Changes to Imputation Credit Rules

2005 amendment to the dividend and imputation rules means when a company is sold prepaid tax benefits stays with the group that paid the tax and cannot be refunded.

Sections CD 7, GC 22, MB 6, ME 4, 5, 9B, 9C, 14, OB 1 of the Income Tax Act 2004; sections GC 22, MB 6, ME 4, 5, 9B, 9C, 14, OB 1 of the Income Tax Act 2004; sections 101B, 140(B) of the Tax Administration Act 1994

The dividend and imputation rules have been amended to ensure that, in certain circumstances, when a company is sold the benefits of any prepaid tax will stay with the original group that paid the tax and cannot be refunded. The changes were designed as a revenue protection measure.

The amendments ensure that imputation credits earned by one group of companies cannot effectively be paid to a different group's shareholders.

Companies that leave wholly owned groups that have available net losses in excess of $1 million may elect that a debit balance in their imputation credit account or an amount of prepaid tax in excess of their imputation credit account's credit balance be transferred to another New Zealand group company immediately before leaving the group.

If such an election is not made and the company then joins another wholly owned group with different ultimate shareholders, a final tax - additional income tax - that cannot be credited against other tax liabilities of the company or group will be payable.

Other amendments:

- modify the imputation credit anti-streaming rule;

- ensure that within wholly owned groups, a taxable bonus issue election can only arise when there is an issue of shares fully paid from reserves; and

- as a remedial measure, clarify that all payments of income tax can create imputation credits.

Background

Under the classical dividend system that applied in New Zealand until 1988, two amounts of tax were levied on company profits: first, as they were earned, by way of company tax, and again when they were distributed as dividends to shareholders. The imputation rules have the effect of relieving this double taxation. A New Zealand company can attach imputation credits to dividends paid to shareholders representing the tax paid by it. Shareholders can use these imputation credits to alleviate the taxation obligations in respect of the dividend.

Detailed provisions within the imputation rules ensure that, among other things, the shareholders at the time the tax was paid are the same shareholders who receive the imputation credits. Obviously, this is in general terms only, since it is not always practicable to track individual shareholders, particularly of widely held companies. Companies are required to maintain a record of the payments of tax and the tax passed on to shareholders through an imputation credit account.

There are also specific provisions within the imputation rules that govern tax refunds. Essentially, a refund may not be claimed unless the company concerned has an equivalent level of imputation credits. This is to ensure the tax paid by a company is not refunded when the imputation credits created by the original payment have already been attached to dividends paid to shareholders and used by them as tax credits.

The imputation rules do not prevent a company prepaying its income tax in order to create imputation credits that it can attach to its dividends. Typically, this happens when the company is in a loss situation.

Several companies have done this in the past, presumably in order to enhance the value of their shares, as dividends with imputation credits are worth more than dividends with no credits. They have also done it, presumably, in circumstances where they anticipate paying income tax in the reasonable future.

When tax has been prepaid in this fashion, use-of-money interest is not payable, on the basis that the shareholders have actually used the imputation credits to reduce their tax liability. There is no policy objection to these prepayments.

Transactions that are contrary to the policy intent

It was always the intention that a tax overpayment not matched by an equivalent credit balance in the imputation credit account would not be refunded but used to offset a tax liability of the company owned by the shareholders who had received the imputation credits.

The changes were aimed at two types of transactions that were contrary to the underlying policy intent of the imputation rules.

The first type involves a special-purpose subsidiary with a prepaid tax amount and imputation credit account with no imputation credits. It is sold to a consolidated group with surplus imputation credits.2 The special-purpose subsidiary then joins the consolidated group and, as the group has imputation credits in excess of the prepaid tax amount, a refund of the tax is made.

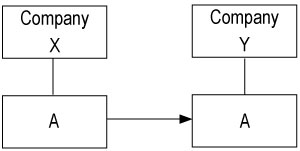

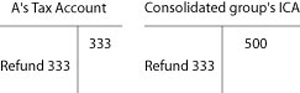

For example, Company A, owned by Company X, has prepaid tax of $300 and no imputation credits in its imputation credit account. Company A is sold to Company Y, which is part of a consolidated group with a credit balance of $500. Company A joins Company Y's consolidated group.

A comparison is made between the amount of prepaid tax in Company A, $300, with the credit balance of the imputation credit account of the consolidated group - $500. As the credit balance exceeds the prepaid tax, a refund is released and the consolidated group's imputation credit account debited by the amount of the refund.

The second type of transaction is more complicated. Here a special purpose subsidiary of the company with a prepaid tax amount and an empty imputation credit account is created. The special purpose subsidiary pays a fully imputed taxable bonus issue, in a form other than by way of a fully paid issue of shares from reserves, to its parent company. The parent company's imputation credit account now has sufficient imputation credits so that its prepayment of tax can be refunded. While the special purpose subsidiary has an equivalent debit balance in its imputation credit account, the final step is that the company is sold to and amalgamated with a company with surplus imputation credits.

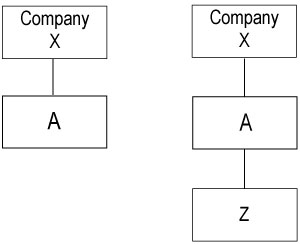

For example, Company A, with prepaid tax of $300, no imputation credits and owned by Company X, now incorporates a special purpose subsidiary z.

Special purpose subsidiary Z makes a subdivision of shares, electing that the subdivision be a taxable bonus issue, with a value of $609 and so attaching imputation credits of $300. This causes a debit to Z's imputation credit account of $300 with a corresponding credit to A's imputation credit account.

Now that A has a credit balance of $300 in its imputation credit account, it can receive a refund of its prepaid tax.

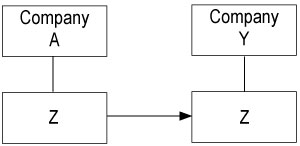

Z, with a debit balance in its imputation credit account of $300, is sold to Company Y, which, as before, has a credit balance of $500 in its imputation credit account.

Company Y and Company Z then amalgamate, and Company Y, as the amalgamated company, puts its debit balance into its imputation credit account.

Key features

New section ME 9B of the Income Tax Act 2004 and the Income Tax Act 1994 applies to companies leaving wholly owned groups that have available net losses in excess of $1 million at the end of the previous tax year. Immediately before leaving the group, a company may elect that a debit balance in its imputation credit account or an amount of prepaid tax, for the amount exceeding the credit balance in its imputation credit account, may be transferred to another company in its original group. Alternatively, the company that leaves may elect to pay additional income tax of an amount equal to the debit balance or excess amount of prepaid tax. This additional income tax will be a final tax and cannot be credited against other tax liabilities. This is because the additional income tax is to offset the tax benefit that has already been received by the leaving group's shareholders in the form of imputation credits.

New section ME 9C generally applies to the companies that did not elect to transfer the debit balance or excess prepaid tax and did not make a payment of additional income tax. It can also, in some limited circumstances, apply to other companies whose ownership changes.

If such a company then joins a new wholly owned group with different ultimate shareholders it will be required to make a payment of additional income tax equal to the debit balance in its imputation credit account, or the amount of prepaid tax to the extent it exceeds its credit balance in its imputation credit account. Again, as in section ME 9B, additional income tax cannot be credited against other tax liabilities because this additional income tax is to offset the tax benefit received by the leaving group's shareholders in the form of imputation credits.

Section ME 14(3B) has been added to ensure that new sections ME 9B and ME 9C also apply to consolidated groups.

Section CD 7 of the Income Tax Act 2004 and section OB 1 - taxable bonus issues of the Income Tax Act 1994 - have been amended to ensure that, within a wholly owned group, only issues of shares that are fully paid up from reserves can become a taxable bonus issue. Outside a wholly owned group the existing law remains.

Section GC 22(4)(b) of the Income Tax Act 2004 and the Income Tax Act 1994 have been amended to ensure that the anti-imputation credit streaming rules apply when there is an account advantage that may not also be accompanied by a tax credit advantage.

As a remedial measure, section MB 6 has been amended to include tax in excess of the taxpayer's income tax liability within the scope of voluntary payments of provisional tax. This means that a voluntary payment of tax includes situations when a taxpayer has no income tax or provisional tax liability. The effect of this inclusion is that, as such payments are now treated as a payment of provisional tax, an imputation credit will arise when such a payment is made.

Application date

The revenue base protection amendments apply from the date of introduction of the original bill - 16 November 2004. The remedial measure applies from 1 April 1995.

Detailed analysis

The amendments are aimed primarily at companies that have no immediate expectation of being liable to income tax but who prepay tax to impute dividends to shareholders and then engage in transactions to have the prepaid tax refunded to them in some way.

The mechanisms, to date, have involved the sale of a company, that has either a debit balance in its imputation credit account or an amount of prepaid tax that exceeds the credit balance in its imputation credit account, to another company that has imputation credits surplus to its immediate needs.

The end result is that, in effect, imputation credits are transferred from the shareholders of the imputation-rich company to the shareholders of the imputation-poor company. This is contrary to the intent of the imputation rules that imputation credits should be of benefit only to the shareholders of the company who paid the tax in the first place. It is for this reason that, under present law, breaches in excess of 66% in shareholder continuity trigger losses in imputation credits.

Because of the need for an explicit buttress for the shareholder continuity rules, but balanced by the concern that non-tax driven transactions should not be disturbed, the amendments are targeted at wholly owned groups that have group losses in excess of $1 million.

Loss-making groups are the most likely to be at risk of entering into such transactions because they are more likely to impute dividends without an expectation of having taxable income.

Therefore section ME 9B has been added to give companies that leave wholly owned groups with accumulated losses in excess of $1 million in the last tax year the ability to transfer immediately, before sale, any debit balance in their imputation credit account or an amount of prepaid tax in excess of their imputation credit account's credit balance to another company within the original wholly owned group.

This is to allow the original group's shareholders to retain the benefit of the amount of prepaid tax that enabled their dividends to be imputed. Similarly, with any debit balance, they retain the obligation to pay tax by 31 March, since this obligation arose because the group utilised the imputation credits.

The election procedure is set out in section ME 9B(8B). This must be:

- in a form acceptable to the Commissioner;

- made by the leaving company and accompanied by a notice of agreement from the company that either receives the imputation debit or the prepayment of tax; and

- made before the company leaves the group or such further period as the Commissioner may allow.

A "leaving company" may instead choose to pay additional income tax equal to the amount of the debit balance or the excess prepaid tax. It is not expected this will be the preferred option as additional income tax is a final tax and cannot be credited against other tax liabilities.

Section ME 4(1)(cb), (cc) and (cd) has been added to allow the transfer of the debit balance, or the payment of additional income tax to create an imputation credit. Section ME 4(2)(bb) has also been added to make the creation of the imputation credit effective from the date the leaving company ceases to be a member of a wholly owned group in the case of a transfer or the date the payment of additional income tax is made, as applicable.

To buttress section ME 9B, section ME 9C provides that imputation credit companies that leave wholly owned groups, and certain other companies, that have available net losses in excess of $1 million and join another wholly owned group with different ultimate shareholders will be required to make a payment of additional income tax equal to any debit balance in the joining company's imputation credit account or any amount of prepaid tax that exceeds the credit balance in its imputation credit account. The additional income tax cannot be credited to other tax liabilities.

It is expected that a liability to additional income tax will arise only in unusual cases.

Sections 101B have been added and 140B has been amended to include additional income tax that arises under section ME 9C within the scope of the Tax Administration Act 1994. Additional income tax under section ME 9B is not included as that is effectively a voluntary tax.

Tax pooling accounts

Entitlements to funds in a tax pooling account are included in the quantification of an "excess entitlement" in ME 9B (3) and ME 9C (4). This is because deposits to a tax pooling account create imputation credits in the same way as voluntary or prepayments of tax.

To prevent the imposition of additional income tax, if any amounts of excess entitlement are held by a company that leaves a wholly owned group with $1 million available net losses in a previous tax year and then joins a wholly owned group with different ultimate owners, a transfer in the tax pool by the leaving company will be necessary.

As the operation of tax pooling accounts are outside the direct control of Inland Revenue, this transfer will need to be initiated by the leaving company to ensure there is no liability to additional income tax when joining a wholly owned group with different ultimate owners.

Subdivisions of shares

In the transactions discussed in the background section, a common feature is the use of a subdivision or share split, for which it was argued that it was a bonus issue, and so when an election is made for it to be a taxable bonus issue, can have imputation credits attached. This is because taxable bonus issues are treated as dividends for income tax purposes.

The change as originally proposed in the bill clarifies that subdivisions or share splits could not be taxable bonus issues. However, the Finance and Expenditure Committee recommended that the restriction apply only to wholly owned groups, with the existing law remaining for non-wholly owned groups. The committee's reasoning was that within these transactions the shareholding company was not subject to tax because of the intercompany dividend exemption on the taxable bonus issue. Therefore the usual constraint on excessive taxable bonus issues that the shareholder is subject to tax on the dividend did not apply.

Because a share split or subdivision was possible under sections other than 48(b) and (c) of the Companies Act 1993, the committee further recommended that, for wholly owned groups, it was preferable to specify the type of issue of shares for no consideration that was acceptable from a policy perspective - that is, an issue of shares fully paid up from reserves.

Strengthening the anti-imputation credit streaming rule

Earlier anti-imputation credit streaming rules appeared not to envisage a situation where an arrangement could create an advantage to an imputation credit account - an "account advantage" - without also creating a credit for use against an income tax liability - a "tax credit advantage".

In the transactions discussed in the background section, the taxable bonus issue to which imputation credits were attached was paid to a wholly owned group member and was therefore exempt from income tax. As there was no tax credit advantage, the anti-streaming rules appeared not to apply, even though there was an account advantage.

To buttress the other amendments, section GC 22(4)(b) has been amended to apply when there is an account advantage, regardless of whether there is also a tax credit advantage.

Clarification that all payments of income tax create imputation credits

A subsidiary issue that arose when these transactions were reviewed by Inland Revenue is that the previous legislation may not have allowed all payments of income tax to create imputation credits. In particular, according to the previous provisional tax rules, tax payments made by companies that were not provisional taxpayers were not considered payments of provisional tax. Therefore no equivalent imputation credit could arise.

The companies most likely affected would be those that have no tax liability because of accumulated losses, but impute dividends to shareholders. The voluntary prepayments of tax were made with the expectation that this would square up the imputation credit account after attaching imputation credits to dividends. In other words, the prepaid tax amount was intended to pay for the tax benefit the shareholders received.

It appeared, however, that this was not the case and that voluntary payments of tax did not create imputation credits, which was contrary to the original policy intent.

Section MB 6, relating to voluntary payments of provisional tax, has been amended to include voluntary payments of tax that exceed a taxpayer's income tax liability for the year. This has the effect of ensuring that all voluntary payments of income tax can create imputation credits. The amendment is retrospective in application to 1 April 1995, to ensure that no imputation credits can be disallowed which would have been contrary to the original policy intent.

2 As there is prepaid tax and no imputation credits in the imputation credit account, this would indicate that tax prepayment was made to square up an imputation credit account. The square-up would have been necessary because imputation credits had been attached to dividends and yet no underlying tax had previously been paid.