2014 GST legislation clarifies existing policy and reduces compliance costs. Covers definition of 'dwelling', residency, directors' fees and more.

Sections 2 (definition of commercial dwelling, dwelling and resident), 3(2) (definition of life insurance contract), 6(3), 11(1)(p)(ii), 11(8D), 11(A)(1)(maa), 11A(3B), 20(3K), 20(3LB), 20(3LC), 20(4B), 21FB, 21(HB), 25(4), 46(1B), and 54C of the Goods and Services Tax Act 1985; section YA 1 of the Income Tax Act 2007; and section OB 1 of the Income Tax Act 2004

The new Act introduces a number of Goods and Services Tax (GST) amendments to clarify and reinforce existing GST policy, and reduce compliance costs. All section references refer to the Goods and Services Tax Act 1985 unless otherwise stated.

Dwelling definition - retirement accommodation

Section 2 (definition of dwelling and commercial dwelling) and section 21HB

Two amendments have been made to the dwelling and commercial dwelling definitions to clarify that residential units in retirement villages and rest homes where the occupants are essentially living independently are treated as GST-exempt "dwellings". Transitional rules have also been introduced in section 21HB for retirement villages and rest homes that have treated residential units as taxable commercial dwellings.

Background

GST is imposed on accommodation in "commercial dwellings" such as hotels but not in "dwellings" such as private residences, which are GST-exempt.

The definitions of "dwelling" and "commercial dwelling" were amended on 1 April 2011. The policy intention behind the changes was to clarify the boundary between these definitions, and to narrow the scope of what could be considered a "dwelling" on the basis of economic equivalence with owner-occupied homes.

Following the 2011 amendments, concerns were raised that accommodation in residential units in retirement villages and rest homes may not meet the new dwelling definition requirement of providing "quiet enjoyment". As such, despite the previous treatment of these units as GST-exempt dwellings, they could be treated as taxable commercial dwellings. This did not align with the policy intent, which was to maintain the pre-April 2011 GST treatment of retirement village and rest home accommodation.

Key features

The amendment to the "dwelling" definition creates a new subsection (b)(iii) which states that when the consideration paid or payable for the supply of accommodation in a retirement village or rest home is for the right to occupy a residential unit, the unit will be treated as a dwelling.

The amendment to the "commercial dwelling" definition will replace subsection (b)(ii) with a cross-reference to the new amendment to the "dwelling" definition. This ensures that units in retirement villages where the occupants are living independently are excluded from the "commercial dwelling" definition.

A special transitional rule has been introduced, under section 21HB. It gives taxpayers that have been treating the supply of residential units as taxable for GST purposes from 1 April 2011 the choice of continuing to treat the supply of residential units in retirement villages and rest homes as taxable.

This amendment recognises that affected taxpayers have made commercial decisions on the basis that the supply of these residential units would be taxable. However, the taxable treatment option would only apply to residential units acquired before 1 April 2015. The supply of residential units acquired after that date would be treated as exempt.

Alternatively, taxpayers that have been treating the supply of residential units as taxable for GST purposes from 1 April 2011, can decide to return to exempt treatment before 31 March 2015. For these taxpayers, a "savings" provision applies to turn off the application of the wash-up rule under new section 21FB. Therefore, these taxpayers would not be required to return input tax deductions claimed between 1 April 2011 and 31 March 2015 in one lump-sum payment. Instead, the regular apportionment rules would apply to take into account the change of use brought about by the dwelling amendment, thereby allowing the payments to be spread over time.

Application dates

The amendments apply for the 2011-12 and later income years. A "savings" provision preserves tax positions taken up until 31 March 2015 on the basis that the supply of residential units became taxable as a result of the 1 April 2011 amendments.

Change of tax residency for GST purposes

Section 2 (definition of resident)

The amendment to the GST definition of "resident" turns off the retrospective application of the day test rules for determining the tax residency status of individuals. For GST purposes, the day test rules now apply on a prospective basis.

Background

The residency status of a person for GST purposes is determined by section YD 1 of the Income Tax Act 2007. The provision contains two rules that determine a person's tax residence - the permanent place-of-abode rule and the day-count rules.

There are two "day count" rules, the 183-day rule for determining whether a person becomes a tax resident, and the 325-day rule for determining when a person ceases to be a tax resident. Previously, once the time period had been exceeded, the person's residence status was backdated to the beginning of the time-period.

A number of provisions in the GST Act refer to the residency status of a person, for example, the provision that allows services supplied to non-residents who are offshore at the time of supply to be zero-rated. The retrospective application of the day-count rules meant that the GST treatment applied at the time of the transaction (based on the facts known at the time) could subsequently become incorrect.

The retrospective application of the rules led to uncertainty. This was because the service provider was unlikely to be aware upfront of whether the non-resident would become a resident (or vice versa) after the services had been provided. The amendment addresses this problem by turning off the retrospective application of the residency rules in relation to both the 183-day residence test, and the 325-day absence test.

Key features

Whether a person is a resident or non-resident for the purposes of the GST Act is dependant, in part, on whether the person is present or absent from New Zealand for a certain period of time as determined by section YD 1 of the Income Tax Act 2007. Previously, once the time-period was exceeded, the person's residence status was backdated to the beginning of the time period (see section YD 1(4) and (6) of the Income Tax Act 2007).

The amendment to the definition of "resident" under section 2 of the GST Act means when applying the resident day-count rules, a person is now treated as a resident or non-resident for the purposes of the GST Act on a prospective basis. Specifically:

- To be considered tax resident, a person must be present in New Zealand for more than 183 days in total, over a 12-month period. The amendment means that a person will be treated as being a tax resident from the first day after the 183-day period has been exceeded.

- To be considered non-resident, a person must be outside New Zealand for more than 325 days in a 12-month period. In this case, the resident will be regarded as a non-resident from the first day after the 325-day period has been exceeded.

It is important to note that the day-count rules are not the only rules for determining an individual's tax residency status, and the amendment does not affect the application of the "permanent place of abode" test.

Application date

The amendment applies from the date of Royal assent, being 30 June 2014.

Directors' fees

Section 6(3)

Two amendments have been made to section 6 that relate to the GST treatment of fees paid to directors and board members.

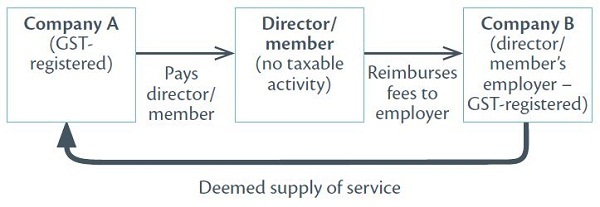

The first amendment provides that when an employee is engaged by a third party to be a director or board member, and the employee is required to remit fees to their employer for any payments received, the employer will be treated as supplying services to the third party. The employer will therefore return GST and the third party will be able to claim input tax on the payment for these services.

The second amendment extends the proviso under section 6(3)(b), that deems services performed by directors to be supplied in the course and furtherance of a taxable activity when that director has a broader taxable activity, to persons listed in section 6(3)(c)(iii) such as members of boards.

Background

The first amendment relates to an issue identified in an Inland Revenue Public Ruling (BR Pub 05/13) regarding the GST treatment of directors. It occurs when an employee who is not GST-registered is engaged by a third party to be a director and is required to remit fees paid by the third party to their GST-registered employer.

In this situation, the directors' fees paid to the employee are not subject to GST because the employee is precluded from having a taxable activity. However, when the employee passes these fees on to their employer, the employer is required to account for output tax on the payment as it is a payment received in the course and furtherance of their taxable activity.

This result means that the third party will not receive an input tax deduction for the fees paid. The director's employer will, however, have to account for output tax on the amount reimbursed by the employee. The same issue could arise in relation to the persons listed in section 6(3)(c)(iii), such as members of boards.

The second amendment concerns the exception to the rule that precludes a director from carrying on a taxable activity, under section 6(3)(b). The rule applies when directors have a broader taxable activity, in which case their services as a director are deemed to be supplied in the course and furtherance of that taxable activity. However, members of boards and the other persons listed in section 6(3)(c)(iii) can also have broader taxable activities. In this sense the persons listed in section 6(3)(c)(iii) are similar to directors, therefore arguably directors and members of boards should be subject to the same rules.

Key features

The first amendment creates a "flow-through" rule (shown below) that deems services to be supplied by an employer (Company B) to a third party (Company A) when an employee is engaged by the third party to be a director or person listed in section 6(3)(c)(iii) (such as a board member) and when the employee is required to account for any fees or other amounts to their employer (Company B). The rule will in effect require the employer (Company B) to issue a tax invoice for the fees paid and the third party (Company A) will be able to claim the related input tax deduction.

Flow-through rule

The second amendment extends the provision that deems services performed by directors to be supplied in the course and furtherance of a taxable activity when that director has a broader taxable activity, to persons listed in section 6(3)(c)(iii) (such as members of a board).

Application date

The amendments apply from the date of Royal assent, being 30 June 2014.

Surrenders and assignments of interests in land

Section 11(8D)

An amendment to section 11(8D) has been made to clarify that assignments and surrenders of interests in land are subject to the zero-rating of land rules.

Background

The policy intent of section 11(8D)(a) is to treat assignments and surrenders of interests in land as zero-rated when the requirements for the zero-rating of land rules are met.

The previous wording of section 11(8D) arguably treated all "surrenders" or "assignments" of interest in land as zero-rated, even when the other zero-rating land transaction requirements were not met, for instance, when the recipient of the supply is not GST-registered.

Key features

The amendment will replace "chargeable with tax at 0%" with "under subsection (1)(mb) if it meets the requirements set out in that subsection" in section 11(8D)(a) and (b). Therefore, the GST treatment of assignments and surrenders of interests in land will depend upon meeting the zero-rating of land requirements in section 11(1)(mb).

Application date

The amendment applies from 1 April 2011.

Procurement of a lease

Section 11(8D)

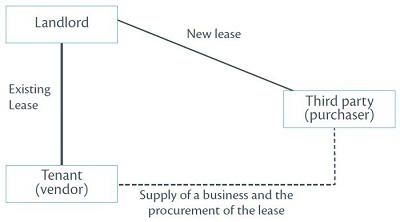

An addition to section 11(8D) has been made to ensure payments for the procurement of a lease are subject to the zero-rating of land rules.

Background

There were concerns that the procurement of a lease when purchasing a business did not fall under the zero-rating of land rules. For example, as a condition of a business sale, the purchaser requires the vendor to arrange for the landlord to enter into a new lease with the purchaser.

An argument could be made that when a new interest has been created in the procurement transaction, no transfer of an interest in land occurs between the vendor and the purchaser. Therefore, any consideration payable in relation to this supply could not be zero-rated. This was inconsistent with lease assignments which are subject to the zero-rating of land rules.

Key features

An addition to section 11(8D) has been made to ensure new interests in land through a procurement of a lease by a third party of an existing lease will be zero-rated, subject to the zero-rating of land requirements of section 11(1)(mb) being met.

Application date

The amendment applies from the date of Royal assent, being 30 June 2014.

Zero-rating tooling costs

Section 11A(1)(maa)

New subsection 11A(1)(maa) ensures services carried out on tools are zero-rated when the tools are used in New Zealand solely to manufacture goods that will be exported.

Background

The Taxation (Livestock Valuation, Assets Expenditure, and Remedial Matters) Act 2013 extended the application of the zero-rating rules to tools used in New Zealand solely to manufacture goods for export when they are supplied to a recipient who is a non-resident and not GST-registered (see section 11(1)(p)).

A further amendment was required to ensure that when services are carried out on tools that are to be zero-rated under the new provision, the services can also be zero-rated. This is consistent with the treatment of services in relation to exports more generally and the policy intention of GST neutrality in cross-border trade.

Key features

New subsection 11A(1)(maa) zero-rates services supplied directly in connection with goods, the supply of which is subject to section 11(1)(p) and for a recipient who, when the services are performed, is a non-resident and not a registered person.

Application date

The amendment applies from the date of Royal assent, being 30 June 2014.

Zero-rated services supplied to non-residents

Section 11A(3B)

Section 11A(1)(k) allows services supplied to non-residents that are outside New Zealand at the time the services are being performed to be zero-rated. New section 11A(3B) has been introduced to allow "outside New Zealand" to be interpreted, for a natural person (individual), as a presence in New Zealand that is minor and not directly in connection with the supply.

Background

New Zealand's GST system is based on the "destination principle" under which supplies of goods and services are taxed in the jurisdiction where the goods and services are consumed. Since services supplied to offshore non-residents will not typically be consumed in New Zealand, the services are zero-rated (see section 11A(1)(k)). This ensures GST is not a cost to overseas consumers.

The zero-rating rule suggests that the supplier must have knowledge of the whereabouts of the non-resident consumer during the period in which the services are performed. However, this may not always be realistic, for example, in some cases the non-resident may visit New Zealand (during the period the service is supplied) on a matter that is unrelated to the services being supplied. In this situation the supplier may be unaware of the non-resident's presence in New Zealand and may mistakenly zero-rate the service.

The amendment addresses this problem by allowing services to remain zero-rated as long as the non-resident's presence is "not directly in connection" with the services being supplied. However, to ensure services are only zero-rated when they are performed to a non-resident that is predominantly outside New Zealand, the amendment also requires the non-resident's presence in New Zealand to be "minor" in nature.

Key features

A new section 11A(3B) has been introduced and applies for the purposes of section 11A(1)(k) of the GST Act. Section 11A(1)(k) zero-rates services supplied to non-residents who are outside New Zealand at the time the services are performed, unless the services are directly connected with land or personal property situated in New Zealand.

The new section defines "outside New Zealand" for the purposes of section 11A(1)(k), which includes a minor presence in New Zealand that is not directly in connection with the supply.

Detailed analysis

In practice, whether or not a person's presence in New Zealand is "minor" and "not directly in connection" with the supply, will be factual.

The policy rationale behind the new section is to deal with situations when it is unreasonable for the supplier to be aware that the non-resident is in New Zealand during the time the services are performed, and therefore, whether the services should be zero-rated. In practice, if the supplier is unaware of the person's presence in New Zealand, it is less likely that the presence is directly connected with the services being performed.

The requirement that the presence be "minor" is to ensure the non-resident is predominantly outside New Zealand while the services are being performed. If the non-resident is present in New Zealand for most of the time the services are being performed (despite the fact that the presence may be unrelated to the services being performed) the person's presence will not be considered as minor, and therefore, the services cannot be zero-rated.

| Example | |

|---|---|

| Jim, a non-resident, applies for a visa to work and live in New Zealand. The visa application process takes six months to complete. During this period Jim visits New Zealand for two weeks to view some property that he would like to purchase. The immigration consultant is unaware of Jim's visit to New Zealand. | |

In the above example, while Jim's presence in New Zealand could be regarded as being connected with his move to New Zealand, it is not "directly" connected to the supply of immigration services. Jim's presence is also relatively minor compared with the six month period in which the services are performed. Therefore, the services can still be zero-rated despite Jim being in New Zealand during some of the time the services are performed.

| Example continued | |

|---|---|

| One of Jim's visa requirements is that he has a job offer from an accredited employer. Therefore, on a separate occasion Jim visits New Zealand for two weeks to seek employment opportunities. During his visit he meets with the immigration consultant to discuss job opportunities in New Zealand. | |

In this situation, it is more likely that Jim's presence is directly connected with the supply of immigration services. Therefore, the services cannot be zero-rated and must be standard-rated.

Application date

The amendment applies from the date of Royal assent, being 30 June 2014.

Non-profit bodies exemption

Section 20(3K)

An amendment to section 20(3K) clarifies that non-profit bodies can claim all of their GST input tax deductions other than those that relate to the making of exempt supplies.

Background

Non-profit bodies are able to apply a special input tax deduction rule that allows them GST deductions on the acquisition of any goods or services received except to the extent that those goods or services are used for making exempt supplies. However, the introduction of the new GST apportionment rules on 1 April 2011 created some uncertainty around the application of the special rule.

This is because the definitions of "percentage actual use" and "percentage intended use" only enable input deductions to the extent that goods and services are actually used for making "taxable supplies". Hence, it was arguable that non-profit bodies may not be able to claim input tax credits for purchases that relate to non-exempt supplies.

The new apportionment rules were not intended to alter the GST input tax entitlements of non-profit bodies.

Key features

The amendment ensures that non-profit bodies can claim all of their GST input tax deductions except those that relate to exempt supplies. It achieves this by extending the application of section 20(3K) so that it applies for the purposes of section 20(3) and (3C), and the definitions of "percentage actual use" and "percentage intended use" in section 21G(1).

Application date

The amendment applies from 1 April 2011.

Non-resident registration rules

Sections 20(3LB) and 20(3LC)

New sections 20(3LB) and (3LC) limit the ability of GST-registered non-residents to claim input tax deductions that relate to GST levied by the New Zealand Customs Service.

Background

The Taxation (Livestock Valuation, Assets Expenditure, and Remedial Matters) Act 2013 introduced rules under which non-resident businesses can register for New Zealand GST and claim input tax deductions for GST incurred. This ensures that GST is neutral for these businesses in the same way as it is for domestic businesses. The new rules took effect from 1 April 2014.

However, a potential fiscal risk with the design of these new non-resident registration rules was identified. The new rules may have enabled registered non-residents to sell high-value goods to New Zealand private consumers without the net imposition of GST.

This could be achieved by the non-resident treating themselves as the "importer" of the goods so that the GST liability falls on the non-resident rather than the recipient of the good. The non-resident would then be able to claim an input tax deduction for the GST incurred on importation. Because the goods were offshore at the time of supply, GST would not be required to be returned on the sale. Therefore, no net GST would be collected despite the final consumer having received the imported good.

Key features

The new sections 20(3LB) and (3LC) limit the ability of GST-registered non-residents to claim input tax deductions in relation to GST levied by the New Zealand Customs Service. Instead, when the non-resident acts as an "importer", the recipient of the good will be treated as if they had paid the GST and will be entitled to an input tax deduction for the GST if they are GST-registered and receiving the goods as part of their taxable activity.

However, the new section does not apply when the non-resident is in fact the recipient of the good, unless the non-resident is merely delivering the good to another person in New Zealand.

Application date

The amendment applies from 1 April 2014, the date the new non-resident registration rules came in to force.

Allowing inputs to registered persons subject to the domestic reverse charge

Section 20(4B)

An amendment has been made to section 20(4B) to ensure that it does not prevent a person from claiming an input tax deduction in cases when they are already registered for GST.

Background

In limited situations, zero-rating can give rise to the revenue risk of purchasers avoiding paying GST by intentionally or unintentionally representing that they are GST-registered and making the relevant taxable supplies. The "domestic reverse charge" mitigates this risk by requiring the purchaser in this situation to account for the output tax on the sale of the land, but preventing the purchaser from claiming an input tax deduction in relation to this sale (unless they subsequently become registered).

What was not catered for is a purchaser who is already GST-registered incorrectly zero-rating a transaction, for example, as a result of a genuine error. Under the previous legislation, output tax would be payable under section 20 with no corresponding input tax credit.

Key features

The amendment extends the scope of the exclusion in section 20(4B) to cover a person that is already registered. This will mean that if a purchaser was already registered for GST when they incorrectly zero-rated a transaction, they will still be able to claim an input tax deduction to offset the GST paid under the domestic reverse charge.

The extended exclusion will only apply to the extent that the person uses the goods for making taxable supplies.

Application date

The amendment applies from 1 April 2011.

Wash-up rule for taxable or non-taxable use

Section 21FB

New section 21FB requires taxpayers who have applied the apportionment rules to perform a "wash-up" calculation when their use of an asset changes to 100 percent taxable or 100 percent non-taxable use.

Background

A taxpayer who purchases an asset with the purpose of using it for both taxable and non-taxable purposes must apportion their input deductions to account for the non-taxable use. However, if the taxpayer changed the use of the asset to 100 percent taxable, under the previous rules they were still required to perform on-going input tax adjustments. This posed a compliance cost burden on taxpayers, especially in relation to long-lived assets such as land.

New section 21FB allows taxpayers to claim a 100 percent deduction or return input tax already claimed earlier to avoid this compliance burden.

Key features

The amendment applies to assets that have been subject to the apportionment rules and requires taxpayers to perform a compulsory "wash-up" calculation to account for any unclaimed input tax or pay output tax when the use of the asset changes to solely taxable or solely non-taxable.

Under new section 21FB:

- Taxpayers that change from mixed-use to 100 percent taxable use of an asset will be able to claim the "full input tax deduction" (defined under section 21D(2)(a)) less the "actual deduction" (defined under section 21F(3)(c)).

- Taxpayers that change from mixed-use to 100 percent non-taxable use of an asset will be required to pay output tax equal to the "actual deduction" already claimed.

Under the new rules, once the wash-up calculation has been performed, taxpayers will no longer be required to make any on-going adjustments.

To qualify for the "wash-up", the taxpayer will need to sustain the 100 percent taxable or non-taxable use of their asset for the current adjustment period and the next adjustment period (up to two years).

| Example | |

|---|---|

| John purchases a building that is used 50 percent for commercial use and 50 percent as residential apartments. On the basis that the apartments will be leased as dwellings, an input tax deduction of 50 percent is taken at the time of purchase. After two years, John gives notice to his tenants and signs an agreement with a management company that will operate the apartments as serviced apartments for business travellers. As serviced apartments are commercial dwellings, the building is now being used solely for making taxable supplies. If the apartments continue to be used solely for making taxable supplies for the remainder of the adjustment period and for the following adjustment period, the balance of the unclaimed input tax deduction can be claimed taking into account any adjustments made leading up to the second adjustment period after the change in use. | |

Application date

The amendment applies from the date of Royal assent, being 30 June 2014.

Transitional rule for commercial dwelling acquisition costs before 1 October 1986

Section 21HB

An amendment to the transitional rule in section 21HB ensures that input tax deductions cannot be claimed in relation to a dwelling reclassified as a commercial dwelling if it was acquired before 1 October 1986.

Background

Section 21HB was originally introduced to address transitional problems associated with the 1 April 2011 changes to the "dwelling" and "commercial dwelling" definitions. The rule gave suppliers of accommodation who were required to start charging GST as a result of the changes to the "dwelling" and "commercial dwelling" definitions the ability to claim input tax deductions for the acquisition costs of their newly defined "commercial dwelling" accommodation.

However, an unintended effect of the transitional rule was that suppliers affected by the definition changes could arguably claim input tax deductions for accommodation acquired before the introduction of GST on 1 October 1986. This is contrary to the policy rationale underlying the rule as this outcome would allow suppliers to claim input tax for property acquired when no GST was incurred.

Key features

The amendment to section 21HB(1) ensures that suppliers who are required to treat their supplies of accommodation as commercial dwellings as a result of the changes to the definitions of "commercial dwelling" and "dwelling" cannot claim input tax deductions for the acquisition costs incurred before 1 October 1986. This is achieved by replacing the requirement for the costs to be incurred before 1 April 2011, with the requirement that they were incurred between 1 October 1986 and 1 April 2011.

Application date

The amendment will apply for tax positions taken after 22 November 2013 (the date the Taxation (Annual Rates, Employee Allowances, and Remedial Matters) Bill was introduced).

Transitional rule for newly defined commercial dwellings

Section 21HB

The amendment to section 21HB allows suppliers affected by the changes to the definitions of "commercial dwelling" and "dwelling" to have the option of either including or not including a commercial dwelling as part of their broader taxable activity.

Background

The definitions of "dwelling" and "commercial dwelling" were amended on 1 April 2011. In certain situations, the amendments increased compliance costs by forcing taxpayers to register for GST. In particular, the amendments affected non-registered owners who had another activity, but were previously not required to register for GST as supplies from their other activity fell below the $60,000 GST registration threshold. However, the combined supplies from their newly defined commercial dwelling and their other activity pushed their supplies above the registration threshold and therefore required them to be registered.

Another situation where the amendment potentially increased compliance costs is when the owner of a newly defined commercial dwelling is registered for GST as a result of a separate activity. This owner may be forced to return GST on supplies of accommodation in their commercial dwelling even if the total supplies from their commercial dwelling falls below the $60,000 registration threshold. If this person did not have a broader taxable activity they would not be required to return GST on their supplies of accommodation in their commercial dwelling.

Key features

The amendment to section 21HB gives a person the option not to treat a supply of accommodation in a dwelling affected by the 1 April 2011 amendments as a taxable supply. However, this option is not available if the total supplies of accommodation affected by the amendments exceeds the $60,000 GST registration threshold.

Application date

The amendment applies from 1 April 2011.

Scope of the "hire purchase" definition

Section YA 1(a)(i) of the Income Tax Act 2007 and section OB 1(a) of the Income Tax Act 2004

The definition of "hire purchase agreement" has been broadened to include any contract where a person has an option to purchase.

Background

The definition of "hire purchase agreement", in section YA 1 of the Income Tax Act 2007 is intended to cover two types of agreement. The first is when the goods are let or hired to a person with an option to purchase (an "option to purchase agreement"). The second is when a person has agreed to purchase the goods with a condition (a "conditional contract of sale"). The main difference between the two is whether the person has agreed to purchase the goods at the time the relevant contract is entered into.

An amendment made to the "hire purchase agreement" definition that took effect from 1 April 2005 contained a drafting error which arguably meant a person's upfront agreement to purchase the goods is required in order for an arrangement to be a hire purchase agreement. This interpretation is inconsistent with the original policy intention, which was to capture both forms of agreement.

The amendment fixes the drafting error by extending the hire purchase agreement definition to include "option to purchase" agreements.

Key features

The definition of "hire purchase agreement" contained in section YA 1(a)(i) of the Income Tax Act 2007 and section OB 1(a) of the Income Tax Act 2004 has been amended to explicitly incorporate contracts under which the person has an option to purchase, but that option is not exercised until a later date.

Application date

The amendment applies from 1 April 2005, with a "savings" provision for taxpayers who filed returns under the contrary position until 30 June 2014, being the date of enactment.

Other remedial amendments

A cross-reference to the Accident Insurance Act 1998 has been updated to the Accident Compensation Act 2001 in the definition of "life insurance contract" in section 3. The amendment applies from 1 April 2002.

The wording of section 11(8D)(b)(ii) has been amended to ensure commercial lease arrangements are standard-rated unless an irregular and large payment is made. The amendment applies from 1 April 2011.

Section 25(4) has been amended to ensure that when the supply of land has been incorrectly standard-rated instead of zero-rated, the recipient of the supply must correct any input tax claim in relation to that supply. The amendment applies from 1 April 2011.

Section 46(1B) has been amended to clarify that the extended period to claim refunds only applies to GST-registered non-residents under the non-resident registration rules (section 54B). The amendment applies from 1 April 2014.

Section 54C(3)(a) has been amended to clarify the effective date of non-resident deregistration. The amendment applies from 1 April 2014.

Section 54C(3)(b) has been amended to clarify the scope of the 5-year embargo on non-resident registration. The amendment applies from 1 April 2014.