Thin capitalisation rules

2014 changes to the thin capitalisation rules mean the rules will now apply when non-residents who appear to be acting together own 50 percent or more of a company.

Sections GB 51, FE 1 to 4, 14, 16, 18, 25, 27 and 31 D, and YA 1 of the Income Tax Act 2007

Changes have been made to five aspects of the thin capitalisation rules to help strengthen the rules and better protect New Zealand's tax base. The most significant change is that the rules will now apply when non-residents who appear to be acting together own 50 percent or more of a company. Non-residents will be treated as acting together if they hold debt in a company in proportion to their equity, have entered into an arrangement setting out how to fund the company with related-party debt, or act on the instructions of another person (such as a private equity manager) in funding the company with related-party debt.

The rules will now also apply to all trusts that have been majority settled by non-residents, as well as all companies controlled by the trustees of such trusts.

Amendments have also been made to the "110 percent worldwide debt test". This test, in essence, compares the amount of debt in a company's worldwide operations to the debt in the company's New Zealand operations. Debt that originates from shareholders will be excluded when calculating the debt level of a company's worldwide operations.

Increases in asset values following internal company reorganisations will be ignored, unless the increase in asset value would be allowed under generally accepted accounting principles in the absence of the reorganisation, or if the reorganisation is part of the purchase of the company by a third party.

A technical amendment has also been made to ensure that, in the outbound thin capitalisation rules, individuals and trustees will generally be required to exclude their indirect interests in offshore companies if the interest is held through a company they are associated with.

Background

The thin capitalisation rules form part of New Zealand's international tax rules and are designed to protect our tax base. The rules place limits on how much debt a non-resident can put into their New Zealand investments. This is important as the use of debt is one method that non-residents can use to take profits out of New Zealand, lowering the amount of tax they would otherwise pay.

While the thin capitalisation rules have generally been operating effectively, Inland Revenue became aware of some situations where the rules could usefully be strengthened. The changes made in this Act provide that strengthening.

These changes follow an officials' issues paper, Review of the thin capitalisation rules, released in January 2013. At a high level, the changes largely follow what was originally proposed in the issues paper, although it was decided not to proceed with one of the proposed changes (excluding capitalised interest from a company's asset base). Technical and minor policy changes have also been made in response to submitters' concerns raised during three rounds of consultation (the initial issues paper, a subsequent technical paper, Thin capitalisation review: technical issues, and Parliament's Select Committee process).

Key features

- The inbound thin capitalisation rules will apply when non-residents (or entities subject to the rules) act together when investing in New Zealand. (The previous rules applied only when a single non-resident controlled the investment.)

- Debt linked to shareholders of group entities or their associates will be excluded from the worldwide group debt test used in the inbound rules.

- The inbound thin capitalisation rules will apply to all resident trustees if 50 percent or more of settlements made on the trust were made by a non-resident, or a group of non-residents and/or other entities subject to the rules who are acting in concert.

- The on-lending concession will be extended to cover financial arrangements held by a trust provided certain criteria are met.

- Increases in asset values will be ignored if they are the result of transactions between associated persons, unless the increase would be allowed by accounting standards in the absence of a transaction.

- In the outbound thin capitalisation rules, individuals or trustees will be required to exclude their indirect interests in offshore companies if their interest is held through a company they are associated with.

Application date

The amendments apply from the 2015–16 income year.

Detailed analysis

Companies controlled by shareholders acting together

The thin capitalisation rules apply to companies controlled by shareholders who have the ability to substitute equity with debt. This is clearly evident when a company is controlled by a single non-resident - the controlling non-resident has little constraint on how it can fund the company, and so is free to invest through debt rather than equity. However, the ability to substitute equity with debt is also available to non-residents who are acting together. They are able to coordinate their activities and act in much the same way as a single non-resident.

The rules have been amended so they also apply to companies controlled by a group of shareholders who appear to be acting together. Section FE 2 provides that the thin capitalisation rules apply if a non-resident owning body holds 50 percent or more of a company's ownership interests, or has control of a company by any other means.

As a consequence, section FE 1 has been amended to reflect the broader application of the rules.

Non-resident owning body

In short, a non-resident owning body is a group of non-residents or entities described in sections FE 2(1)(cc) to (db) (such as trusts settled by non-residents) that have one or more characteristics indicating they are acting together to debt-fund a New Zealand company. These characteristics are having:

- proportionate levels of debt and equity among the group;

- an agreement that sets out how the company should be funded with member-linked funding if the company is not widely held (a term defined in section YA 1);

- member-linked debt in the company in a way recommend by a person (such as a private equity manager), or implemented by a person on behalf of the members.

Arrangements on how to fund the company are only counted as a characteristic of acting together if the arrangement applies to the current income year. That is, shareholders who have agreed how to fund an entity in the event of a specified event that is yet to occur (such as insolvency) are not a non-resident owning body by virtue of that agreement.

The proportionality rule

Proportionality is a characteristic of acting together as it generally requires a degree of coordination to achieve. More generally, proportionality is also a situation where shareholders are able to substitute debt for equity. This is because, where there is proportionality, the level of debt in a company does not change shareholders' exposure to the risk of holding equity in the company or shareholders' overall return. As debt levels increase, the makeup of the return will change (ie, fewer dividends and higher interest payments) but the sum of interest and dividends will be unchanged.

The new proportionality rule will capture both direct and indirect proportionality, including debt or equity that is routed through a trust (a linked trustee, explained below).

Subsection FE 4(a)(i) provides that the rule will apply if the company ultimately owes money to each member of the group and, for each member, the member's debt as a fraction of the total debt the company owes to all members (the member debt) is the same as the member's direct or indirect interests in the company as a fraction of direct or indirect ownership interests held by all members in the company.

Subsection FE 4(a)(ii) provides that the rule also applies in relation to a member if the criteria of subsection FE 4(a)(i) would be met if the debt and equity held by the member's linked trustees, and the debt held by the member's subsidiaries, were held directly by the member.

A linked trustee is a trust that a person has provided money to, whether through settlement or some other arrangement (such as a financial arrangement). This is to ensure a non-resident cannot avoid being included in a non-resident owning body by holding shares or debt in a New Zealand company through a trust.

Note that as per subsection (2) of the definition of non-resident owning body, each type of ownership interest is to be considered in the proportionality rule.1

Anti-avoidance provision

New section GB 51 provides that arrangements are void if they have the effect of defeating the intent of the proportionality rule (to capture groups of non-residents and entities described in section FE 2(1)(cc) to (db) who, in economic substance, have proportionate levels of debt and equity). An example of this type of arrangement would be using a back-to-back loan to make it appear as if there is no proportionality.

Member-linked debt

The other two characteristics of acting together described above only apply to member-linked debt. This is debt that where the member:

- is a party to the financial arrangement;

- guarantees or provides security for the arrangement (if the worldwide group is provided by sections FE 3(e) or FE 31D - this is described more in more detail in the section Worldwide group debt test); or

- has entered into a back-to-back arrangement with the person who has provided the funds to the company.

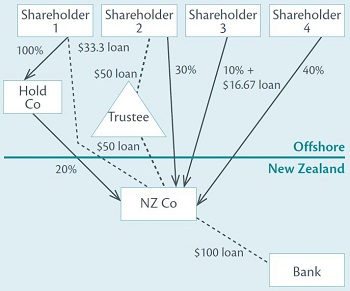

| Example | |

|---|---|

|

Resident company NZ Co has four non-resident shareholders: Hold Co, 2, 3 and 4. Shareholder 1 owns 100 percent of Hold Co and is therefore an indirect owner of NZ Co. Shareholders 1 and 3 have lent money to NZ Co ($33.33 and $16.67, respectively). Shareholder 2 has lent $50 to Trustee, who has on-lent that money to NZ Co. As shareholder 2 has provided money to Trustee, it is a linked trustee. NZ Co has also borrowed $100 from a New Zealand bank. The bank is not associated with any of NZ Co's shareholders.

Shareholders 1 (together with its associate Hold Co), 2 and 3 will be members of a non-resident owning body. NZ Co's total member debt is $100 ($33.33 + $50 + $16.67) and the total equity in NZ Co held by the members is 60 percent (20 percent + 30 percent + 10 percent). This means:

Each shareholder's share of total member debt is equal to their share of total member equity. They therefore have proportionate levels of debt and equity (ratio of 1:0.6 debt to equity). The thin capitalisation rules will therefore apply to NZ Co as 60 percent of its shares are held by a non-resident owning body. |

|

Aggregation of ownership interests

New section FE 2(1)(cb) provides that the total ownership interests of a non-resident owning body should be determined as if the members were associated persons. The purposes of this is that, as per section FE 41, the ownership interests of the owning body will be calculated by aggregating the ownership interests of the body's members, except to the extent the aggregation would result in double counting.

| Example | |

|---|---|

|

Resident company A Co has five non-resident shareholders: Mr W (married to Mrs W), Mrs W, Mr X, Mr Y and Mr Z. Each holds 20 percent of the issued shares. They all have agreed to lend some of their own money to the company, and therefore form a non-resident owning body. Mr W's ownership interest in A Co is 40 percent (as his interests are aggregated with Mrs W under section FE 41). Mrs W's ownership interest is similarly 40 percent. The other shareholders (who are not associated with each other or Mr and Mrs W) have an ownership of 20 percent each. The ownership interests are added together, but with 40 percent removed to correct for double counting of Mr and Mrs W's interests. The non-resident owning body made up of Mr W, Mrs W, Mr X, Mr Y and Mr Z therefore has 100 percent of the ownership interests in A Co. |

|

New Zealand groups

Under the new rules, the New Zealand group of a company controlled by a non-resident owning group will be determined much in the same way as a company controlled by a single non-resident.

As with companies controlled by a single non-resident, new section FE 26(2)(bb) will provide the general rule that a New Zealand company is a New Zealand parent company if a non-resident owning body has direct ownership interests of 50 percent or more in the company.

There is an exception to this if one or more of the members operates a branch in New Zealand or has New Zealand-sourced income (other than non-resident passive income). In that case the non-resident owning body itself is the New Zealand parent. This matches the treatment of companies owned by a single non-resident where that non-resident operates a branch or has New Zealand-sourced income (other than non-resident passive income).

A similar amendment has been made to section FE 26(3)(d), which defines the parent of an excess debt entity as the company where the non-resident owning body directly holds 50 percent or more of its ownership interests. Again, there is an exception when one or more members of the non-resident owning body operates a branch in New Zealand or has New Zealand-sourced income (other than non-resident passive income). In this case the parent will be the non-resident owning body.

| Example | |

|---|---|

|

Non-residents X Co, Y Co and Z Co (who are not associated persons) each own 33 percent of resident company A Co and have proportionate debt and equity. They therefore will form a non-resident owning body. A Co has three resident subsidiaries. The New Zealand parent for A Co is determined under section FE 26(2)(bb) (a non-resident owning body has direct ownership interests in A Co of 50 percent or more). A Co is therefore the New Zealand parent. A Co's subsidiaries will determine their New Zealand parent (A Co) under section FE 26(3)(d)(ii). A Co's New Zealand group will therefore comprise A Co and its three subsidiaries. |

|

Special grouping rule: investments via holding companies

A special rule will apply if some members of a non-resident owning body invest into New Zealand through a holding company. The grouping rules described above will not be able to identify a New Zealand parent for the top-level operating company in New Zealand (Z Co in the example below).2

Accordingly, section FE 26(6) will deem the top-level operating company as the New Zealand parent. A company controlled by the top-level operating company will identify the operating company as its parent under section FE 26(3). Each holding company will also have a New Zealand group that is just the company.

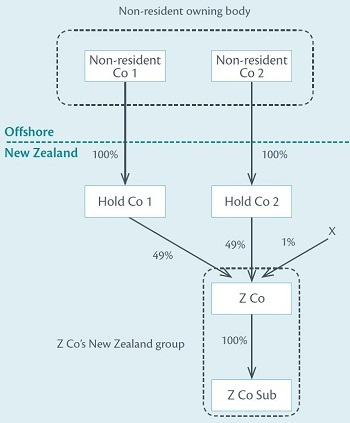

| Example | |

|---|---|

|

Non-resident Co 1 owns 100 percent of Hold Co 1 and Non-resident Co 2 owns 100 percent of Hold Co 2. Hold Co 1 and Hold Co 2 are therefore subject to the thin capitalisation rules under section FE 2(1)(c). The non-residents meet the criteria for being a non-resident owning body. Z Co is therefore also subject to the thin capitalisation rules under section FE 2(1)(cb).

Hold Co 1's New Zealand group is Hold Co 1 (as Hold Co does not hold 50 percent or more of Z Co's ownership interests it does not include it in its group under section FE 26). Hold Co 2's New Zealand group is similarly just Hold Co 2. Z Co's New Zealand group cannot be determined under section FE 26 other than under subsection (6). Z Co is therefore deemed to be its New Zealand parent. Z Co Sub will identify Z Co as its parent under FE 26(3)(d)(ii). Z Co's New Zealand group will therefore be Z Co and Z Co Sub. |

|

New grouping rules only apply if existing rules do not

These new grouping rules will only apply if the thin capitalisation rules as they currently stand do not apply - that is, to a company not controlled directly or indirectly by a single non-resident.3 This means the New Zealand parent of a company controlled by a single non-resident will be unaffected by the changes, even if the company is also controlled by a non-resident owning body. Its New Zealand group will, by extension, also be unaffected.

| Example | |

|---|---|

|

Non-resident companies Z, X and Y own 51, 25 and 24 percent, respectively, of New Zealand-resident company A Co. Companies Z, X and Y have funded A Co with related-party debt as instructed by a private equity manager. Companies Z, X and Y therefore form a non-resident owning body. A Co has three resident subsidiaries. Company Z also owns 100 percent of an Australian company. Under the current thin capitalisation rules, the New Zealand group of A Co comprises A Co and its three New Zealand subsidiaries. The worldwide group is the New Zealand group, Company Z and the Australian company. There will be no change to the New Zealand or worldwide group of A Co as a single non-resident (Company Z) owns 51 percent of its shares - even though a non-resident owning body also holds 50 percent or more of A Co's shares. |

|

Worldwide groups

New section FE 31D provides that the worldwide group of a company controlled by a non-resident owning body is just its New Zealand group, unless a single non-resident also controls the company. This is because it is not possible to construct a meaningful worldwide group when a company is not controlled by a single person.

Rules to ensure matching New Zealand groups

Under the thin capitalisation rules it is important that New Zealand groups of different entities match. That is, if Company A includes Company B in its New Zealand group, then Company B should include Company A in its group. It is also important that an entity cannot be included in multiple groups. This is to prevent the double-counting of the entity's debt and assets.

Section FE 3(d) excludes a company from a trust's group if the company does not include the trust in its own group (that is, the trust is not found to be the company's New Zealand parent under section FE 26(4D)). This ensures the two groups are identical.

A separate rule in section FE 14(3B) ensures that an entity cannot include its debt and assets in more than one New Zealand and worldwide group. This might arise, for example, if it were possible to argue there are multiple different non-resident owning bodies that hold 50 percent or more of the ownership interests in a company.

An ordering rule applies in some cases when determining the group an entity's debt and assets should be included in. If the entity is a company that is controlled indirectly or directly by a single non-resident, it must include its debt and assets in the New Zealand group of the single non-resident. Otherwise there is no rule for determining the group the debt and assets should be included in.

Worldwide group debt test

Whether there is any interest denial under the thin capitalisation rules depends on the result of two tests. One of these tests is known as the "worldwide group debt test" and is designed to ensure that the amount of debt in a New Zealand company is proportionate to the amount of genuine external debt of the ultimate non-resident parent of that New Zealand company.

In some circumstances, however, the debt of the ultimate parent company may also include debt from the parent's shareholders or other owners of the group. In such cases the debt level of the worldwide group does not reflect the level of genuine external debt.

To address this, new section FE 18(3B) provides that, when an excess debt entity (other than an outbound excess debt entity)4 is calculating its worldwide group debt percentage, it must generally exclude debt that is linked to an owner of the worldwide group. There are a few carve-outs to this rule; these are described below.

An "owner" will be a person who has an ownership interest in a member of the group or is a settlor of a trust that is a member of the group.

A financial arrangement will be treated as linked to an owner of the group if the owner, or an associate of the owner (excluding associates who are members of the group):

- is a party to the financial arrangement (for example, by a loan directly from the owner);

- has guaranteed or otherwise provided security for the financial agreement and the entity's worldwide group is deemed to be the same as its New Zealand group under sections FE 3(e) or FE 31D (discussed below); and

- has provided funds or will provide funds, directly or indirectly, to another person who is providing funds under the financial arrangement (such as a back-to-back loan).

Worldwide group is the same as New Zealand group

When a company is owned by a group of non-residents who meet the definition of a "non-resident owning body" (or by trusts subject to the thin capitalisation rules) there is no true worldwide debt test that can be used to ensure the owners have allocated a fair amount of their worldwide debt to New Zealand. It is therefore important that shareholder-guaranteed loans are counted as "owner-linked". The presence of a shareholder guarantee suggests the New Zealand entity would not be able to commercially support the loan in the absence of the guarantee. This provides an indication that debt that should be allocated elsewhere in the world has been put in New Zealand - since the loan is implicitly being supported by assets outside of New Zealand.

The issue of shareholder-guaranteed debt is less significant in the case of a company controlled by a single non-resident. While shareholder guarantees could nonetheless be used to excessively gear the worldwide group, this concern must be tempered with the fact that the worldwide group debt test can act to ensure that only a reasonable amount of the worldwide group's debt is allocated to New Zealand. Moreover, a New Zealand company may struggle to get information about guarantees provided by shareholders of the ultimate parent company.

On this basis, section FE 18(3B)(b)(ii) applies only in relation to entities with a worldwide group deemed to be the same as their New Zealand group under sections FE 3(d) or FE 31D.

Carve-out for public debt and minor shareholders

New section FE 18(3B) also includes a carve-out for minor shareholders and publicly traded debt. An owner's financial arrangement will not be excluded from the worldwide group debt test if:

- the owner has a 5 percent or less direct ownership interest in the group; or

- the financial arrangement held by the owner is traded on a recognised exchange (if the definition of recognised exchange in section YA 1 was read to include a reference to an exchange for trading financial arrangements).

These carve-outs are designed to reduce compliance. It would be difficult to manipulate a company's debt financing through publicly traded debt where the debt is widely traded. Excluding such debt reduces compliance costs. Limiting the rule to shareholders with a direct ownership interest of 5 percent or more limits the number of shareholders that a company needs to investigate to determine if they hold owner-linked debt.

The 5 percent ownership threshold does not refer to indirect interests or interests held by associates. This is intentional. Otherwise the exemption's purpose as a compliance reduction measure would be defeated. However, it is not intended to provide an opportunity for a non-resident with a significant interest in a company to avoid the application of the owner-linked debt rules by spreading their interests across numerous associated entities.

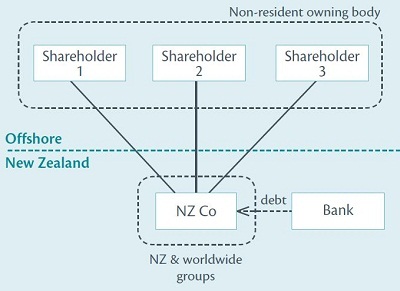

| Example | |

|---|---|

|

Three shareholders collectively own New Zealand company NZ Co. As NZ Co is controlled by a non-resident owning body, its worldwide group is the same as its New Zealand group.

The three non-resident shareholders will be treated as "owners" of NZ Co as they each have an ownership interest in NZ Co and are outside of its worldwide group. Any debt they extend to NZ Co will not be treated as debt in NZ Co's worldwide group debt test. "Bank", however, will not be treated as an "owner" of NZ Co as it has no ownership interest in NZ Co and is not associated with any of the shareholders. A loan from Bank will therefore be included as debt in NZ Co's worldwide group debt test. Effect of shareholders lending to NZ CoThe three shareholders decide to lend a total of $500,000 to NZ Co. NZ Co has $800,000 of assets. The debt-to-asset ratio of NZ Co's New Zealand group is ($500,000 ÷ $800,000) = 62.5 percent. The debt-to-asset ratio of NZ Co's worldwide group is ($0 ÷ $800,000) = 0 percent (as the debt from the owners is excluded). The debt-to-asset ratio of NZ Co's New Zealand group exceeds both the 60 percent safe harbour and worldwide group debt test. NZ Co will therefore have income under section CH 9 to cancel out some of its interest deductions. Effect of Bank lending to NZ CoInstead of borrowing from its shareholders, NZ Co borrows the $500,000 from Bank. Again, NZ Co has $800,000 of assets. The debt-to-asset ratio of NZ Co's New Zealand group is ($500,000 ÷ $800,000) = 62.5 percent. The debt-to-asset ratio of NZ Co's worldwide group is ($500,000 ÷ $800,000) = 62.5 percent. While the debt-to-asset ratio of NZ Co's New Zealand group exceeds the 60 percent safe harbour, it does not exceed the worldwide group debt test. The debt percentage of the New Zealand group is less than 110 percent of the debt percentage of the worldwide group. NZ Co will not have any income under section CH 9. |

|

Extending the thin capitalisation rules to more trusts

Amendments to section FE 2(1)(d) extend the thin capitalisation rules to all types of trusts for tax purposes (complying trusts, non-complying trusts and foreign trusts). The new rules mean a trust is subject to the thin capitalisation rules if the majority of settlements on it come from non-residents or from persons who are subject to the thin capitalisation rules.

A trust will be subject to the rules if 50 percent or more of the settlements are made by:

- a non-resident or a person associated with the non-resident;5

- an entity subject to the inbound thin capitalisation rules (that is, an entity to which section FE 2(a) to (cc) and (db) applies); or

- a group of non-residents or entities subject to the thin capitalisation rules that act in concert.

As with companies, the thin capitalisation rules apply to trusts settled by entities acting in concert. This is important to ensure the rules cannot be easily circumvented through the use of trusts. However, the rules for determining when a group of entities appear to be acting together used for companies (described in the section non-resident owning body) cannot be used for trusts. Instead, the rules apply to a trust settled by a group "acting in concert". This is because, for example, it is not sensible to refer to settlements made in proportion to debt extended to a trust because rights to income from a trust generally do not depend on the amount a person has settled on it.

New section FE 2(1)(db) also provides that a trust is subject to the thin capitalisation rules if a person subject to the thin capitalisation rules has the power to appoint or remove a trustee. This is designed as an anti-circumvention measure. It means trusts are subject to the rules if they have been settled by a New Zealand resident and then effective control of the trust is transferred to a non-resident by giving the non-resident power to appoint or remove the trustee.

There is a carve-out from this rule if a person has the power to add or remove a trustee for the purpose of protecting a security interest. This type of security interest is commonly held by banks that have lent to a trust.

Section FE 2(1)(d) and (db) provides that settlements made by the trustee and powers of removal or appointment of the trustee must be ignored when applying the sections. This is to prevent circularity if two trusts make settlements on each other or each has the ability to appoint the other's trustee.

To illustrate, say settlements on Trust A are made by a non-resident and Trust B. Settlements made on Trust B are made by Trust A. It is only possible to determine whether Trust B is subject to the thin capitalisation rules if the settlement it has made on Trust A is ignored. Ignoring the settlement means the sole settlor of Trust A is a non-resident. Trust B is therefore subject to the thin capitalisation rules as it has been settled by a trust that is itself subject to the rules. Once Trust B's status is determined, it is possible to determine that Trust A should also be subject to the rules as it has also been settled by entities that are subject to the rules (a non-resident and Trust B).

Grouping rules for trusts

Amendments to section FE 3 define the New Zealand group of a trust as the trust and all companies controlled by the trust. Whether a trust controls a company is determined under section FE 27, based on the trust's choice of control threshold under that section.

Similarly, the New Zealand group of a company that is controlled by a trust will be the trust and all other companies controlled by the trust. This is provided by new section FE 26(4D), which defines the New Zealand parent of a company controlled by a trust to be the trust. The other members of the New Zealand group will then be determined under section FE 28.

As with companies controlled by non-resident owning bodies, the worldwide group of a trust will be the same as its New Zealand group. This is provided by section FE 3(1)(d).

Extension of on-lending concession for trusts

Currently, section FE 13 provides what is commonly referred to as the "on-lending concession". It removes financial arrangements that provide funds to a person from the ambit of the thin capitalisation rules.

Proposed amendments to section FE 13 mean that, for a trust that holds only financial arrangements and property incidental to those financial arrangements, the on-lending concession will apply regardless of whether the arrangement provides funds.

This amendment is designed for securitisation vehicles that hold only financial arrangements which will become subject to the rules because of the changes relating to trusts described above. This carve-out is on the basis that the on-lending concession would apply to most of the trust's debt in any event.

Exclusion of asset uplift

New sections FE 16(1D) and (1E) provide that increases in a company's New Zealand group assets that arise from the sale or other transfer of assets between a member of the group and a person associated with the group must be ignored. This may or may not be another member of the group.

This change applies only in relation to transfers that occur in or after the 2015–16 income year.

The purpose of this change is to ensure that increases in asset values that are not recognised under generally accepted accounting practice in the consolidated worldwide accounts of a company cannot be recognised in the asset values of the company's New Zealand group.

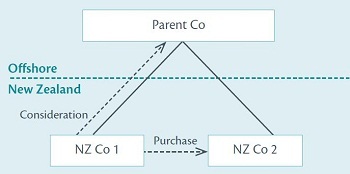

| Example | |

|---|---|

|

Parent Co owns two New Zealand subsidiaries, NZ Co 1 and NZ Co 2.

NZ Co 1 purchases the shares in NZ Co 2 from Parent Co. NZ Co 1 will not be able to include any increase in asset values resulting from this purchase for thin capitalisation purposes unless that increase would have been allowed under generally accepted accounting practice in the absence of the purchase. |

|

When uplift can be recognised

Section FE 16(1E) will provide two exemptions to the rule above. These are when:

- generally accepted accounting practice would allow the increase in asset values in the absence of the transfer; or

- the transfer is part of a restructure following the purchase of the group by a person not associated with the group and the change in the value of the New Zealand group's assets is a reasonable proportion of the change in the value of the group's total assets.

The intention behind the second exemption is to allow uplifts to be recognised when a third party has, in essence, purchased a group of companies and part of that purchase price relates to the group's intangible property. Following this, the purchaser may restructure the group, in part to spread the value of the intangible property among all its subsidiaries. An increase in the assets of the New Zealand group following such a restructure is allowable, provided the increase is a reasonable considering the increase in the value of the entire group's assets (for example, having regard to the relative size of the New Zealand group).

Excluding individuals' and trustees' interest in a CFC

New section FE 16(1BA) largely rewrites the previous section FE 16(1B) but with a new provision. Individuals or trustees will be required to exclude certain interests in a controlled foreign company (CFC) or foreign investment fund (FIF) they hold indirectly through an associate that is outside their New Zealand group if the associate is outside their group by virtue of being an excess debt outbound company or included in the group of such a company.

This provision is necessary as section FE 3(2)(a) excludes from the New Zealand group of an individual or trustee who is an outbound investor, all companies that are excess debt outbound companies or included in the group of such a company. Despite this provision, the person or trustee's indirect interests in the CFC or FIF should be still be excluded from their group assets.

1 These are: shares, decision-making rights, the right to receive income and the right to receive the net value of any assets.

2 There would be no issue if one of the holding companies held ownership interests of 50 percent or more of Z Co. The thin capitalisation rules as they were before these amendments would apply.

3 For example, section FE 26(2)(bb) applies only if "none of the other paragraphs apply" and subsection (3)(d)(ii) applies only if subsection (3)(d)(i) does not. Subsection (3)(d)(i) is a paraphrase of previous section FE 26(3)(d).

4 This change applies to the "inbound" thin capitalisation rules, which apply to non-resident investments in New Zealand. The "outbound" thin capitalisation rules, which apply to New Zealand investment abroad, are not affected.

5 Here, an associate will not include a relative that has not made any settlements on the trust. This is to prevent the rules from applying to a trust settled by a New Zealand resident merely because the resident has a non-resident relation.