The taxation of land-related lease payments

2014 amendments to address specific revenue risks with land-related lease transfer payments.

Sections CC 1, CC 1B, CC 1C, DB 20B, DB 20C, EE 7, EE 67, EI 4B and YA 1 of the Income Tax Act 2007

Amendments have been made to achieve a more coherent and consistent tax treatment of land-related lease payments. The reforms address specific revenue risks with lease transfer payments (that is, received by an exiting tenant for transferring a lease to an incoming tenant). Certain lease transfer payments, which are substitutable for taxable lease surrender and lease premiums payments, are taxable from 1 April 2015.

These reforms build on amendments made to the Income Tax Act 2007 in 2013 that treat lease inducement and lease surrender payments as deductible to the payer and taxable to the recipient over the lease term.

There are also a number of technical amendments to tax law relating to leases and licences of land to provide consistency and certainty.

Lease Transfer Payments

Sections CC 1B and EI 4B of the Income Tax Act 2007

Background

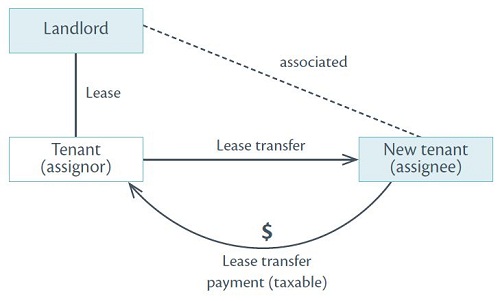

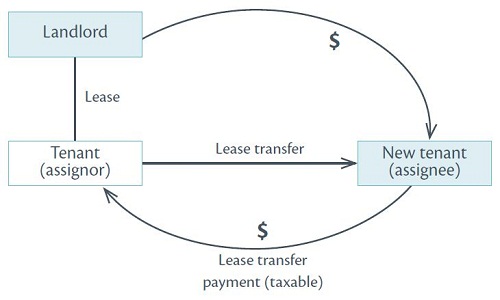

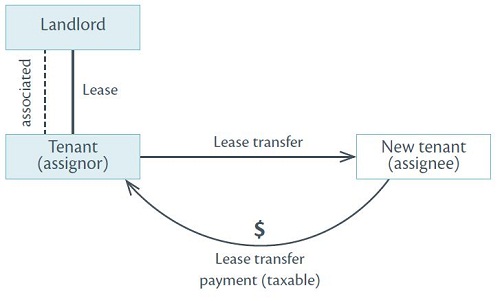

Lease transfer payments are generally received by an exiting tenant (assignor) from a new incoming tenant (assignee), for the transfer or assignment of a lease. Prior to this amendment, the payment was typically non-taxable to the exiting tenant for income tax purposes.

The previous non-taxable status of lease transfer payments, in tandem with taxable lease surrender payments,1 could potentially distort commercial decisions upon termination of a tenant's lease. It could be tax advantageous for a tenant to exit a lease by transferring it to a third party for a then tax-free lease transfer payment, rather than surrendering it to a landlord for a taxable lease surrender payment.

From the exiting tenant's perspective, there is no economic difference between surrendering the lease to the landlord and transferring it to a third party. The effect is the same—the tenant exits the lease and receives consideration for it. Treating similar payments differently for income tax purposes distorts business decisions and results in economic inefficiency and unfairness.

Key features

Section CC 1B has been extended and now includes certain lease transfer payments that are substitutable for taxable lease surrender payments in section CC 1C and taxable lease premiums in section CC 1. This inclusion makes these lease transfer payments taxable to the recipient and tax-deductible to the payer.

In accordance with new section CC 1B, a lease transfer payment is income of the payee, and therefore taxable, in the following situations:

- The person purchasing the lease is associated with the owner of the estate in land from which the land right is granted; such a payment is substitutable for a lease surrender payment.

- The amount is sourced from funds provided by the owner of the estate in land from which the estate is granted for the purpose of obtaining the surrender or termination of the land right; the lease transfer payment is substitutable for a lease surrender payment.

- The vendor of the lease is associated with the owner of the estate in land from which the land right is granted; the lease transfer payment is substitutable for a lease premium.

Detailed analysis

If a person (the payee) derives an amount in relation to a land right as consideration for the transfer of the land right from the holder of the land right to another person, the amount will be taxable to the payee (new section CC 1B(1)(b)(ii) and (2)). The land right must be a right that is a leasehold estate (other than a lease with permanent right of renewal) or a licence to use land.

The term "leasehold estate" is defined broadly in section YA 1 to include any estate, however created, other than a freehold estate.2 The charging provision, therefore, does not apply to payments for a freehold estate in land, such as the proceeds from the sale of land.

Despite this broad charging provision for lease transfer payments in section CC 1B, most lease transfer payments will not be taxable, if the following conditions are satisfied:

- the payee is the holder of the land right (for example, the exiting tenant);

- the amount is consideration for the transfer of the land right to the person paying the amount (for example, the incoming tenant);

- the amount is not sourced from funds provided by the owner of the estate in land from which the estate is granted for the purpose of obtaining the surrender or termination of the land right—an arm's length transaction between a landlord and an incoming tenant would therefore satisfy this condition;

- the payee and the incoming tenant are not associated with the owner of the estate in land from which the land right is granted.

Payments derived in situations when the conditions above are not satisfied, will be taxable to the payee. If a lease is transferred as part of a business transfer, consideration for goodwill attaching to the land will be taxable to the payee; however, consideration for business or personal goodwill will not be subject to the charging provision in section CC 1B.

Situations involving lease transfer payments that are covered by new section CC 1B are payments that are substitutable for taxable lease surrender payments in section CC 1C and taxable lease premiums in section CC 1.

There are two situations when lease transfer payments that are substitutable for lease surrender payments will be taxable to the payee. They are:

- If the person paying the amount (that is, the incoming tenant) is associated with the owner of the estate in land from which the land right is granted.

- If the amount is sourced from funds provided by the owner of the estate in land from which the land right is granted,3 for the purpose of obtaining the termination of the lease.

Another situation when lease transfer payments will be taxable is payments that are substitutable for lease premium payments. In particular, a lease transfer payment will be taxable if the payee (that is, the exiting tenant) is associated with the owner of the estate in land from which the land right is granted.

This would prevent a landlord setting up a lease with a low rent with their associate and, as part of this arrangement, the associated tenant transfers the lease to a non-associated tenant and receives a non-taxable lease transfer payment.

Taxing a lease transfer payment in such situation supplements the existing anti-avoidance provision in section GC 5, which allows the Commissioner to set an adequate level of rent for leases between associates.

The definition of "land provisions" in section YA 1 has been amended so the definition of "associated person" applying in new section CC 1B is the one applicable to land provisions.

If a person receives a lease transfer payment on behalf of another person, the nominee rules in section YB 21 apply to treat the amount as derived by that other person.

An amount that is subject to the existing capital contribution rules is not subject to the charging provision (section CC 1B(5)). A capital contribution continues to be income under section CG 8 and needs to be spread evenly over 10 years unless the payee chooses to reduce the cost base of the depreciable property under section DB 64.

Residential exception

A lease transfer payment will not be income of the payee if the payee is a natural person (individual) and derives the amount as a tenant or licensee of residential premises whose expenditure on the residential premises does not meet the requirements of the general permission, and is not associated with the owner (section CC 1B(4)). This exclusion is intended to provide a consistent tax treatment with that for lease surrender payments in section CC 1C.

Timing of income

The timing provision in section EI 4B applies to the amount of income under section CC 1B. Under that provision, the allocation of income is affected by when the income is derived in relation to the spreading period.

The exiting tenant (assignor) who receives a lease transfer payment has no remaining period over which to spread the amount of income under section CC 1B. Therefore, the amount of income is allocated to the income year in which the amount is derived.

A remedial amendment has been made to section EI 4B to ensure that if a lease is terminated early, land owners can receive the balance of deductions for a lease inducement payment in the year of termination. For example, if a tax-deductible lease inducement payment of $1,000 was provided by a landlord in relation to a tenancy agreement that was meant to last for 10 years but terminated after two years, the landlord can deduct the remaining $800 in the year of termination. This is consistent with the treatment of a lessee who is taxed on the balance of income from a lease inducement payment if the lease is terminated early.

Application dates

New section CC 1B applies from 1 April 2015.

The amendment to section EI 4B applies from 1 April 2013.

Perpetually Renewable Leases

Sections CC 1B, CC 1C, DB 20B, DB 20C and EE 7 of the Income Tax Act 2007

Amendments exclude perpetually renewable leases from the charging provisions for land-related lease payments in sections CC 1B and CC 1C, as well as the related deduction provisions. An amendment also excludes perpetually renewable leases from being depreciable property.

Background

Perpetually renewable leases (commonly known as "Glasgow" leases) last for a certain period of time (for example, 7, 10 or 21 years), but are renewable in perpetuity at the option of tenants.

The "right to use land", which includes a lease, is contained in the list of depreciable intangible property in schedule 14 of the Income Tax Act 2007. Usually, a commercial tenant under a lease can claim depreciation deductions for their cost to acquire the lease (that is, a lease premium or lease transfer payment) over its term.

A tenant under a perpetually renewable lease cannot claim depreciation deductions during the term of the lease because these leases have a perpetually renewable lease period. The tenant, however, may have been able to claim a depreciation loss when the perpetually renewable lease was sold for less than its adjusted tax value if the lease met the definition of "depreciable property" in section EE 6, that is, in normal circumstances, the lease might reasonably be expected to decline in value.

Key features

Previously, the charging provisions for land-related lease payments in sections CC 1B and CC 1C included all leasehold estates, including those with a perpetual right of renewal.

Because perpetually renewable leases are more akin to freehold property than ordinary commercial leases with a finite term, amendments have been made to align their treatment with that of freehold estates. Section CC 1B has been amended to exclude payments made for the grant, renewal, extension or transfer of perpetually renewable leases from being income of the person to whom the payment was made. Section CC 1C has also been amended to exclude payments for the surrender of a perpetually renewable lease from being income of the recipient.

Note that a premium paid on the grant of a perpetually renewable lease continues to be taxable to a landowner under section CC 1.

Sections DB 20B and DB 20C have been amended to exclude a payment for a grant, renewal, extension or transfer of a perpetually renewable lease from being deductible to the person who made such a payment.

Section EE 7 has been amended to exclude a lease of land with a perpetual right of renewal from being depreciable property. Accordingly, depreciation deductions are not available for a perpetually renewable lease. The purpose is to treat a perpetually renewable lease similarly to freehold land under the depreciation rules.

Application dates

The amendments to sections CC 1B, DB 20B and EE 7 apply from 1 April 2015.

The amendments to sections CC 1C and DB 20C apply from 1 April 2013.

Permanent Easements

Section CC 1 of the Income Tax Act 2007

This amendment excludes a payment for a permanent easement (for example, a permanent right of way) from being taxable to a landowner under section CC 1.

Background

Section CC 1 applies broadly to tax income from land by providing that amounts derived from land by a landowner are taxable even if the amounts are traditionally categorised as capital in nature, for example, a lease premium. Before this amendment, a payment for a permanent easement was taxable to a landowner under section CC 1.

A payment for a permanent easement is generally non-deductible to the payer (the grantee) under the depreciation rules. Generally, a permanent easement does not meet the definition of depreciable property under section EE 6; in particular, in normal circumstances, a permanent easement is not reasonably expected to decline in value.

Key features

An amendment to section CC 1 excludes a one-off payment for the grant of a permanent easement from being income of the landowner, by inserting new section CC 1(2C). Accordingly, a payment for a permanent easement is not taxable to the owner of land under section CC 1.4 The purpose of this amendment is to align the tax treatment of a permanent easement with that for freehold land under section CC 1.

The amendment applies only to one-off payments, but not to periodical payments, which are more in the nature of rental. Periodical payments received for permanent easements continue to be taxable under section CC 1.

Application date

The amendment applies from 1 April 2015.

Consecutive Leases

Sections EE 67 and YA 1 of the Income Tax Act 2007

This amendment treats consecutive leases of land as a single lease for depreciation purposes.

Background

Consecutive leases are multiple leases for the same parcel of land that are granted to a person or an associated person at the same time, and are linked to take effect immediately after one terminates. Under the previous rules, depreciation deductions on a lease could be accelerated by entering into consecutive leases, including involving associated persons, rather than a single lease.

Key features

Section EE 67 has been amended to include consecutive leases in the existing definition of "legal life" for a lease and licence to use land. The definition of "legal life" is used to determine the annual depreciation rate for an item of fixed-life intangible property, such as a lease of land, in section EE 33.

If consecutive leases over the same parcel of land are granted to a person or an associated person at the same time, the term of a lease owned by the person also includes the terms of consecutive leases owned by that person or their associate. This has an effect of treating consecutive leases as a single lease.

| Example | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

On 1 April 2015, A Ltd and its associates, B Ltd and C Ltd, enter into three separate leases for the same parcel of land to take effect immediately after one terminates. The first lease commences on 1 April 2015. Each lease lasts for 10 years.

A Ltd, B Ltd and C Ltd are associated and they have entered into consecutive leases for the same parcel of land on the same day. Therefore, under the new rules:

|

|||||||||||||||||

Any genuinely subsequently negotiated leases or licences of land are not counted towards the legal life of a lease. Consecutive leases would need to be acquired by the person or associated person at the same time to be counted towards the legal life of a lease.

This is an anti-avoidance measure preventing the timing of depreciation deductions for the cost of acquiring a lease (a lease premium or lease transfer payment) being accelerated by entering into consecutive leases. If consecutive leases are entered into around the same time (such as one day apart), the general anti-avoidance provision in section BG 1 may apply to counter any transactions that attempt to circumvent this measure contrary to the policy intent.

The definition of "land provisions" in section YA 1 has been amended so that the definition of "associated person" applying in section EE 67 is the one applicable to land provisions.

Also, paragraph (d)(v) of the definition of "lease" in section YA 1 has been amended to remove the Commissioner's discretion to determine consecutive leases for the purposes of personal property lease payments. A similar definition to the one that has been inserted in section EE 67 for depreciation purposes has been adopted to provide certainty and consistency.

Application date

These amendments apply from 1 April 2015.

Retirement Village Occupation Rights

Section YA 1 of the Income Tax Act 2007

The amendment ensures that all occupation right agreements under the Retirement Villages Act 2003 are excluded from the financial arrangement rules.

Background

Leases are excluded from the financial arrangement rules because they are excepted financial arrangements under section EW 5(9). However, retirement village occupation rights that are licences to occupy were previously regarded as financial arrangements because they were not a lease for the purposes of the financial arrangement rules as defined in section YA 1.

Treating certain retirement village occupation rights as financial arrangements was undesirable; if certain retirement village occupation rights were subject to the financial arrangement rules, there could have been tax consequences for a retirement village resident.

Key features

Paragraph (f) of the "lease" definition in section YA 1 has been amended to include an occupation right agreement as defined in the Retirement Villages Act 2003. Retirement village occupation rights are therefore treated as an excepted financial arrangement in section EW 5(9), and accordingly excluded from the financial arrangement rules.

This amendment aligns the treatment of retirement village occupation rights, that are licenses to occupy, with leases of land under the financial arrangement rules, and provides certainty that retirement village residents will not be subject to these rules.

Application date

The amendment applies from 1 April 2015.

1 Lease surrender payments are taxable under section CC 1C of the Income Tax Act 2007.

2 For income tax purposes, an interest in land has the same meaning as an estate in land.

3 Note that the payment from the landlord to the new tenant for the lease transfer is deductible to the landlord under section DB 20B and taxable to the new tenant under section CC 1B.

4Note that the land provisions in sections CB 6-CB 23B continue to apply to permanent easements.