Exemption from attribution requirement

2009 legislation covering the rules for taxing CFCs and foreign dividends and exemptions from the attribution requirement.

Sections CQ 2, DN 2, EX 21B to EX 21E, EX 22 and EX 23 of the Income Tax Act 2007; section 91AAQ of the Tax Administration Act 1994

Key features

Active business exemption

A person with an income interest of 10 percent or more in a CFC will not generally have to include attributed CFC income or loss in the person's gross income if the CFC passes an active business test. This is expected to save most CFCs the work of calculating attributed income.

A CFC will pass the active business test and be a non-attributing active CFC if it has attributable income that is less than 5 percent of its total income. Attributable and total income, for the purposes of the test, are measured using either financial accounting or tax measures of income. These measures are defined in the legislation.

It is expected that most people will prefer to use accounting measures of income, because they will be more readily available or easier to calculate. Accounting measures may be used to calculate the ratio if they are taken from accounts that comply with international financial reporting standards (IFRS) and certain other conditions are met. Accounting measures of income based on pre-IFRS New Zealand financial reporting standards may also temporarily be used by some people, primarily small and medium-sized enterprises.

For people who do not wish to or are unable to use accounting measures of income, tax measures of income may also be used to calculate the ratio of attributable income to total income.

CFCs in the same country may be consolidated for the purposes of the calculation of the 5 percent ratio calculation, subject to certain conditions.

A CFC will also be a non-attributing active CFC for a person with an income interest in the CFC, if the person has applied for and obtained a determination from Inland Revenue that the CFC is an active insurance business.

Australian exemption

A person with an income interest of 10 percent or more in a CFC will not have to include attributed CFC income or loss in the person's gross income if the CFC is resident and subject to income tax in Australia, and meets certain other conditions. A CFC that meets these conditions is a non-attributing Australian CFC.

Personal services income

There is an exception to the active business and Australian exemptions for CFCs. If a CFC derives certain personal services income or incurs a loss in deriving such income, such income or loss is always attributed, even if the CFC is a non-attributing active CFC or a non-attributing Australian CFC.

Detailed analysis

How to use the rules

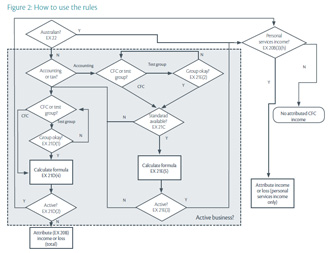

The goal is to work out whether a CFC qualifies for either the Australian or active business exemption.

Go to section EX 22 to work out whether or not the Australian exemption applies to a CFC.

If the Australian exemption does not apply, decide whether to use tax measures of income or accounting measures of income to check if the CFC qualifies for the active business exemption.

Use of accounting measures of income

If accounting measures of income are to be used, they can be used for a single CFC or for a test group of CFCs.

If the measures are to be used for a test group, go to subsection EX 21E(2) to see which CFCs can be members of the test group.

Go to section EX 21C to determine whether a suitable accounting standard is available for the CFC or the test group and, if there is, choose that as the applicable accounting standard.

If no applicable accounting standard is available for the CFC or the test group, you will have to use tax measures of income.

If an applicable accounting standard is available, calculate the formula in subsection EX 21E(5) using accounts that comply with that standard. The formula is the ratio of attributable income to total income. There are six components in the formula, which are further explained in subsections EX 21E(7) to (12). Rules in subsection EX 21E(4) govern how the calculation is to be done. Subsection EX 21E(3) explains, based on the result of the calculation, whether the CFC or the CFCs in the test group qualify for the active business exemption.

If a CFC qualifies to use the active business exemption using accounting measures of income, there may still be some attributed CFC income or loss from the CFC under subsections CQ 2(2B) and DN 2(2).

If a CFC does not qualify to use the active business exemption using accounting measures of income, try again using tax measures of income.

Use of tax measures of income

If tax measures of income are to be used, they can be used for a single CFC or for a test group of CFCs.

If the measures are to be used for a test group, go to subsection EX 21D(1) to see which CFCs can be members of the test group.

Go to subsection EX 21D(4) and calculate the formula there. This formula is the ratio of attributable income to total income. There are four components in the formula, which are further explained in subsections EX 21D(6) to (9). Rules in subsection EX 21D(3) govern how the calculation is to be done. Subsection EX 21D(2) explains, based on the result of the calculation, whether the CFC or the CFCs in the test group qualify for the active business exemption.

If a CFC qualifies to use the active business exemption using tax measures of income, there may still be some attributed CFC income or loss from the CFC under subsections CQ 2(2B) and DN 2(2).

If a CFC does not qualify to use the active business exemption using tax measures of income, certain income (see section EX 20B) from the CFC will be attributable under sections CQ 2 or DN 2.

Figure 2 illustrates the process described above.

Figure 2: How to use the rules

Sections CQ 2 and DN 2 of the Income Tax Act 2007

New paragraphs CQ 2(1)(h), CQ 2(1)(i), DN 2(1)(h) and DN 2(1)(i) apply to a person who holds an income interest in a CFC. If the CFC is a non-attributing active CFC or a non-attributing Australian CFC, the interest-holder does not have attributed CFC income under subsection CQ 2(1) or attributed CFC loss under subsection DN 2(1). In other words, these paragraphs implement the active business and Australian exemptions. The terms 'non-attributing active CFC" and "non-attributing Australian CFC" are further defined in sections EX 21B and EX 22 respectively.

A holder of an interest in a non-attributing active CFC or a non-attributing Australian CFC may still have attributed CFC income under subsection CQ 2(2B), or attributed CFC loss under subsection DN 2(2). These subsections apply if the CFC derives income that is an amount of personal services income described by section EX 20B(3)(h). This income is always attributable.

Paragraph CQ 2(1)(g) has been repealed because there is no longer an exemption from attribution of CFC income for CFCs resident in grey list countries.

The active business exemption (sections EX 21B to EX 21E of the Income Tax Act 2007)

Section EX 21B

Section EX 21B defines a non-attributing active CFC as a CFC that:

- meets the requirements of section EX 21D (has a ratio of attributable to total income, using tax measures of income, of less than 5 percent); or

- is able to and chooses to apply section EX 21E, and meets the requirements of that section (has a ratio of attributable to total income, using accounting measures of income, of less than 5 percent); or

- meets the requirements of a determination made by the Commissioner under section 91AAQ of the Tax Administration Act 1994 (is a CFC with an active insurance business).

A CFC may meet the requirements of sections EX 21D or 21E alone or as part of a test group. The income of the CFCs in a test group is consolidated for the purposes of calculating the ratio of attributable to total income, which can be advantageous for taxpayers. If the test group meets the requirements, all CFCs in the group are non-attributing active CFCs. There are additional requirements which must be met in order to use a test group. These are explained further in the analysis of sections EX 21C to 21E.

A CFC is a non-attributing active CFC for an accounting period of the CFC. If a CFC does not meet the requirements to be a non-attributing active CFC in one accounting period, it will not be a non-attributing active CFC in that period, regardless of whether it has been one in the past or will be one in the future. "Accounting period" is defined in section YA 1.

A CFC is a non-attributing active CFC for a person who holds an interest in that CFC. It is theoretically possible that one person with a 10 percent or greater interest in a CFC will be able to count that CFC as a non-attributing active CFC, but another person with a 10 percent or greater interest in the same CFC will not. This is expected to be rare in practice.

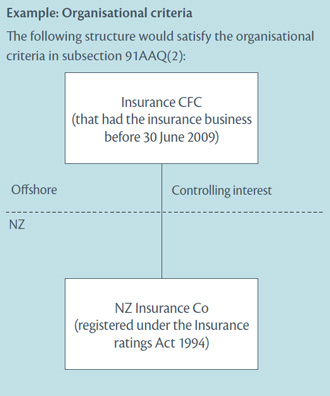

To meet the requirements of a determination made by the Commissioner under section 91AAQ of the Tax Administration Act 1994 for a particular accounting period, the taxpayer must first have applied for and obtained the determination and it must not have expired or been revoked. Section 91AAQ regulates this process. Secondly, any requirements laid out in the determination must also be satisfied. A CFC that fails to obtain a determination or to meet the requirements of the determination may still be a non-attributing active CFC if it meets the requirements of sections EX 21D or EX 21E.

Accounting standards that may be used (section EX 21C)

Section EX 21C states the sets of accounting standards that may be used to calculate the ratio of a CFC's attributable income to total income under section EX 21E, when a person holds an interest in that CFC. Certain conditions must be satisfied before any particular set of accounting standards can be used.

This means the person may be unable to use any of the sets of accounting standards because the relevant conditions are not satisfied. A person may also choose not to use any of the sets of accounting standards, even if they are available. In either case, the ratio of a CFC's attributable income to total income will be calculated under section EX 21D using tax measures of income.

If section GB 15C, which relates to use of the test in section EX 21E to avoid tax applies, it is not possible to use any of the sets of accounting standards in section EX 21C and so section EX 21D must be used to calculate the ratio of attributable income to total income (See the analysis of section GB 15C for further information.).

If, under section EX 21C, a person is able use one or more sets of accounting standards to apply section EX 21E for a particular CFC or a particular test group of CFCs, only one set of accounting standards (called the applicable accounting standard) may be used for that purpose.

Subsection EX 21C(2) allows the use of generally accepted accounting practice with IFRS for a particular CFC if accounts exist that include the accounts of that CFC, those accounts comply with generally accepted accounting practice with IFRS, and specified audit requirements are met.

The accounts may be for the CFC alone or for a group of companies that includes the CFC. In the latter case, further work is likely to be required to separate amounts relating to the CFC when applying section EX 21E. The accounts may be held by the person who holds an interest in the CFC or by someone else. Under existing rules applying before enactment of section EX 21C, Inland Revenue can require that the accounts be produced to verify a tax position taken. (The comments in this paragraph apply equally to subsections EX 21C(4) and EX 21C(6)).

The term "generally accepted accounting practice with IFRS" means generally accepted accounting practice, as defined in section 3 of the Financial Reporting Act 1993, but with a restriction. The restriction is that the New Zealand equivalents to International Financial Reporting Standards must be used as the financial reporting standards referred to in that section. These New Zealand standards, referred to as "IFRS" in section YA 1 of the Income Tax Act 2007, have initially been issued by the International Accounting Standards Board, then approved, with modifications, by the New Zealand Accounting Standards Review Board. Some entities qualify to use a subset of these standards (the "framework for differential reporting for entities applying the New Zealand equivalents to the international financial standards reporting regime"). That subset is also acceptable for the purposes of section EX 21E.

The accounts must comply with generally accepted practice with IFRS. Often, absolute compliance is not practical but audited accounts will be treated as complying anyway. The analysis of subsection EX 21C(9) below provides further explanation.

The audit requirements are specified in subsection EX 21C(8). Analysis of that subsection below provides more information.

Subsection EX 21C(3) allows a person to use generally accepted accounting practice with IFRS for a test group of CFCs if accounts exist that include the accounts of the CFCs in the test group, the first-mentioned accounts comply with generally accepted accounting practice with IFRS, and specified audit requirements are met.

The test group is defined under subsection EX 21E(2) as a group of CFCs a taxpayer has an interest in, that are resident in the same country and that meet certain other requirements.

The complying accounts must include the accounts of all the CFCs in the test group. The complying accounts may also include the accounts of other entities, such as all the entities in a worldwide group. In that case, further work is likely to be required to separate amounts relating to the test group when applying section EX 21E. The accounts may be held by the person who holds an interest in the CFCs in the test group or by someone else. Under existing rules applying before the enactment of section EX 21C, Inland Revenue can require that the accounts be produced to verify a tax position taken. (Comments in this paragraph apply equally to subsections EX 21C(5) and EX 21C(7)).

The term "generally accepted accounting practice with IFRS" has the same meaning as in subsection EX 21C(2).

Subsection EX 21C(4) allows a taxpayer to use IFRSEs for a particular CFC if accounts exist that include the accounts of the CFC, the first-mentioned accounts comply with IFRSEs, and specified audit requirements are met.

An "IFRSE" is defined in section YA 1 as "an International Financial Reporting Standard approved by the International Accounting Standards Board, as amended from time to time". In other words, subsection EX 21C(4) allows the use of accounts that comply with international financial reporting standards. Those standards are either required to be used or may be used in over 100 countries. In contrast, subsection EX 21C(2) allows the use of New Zealand equivalents to international financial reporting standards. In most respects, international financial reporting standards and the New Zealand equivalents to those standards are identical. However, that may not always be the case.

Subsection EX 21C(5) allows a taxpayer to use IFRSEs for a test group of CFCs if accounts exist that include the accounts of the CFCs in the test group, the first-mentioned accounts comply with IFRSEs, and specified audit requirements are met.

The term "IFRSEs" has the same meaning as in subsection EX 21C(4).

Subsection EX 21C(6) allows a person to use generally accepted accounting practice without IFRS for a particular CFC if specific requirements are met.

The term "generally accepted accounting practice without IFRS" means generally accepted accounting practice as defined in section 3 of the Financial Reporting Act 1993, but with the restriction that the financial reporting standards referred to in that section must not be New Zealand equivalents to international financial reporting standards. Pre-IFRS financial reporting standards (usually referred to as FRSs) will be used instead.

Subsection EX 21C(6) exists because a large number of small and medium-sized entities are not yet required to comply with New Zealand equivalents to international financial reporting standards, pending completion of a review of financial reporting requirements by the government. The subsection is intended to be temporary. It may be replaced or repealed as the future of reporting requirements becomes clearer or as FRS become outdated. The subsection is not to be used when accounts that comply with IFRS are available; IFRS accounts are to be preferred in that case.

The requirements that must be met to use generally accepted accounting practice without IFRS are that a company that is resident in New Zealand must:

- hold accounts that include the accounts of the CFC, that comply with generally accepted accounting practice without IFRS, and that meet specified audit requirements;

- not have revenue under either Financial Reporting Standard 34 or Financial Reporting Standard 35 (the intent is that insurance businesses will not be able to use generally accepted accounting practice without IFRS for the purpose of section EX 21E);

- not be an issuer under section 4 of the Financial Reporting Act 1993 in the current accounting period and not have been an issuer in the preceding accounting period;

- not be required by section 19 of the Financial Reporting Act 1993 to file its accounts with the Registrar of Companies;

- not be a large company under section 19A(1)(b) of the Financial Reporting Act 1993; and

- not have accounts (and not be a subsidiary of a company having accounts) that are prepared and audited under generally accepted accounting practice with IFRS (if such accounts are available, generally accepted accounting practice with IFRS should be used for the purposes of EX 21E).

Most but not all of the requirements match those in Accounting Standards Review Board Release 9 (ASRB 9). ASRB 9 specifies the entities that are permitted to defer compliance with New Zealand equivalents to international financial reporting standards. In the event that ASRB 9 is withdrawn, amended or superseded, the requirements in the legislation will be unaffected.

Subsection EX 21C(7) allows a taxpayer to use generally accepted accounting practice without IFRS for a test group of CFCs if certain requirements are met. The requirements are mostly the same as those in subsection EX 21C(6), except that the accounts must include the accounts of all the CFCs in the test group, rather than just the accounts of the CFC. It is acceptable for the accounts to include the accounts of other entities, in addition to the CFCs in the test group. In that case, additional work is likely to be required to identify and separate amounts relating to the test group.

Subsection EX 21C(8) contains the two audit requirements that must be met in each of subsections EX 21C(2) to (7).

The first requirement in subsection (8) is that the accounts in question must be audited by a chartered accountant who is independent of the CFC and of the person who holds the accounts. In the case of a test group, the chartered accountant must be independent of all the CFCs in the test group.

The use of the term "chartered accountant" is regulated by the Institute of Chartered Accountants of New Zealand Act 1996, and requires membership of the New Zealand Institute of Chartered Accountants (NZICA). Because the accounts of a CFC will commonly be audited in a country other than New Zealand, requiring membership of NZICA in all cases is impractical. For that reason, it is also acceptable for the auditor to be a person who is not a chartered accountant (as defined in New Zealand legislation), provided they meet a professional standard, in their country, that is equivalent to the professional standard a chartered accountant must meet in New Zealand.

The second requirement in subsection (8) is that the auditor must have given an unqualified audit opinion or - in countries in which the term "unqualified audit opinion" is not used or has a different meaning - a type of audit opinion that is used in that country and is of a standard that is equivalent to an unqualified audit in New Zealand.

Subsection EX 21C(9) sets out the circumstances in which accounts will be treated as complying with a particular set of accounting standards for the purposes of subsections EX 21C(2) to (7). The subsection is required because accounts will rarely comply completely with accounting standards at a detailed level, even though they comply in all material respects. The fact that there is non-compliance at a detailed level should not, in general, prevent the use of the accounts for the purposes of applying section EX 21E.

The accounts will be treated as complying with the relevant standards if there is a statement in the accounts that they comply, the audit requirements of subsection EX 21C(8) are satisfied, and there is not evidence of wrong-doing or incompetence.

In the case of wrong-doing or incompetence, Inland Revenue must have reasonable grounds to suspect fraudulent activity, preparation of the accounts with an intent to mislead, or incompetence of the auditor. "Fraudulent activity" is fraudulent activity by the person who holds the interest in the CFC, by the CFC itself, by a CFC in the CFC's test group, or by the auditor. "Mislead" and "incompetence" are not further defined.

Subsection EX 21C(9) does not affect in any way the requirements to keep records relating to CFCs, or the powers of Inland Revenue to require the production of records and other information relating to the CFC. If these records or information give Inland Revenue reasonable grounds to suspect fraud, an intent to mislead or incompetence, the accounts will not automatically be treated as complying with a particular set of accounting standards.

The active business exemption using tax measures of income (section EX 21D)

Section EX 21D sets out the rules for calculating the ratio of attributable income to total income when using tax measures of income. The ratio may be calculated either for a single CFC or, if certain requirements are met, for a test group of CFCs. If the ratio is not less than 0 and is less than 0.05, then in the case of a single CFC it will be a non-attributing active CFC, unless it is prevented from being one for some other reason (such as the application of section GB 15C). In the case of test groups, all the CFCs in the test group will be non-attributing active CFCs unless they are prevented from being non-attributing active CFCs for some other reason.

The ratio calculation, with only one exception, is based on amounts of income and no deductions for expenditure or losses incurred are included in the calculation.

Subsection EX 21D(1) contains the requirements that must be met for the ratio to be calculated for a test group of CFCs.

The first requirement is that all the companies must be resident in the same country. The test for residence in this case is that all of the companies are liable for income tax in the same country by reason of domicile, residence, place of incorporation, or centre of management. This is intended to exclude a CFC that is liable for tax in a country merely because of, for example, the presence of a permanent establishment in that country.

The second requirement is that the person undertaking the calculation (the person with the interest in the CFC) holds an income interest of more than 50 percent in each of the CFCs in the test group. This is intended to prevent a CFC being a part of a test group for more than one interest holder.

The third requirement is that all CFCs in the group must make the same choice of method and currency under subsection EX 21(4). They must either all make the choice to convert all transactions to New Zealand dollars at the applicable daily rate, or all make the choice to use the same reporting currency. If the reporting currency is used, subsections EX 21(5) and (6) must be observed in the normal way, and section EX 21(7) will apply to certain financial arrangements. The purpose of this provision is to limit the scope for manipulating the test by the deliberate choice of different reporting currencies for CFCs within the group.

The fourth requirement is that the CFCs in the test group must be consolidated for the purposes of the test (and only for the purposes of the test). Consolidation requires the elimination of all balances, transactions, income and expenses between CFCs in the group, and the use of like tax treatments for like transactions. For example, it would not be appropriate for different CFCs in the test group to use different options for calculating financial arrangement income for the same type of financial arrangement. It is expected that elimination will be carried out in a way that is consistent with accepted accounting principles. It is not expected or intended that there will be rigid compliance with any particular set of financial accounting standards. The rules for consolidation in subpart FM of the Income Tax Act 2007 are not to be used for the consolidation of CFCs.

Subsection EX 21D(2) designates a CFC (whether alone or as part of a test group) as a non-attributing active CFC if the ratio of attributable income to total income in sub-section EX 21D(4) is less than 0.05 and, if zero, is not zero because of the application of paragraph EX 21D(3)(f). The ratio may be zero because attributable income is zero and there is some total income. In that case, the CFC is a non-attributing active CFC. If the ratio is zero for any other reason (paragraph EX 21D(3)(f) applies), the CFC is not a non-attributing active CFC. In that case, the formula has produced an unusual, and possibly unintended, result, so attribution is required.

Subsection EX 21D(3) explains how to apply the formula in subsection EX 21D(4).

If the formula is being applied for a test group, the test group is effectively treated as a single consolidated entity (using the consolidation described in the analysis of sub-section EX 21D(1) in this report). Consolidated amounts are used in the formula. Consistent with the single-notional-entity approach, special rules apply if it is necessary to determine whether the test group is associated with a person or in the same group of companies as a person, such as in parts of section EX 21B. The person is associated with the test group if the person is associated with a member of the test group but is not a member of the test group. The person is a member of the same group of companies as a test group if the person is in the same group of companies as a member of the test group, but is not a member of the test group (these rules apply only for the purposes of calculating the formula and do not affect, for example, the application of the loss offset rules in Part I).

If either the numerator or denominator in the formula is negative, it is treated as being zero. The ratio calculation has been designed in such a way that a negative numerator or denominator should not be possible. If a negative result is produced, this is unintended and the result is set to zero.

If the denominator in the ratio formula is zero, the ratio is set to zero and the CFC will not be a non-attributing active CFC. A nil denominator implies either an unintended result or no activity on the part of the CFC. Because of the possibility of an unintended result, attribution is required. If the CFC is inactive, the calculation of attributed income should be trivial.

Subsection EX 21D(4) contains the formula for calculating the ratio of attributable income to total income.

The numerator contains the calculation of attributable income, being the attributable CFC amount for the CFC (or test group notionally treated as a single CFC) under section EX 20B, less two optional adjustments specified in subsection EX 21D(7).

The attributable CFC amount under section EX 20B is calculated using the rules in section EX 21. Those rules, broadly speaking, treat the CFC as resident in New Zealand for the purposes of the calculation. They also allow the use of a foreign currency for the bulk of the calculation, if certain conditions are met.

The first adjustment, if the holder of the interest in the CFC chooses to apply it, is to remove certain amounts relating to personal services under paragraph EX 20B(3)(h). These amounts are always attributable, but the adjustment means a CFC may qualify for the active business exemption in relation to its other income. It is not possible to remove the amount if it would also come within another paragraph of subsections EX 20B(3) or (4). The removal of the amount is only for the purposes of applying the active business exemption. When attribution is required, as it will be under either of subsections CQ 2(1) or (2B), the amount is included.

The second adjustment, which is again optional, is the subtraction of the cost of revenue account property if there would be an amount under paragraph EX 20B(3)(k) as a result of the disposal of the property. That paragraph includes the gross proceeds of the disposal as an attributable CFC amount. The effect of the adjustment is that only a net amount is included in attributable income. The adjustment is limited to the part of the cost of the property that would be allowed as a deduction for the period under section EX 20C, but also may not be more than the amount under paragraph (k). In this way, net losses on disposal are not possible. This is for partial consistency with the use of gross amounts in the ratio calculation. If any amounts would be required to be added back in relation to the deduction under subpart CH of the Income Tax 2007, they must also be added back in the formula.

The denominator in the formula contains the calculation of total income, being annual gross income for the accounting period less up to four adjustments.

Annual gross income is calculated, broadly speaking, as if the CFC were a resident (the term "annual gross income" is defined in section BC 2). As with the calculation of the attributable CFC amount under section EX 20B, section EX 21 applies to the calculation. Income under subpart CQ of the Income Tax Act 2007 is not included in the measure of annual gross income because existing "look-through" rules treat CFC or FIF interests held by a first CFC as held directly by the interest-holder in the first CFC. This is to prevent double-counting of gross income.

The first adjustment is only required if optional adjustments were made to the numerator in the formula. If amounts were subtracted from the numerator, they must also be subtracted from the denominator.

The second adjustment is the removal of any expenditure or loss included in the calculation of the attributable CFC amount under section EX 20B. In practice, there should never be any such amounts, because section EX 20B includes only income; this adjustment is a purely protective measure, to be used in the event that section EX 20B does not operate as intended. The subtraction of personal services income or the cost of revenue account property from the numerator of the formula, under subsection EX 20D(7), is not expenditure or loss under section EX 20B, but is in any case removed in the first adjustment.

The third adjustment is the removal of income derived by the CFC from a company, if the CFC and the company could be members of the same test group under subsection EX 20D(1). The purpose of this adjustment is to prevent the inflation of total income by transactions between associated entities. In determining whether the CFC and the company could be members of the test group, it is not relevant that the required consolidation has actually been undertaken or not. It is relevant that if a person were to undertake the required consolidation, the CFC and the company would be eligible to be members of the same test group.

The fourth adjustment is the removal of income derived by the CFC from a supply to a company that could not be a member of a test group with the CFC, if the supply was made with the purpose of inflating the measure of total income (the analysis of section GB 15B in this report provides further information). The third and fourth adjustments have a similar purpose, with the following differences:

- The third adjustment applies to income derived by a CFC from a company that could be part of a test group with the CFC, while the fourth adjustment applies when the company could not be part of a test group with the CFC.

- The third adjustment does not require any purpose, while the fourth adjustment requires the purpose of increasing the measure of total income.

The ratio in the formula in subsection EX 21D(4) will never be less than zero (subsection EX 20D(3) ensures this). The ratio may be zero if attributable income is zero, or because of the application of paragraph EX 21D(3)(f).

The active business exemption using accounting measures of income (section EX 21E)

Section EX 21E contains the rules for calculating the ratio of attributable income to total income when using accounting measures of income. The availability of an applicable accounting standard under section EX 21C is a prerequisite for the use of section EX 21E. The ratio may be calculated either for a single CFC or, if certain requirements are met, for a test group of CFCs. If the measure of total income is more than zero and the measure of attributable income is not negative, and the ratio is less than 0.05, then the CFC (or every CFC in the test group) will be a non-attributing active CFC. This is subject to any limitations imposed by other provisions, such as section GB 15C.

The calculation requires, firstly, a base calculation of attributable income, subsequently altered by some compulsory adjustments and some optional adjustments. Secondly, it requires a base calculation of total income, also subsequently altered by some compulsory adjustments and some optional adjustments. The altered measure of attributable income is finally divided by the altered measure of total income.

Amounts used in the ratio calculation must comply with the applicable accounting standard, but will often be taken to comply in the absence of strict compliance at a detailed level (see the analysis of subsection EX 21E(13) in this report). It is accepted that the accounting standards may change over time. Any guidance provided in this report about the meaning of particular terms under accounting standards may be made obsolete by changes in the standards.

The use of section EX 21E is purely optional (see subparagraph EX 21B(2)(b)(ii)). If a person chooses to apply the section but its requirements are not met for a CFC, sub-section EX 21B(3) and section EX 21D must also be applied to the CFC (subject to other provisions such as section GB 15C). In other words, there is no automatic requirement to attribute CFC income or loss when the requirements of section EX 21E are not met; it will depend on whether it is a non-attributing CFC by some other means.

Most amounts used in the ratio calculation are gross amounts, with no deductions for expenditure or losses incurred. However, and in contrast to the ratio calculation that uses tax measures of income (section EX 21D), some amounts relating to derivatives and non-derivative financial assets are included even if they are losses or expenditure. This is not "net" treatment in the sense of subtracting all expenditure incurred in earning a particular item of income. Rather, losses or expenditure on some derivatives or financial assets are netted off against income or gains on other items. This is done to reduce the cost of calculating the ratio, in recognition that ledger accounts and items on the face of financial statements will often be reported net, or net of derivative gains and losses.

By allowing the use of net amounts in some cases, the legislation creates the possibility of negative measures of attributable income or total income. As is clear from the restrictions on the measures of attributable income (which must not be negative) and total income (which must be positive), a CFC with negative measures of income is not a non-attributing active CFC under section EX 21E.

Subsection EX 21E(1) contains the requirement that an applicable accounting standard under section EX 21C be available to the person for undertaking the ratio calculation.

Subsection EX 21E(2) contains the requirements that must be met for the ratio to be calculated for a test group of CFCs. Section EX 21C imposes further requirements relating to the sets of accounting standards (the applicable accounting standard) that may be used by the test group. It is possible that the requirements of subsection EX 21E(2) will be met, but that no applicable accounting standard will be available for use under section EX 21C. In that case, the ratio may not be calculated for the test group under section EX 21E.

The first requirement for using a test group is that all the CFCs in the group are required by the applicable accounting standard to be consolidated for the accounting period. Typically, this means all the CFCs will be under common control, but the accounting standard is the authoritative reference. If the applicable accounting standard does not require that a CFC is to be consolidated with all the other CFCs in the test group for the whole of the accounting period, the CFC is not to be included in the test group. It is acceptable for the CFC to be required to consolidate, under the applicable accounting standard, with entities outside the test group as well as those in the test group. If there are entities outside the test group, additional work is likely to be required to identify amounts pertaining to the test group.

The second requirement for using a test group is that all the companies in the test group must be resident in the same country. This is the same requirement imposed on a test group under section EX 21D.

The third requirement for using a test group is that the person applying the test (the person with an income interest in the CFC) holds an income interest of more than 50 percent in every company in the group. Again, this is the same requirement imposed on a test group under section EX 21D.

The fourth requirement for using a test group is that all the CFCs must use the same functional currency. The calculations under section EX 21E will effectively be undertaken using the functional currency of a CFC (see the analysis of paragraph EX 21E(4)(g)), and the use of different functional currencies within a test group would therefore complicate that calculation.

The final requirement for using a test group is that audited and consolidated financial statements, complying with the applicable accounting standard, must exist. These must contain the accounts of all the CFCs in the test group. As with the first requirement, it is acceptable for the consolidated financial statements to also include the accounts of companies not in the test group, but additional work is likely to be required in this case to isolate the amounts applicable to the test group. Subsection EX 21E(13) states that the financial statements (being accounts) will be taken to comply with the applicable accounting standard if they meet the requirements of section EX 21C in relation to that standard (see especially subsection EX 21C(9)).

Subsection EX 21E(3) is the rule that makes a CFC a non-attributing active CFC if the CFC's ratio of attributable income to total income is less than 0.05, its attributable income is not negative, and its total income is greater than zero.

Subsection EX 21E(4) explains how the ratio calculation in subsection (5) is to be undertaken.

Amounts used in the calculation must be determined under the applicable accounting standard. Amounts will be taken to be determined under the applicable accounting standard if they are actually determined under that standard, or if the requirements in subsection EX 21E(13) are met. Some of the adjustments to base measures of attributable income and total income require the use of tax measures of income or expenditure. In those cases, it is clear that the amount will not be determined under the applicable accounting standard.

Each item in the formula (there are six items) must be adjusted so that there is no double-counting of amounts. Double-counting could occur if, for example, an amount was both income from a financial asset under paragraph EX 21E(7)(f) and income from property used to back insurance assets under paragraph EX 21E(7)(h). Double-counting across items, rather than within an item in the formula should be automatically prevented by the structure of section EX 21E.

Paragraph EX 21E(4)(g) requires that amounts are to be determined for a CFC using the functional currency of the CFC. The functional currency of a CFC is determined by the applicable accounting standard and cannot be freely chosen. The concept of "functional currency" is much more restrictive than the concept of "the currency of the CFC's financial accounts" in subsection EX 21(4).

Amounts may have to be translated from a currency that is not the functional currency of the CFC, such as when the CFC makes sales outside its own country. In that case, conversion to the functional currency must comply with the applicable accounting standard (with one exception). Translation under the applicable standard will frequently result in the recognition of an exchange rate gain or loss, and the gain or loss may need to be included in measures of attributable or total income. The one exception to the general rule is that exchange differences arising on a monetary item that forms part of a net investment of the CFC in a foreign operation are ignored. A monetary item that is part of a net investment in a foreign operation is an item for which settlement is neither planned nor likely to occur in the foreseeable future (see the definition in International Accounting Standard 21, for example).

If the ratio in subsection EX 21E(5) is calculated for a test group, the test group is - broadly speaking - treated as a single CFC for the purposes of the calculation. Amounts for the test group must be consolidated under the applicable accounting standard. This requires elimination of transactions, balances, income and expenses between the group members. If consolidated financial accounts exist that include the accounts of companies in the test group and only those companies, it may be possible to use those accounts without alteration. If consolidated accounts include entities that are not members of the test group, a sub-consolidation will be required for the test group. Information from consolidation worksheets may be used for this purpose, providing it meets the requirements of subsection EX 21E(13).

Because the test group is effectively treated as a single entity for the purposes of section EX 21E, there are special rules for determining when a person who is not a member of the test group is associated with the test group, or is a member of the same group of companies as the test group. The analysis of subsection EX 21D(3) in this report provides more information.

Each item in the formula is to be adjusted to remove amounts attributable to minority interests. "Minority interest" is not further defined in the legislation. However, it is clear from the context that a minority interest is an interest in the CFC held by a person who is not the interest-holder calculating the ratio.

Removal of amounts attributable to minority interests is most relevant for test groups. For an individual CFC, removal of these amounts is expected to affect all amounts equally so that the ratio in the formula is unchanged. For a test group, removal of these amounts is necessary to prevent, for example, all the income of an active business that is only partly owned by a New Zealand resident from sheltering attributable income of a company that is wholly owned by that resident.

Example: Removal of minority interest

A test group applies the same rules for exchange rate conversion as an individual CFC. Consolidated financial accounts are presented in a presentation currency, which may differ from the functional currency of any of the entities whose accounts are being consolidated. Because all the entities in a test group will have the same functional currency, conversion to a different presentation currency is unnecessary and the functional currency should be used. For the avoidance of doubt, the legislation requires that if a presentation currency is used to calculate amounts, translation of all amounts from the functional to the presentation currency must be undertaken using an average exchange rate for the year. The effect is that the amounts in presentation currency will be nothing more than a scaled-up or scaled-down version of the amounts in the functional currency.

Subsection EX 21E(5) contains the formula for calculating the ratio of attributable income to total income using accounting measures of income.

The intent, in defining the items used in the numerator in the formula, was to define a measure of attributable income that was a reasonable approximation to the tax measure of attributable income, while not requiring excessive adjustments to readily available accounting measures. Similar comments apply to the denominator. In cases in which net amounts are allowed to be used in the formula, the approximation will not be to tax measures of gross income, but to tax measures of net income or loss.

The numerator in the formula consists of a base measure of attributable income (reported passive). There are subsequent compulsory upward adjustments (added passive) and then optional downward adjustments (removed passive). Double-counting and double-elimination are prevented by requiring that amounts are included in added passive only to the extent they are not already included in reported passive. Amounts are included in removed passive only to the extent that they are already in added passive or reported passive.

The denominator in the formula consists of a base measure of total income (reported revenue). There are subsequent optional upward adjustments (added revenue) and compulsory downward adjustments (removed revenue). As with the numerator, double-counting and double-elimination are prevented.

Subsection EX 21E(7) defines the base measure of attributable income (reported passive).

The measure includes dividend, royalty, rental and lease income, whether or not in the ordinary course of business, and all are measured on a gross basis. It is intended that these terms have the meanings they have under the applicable accounting standard, rather than their meanings in the Income Tax Act 2007. For example, if generally accepted accounting practice with IFRS or IFRSEs are used, International Accounting Standard 18 (Revenue) provides some guidance about the recognition of dividends and royalties when received in the ordinary course of business. International Accounting Standard 17 (Leases) provides some guidance about the recognition of interest, rents and other lease income under a lease. If the applicable standard provides no guidance, the meanings of dividend, royalty, rental and lease should be determined according to the general understanding of accountants who would apply the standard.

It is important to note that the label given to a component of income in the accounts or on the face of financial statements does not determine the character of the amount. For example, if an amount would be a royalty under International Accounting Standard 18, but is included in “Other income” in the income statement because it is not in the ordinary course of business, it is still a royalty for the purposes of subsection EX 21E(7).

Another component of reported passive income is interest income. This is measured on a gross basis (with no deduction for expenses). Interest income is recognised under generally accepted accounting practice with IFRS and IFRSEs under the Revenue Standard (International Accounting Standard 18), if the interest is received in the course of ordinary activities of the entity. That standard specifies that the effective interest method (set out in International Accounting Standard 39) is to be used to calculate the amount of interest (this is essentially a yield-to-maturity calculation). Interest income may also be recognised other than under the Revenue Standard, such as when not in the ordinary course of activities of the entity. Again, the effective interest method would normally be used. It is expected that similar principles would apply under generally accepted accounting practice without IFRS, although there is no relevant standard to spell this out.

A further component of reported passive income relates to income or loss from a financial asset that is not a derivative.

The income or loss is included if it is a change in the reported fair value of the financial asset, a gain or loss on the derecognition of the asset or a foreign exchange gain or loss on the asset. Income or loss is to be included regardless of whether or not it appears in the income statement or elsewhere in the accounts. Losses will occur if the reported fair value declines, there is a loss on derecognition of the asset or there is a foreign exchange loss on the asset. Losses will not occur because expenditure, such as the cost of borrowing to purchase the asset, has been incurred in deriving income from the asset. Such expenditure is ignored for the purposes of the ratio calculation.

Not all amounts of income that relate to financial assets are included under paragraph EX 21E(7)(f). For example, some interest income is recognised under paragraph EX 21E(7)(b) even though it flows from the holding of a financial asset. If an amount is included under paragraph (f) and another paragraph, subparagraph EX 21E(4)(a)(ii) allows an adjustment to prevent double-counting.

Example 1: Income or loss from a financial asset (held-to-maturity)

Example 2: Income or loss from a financial asset (at fair value through profit and loss)

Example 3: Income or loss from a financial asset (available-for-sale)

The definitions of “financial asset”, “derivative” and “derecognition” are contained in NZ IAS 39 (the New Zealand equivalent to International Accounting Standard 39), regardless of the applicable accounting standard being used in section EX 21E. In the case of “financial asset”, the definition is by reference to the definition in NZ IAS 32. The definitions from NZ IAS 39 are used only for the purposes of identifying which assets are non-derivative financial assets and when they are effectively disposed of, not for determining how these assets are measured. If, for example, generally accepted accounting practice without IFRS is being used as the applicable accounting standard, a person will use NZ IAS 39 to identify which assets of the CFC are financial assets. Having identified the assets, the person may use the values of those assets as determined under generally accepted accounting practice without IFRS. The use of the definitions from NZ IAS 39 is necessary because generally accepted accounting practice without IFRS does not rigorously define “financial asset” or “derivative”.

Income or losses from shares that are not revenue account property are excluded from the ambit of paragraph EX 21E(7)(f). This is to obtain a better approximation to tax measures of income; the assumption is that gains or losses on these shares would not be income or loss if tax measures of income were used. The term “revenue account property” is defined in section YA 1 of the Income Tax 2007 and is intended to have that meaning.

Another component of reported passive is income or loss from a derivative instrument. “Derivative instrument” is to be given the definition in NZ IAS 39. As with the use of NZ IAS 39 definitions for the purposes of paragraph EX 21E(7)(f), the definition is used only to identify which items the CFC holds are derivative instruments. Subsequent measurement is undertaken using the applicable accounting standard, whatever that may be.

Income or loss from a derivative may be recorded directly in the income statement in a set of accounts (profit and loss), or may be recorded directly as a component of equity and only later recognised in the income statement. It is only to be included in reported passive when it is recognised in the income statement. This is intended to prevent excessive volatility when cashflow hedges are used and the hedged cashflow has not yet occurred (assuming that hedge accounting can be used).

Income or loss from a derivative instrument is included only if the instrument is held for dealing, not held in the ordinary course of business, or is hedging the accounting measure of attributable income or a transaction that would give rise to such attributable income. In general, derivative income or losses will not be in reported passive to the extent they are the result of hedges of active income (income that is not attributable). This recognises that CFCs with active business will use derivatives to limit risk. For example, derivatives may be used to remove the risk that the exchange rate will fluctuate when sales of goods are made in a foreign currency.

The terms “ordinary course of business” and “dealing” are not further defined in the legislation.

A “hedging relationship” must be one of a type defined in NZ IAS 39. Again, this applies only to identify when there is a hedging relationship, not to determine how to measure any income or loss from a derivative instrument that is in a hedging relationship. NZ IAS 39 defines three types of hedging relationship. The two that are expected to be most common in practice are:

- a hedge of the exposure to changes in fair value of an asset or liability;

- a hedge of the exposure to variability in cashflows that could affect profit and loss and that is attributable to a particular risk associated with an asset or liability or to a highly probable transaction.

It is not necessary for the hedging relationship to qualify for hedge accounting treatment (under generally accepted accounting practice with IFRS or IFRSEs, this requires proper designation of the hedge and that the hedge be highly effective). However, the effectiveness of the hedging relationship and the existence of documentation of a hedge may be relevant in determining whether a hedge really exists. If a purported hedging relationship is not effective or only partly effective, it is likely that income from the hedge will be attributable income anyway (it is either not held in the ordinary course of business or the business deals in derivatives).

When the hedge is effective enough that a hedging relationship exists, but the hedge is still partly ineffective, the part of the gain or loss that reflects the ineffective portion of the hedge will normally be included in attributable income. This is because the legislation refers to “income or loss […] from a hedging relationship [with the accounting measure of attributable income]”, and does not limit the income or loss to the amount attributable to the effective portion of the hedge. This is the case even though income or loss from the ineffective portion of the hedge may be presented in a different line item in the accounts.

If a CFC uses a derivative to hedge both non-attributable and attributable income (or transactions that give rise to both non-attributable and attributable income), the hedge gain or loss is recognised only to the extent it relates to the hedging relationship with attributable income. This will require apportionment on a reasonable basis. Any income or loss attributable to the ineffective portion of a hedge will usually be included in the amount to be apportioned.

Example: Derivative gain (foreign currency hedge)

CFCA, which has a functional currency of Canadian dollars takes out a single contract for exchange rate cover. It covers $1,000,000 of US dollar sales and interest income over the following income year.

CFCA subsequently receives US$700,000 of sales income and US$100,000 of interest income at the end of the year. The Canadian/US dollar exchange rate ends up higher than expected at the time the hedge was taken out. There is a gain on the foreign currency hedge of CA$333,333. This offsets sales and interest income that was CA$300,000 lower than expected because of the stronger exchange rate.

The exchange rate cover contract is a derivative instrument. The instrument is in a hedging relationship (a cashflow hedge) with non-attributable income (sales). The instrument is also in a hedging relationship with attributable income (interest), and the income attributable to this hedging relationship should be included in reported passive.

A reasonable apportionment of the hedge gain in this case would be CA$41,667, being US$100,000 ÷ (US$700,000 + US$100,000) × CA$333,333.

The hedge is not completely effective, and $33,333 of the derivative gain is attributable to the ineffective portion of the hedge. In the foregoing apportionment, one-eighth of the ineffective portion is attributed to the hedging relationship with interest income.

The final amount included in reported passive is income or gains from a business of insurance. This includes premium income from insurance or re-insurance activities. It also includes income or gains from property used to back insurance assets, such as interest, dividends, rents or fair value changes flowing from assets held to satisfy future insurance claims. If generally accepted accounting practice with IFRS or IFRSEs are used, International Financial Reporting Standard 4 or its New Zealand equivalent are likely to apply to such income.

There should be no income from a business of insurance if using generally accepted accounting practice without IFRS. CFCs are prevented from using that set of standards as the applicable accounting standard if they have insurance income under the relevant FRSs.

Subsection EX 21E(8) defines the compulsory upward adjustments to the base measure of attributable income (added passive). There are four adjustments.

The first adjustment is to add income from a life insurance policy that would be included in the attributable CFC amount under paragraph EX 20B(3)(g). This adjustment was included primarily because some life insurance products, even though excluded from the scope of the financial arrangement rules in the Income Tax Act 2007 and the financial instrument rules in NZ IAS 39, are close substitutes for interest-bearing investments. The amount to include is to be determined under tax concepts (see the analysis of section EX 20B in this report for more information). If an accounting measure of such income has already been included under subsection EX 21E(7) but the tax measure is higher, the difference must be added.

The second adjustment is to add income from the disposal of revenue account property that would be included in the attributable CFC amount under paragraph EX 20B(3)(k). The adjustment does not apply to the disposal of a share, a financial arrangement or a life insurance policy, because other provisions are designed to capture gains in those cases. The adjustment also does not apply unless the property is used in a way giving rise to income or gains that increase the accounting measure of attributable income. The amount of the upward adjustment is the same as the amount that would be included under paragraph EX 20B(3)(k), except to the extent the amount is already included in reported passive. See also the analysis of paragraph EX 21E(9)(d), which may allow removal of the cost of the property.

The remaining adjustments add income from services that would be part of the attributable CFC amount under paragraphs EX 20B(3)(l) to (n), which relate to income from services physically performed in New Zealand and certain income from the supply of telecommunications services. The amount of the upward adjustment is the same as the amount that would be included under the relevant paragraphs in subsection EX 20B(3), except to the extent the amount is already included in reported passive.

Subsection EX 21E(9) defines the optional downward adjustments to the base measure of attributable income (added passive). There are four adjustments. If a person chooses not to apply the adjustments, there is no adjustment.

The first adjustment is the removal of dividend income that would not be part of an attributable CFC amount under paragraphs EX 20B(3)(a) to (c). First, the amount that would not be part of the attributable CFC amount under those paragraphs is determined. That amount is then removed, but only to the extent that it was included in reported passive or added passive to begin with.

The second and third adjustments are the removal of royalty or rental income that would be attributable CFC amounts but are not, because they come within one or more of the exceptions in paragraphs EX 20B(5)(a) to (d) and EX 20B(7)(a) to (c). The amount to remove is the amount determined under those paragraphs, using tax measures of income. Removal is permitted only to the extent the amounts were already included in reported passive or added passive.

The fourth adjustment is the removal of the cost of revenue account property that, on disposal, produced an attributable CFC amount under paragraph EX 20B(3)(k). Such an amount was included, on a gross basis, in added passive. The effect of subtracting the cost is that only the net profit from the sale is included in attributable income. In order to be removed, further requirements must be met. The first requirement is that the amount of cost subtracted would have been an allowable deduction of the CFC in the accounting period if the CFC were resident in New Zealand. The second requirement is that the amount subtracted may not exceed the gross proceeds of the sale already included in added passive or (less likely) reported passive. Any amounts that would have to be added back in relation to the deductions under subpart CH of the Income Tax Act 2007, if the CFC were a New Zealand resident, reduce the amount of cost that is subtracted.

Subsection EX 21E(10) defines the base measure of total income (reported revenue) used in the ratio of attributable income to total income.

The core item of reported revenue for most CFCs with active businesses will be “revenue”. If the applicable accounting standard is generally accepted accounting practice with IFRS or IFRSEs, the amount of revenue to recognise is dictated by International Accounting Standard 18 (IAS 18, Revenue). If the applicable accounting standard is generally accepted accounting practice without IFRS, the amount of revenue to include is the amount reported as operating revenue. It is expected that revenue, under any standard, will usually include income from interest, dividends and royalties. It might not include income from leases because most lease income is excluded from IAS 18; if there is lease income that is not included in revenue under IAS 18, this income is included separately under paragraph EX 21E(10)(b). Revenue is also expected to include most income from the supply of services, such as attributable CFC amounts under paragraphs EX 20B(3)(l) to (n).

Another component of reported revenue is gains or losses on certain non-derivative financial assets. The description of this item is identical to the description in paragraph EX 21E(7)(f). The amount to be recognised may, however, be different from the amount under subsection (7), depending on whether some of the income is already included in revenue (there should be no double-counting).

A further component of reported revenue is gains or losses on certain derivative instruments. The description of this component is very nearly the same as the description in paragraph EX 21E(7)(g). The only difference is that instead of the hedging relationship being with the accounting measure of attributable income or transactions that would give rise to such attributable income, the hedging relationship must be with the accounting measure of total income. In practice, this component of reported revenue should bring in nearly all hedges except those that relate to expenses or liabilities.

Example: Derivative gain (foreign currency hedge of income and expenses)

CFCB, which has a functional currency of Canadian dollars, takes out a single contract for exchange rate cover. It covers US$100,000 of net costs over the following income year, being US dollar purchase costs less US dollar sales and interest income.

The exchange rate cover contract is a derivative instrument. The instrument is in a hedging relationship (a cashflow hedge) with expenditure. More precisely, it is in a hedging relationship with the amount of expense that is forecast to exceed income.

The amount of any hedge gain or loss is not included in reported revenue, because the hedging relationship is not with income.

The final component of reported revenue is insurance income. The description of this component is the same as the description in section EX 21E(7)(h). This will often have the character of revenue, but income from insurance contracts that is dealt with in International Financial Reporting Standard 4 (and its New Zealand equivalent) is explicitly excluded from the revenue standard IAS 18 (and its New Zealand equivalent).

Subsection EX 21E(11) defines the optional upward adjustments to the base measure of total income (added revenue). There are two adjustments. They add certain income from a life insurance policy or certain income from the disposal of revenue account property. These adjustments are described in the analysis of subsection EX 21E(8). The assumption behind these adjustments is that such amounts are more likely than others not to be included in revenue or operating revenue, because they will often not be in the ordinary course of business.

Subsection EX 21E(12) defines the compulsory downward adjustments to the base measure of total income (removed revenue). There are seven adjustments.

The first adjustment is the removal of the cost of revenue account property, if it was also removed from the measure of attributable income under paragraph EX 21E(9)(d).

The second adjustment is the removal of the amount of a dividend, if it was also removed from the measure of attributable income under paragraph EX 21E(9)(a). Bearing in mind the desire to produce a reasonable approximation to the tax measure of total income, the basis for removal is that these dividends would not be gross income of a New Zealand-resident company. However, to reduce compliance costs, if the dividends are not removed from the measure of attributable income, they are not required to be removed from total income either.

The third adjustment is the removal of personal services income that would be an attributable CFC amount under paragraph EX 20B(3)(h). This income is disregarded for the purposes of the ratio calculation, though will still be taxable under subsections CQ 2(2B) and DN 2 if the CFC qualifies for the active business exemption. In contrast, the personal services income was not explicitly removed from attributable income (the numerator in the formula), because it is unlikely to have been included in any of the categories of attributable income using accounting measures.

The fourth adjustment is the removal of income or loss from a share that is not revenue account property. "Revenue account property" is defined in section YA 1. The income or loss may have been included in reported revenue (as operating revenue, for example, if generally accepted accounting practice without IFRS was the applicable accounting standard). This adjustment is for greater consistency with the tax measure of total income (gross income).

The fifth adjustment is the removal of income derived by the CFC from a second CFC, if the second CFC could be part of a test group with the first CFC. This is to prevent the inflation of total income by arrangements between associates.

The sixth and seventh adjustments apply only when the applicable accounting standard is generally accepted accounting practice without IFRS. The inclusion of operating revenue, which is a very wide measure, in reported revenue makes these adjustments necessary; they are not thought to be required in relation to the much narrower measure of revenue as defined under IAS 18 or the New Zealand equivalent.

The sixth adjustment removes income if it is income from a liability, such as a reduction of a provision. It is possible that such income would be included in operating revenue, although this would be rare. Income from a liability is not removed if it is income in the ordinary course of business from a sale or supply of services. This might be the case, for example, when a prepaid service is provided, with the income in that case corresponding to a reduction of an unearned income liability.

The seventh adjustment removes income if it is income from an asset that is not a financial asset and not revenue account property. "Financial asset" is defined in NZ IAS 32, but that standard is used only to identify relevant assets, not to measure income relating to those assets. "Revenue account property" is defined in section YA 1. This adjustment prevents, for example, revaluations of real property from being included in the measure of total income. It could be possible, although unusual, for such amounts to be included in "operating revenue". The adjustment is intended to provide a closer approximation to tax measures of income.

Subsection EX 21E(13) sets out the conditions under which accounts are taken to meet the requirements of the applicable accounting standard. Strict compliance at a detailed level with the requirements of the standard will often not be practical, and an unqualified audit opinion will usually require compliance only in all material respects. Therefore, this subsection does not require strict compliance.

The primary requirement in subsection EX 21E(13) is that the accounts meet the requirements of section EX 21C for the applicable accounting standard (see particularly section EX 21C(9)). This means, in simplified terms, the accounts must state they comply with the relevant standard, the accounts must have received an unqualified audit by an independent chartered accountant, and there must not be reasonable grounds to suspect fraud, intent to mislead or incompetence.

If only information taken directly from published accounts were used in the test, this primary requirement could be sufficient.

However, this will sometimes not be the case. For example, in producing consolidated accounts for a corporate group, each CFC might provide information in a relatively aggregated form (such as line items actually appearing in the financial statements). When more detailed information is required, this will not be taken from the accounts that have been audited but directly from the CFC's internal accounting systems or from other similar sources.

This information will still be taken to comply with the relevant accounting standard, as long as:

- it is information that is drawn from the compliant accounts (even though not appearing on the face of financial statements), or that was used to prepare the compliant accounts (such as detailed information from CFC accounts that has been aggregated before being provided for the preparation of the compliant accounts); and

- the information is consistent with the compliant accounts; and

- there is no evidence of fraud, intent to mislead or incompetence (see the analysis of subsection EX 21C(9) for further information).

The word "consistent" is not further defined, so has its ordinary meaning. One implication of the consistency requirement is that information from the compliant accounts should be used if available, in preference to other information.

As with subsection EX 21C(9), nothing in subsection EX 21C(13) affects requirements to keep records or information, or to make those available when required by Inland Revenue.

The Australian exemption (sections EX 22 and 23 of the Income Tax Act 2007)

Section EX 22 defines a non-attributing Australian CFC.

A CFC qualifies to be a non-attributing Australian CFC if it is resident in Australia and is subject to income tax in Australia.

"Resident in Australia" means resident in Australia according to the Income Tax Act 2007. See, for example, section YD 2. There is also a requirement that the CFC is treated as a resident of Australia under every tax treaty between Australia and another country. This requirement might not be satisfied if, for instance, the CFC was incorporated in Australia but was managed from another country. In that case, it would be common for a tax treaty to treat the CFC as resident in the other country and Australia would lose worldwide taxing rights over the CFC.

For a CFC to be "subject to tax" requires one of two things. Firstly, the CFC can itself be subject to Australian income tax. Or secondly, the CFC can be part of a consolidated group for Australian tax purposes, if that consolidated group (through the "head company") is itself subject to Australian income tax. It is not sufficient for a person with an income interest in the CFC to be subject to Australian tax on the CFC's income.

A CFC will not qualify to be a non-attributing Australian CFC if its liability for Australian income tax has been reduced by an exemption from or reduction of income tax for certain offshore business income. These restrictions also applied to prevent Australian CFCs qualifying for the grey list exemption when there was a grey list.

If a non-attributing Australian CFC holds an interest in another CFC, the Australian exemption will not automatically apply to that other CFC. This is because the other CFC is effectively treated as held by the resident holders of interests in the first CFC, rather than by the first CFC (this is not a change of law; see existing sections EX 10 and EX 21(13)(c)). The eligibility of the other CFC for the exemption must be separately assessed.

If a non-attributing Australian CFC holds an interest in a FIF, the Australian exemption will not automatically apply to that other FIF. Again, this is because the FIF is effectively treated as being held by the resident holders of interests in the CFC, rather than by the CFC itself (see section EX 58).

Section EX 23 previously applied to CFCs resident in grey list countries that received certain tax concessions and thereby did not qualify for the grey list exemption. This has been repealed along with the grey list exemption for CFCs. If an Australian-resident CFC is not a non-attributing Australian CFC because it has reduced its income in a way described in section EX 22(1)(b), it is treated in the same way as any other CFC. It may be a non-attributing active CFC, or there may be attributed CFC income or loss from the CFC.

Anti-avoidance rules for the active business exemption (sections GB 15B and 15C)

Two anti-avoidance rules may affect the application of the active business exemption (sections EX 21D and EX 21E). The presence of these rules is not intended to imply anything about the general anti-avoidance provision (section BG 1). They are included for clarity. They may apply alone or in addition to the general anti-avoidance provision.

Section GB 15B

Section GB 15B applies when a CFC makes a supply with the purpose of increasing the tax measure of its total income in section EX 21D. This is an anti-avoidance rule. Increasing total income lowers the ratio of attributable income to total income, and the rule makes it clear that supplies made for this purpose are to be ignored.

It is expected that two CFCs who repeatedly sell goods back and forth between each other would come within the rule. Similarly, a sale which is put through an intermediate CFC with the purpose of increasing the intermediate CFC's total income for the purposes of section EX 21D would be caught.

However, the purpose of inflating total income must be the main purpose for section GB 15B to apply. It is accepted that there will commonly be sales between CFCs, such as between a regional supplier and country offices, that have no tax motivation.

Section GB 15B does not apply if the CFC makes a supply to a person who could be a member of a test group with the CFC. Separate rules apply in that situation (see section EX 21D(9)(c)) to require the removal of the income from the measure of total income.

Section GB 15C

Section GB 15 applies when a person enters an arrangement having a purpose, that is more than incidental, of enabling a CFC to meet the requirements of section EX 21E (active business exemption based on accounting measures of income) when the CFC would not meet the requirements of section EX 21D (active business exemption based on tax measures of income) to be a non-attributing active CFC.

This is an anti-avoidance rule to prevent manipulation of the active business exemption when using accounting measures of income. Accounting measures of income may often be used to determine whether a CFC qualifies for the active business exemption (see section EX 21E). The use of accounting measures is allowed because it can reduce compliance costs for taxpayers. Some effort has been made to align accounting and tax measures of income (see the required adjustments in section EX 21E, for example). However, accounting measures of income will inevitably be different from tax measures. There is therefore a risk that some taxpayers will attempt to exploit the differences to benefit from the active business exemption when, under tax measures of income, it is clear they should not benefit.

There are two conditions that must be satisfied before the section applies.