Foreign dividend exemption

2009 legislation including exceptions to the rule that dividends from a foreign company are treated as exempt income if derived by a company resident in NZ.

Sections CW 9 and HA 8B of the Income Tax Act 2007

Key features

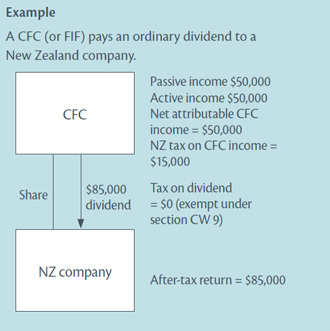

Section CW 9 provides that a dividend from a foreign company is treated as exempt income if derived by a company resident in New Zealand. However, there are several exceptions to this general rule, including:

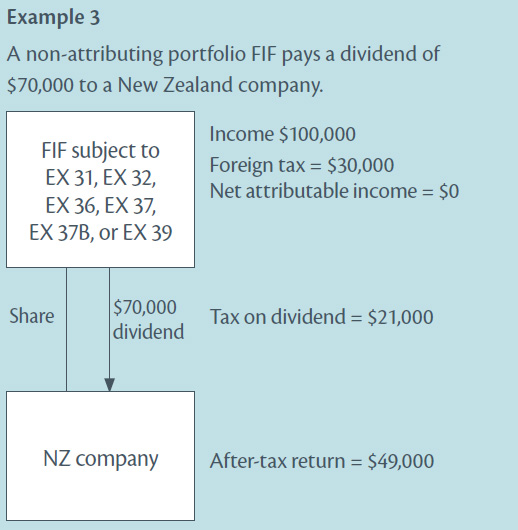

- dividends from a less than 10 percent interest in a FIF described in sections EX 31, EX 32, EX 36, EX 37, EX 37B or EX 39. These comprise shares in ASX-listed Australian companies, Australian unit trusts with adequate turnover or distributions, certain venture capital investments into New Zealand companies that have since migrated to a grey list country, and shares in Guinness Peat Group plc;

- dividends from fixed-rate foreign equity; and

- dividends from deductible foreign equity.

The foreign dividend is subject to income tax in these instances.

Foreign dividends that are received by non-companies (such as individuals or trustees of a trust) remain subject to income tax. However it should be noted that if a foreign dividend is received by a company that is acting in its capacity as a trustee of a trust, that foreign dividend will be subject to income tax.

Qualifying companies are not be permitted to hold attributing interests in CFCs or non-portfolio FIFs. If a qualifying company holds such interests in any income year beginning on or after 1 July 2009, it will cease to be a qualifying company.

Detailed analysis

If a foreign company pays a dividend to a company that is resident in New Zealand that dividend will in most cases be treated as exempt income of the New Zealand company under section CW 9.

However, the foreign dividend exemption in section CW 9 only applies to companies. Other New Zealand taxpayers are taxable on their foreign dividends. Some types of foreign dividend are also excluded from the exemption and are described below.

New Zealand taxpayers to which the foreign dividend exemption does not apply

Foreign dividends that are received by a portfolio tax rate entity will be subject to income tax as subsection CW 9(3) excludes these companies from the exemption.

Foreign dividends that are received by non-companies (such as individuals or trustees of a trust) are also subject to income tax. However, it should be noted that if a foreign dividend is received by a company that is acting in its capacity as a trustee of a trust, that foreign dividend will be subject to income tax. Branch equivalent tax accounts have been retained for non-companies (sections OE 17 to OE 22) to relieve any double taxation.

Under new section HA 8B, qualifying companies are not permitted to hold CFC income interests or interests in a FIF that are a direct income interest of 10 percent or more. This ensures that qualifying companies cannot be used as intermediaries to distribute untaxed foreign income to New Zealand shareholders (as dividends from qualifying companies are exempt under section CW 15 to the extent to which they are not fully-imputed). If a qualifying company holds a CFC income interest or non-portfolio FIF interest in any income year beginning on or after 1 July 2009 it will immediately cease to be a qualifying company.

Certain foreign dividends are subject to income tax

Certain types of foreign dividends are explicitly excluded from the section CW 9 foreign dividend exemption. These are listed in subsection CW 9(2) and are as follows:

- dividends from a less than 10 percent interest in a FIF described in sections EX 31, EX 32, EX 36, EX 37, EX 37B or EX 39. These comprise shares in ASX-listed Australian companies, Australian unit trusts with adequate turnover or distributions, certain venture capital investments into New Zealand companies that have since migrated to a grey list country, and shares in Guinness Peat Group plc;

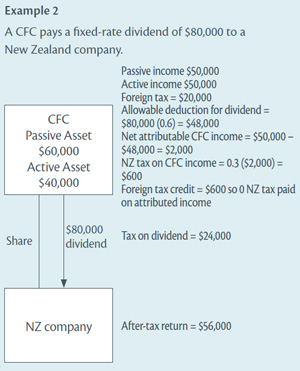

- dividends from fixed-rate foreign equity; and

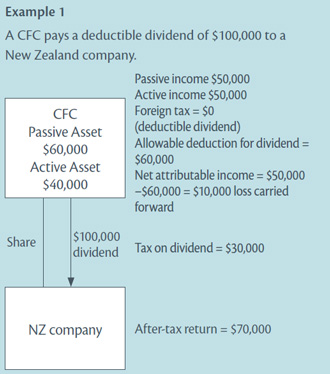

- dividends from deductible foreign equity.

Income tax is payable on the foreign dividend in these cases.

If a person holds an attributing interest in a FIF that is calculated using the comparative value, deemed rate of return or fair dividend rate methods, any dividends from this FIF will be exempt. This is because these FIF interests have no income other than FIF income under section EX 59(2).

Fixed-rate foreign equity and deductible foreign equity are defined in section YA 1.

Fixed-rate foreign equity includes foreign dividends that are a specific, fixed percentage of the amount paid for the equity (as well as variations on this) and any dividend that is regarded as equivalent to payment for money lent.

A deductible foreign equity distribution is a dividend where the foreign company paying the dividend (or a company in the same group or further up the chain as the foreign company) is allowed a deduction for the payment of the dividend against foreign income tax.

To prevent double taxation on fixed-rate foreign equity and deductible foreign equity a deduction will be available under section EX 20C(2) to a CFC in determining its net attributed CFC income in cases where the CFC pays these dividends to a New Zealand company or another CFC.

The deduction is apportioned to the extent to which the CFC has active assets to account for the fact that active CFC income is not attributed. More specifically the deduction is calculated according to the fraction found under section EX 20C(8).