% share in Limited Partnership is aggregated with his associate’s (Spouse B) 12.5% share, the required 25% threshold is met and Spouse A is therefore associated with Limited Partnership under section YB 12(2). Once again, the aggregation rule is applied afresh to each person. As a result, the aggregation rule is also applied in this case to associate Spouse B with Limited Partnership. This is consistent with the application of the aggregation rule in the company-related tests. |

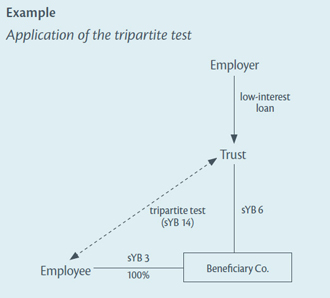

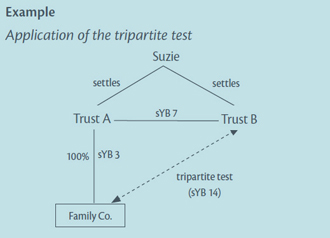

Tripartite test (section YB 14)

The tripartite test in section YB 14 associates two persons if they are each associated with the same third person under different associated persons tests.

The tripartite test acts as an important buttress to the other associated persons tests and makes the associated persons definition as a whole more difficult to circumvent.

For the tripartite test to associate two persons, each of these persons must be associated with the same third person under different associated persons tests, not including the tripartite test itself. The requirement that the two persons cannot be associated with the same third person under the tripartite test itself is necessary to prevent the tripartite test operating in a reiterative manner. The requirement that the two persons have to be associated with the same third person under different associated persons tests ensures that the tripartite test does not apply more widely than is necessary to protect the tax base.

The examples below illustrate the important role of the tripartite test in preventing the other associated persons tests being circumvented by arrangements involving the interposition of relatives, companies and trusts which are under the influence or control of the main protagonists.

| In this example, the employer makes a low-interest loan to Trust which in turn makes a distribution to Beneficiary Co. which is wholly owned by an employee of the employer. The tripartite test in section YB 14 associates Trust with the employee because they are both associated with Beneficiary Co. In particular, Trust is associated with Beneficiary Co, under the trustee-beneficiary test in section YB 6 and the employee is associated with Beneficiary Co. under the test in section YB 3 associating a company and a person other than a company. As a result, because the employer has provided a fringe benefit (the low-interest loan) to an associate of an employee, the employer would have to account for FBT on the low-interest loan. |

| In the above example, Suzie settles two family trusts: Trust A and Trust B. Trust A in turn owns all the shares in Family Co. The issue is whether Family Co. is associated with Trust B. Without a tripartite test, Family Co. and Trust B would not be associated, despite the close community of interests between them. However, under the tripartite test in section YB 14, Family Co. and Trust B are associated. In particular, Family Co. is associated with Trust A under the company and person other than a company test in section YB 3, and Trust A is associated with Trust B under the two trustees with a common settlor test in section YB 7. Therefore, under the tripartite test, Family Co. and Trust B are associated persons. |

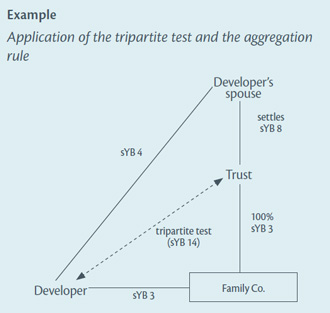

| In this example, Developer’s spouse settles Trust, which in turn owns all the shares in Family Co. The issue is whether Developer is associated with Family Co. under the test associating a company and a person other than a company in section YB 3. Developer would be associated with Family Co. under the company and person other than a company test because of the application of the aggregation rule in that test, in conjunction with the tripartite test. In particular, Developer would be treated for the purposes of the company and person other than a company test as holding all the shares held by Trust in Family Co. This is because Trust is associated with Developer under the tripartite test: Developer is associated with his spouse under the relatives test (section YB 4) and Developer’s spouse is associated with Trust under the trustee and settlor test (section YB 8), which means that Developer is associated with Trust under the tripartite test. Without the tripartite test in section YB 14 and the rule in the company and person other than a company test aggregating interests held by associated persons, Developer would not be associated with Family Co. even though there is a large community of interest between them. |

Different associated persons requirement

The requirement in the tripartite test in section YB 14 that the two persons have to be associated with the same third person under different associated person tests is designed to prevent the tripartite test applying more widely than is necessary to protect the tax base. This requirement is illustrated by the following examples.

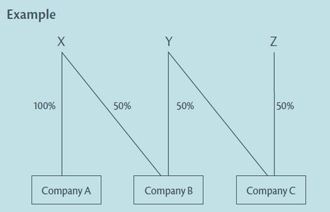

| In this example, individuals X, Y and Z, who are not associated with each other, own all the shares in Company A, Company B and Company C. Without the different associated persons tests requirement, Company A and Company C would be associated under the tripartite test in section YB 14, despite not having any common shareholders. However, because Company A and Company C are each associated with Company B under the same two companies test in section YB 2, they are not associated under the tripartite test. |

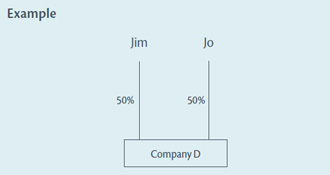

| In this example, Jim and Jo, who are not separately associated with each other, each hold 50% of the voting interests in Company D and are therefore each associated with Company D under the test in section YB 3 associating a company and a person other than a company. Without the different associated persons tests requirement, Jim and Jo would be associated under the tripartite test. However, because Jim and Jo are each associated with Company D (the common third person) under the same test (section YB 3), they are not associated under the tripartite test in section YB 14. |

Exception for companies tests (section YB 14(2))

As well as not applying to associate two persons if they are each associated with the same third person under the same associated persons test, the tripartite test will not associate two persons if they are each associated with the same third person under the company-related tests in sections YB 2 and YB 3.

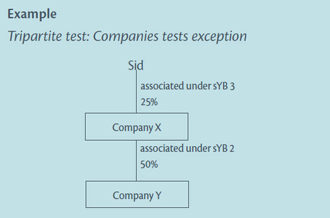

| In this example, Sid is associated with Company X under the company and person other than a company test in section YB 3, and Company X and Company Y are associated under the two companies test in section YB 2. Without the companies tests exception in section YB 14(2), the tripartite test would apply to associate Sid and Company Y (Company X being the common third person). This would be the case even though Sid only has a 12.5% interest in Company Y - the product of multiplying Sid’s 25% interest in Company X by Company X’s 50% interest in Company Y - which is below the 25% threshold in the company and person other than a company test in section YB 3. The companies test exception in section YB 14(2) ensures that Sid is not associated with Company Y under the tripartite test. |

Exceptions for certain trusts and charitable organisations (sections YB 16 and YB 8(2))

Energy consumer trusts and bonus bonds unit trust

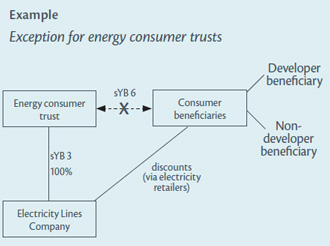

Under section YB 16(1), a lines trust established under the Energy Companies Act 1992, commonly referred to as an energy consumer trust, is excluded from the trustee for relative test (section YB 5) and the test associating trustees and beneficiaries (section YB 6). This is because such trusts are public in nature and do not pose a risk to the tax base. Such large public trusts are different in nature from private trusts which are intended to be subject to the associated persons tests.

Excluding energy consumer trusts from the tests in sections YB 5 and YB 6, ensures that discounts to consumers from electricity lines companies owned by consumer trusts are not treated as dividends, as illustrated in the following example.

The exception for energy consumer trusts also prevents consumer beneficiaries from being associated with one another. Even without this exception, the scope of the tripartite test is such that it would not apply to treat consumer beneficiaries as associated persons. Using the above example, this means that the developer beneficiary and the non-developer beneficiary will not be associated persons. This is because they are both associated with the same third person (Energy consumer trust) under the same associated persons test, namely the trustee and beneficiary test in section YB 6, which means that the tripartite test does not apply.

Additionally, section YB 16(1) also excludes the unit trust that administers bonus bonds from the associated persons tests in section YB 5 and YB 6 because of its public nature. This unit trust is excluded from the unit trust definition in section YA 1 of the Income Tax Act 2007, and therefore is not treated as a company, which means that the trust-related associated persons tests could potentially apply to it.

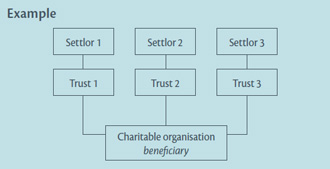

Charitable organisations

Under section YB 16(2), "charitable organisations" (as defined in section YA 1 of the Income Tax Act 2007) are not treated as beneficiaries for the purposes of tests associating trustees and beneficiaries (section YB 6) and settlors and beneficiaries (section YB 9).

| Without the exception for charitable organisations in section YB 16(2), the beneficiary-related tests could have unintended consequences. For example, if the beneficiary of several unrelated trusts is the same charity, the trustee and settlor of each such trust could end up being associated with the trustees and settlors of the other trusts without being aware of the fact. This exception therefore ensures that trustees and settlors of trusts in this situation are not treated as associated persons simply because the same charity is a beneficiary under their trusts. |

Charitable trusts

The trustee and settlor test in section YB 8 does not apply if the trust is a charitable trust. This exception - section YB 8(2) - prevents donors to a charitable trust being associated with each other. A charitable trust under the Income Tax Act 2007 is required to be registered as a charitable entity under the Charities Act 2005 and is therefore subject to any regulatory requirements of that Act. Such charities do not pose a risk to the tax base and therefore it is not necessary to include them in the trustee and settlor associated persons test.

Rationalising associated persons references in operative provisions

A number of operative provisions in the Income Tax Act 2007 previously contained modifications or additional wording in their associated persons references. These modifications were a result of different combinations of the associated persons tests in former subpart YB applying, in particular, the tests that applied for the purposes of the whole Act (excluding the 1973, 1988 and 1990 version provisions) or the 1988 version provisions (corresponding to the associated persons definitions in sections OD 7 and OD 8(3) of the Income Tax Act 2004). An example of such a provision was section EX 21(15).

These modifications to the associated person references in the operative provisions of the Income Tax Act 2007 have been generally omitted because they have been effectively subsumed by the various reforms to the associated persons tests in new subpart YB. The wording of these operative provisions therefore has been significantly simplified because they will simply refer to persons being associated without more (for example, without various references to the 1973, 1988 or 1990 version provisions). As a result, the wording of the associated person references in the operative provisions of the Income Tax Act 2007 are now streamlined and easier to understand.

For example, the wording of section GB 28(2) was:

- "A person is treated as being associated with another person if a person would be treated as being associated under the parts of subpart YB (associated persons and nominees) that apply for the purposes of the whole Act (excluding the 1973, 1988, and 1990 version provisions), or the 1988 version provisions, at the time the services are personally performed by the working person."

This wording has been replaced by:

- "A person is treated as being associated with another person if they are associated at the time the services are personally performed by the working person."

The definitions of the 1973, 1988 and 1990 version provisions and previous section YB 20 have been repealed because they are largely subsumed by the various reforms to the associated persons tests in subpart YB. These definitions equate to the lists of operative provisions to which the former specific associated persons definitions in sections OD 8(4), OD 8(3) and OD 8(1) of the Income Tax Act 2004 applied. However, because of the various modifications that apply in the associated persons tests in relation to the land transaction provisions, previously defined as the "1973 version provisions", this definition has been re-enacted in section YA 1 and called "land provisions".

The new associated persons definition in the Income Tax Act 2007 also applies in the Tax Administration Act 1994 because of section 3(2) of the Tax Administration Act 1994.

A number of the specific modifications or additional wording in the associated persons references in the operative provisions in the Income Tax Act 2007 were incorrect. These references have been corrected applicable from the commencement of the Income Tax Act 2007 on 1 April 2008, even though these references themselves have been omitted as part of these reforms of the associated persons definitions. It is necessary to correct these references from the commencement of the Income Tax Act 2007 on 1 April 2008 because the current associated person reforms do not apply generally until the 2010-11 income year.

Section CD 6(1)(a)(iii) repealed

A transfer of value from a company to a person is a dividend if the cause of the transfer is a shareholding in the company as described in section CD 6 of the Income Tax Act 2007. Section CD 6(1)(a)(iii) contained an extension which treated as a dividend any distribution made by a company to a trust under which a shareholder of the company, or spouse, civil union or de facto partner of the shareholder, was a beneficiary. This trust extension rule has been repealed because its function is performed by the new associated persons definition - in particular, the trustee-beneficiary test in new section YB 6.

Section CD 22(9) amendment

The definition of "fifteen percent interest reduction" in section CD 22(9), which relates to the share buy-back exclusion from the dividend definition, refers to "counted associate", which is defined inter alia as "a trustee of a trust under which a spouse, civil union partner or de facto partner, or minor child of the shareholder is a beneficiary". This wording has been amended so that it is consistent with other references in the associated persons definitions which describe discretionary beneficiaries. The provision now refers to a person who has benefited or is eligible to benefit under a trust (instead of referring to a beneficiary).

Section DB 42(2) amendment

Section DB 42(1) allows a taxpayer a deduction for any loss arising through misappropriation by an employee. Former section DB 42(2) stated that this deduction was not available if the taxpayer and the defalcating employee were associated in certain ways.

The new associated persons definition is comprehensive enough to cover all the relationships described in former section DB 42(2). Therefore the specific associated persons tests in this provision have been replaced by a standard associated persons reference. New section DB 42(2) simply provides that the section does not apply when a person who misappropriates property is associated with the person who carries on the business.

Omitted tests

Several associated persons tests contained in the previous subpart YB of the Income Tax Act 2007 have been omitted for simplification and rationalisation purposes. These omitted tests were:

- The test associating two persons if they habitually act together (former section YB 18).

- The test associating a person and a charity, friendly society, or non-profit body controlled by that person or a relative of that person (former section YB 19).

- The tests associating two companies and a company and a person other than a company, which were based on income interests (former sections YB 3 and YB 7). These tests were redundant given the equivalent comprehensive tests based on voting interests. The existence of these tests can be explained historically by the fact that they were originally enacted in 1988 before the voting interest concept was enacted in 1992.

- The test associating a partnership and an associate of a partner (former section YB 17). This test has been subsumed by the new tripartite test in section YB 14. Under the tripartite test two persons are associated if they are each associated with the same third person under different associated persons tests. This means that an associate of a partner, such as a spouse of a partner, would still be associated with the partnership under the tripartite test.

Rationalisation of other income tax provisions

A number of provisions in the Income Tax Act 2007 embodying a related person concept, similar to that in the associated persons definitions, have been rationalised. It is desirable, from a simplification perspective, that similar concepts in the Act be addressed similarly.

Replacing company control definition with associated persons definition

Section YC 1 of the Income Tax Act, which defined when a company was treated as being under the control of any persons, has been repealed. Its function is now performed by the new associated persons definition.

The definition of company control in section YC 1 and the definitions of associated persons in subpart YB are conceptually similar in that they define related parties for the purposes of operative provisions in the Income Tax Act 2007. The separate use of the section YC 1 company control definition rather than the associated persons definitions was probably a legacy of the company control definition being developed in the Income Tax Act before the associated persons definitions. The company control definition in the Act was first implemented in 1939, whereas the first associated persons definition in the Act was not enacted until 1968.

Allowing section YC 1 to be subsumed by the new associated persons definition is a desirable simplification measure.

The provisions in the Income Tax Act 2007 which previously employed the section YC 1 definition of company control, have been amended to use the new associated persons definition. They are:

- section GC 5 (leases for inadequate rent);

- section RF 11 (dividends paid to companies under control of non-residents); and

- paragraph (a) of the definition of "holding company" in section YA 1.

Replacing related person definition with associated person definition

Former section CD 44(15) to (17) of the Income Tax Act 2007 contained a definition of "related person" which was used in section CD 44(11) and (12) to determine the amount of the capital gain exclusion from a dividend arising from the realisation of a capital asset in the course of a company’s liquidation. As part of the amendments to rationalise the Income Tax Act provisions which embody an associated persons concept, the function of the former related person definition in section CD 44 will be performed by the new associated person definition.

Section CD 44(11) and (12) have been replaced by section CD 44(10A) and (10B) with associated persons references replacing related persons references. The new provisions apply for capital gain amounts derived or losses incurred after 31 March 2010, therefore ensuring that the changes have prospective application only.

For capital gain amounts derived or capital loss amounts incurred between 1 April 1988 to 31 March 2010, the previous law which used the related person definition continues to apply. This law contained in former section CD 44(11), (12) and (15) to (17), is now contained in section CZ 9B of the Income Tax Act 2007.

The references to related persons in the dividend definition in section YA 1 have also been replaced with references to associated persons.

Definition of "relative"

The definition of "relative" in section YA 1 of the Income Tax Act 2007 has been simplified so that it extends only to the second degree of blood relationship. Previously the definition also extended for the purposes of some provisions to the fourth degree of blood relationship. The new definition of relative includes a trustee of a trust under which a relative has benefited or is eligible to benefit - this continues the effect of paragraph (c)(v) of the old relative definition.

Application of changes to other Acts

A number of provisions in other Acts, which utilise the associated persons definitions in the Income Tax Act 2007, have been consequently amended as a result of these reforms. The provisions in these other Acts are:

- Fisheries Act 1996, section 59(10)(c) and (d);

- Misuse of Drugs Amendment Act 2005, section 31;

- Privacy Act 1993, section 6;

- Radiocommunications Act 1989, sections 153(2) and 161(2); and

- Smoke-free Environments Act 1990, section 2(1).

A number of provisions in other Acts also utilised former section YC 1 of the Income Tax Act 2007, which defined when a company was treated as being under the control of any persons. These references to section YC 1 have been replaced with references to the new associated persons definition in the Income Tax Act 2007. The provisions in these other Acts are:

- Insolvency Act 2006, section 182(1);

- Public Service Investment Society Management Act (No.2) 1979, section 2(2);

- Trustee Companies Management Act 1975, section 2(2); and

- Unit Trusts Act 1960, section 3(4).