Financial arrangements - agreements for the sale and purchase of property or services in foreign currency

2014 change to tax rules for the valuation of property or services included in agreements for the sale and purchase of property or services in foreign currency.

Sections EW 15D, EW 15F to EW 15I, EW 32, EW 33B, EW 33C, EW 35, EZ 75, EZ 76 and YA 1 of the Income Tax Act 2007

The tax rules for the valuation of property or services included in agreements for the sale and purchase of property or services (ASAPs) in foreign currency (foreign currency ASAPs as defined) have been changed. Consequently, the taxation spreading methods for income and expenditure under foreign currency ASAPs for tax have also been changed. The changes have been made to make compliance easier for all taxpayers and to remove volatility between accounting income and taxable income.

There is an exception to the new rules for foreign currency ASAPs that are life financial reinsurance. There are no changes to the tax rules for agreements for the sale and purchase of property or services which are not foreign currency ASAPs.

Key features

Taxpayers who use International Financial Reporting Standards (IFRS taxpayers) to prepare financial statements will almost always use the accounting valuation of the property or services in foreign currency ASAPs as the tax cost for depreciation purposes. They will also use the accounting results to spread income and expenditure under foreign currency ASAPs. The income or expenditure included in the financial statements for foreign currency ASAPs will generally be any recognised interest.

The valuation and spreading rules for foreign currency ASAPs will incorporate the effect of IFRS designated FX hedging of FX amounts in the financial statements.

There are some legislative modifications to the use of the accounting results. These modifications only apply to hedges of certain transactions.

Non-IFRS taxpayers will generally use spot foreign exchange rates to convert amounts paid to value property or services included in foreign currency ASAPs. Interest income or expenditure will arise in two situations:

- interest may be commercially agreed and expressly included in the terms of the contract; or

- it will be calculated where there are payments 12 months or more before or after the "rights date" (as defined).

In the second situation, interest is calculated on a future or discounted value basis. Progress payments and deposits up to 10 percent of the total price are not payments included in the second situation. The spreading and valuation rules will allow a one-time-only election to include the effects of prescribed hedging rules for foreign exchange amounts included in foreign currency ASAPs. In substance this is designed to replicate the tenor of the equivalent IFRS rules.

It is expected that relatively few foreign currency ASAPs for non-IFRS taxpayers will have interest income or expenditure to spread under the new rules. The reasons for that are the exclusion of 10 percent deposits and progress payments, and other payments that are less than 12 months before or after the rights date.

The changes to the rules mean that Determination G29 will have no relevance for either IFRS or non-IFRS taxpayers for foreign currency ASAPs that are subject to the new rules.

The new rules apply to foreign currency ASAPs entered into from the 2014-15 income year. IFRS taxpayers can make a one-time-only election to apply the new rules to foreign currency ASAPs entered into from the beginning of an income year commencing with the 2011-12 income year so long as they have filed on that basis since that first year.

Further, tax positions taken consistently for existing agreements for the sale and purchase of property or services in foreign currency which are based on the new rules are confirmed.

Foreign currency ASAPs entered into before the 2014-15 income year or an earlier elective year will continue to have the old rules applied to them for their life.

Detailed analysis

Background

Agreements for the sale and purchase of property (or services) in foreign currency have been subject to Determination G29 since the 1996-97 income year. Determination G29 and associated deemed interest rules have caused significant compliance difficulties and volatility of taxable income (compared with accounting income). The volatility of taxable income is especially significant for IFRS taxpayers. The compliance difficulties are relevant to all taxpayers but are especially significant for non-IFRS taxpayers.

Modern IFRS accounting practice has now comprehensively and coherently dealt with this issue, thereby offering an opportunity to change the tax rules for the foreign currency ASAPs.

Foreign currency ASAPs

A foreign currency ASAP is defined in section YA 1. It is a financial arrangement that is an agreement for the sale and purchase of property or services. At the time it is entered into, 50 percent or more of the consideration in New Zealand dollars is in a foreign currency, measured using spot rates at that time. For example, where a contract includes the sale of aluminium for a total consideration equivalent to New Zealand $5 million it will be a foreign currency ASAP if $2.5 million or more equivalent New Zealand dollars is to be paid in a foreign currency (measured at the spot rate when the contract is entered into).

IFRS taxpayers

Subsection EW 15D(2)(ae) has been inserted. The subsection, along with the amendments to sections EW 15F, EW 15G and EW 15H, means that the IFRS financial spreading method applies to foreign currency ASAPs entered into from the 2014-15 income year (or an earlier income year from the 2011–12 income year if returns were filed under the new rules, see the section "Application dates"). There is an exception to the application of section EW 15D(2)(ae) for foreign currency ASAPs that are life financial reinsurance. Section EW 15I continues to apply to spread income and expenditure for foreign currency ASAPs that are life financial reinsurance.

Some foreign currency ASAPs may include significant payments before or payments after the accounting recognition dates for property or services. In these cases the IFRS financial statements may exclude some of the amounts paid from the value of the property or services and allocate them separately to the income statement. This treatment will generally not apply to deposits and progress payments which are not generally regarded as financial instruments under IFRS.

Any amounts allocated directly to the income statement are in the nature of interest resulting from future value or discounted value calculations for the amounts paid. Using section EW 15D for foreign currency ASAPs means these amounts are income or expenditure in the income years they are allocated to the income statement. The IFRS valuation and spreading of interest treatment described in this paragraph applies to all foreign currency ASAPs.

Subsection EW 15D(2)(ae) refers to sections EW 32 and EW 33B to value property or services in foreign currency ASAPs and any relevant IFRS-designated FX hedges for those foreign currency ASAPs. Those sections are discussed further below.

Subsection EW 15D(2B)(b) has been amended to remove Determination G29 for foreign currency ASAPs entered into from the 2014–15 income year (or an earlier income year from the 2011–12 income year if returns were filed under the new rules).

Subsection EW 15F(1)(bb) has been inserted to remove the expected value method for calculating income and expenditure for foreign currency ASAPs.

Subsection EW 15G(1)(bb) has been inserted to exclude using the modified fair value method for calculating income and expenditure for foreign currency ASAPs.

Subsection EW15H(1)(d) has been repealed to remove Determination G29 from being used to value property or services and spread income and expenditure for foreign currency ASAPs.

Subsection EW 15I(1)(b)(iii) has been replaced. It previously applied to all agreements for the sale and purchase of property or services (including foreign currency ASAPs). It now applies to foreign currency ASAPs that are life financial reinsurance, or agreements for the sale and purchase of property or services that are not foreign currency ASAPs. Income and expenditure on these financial arrangements will continue to be spread under section EW 15I.

New subsection EW 32(2B) applies to foreign currency ASAPs of IFRS taxpayers. It values property and services in foreign currency ASAPs at the values under IFRS accounting rules. These are usually amounts in New Zealand dollars at the time they are recognised in IFRS financial statements, using spot exchange rates to convert foreign currency amounts.

New subsection EW 32(8) provides that section EZ 75 overrides the application of section EW 32 for IFRS taxpayers in certain cases. The effect of section EZ 75 is described in the section "Application dates".

The IFRS values will include amounts allocated to the value of the property or services in the IFRS financial statements for IFRS-designated FX hedges of foreign currency amounts (as provided for in new subsections EW 33B(1) and (3) below).

Section EW 35 (as amended by this Act) applies to use the IFRS values for property or services in foreign currency ASAPs for other provisions of the Act, such as the cost of depreciable assets, the cost of revenue account property, or income from sales of goods or services.

IFRS-designated hedging

Subsections EW 33B(1), (3) and (5) apply to certain foreign currency ASAPs and IFRS-designated FX hedges (defined in section YA 1) of foreign currency amounts in those foreign currency ASAPs. Subsection EW 33B(1) limits the application of the IFRS-designated FX hedges rules to certain property or services. Subsection EW 33B(3) includes in the tax values of property or services described in subsection EW 33B(1) amounts for IFRS-designated FX hedges attributed to the values of that property or services in the IFRS financial statements.

Subsection EW 33B(1) limits the IFRS-designated FX hedging rules. They are limited to foreign currency ASAPs for depreciable property and revenue account property, or services which result in assessable income or deductible expenditure under provisions under the Act outside the financial arrangements rules. Therefore the rules do not apply to IFRS-designated FX hedges for foreign currency ASAPs for non-revenue account property that is not depreciable property and non-deductible/non-taxable services. Hedges for these matters will continue to be treated as stand-alone financial arrangements. All consideration for, and under those hedges, will continue to be spread under the present rules. None of the consideration for the IFRS-designated FX hedge will be included in the value of the non-revenue account property or services under the new rules for foreign currency ASAPs.

This is the appropriate policy outcome. The objectives of new rules for foreign currency ASAPs are to reduce compliance with, and the volatility of, taxable income compared with accounting income. They are achieved by allowing IFRS taxpayers to use the values and spreading of any income and expenditure used in the financial statements for tax. However, IFRS-designated FX hedges are financial arrangements which, in the absence of the new tax rules, would be fully taxed under the financial arrangements rules. Where the hedges are for non-revenue account property, amounts relating to the hedges should continue to be taxed under the financial arrangements rules because they otherwise would not be in the tax base.

Subsection EW 33B(3) allocates for tax amounts for IFRS-designated FX hedges attributed under IFRS rules to the value of relevant property or services in a foreign currency ASAP described in subsection EW 33B(1). So the tax values for property or services in these cases are those used in the IFRS financial statements, including amounts attributed to them for IFRS-designated FX hedges.

Subsection EW 33B(5) excludes from the spreading methods and base price adjustments for the IFRS-designated FX hedges amounts attributed to the tax values of property or services by subsection EW 33B(3). This prevents double counting of these amounts under the two financial arrangements. Therefore amounts for designated FX hedges attributed to the value of property or services will not be spread for tax under the FX-designated hedge. Those amounts will usually be allocated to reserves in "Other Comprehensive Income" in the IFRS financial statements until the property or services are recognised in the financial statements. The amounts attributed to the value of property or services will also be excluded from the base price adjustment for the IFRS-designated hedges.

New subsection EW 33B(6) provides that section EZ 75 overrides the application of section EW 33B for IFRS taxpayers in certain cases. The effect of section EZ 75 is described in the section "Application dates".

| Example | The new tax rules applied to the purchase of a depreciable asset of an IFRS taxpayer | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

The example is based on the following assumptions: The purchase of a depreciable asset for US$100,000 in 12 months (being the IFRS GAAP recognition date). The payments are US$50,000 in 6 months (payment A, a non-monetary item for IFRS GAAP), and US$50,000 at the recognition date in 12 months (payment B). Both payments are hedged from the beginning with forward exchange contracts (FEC/s) designated as cashflow hedges. However, for comparison the example includes the treatment where both payments are not hedged at all (the "No Hedges" column) and where the hedge is not designated. The forward (FEC) rate for payment A is 0.72 and the FEC rate for payment B is 0.65. The spot rate for payment A is 0.65 and the spot rate for payment B is 0.80. A balance date falls three months prior to the recognition date when the spot rate is 0.75. The IFRS GAAP results are set out for three situations: the hedges are designated as cashflow hedges; the hedges are not designated as hedges; and there are no hedges at all.

Designated IFRS FX hedges: The asset is capitalised and depreciated for tax at the FEC rates, being $146k. There is no impact on the profit and loss up to the IFRS recognition date and therefore no income or expenditure under the financial arrangements rules for tax up to that point. Undesignated IFRS FX hedges: The asset is capitalised and depreciated for tax at the spot rates, being $139k. The P&L has been debited with $7k ($3k and $4k for the two years up to the recognition date). These amounts are expenditure under the financial arrangements rules for the undesignated IFRS FX hedges. The spreading of them will depend on which of the available spreading methods is being used for these types of financial arrangements. No hedges: The asset is capitalised and depreciated for tax at the spot rates being $139k. There is no impact on the profit and loss and therefore no income or expenditure for tax under the financial arrangements rules. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Non-IFRS taxpayers

Rights date

A new definition of "rights date" has been inserted into section YA 1 for agreements for the sale and purchase of property or services. The definition only applies to foreign currency ASAPs of non-IFRS taxpayers because the tax rules for agreements for the sale and purchase of property or services which are not foreign currency ASAPs are not being changed. The definition does not apply to IFRS taxpayers because they will apply the IFRS recognition dates for property or services in foreign currency ASAPs. The definition means the date on which the first right in the property is transferred or the services are provided. The words used in the new definition are similar to those contained in section EW 32(3) for the use of lowest price to establish the point at which the property or services in non-foreign currency ASAPs is valued.

The intended effect of the definition of "rights date" is to identify when property or services in foreign currency ASAPs are valued under the new rules for non-IFRS taxpayers. It is intended that this is the same point at which the property or services would be valued under the old rules for foreign currency ASAPs and the ongoing rules for non-foreign currency ASAPs. For instance, if the first right in the property under the foreign currency ASAP was to possession, that would be the rights date under the new rules and the point at which the value was established under the old rules.

Spreading methods

The spreading methods in sections EW 16 to EW 22 (based on their terms) are available to use to spread income or expenditure for foreign currency ASAPs of non-IFRS taxpayers. Using them has to recognise the consistency and anti-arbitrage rules contained in sections EW 24, EW 25 and EW 26. However, as an integral part of the new tax rules it is intended that under section EW 20, Determination G29 is not used by non-IFRS taxpayers for foreign currency ASAPs entered into from the 2014–15 income year.1

Value of property or services

Express "interest" foreign currency ASAPs (section EW 32(2C))

Section EW 32(2C) applies to the foreign currency ASAPs of non-IFRS taxpayers. It values property and services in foreign currency ASAPs at the aggregate of the amounts paid or payable in the foreign currency ASAPs. However, it excludes from the values of property or services amounts expressly provided for in the foreign currency ASAPs as "interest" (amounts paid or payable on account of the future value, or the discounted value, or a combination of both the future and discounted values, on the rights date"). The exclusion is intended to apply to interest which has been agreed on a commercial basis where there are payments before or after the rights date. These amounts will be income or expenditure under foreign currency ASAPs and spread using an applicable spreading method.

Where interest is expressly provided for in a foreign currency ASAP subsection EW 32(2C) applies to exclude it from the value of property or services. Subsections EW 32(2D) and (2E) (see below) are therefore overridden by subsection EW 32(2C) where interest is expressly provided in foreign currency ASAPs. Otherwise the subsequent subsections will apply to value property or services in foreign currency ASAPs of non-IFRS taxpayers.

After the value of the property or services and the express interest in the foreign currency ASAP are identified in foreign currency an appropriate spreading method will be applied to spread the interest income or expenditure.

The conversion of the foreign currency value of the property or services into New Zealand dollars will use spot rates on the payments dates (see below). The value may include amounts for non-IFRS designated FX hedges if the non-IFRS taxpayer elects into that part of the new rules (see below).

12-month ASAPs (section EW 32(2D))

Section EW 32 (2D) applies to foreign currency ASAPs of non-IFRS taxpayers which are "12-month ASAPs". The policy background is that significant pre-payments and delayed payments for property or services are in the nature of loans under the financial arrangements rules. Any interest component of the financial arrangement should be spread as income or expenditure for tax and not be included in the value of the property or services.

Section YA 1 has a new two-part definition of "12-month ASAP". A 12-month ASAP means an agreement for sale and purchase of property or services for which:

- An amount paid or payable for property or services is pre-paid by reference to the rights date and the pre-payment is 12 months or more before the rights date. A pre-payment by the purchaser of property under a foreign currency ASAP is a loan by the purchaser to the supplier and will result in assessable income to the purchaser under the financial arrangements rules. Limiting the definition to payments 12 months or more before the rights date should significantly restrict its application to a small number of foreign currency ASAPs of non-IFRS taxpayers and limit compliance for taxpayers. The limitation also reflects that there would not be a significant overall tax impact of pre-payments within 12 months of the rights date. As well, some pre-payments are excluded from the definition which should also help to restrict its application to relatively few foreign currency ASAPs. They are:

- Pre-payments which are made for either making or constructing property, or providing services ("progress payments"). The exclusion of progress payments is to recognise that some commercial contracts provide for payments which are linked to the progress for making or constructing property, or providing services, and they are not in the nature of loans. Therefore they should be excluded from creating income or expenditure under the financial arrangements rules for foreign currency ASAPs.

- Deposits paid within the first three months of the contract which aggregate to 10 percent or less of the amount paid or payable for the property or services. This exclusion is intended to apply to commercially agreed deposits which are often included in agreements for the sale and purchase of property or services. As with progress payments these amounts are not considered to be in the nature of loans; and

- An amount paid or payable for the property or services is delayed (the deferment) and the deferment is paid 12 months or more after the rights date. Some deferments are excluded from the definition. They are amounts or adjustments that are commonly commercially agreed and included in agreements for the sale and purchase of property or services:

- Earnout amounts based on business performance after the sale of a business. The deferral of payment in such a case occurs because of uncertainty regarding the value of the business, not because there is some imputed interest component as between the parties that ought to be recognised for tax purposes.

- Adjustments to amounts paid or payable for property services under warranties. These types of adjustments can take more than 12 months to determine.

- Adjustments to amounts paid or payable for property or services on account of working capital. Sales and purchases of businesses often include these adjustments which can sometimes take more than 12 months to determine.

Property or services in a foreign currency ASAP which is a 12-month ASAP is valued at the future value, or the discounted value, or a combination of the two, on the rights date, of the amounts paid under the foreign currency ASAP. The interest component will be income or expenditure under the foreign currency ASAP and spread appropriately using an applicable spreading method.

Calculating the future and/or discounted values for foreign currency ASAPs applies when the foreign currency ASAP is a 12-month ASAP. It is anticipated this will apply to relatively few foreign currency ASAPs which have qualifying pre-payments or deferred payments, or both. Qualifying pre-payments or deferred payments do not include the exclusions set out in a) and b) above, for example, progress payments and earnout amounts.

It is intended that only pre-payments and deferred payments 12 months or more before or after the rights date will result in interest income or expenditure. So when a foreign currency ASAP also has pre-payments or deferred payments within 12 months of the rights date, they are ignored for calculating the value of the property or services and any interest income and expenditure.

Calculation of the future value or discounted value amounts to be used to value property or services in foreign currency ASAPs which are 12-month ASAPs will be on usual commercial principles. Existing Determination G21A encompasses these principles in paragraphs 1.(2)(a)(ii) (Explanation - discounted value), 4.(4) (Principle - discounted value), 5.(2) (Interpretation - acceptable present value calculation), and 6.(2)-(4) (Method - present value calculations). The calculations are carried out using foreign currency and interest rates relevant for those foreign currencies. Determination G21A also refers to the use of Determinations G10B (Present Value Calculations) and G13A (Prices or Yields) where relevant. These three determinations provide appropriate guidance for calculating discounted/present values and include examples. While they do not expressly address future valuing, the principles to be applied are the same as for discounted/present valuing but in reverse. These principles are applied in the simple example provided below.

Once the value of the property or services and any income or expenditure has been calculated in foreign currency, Determinations G9A or G9C may be applied as applicable to spread the income or expenditure on the deemed loans. Using Determinations G9A and G9B to spread the income or expenditure will need to meet the consistency requirements for the same or similar financial arrangements in section EW 24. Other spreading methods in sections EW 16 to EW 22 may be applied as appropriate.

Converting the foreign currency values of property or services at spot rates and including amounts for non-IFRS designated FX hedges if relevant is on the same basis as set out for section EW 32(2C) (see below).

Express value: Foreign currency ASAPs not subject to 12-month ASAP (section EW 32(2E))

Section EW 32 (2E) applies to foreign currency ASAPs of non-IFRS taxpayers which are not "12-month ASAP(s)". The value of property or services is the value expressly provided in the agreement as paid or payable for the property or services. The value of property or services in commercial contracts is usually clearly stated and easy to obtain. It will usually be the aggregate of the total amounts paid or payable for the property or services under the contract.

Section EW 33B (non-IFRS designated FX hedges) may apply to valuing property or services in 12-month ASAPs. Its application will be the same as set out for "express interest" foreign currency ASAPs above.

Converting the foreign currency values of property or services at spot rates and including amounts for non-IFRS designated FX hedges if relevant is on the same basis as set out for section EW 32(2C) (see below).

Use of spot exchange rates to convert amounts in foreign currency ASAPs

Section EW 33C applies to convert amounts paid or payable in foreign currency to New Zealand dollars. It applies the spot exchange rate for the foreign currency on the payment dates to convert them to New Zealand dollars.

When no spot exchange rate is available because payments are deferred until a subsequent income year, two alternative spot rates can be used for the deferred payments. The spot exchange rate at the end of the current income year can be used in all cases. Alternatively, if amounts are paid or payable within 93 days of the end of the income year, the spot exchange rates on the dates they are paid or payable may be used. Differences between New Zealand dollar amounts converted at these spot exchange rates and the New Zealand dollar amounts converted at spot exchange rates when they are ultimately paid will be income or expenditure under foreign currency ASAPs.

Non-IFRS designated FX hedges

Section EW 33B may apply in relation to FX hedges. Section EW 33B(2) applies to foreign currency ASAPs when section EW 32(2C), (2D), or (2E) applies, and:

- The foreign currency ASAP relates to:

- property that is depreciable property or revenue account property (such as trading stock); or

- services which give rise to assessable income or deductions under the Income Tax Act 2007 outside the financial arrangements rules (which are on revenue account); and

- The taxpayer has made, at the time of filing a return of income for the income year in which they enter into the foreign currency ASAP or at the time of filing a return of income for an earlier income year, an irrevocable election in writing to apply section EW 33B(2) to all foreign currency ASAPs described in (a)(i) and (ii) above; and

- The person holds a non-IFRS designated FX hedge in relation to the foreign currency ASAP.

Section EW 33B(4) applies to modify the value of property or services in foreign currency ASAPs which are subject to section EW 33B(2). For non-IFRS taxpayers these are foreign currency ASAPs when section EW 32(2C), (2D), or (2E) applies. The value of the property or services in these foreign currency ASAPs is modified by the amount that would be the base price adjustment for the non-IFRS designated FX hedge in the absence of section EW 33B. Section EW 33B(4) works in tandem with section EW 33B(5) to obtain the value of property or services in foreign currency ASAPs when the elective non-IFRS designated FX hedging rules apply.

Section EW 33B(5) applies to amounts for non-IFRS designated FX hedges which are attributed to the value of property or services in foreign currency ASAPs. It excludes these amounts from being included in the spreading methods or the base price adjustments for the non-IFRS designated FX hedges. This prevents double counting these amounts for tax purposes. They are included in the value of the property or services and are not included in income or expenditure under the financial arrangements rules. The intention is to allow non-IFRS taxpayers to ignore spreading of income and expenditure on non-IFRS designated FX hedges. It also provides that amounts for non-IFRS designated FX hedges included in the value of property or services is not taken into account for the base price adjustment calculations.

The elective hedging rules for non-IFRS taxpayers apply in a different manner to IFRS-designated hedging and all gains or losses on non-IFRS designated hedges are mandatorily included in the value of property or services. So where the overall gain or loss for a non-IFRS designated FX hedge is included in the value of property or services there is no income or expenditure to spread and the base price adjustment will be nil. The application of section EW 33B(4) and (5) is intended to provide those outcomes for non-IFRS taxpayers who elect into the rules for non-IFRS designated FX hedging.

The effects of section EW 33B for non-IFRS designated FX hedges described above apply to all foreign currency ASAPs under section EW 32(2C), (2D) and (2E). It is intended that amounts from non-IFRS designated FX hedges attributed to the value of property or services are attributed after the provisions of other sections are applied to arrive at the relevant values. Therefore sections EW 32(2C) or (2D) (interest) and EW 33C (spot exchange rates) are applied before amounts for non-IFRS designated FX hedges are attributed.

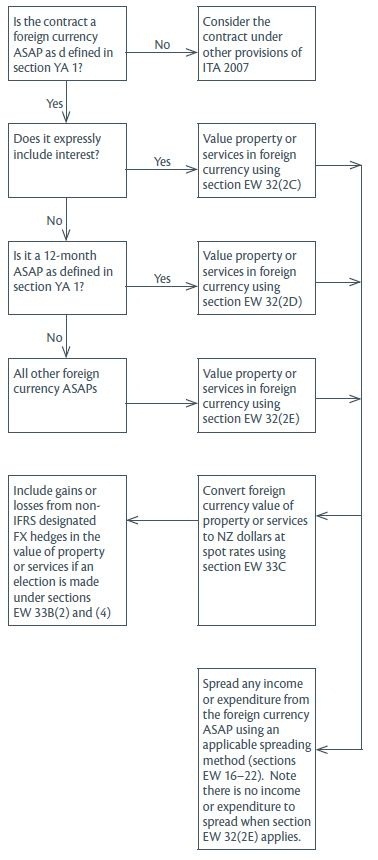

Flowchart of new tax rules for foreign currency ASAPs for non-IFRS taxpayers

| Example | Future valuing and discounted valuing of amounts for valuing property in a foreign currency ASAP of a non-IFRS taxpayer |

|---|---|

|

A non-IFRS taxpayer agrees to buy trading stock for US$2 million for possession in 12 months' time (the rights date). Unusual payment terms are agreed (for the purposes of this example) where the taxpayer pays US$1 million when the contract is signed and US$1 million 12 months after the possession date. The US$1 million paid when the contract is signed is not a progress payment as defined. The foreign currency ASAP is a 12-month ASAP as defined because it has at least one payment 12 months or more before or after the rights date. In this case the foreign currency ASAP has two payments which meet the definition. Assume that an appropriate discount rate for discounted and future valuing purposes in this case is 4% a year. To value the trading stock at the rights date, the taxpayer will future-value the first payment to the rights date and discount the last payment back to the rights date. The US$1 million paid 12 months after the rights date is discounted back to the rights date. As the term of the foreign currency ASAP runs for 24 months it will be relevant to two or three income years. However each deemed loan only affects two income years. Spreading the income and expenditure on the deemed loans for tax may be achieved by various appropriate spreading methods. Determinations G9A or G9B (section EW 20) could be applied to calculate how the income and expenditure is spread for each loan. They are both variants of YTM (yield to maturity) calculations (section EW 16) for financial arrangements in foreign currency. Section EW 17 (Straight-Line) may be applied if the total value of the taxpayer's financial arrangements is less than $1.85 million during the income year (which it would probably not be in this example). The trading stock is valued at US$2,002,000 approximately (US$1,040,000 + US$962,000) for tax and this will be the tax cost of the stock. It will be converted to New Zealand dollars at the spot exchange rate on the rights date. Say the spot exchange rate at the rights date is 0.8500, the New Zealand dollar value of the stock is $2,355,294. The taxpayer may hedge the US$1 million payment 12 months after the rights date and make an election under section EW 33B(2) to include hedging amounts in the value of the trading stock. It will include any gain or loss on the hedge in the value of the trading stock which has been converted to New Zealand dollars. Say there is a gain of $15,000 on the hedge; this will be included in the value of the stock to reduce the tax value of the stock to $2,340,294. The amount of the gain or loss on the hedge is not spread or included in the base price adjustment for the hedge. |

|

Value of property or services relevant for non-financial arrangements rule

Section EW 35 has been amended to include services. The omission of services from this section was an oversight when the previous legislation was extended to services. This change is treated as coming into force on 1 April 2008.

Application date(s)

General application - IFRS and non-IFRS taxpayers

The new rules apply to foreign currency ASAPs entered into in the 2014–15 and later income years. This means that foreign currency ASAPs entered into before the 2014–15 income year remain subject to the old rules until base price adjustments are performed.

Early adoption by IFRS taxpayers from the 2011-12 income year

IFRS taxpayers can apply the new rules for foreign currency ASAPs entered into from the 2011–12 or subsequent income years. They apply the new rules for foreign currency ASAPs by filing the return of income for the relevant income year using the new rules.

The new rules will be applied to all foreign currency ASAPs entered into in that income year and all subsequent income years. The first income year to apply the new rules can be any of the 2011-12 to 2013-14 income years. They will continue to apply the old rules to foreign currency ASAPs entered into before the relevant income year.

Foreign currency ASAPs entered into before the 2014-15 income year

Sections EZ 75 and EZ 76 apply to foreign currency ASAPs entered into before the 2014-15 income year. They are "savings" positions for taxpayers who have filed returns of income for foreign currency ASAPs essentially based on the new rules for years prior to the 2014-15 year.

Section EZ 75 applies to IFRS taxpayers who have foreign currency ASAPs for which section EW 32 applies to value the property or services, the foreign currency ASAPs have been entered into before the end of the 2013–14 income year, and the taxpayers have filed returns of income for the foreign currency ASAPs in accordance with section EZ 75 for the 2013-14 income year and every earlier income year.

Under section EZ 75(2) the taxpayer, applying sections 66 and 67 of the Taxation (Annual Rates, Employee Allowances, and Remedial Matters) Act 2014 as if in force, may:

- treat sections EW 32 and EW 33B as applying to the foreign currency ASAPs for the 2013-14 income year and every earlier income year; or

- treat section EW 32 as applying, but excluding section EW 33B. The value of the relevant property or services is modified by excluding amounts attributed under IFRS accounting rules from the value on account of IFRS-designated FX hedges.

Therefore, tax positions taken for foreign currency ASAPs which have followed the new IFRS rules are confirmed. Those positions will have been taken for all income years for the relevant foreign currency ASAPs. Those positions will have followed the IFRS accounting treatment (para (a) above), being based on either spot exchange rates or including designated hedging where relevant. However, where IFRS designated hedge accounting applies to a foreign currency ASAP the position taken may have excluded that effect (para (b) above) and effectively be based on spot exchange rates.

As well, subsection (3) of section EZ 75 modifies the treatment under subsection (2) for payments that have been made prior to the property or services being recognised in IFRS financial statements. These payments will have been recognised at their original New Zealand dollar amounts using the spot exchange rates at that time. This modification allows those payments to be revalued for tax using spot exchange rates at the point they are recognised in IFRS financial statements. Those payments will not have been revalued in the IFRS financial statements from the amounts recognised at the spot exchange rates when they were paid. However for tax the revaluation changes on the amounts paid have been taxed and the value of the property or services adjusted by the same amounts compared with the values recognised in IFRS financial statements.

Section EZ 76 applies to non-IFRS taxpayers who have foreign currency ASAPs for which section EW 32 applies to value the property or services; the foreign currency ASAPs have been entered into before the end of the 2013-14 income year; and the taxpayers have filed returns of income for the foreign currency ASAPs in accordance with section EW 76 for the 2013–14 income year and every earlier income year.

Under section EW 76(2) the taxpayer, applying sections 65 and 66 of the Taxation (Annual Rates, Employee Allowances, and Remedial Matters) Act 2014 as if in force, may treat sections EW 32 and EW 33C as applying to the foreign currency ASAPs for the 2013-14 income year and every earlier income year. However, section EW 33B (non-IFRS designated FX hedges) is excluded from this application. This means that returns filed in those years for relevant foreign currency ASAPs based on spot exchange rates are confirmed.

1 After further analysis, it is considered that as currently drafted, the legislation does not give the intended result for cancelling the use of Determination G29 for new foreign currency ASAPs from the application dates. Legislative amendments are expected to be made in the next tax bill to achieve the intended result, with the application date for the amendments likely to be the same as the application dates for the new rules for foreign currency ASAPs.