GST on goods and services supplied to security holders

2006 changes to the GST Act to clarify the application of GST to supplies of financial services following CIR v Gulf Harbour Developments Ltd (Court of Appeal).

Sections 2, 3, 5, 9, 10 and 14 of the Goods and Services Tax Act

Changes have been made to the Goods and Services Tax Act to clarify the application of GST to supplies of financial services following the Court of Appeal decision Commissioner of Inland Revenue v Gulf Harbour Developments Ltd. 1

Background

Since its enactment in 1985, the Goods and Services Tax Act has contained a number of measures that address the substitution of otherwise taxable goods and services for GST-exempt financial services. Examples of these measures include the exclusions that remove from the definition of "financial services" transactions involving real property and shares in the capital of flat- or officeowning companies. These measures are designed to prevent consumer preferences from being distorted as a result of otherwise taxable goods and services being repackaged as exempt financial services.

Concerns that similar repackaging could occur for nonland transactions were raised by the government in the discussion document, GST and financial services, in the context of participatory securities. However, as the recent Court of Appeal decision, Commissioner of Inland Revenue v Gulf Harbour Development Limited has highlighted, the problem of substitution using the definition of "financial services" also applies to equity securities.

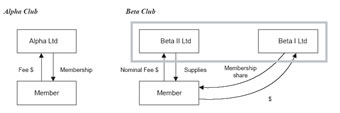

For the most part, determining the GST treatment of a transaction according to its form produces the most efficient tax outcome. This outcome, however, needs to be balanced against the effect that substitution, which gives rise to tax advantages, can have on consumer behaviour. If, in the absence of suitable anti-avoidance measures, a product can be offered without GST, consumers will have an obvious preference for this product over an identical product that is subject to GST. An example of a substitution arrangement is illustrated in figure 1.

The recent changes to the GST rules are therefore antiavoidance measures. The amendments are directed at arrangements involving supplies of goods and services to final consumers with either or both the following features:

- The supplies would be taxable supplies but for the terms of an equity security or participatory security under which the supplies are made.

- The supplies are for a consideration other than market value, as a consequence of the terms of the equity security or participatory security.

The relevant clauses in the bill initially applied to debt securities as well as equity securities and participatory securities. The inclusion of debt securities in the amendments was in response to concerns regarding the general substitutability between equity and debt. 2 References to debt securities were subsequently removed at the recommendation of the Finance and Expenditure Committee in response to concerns that their inclusion could require GST to be paid on refundable deposits paid to secure licences to occupy at retirement complexes.

Key features

The key changes to the GST Act are:

- A new term, "associated supply", is inserted into section 2. An "associated supply" includes:

- supplies of goods and services for which the supplier and the recipient are associated persons; and/or

- the supply of a right, under an equity security or participatory security, to a supply of goods and services, other than exempt goods and services, which may be for a consideration that is other than at open market value.

- The meaning of the term "supply" has been amended by inserting new section 5(14B). Section 5(14B) will apply if part of a supply of an equity or participatory security involves an "associated supply". The section treats the "associated supply" as separate from the equity security or participatory security. Section 5(14B) applies to securities that are supplied on and after the date of enactment.

| Figure 1: Substitution arrangement | ||||

| Alpha Club provides health-club facilities, including gymnasium and aerobic facilities. Membership to Alpha Club costs $1,350 each year including GST. Alpha Club requires $1,200 (net of GST) from each member each year to operate. Beta Club, Alpha Club's competitor, offers comparable facilities and also requires $1,200 (net of GST) each year from each member to operate. | ||||

| ||||

| Instead of annual membership subscriptions, Beta Club's members are offered shares in Beta Club's holding company Beta I Ltd for $11,600.see note The shares are redeemable for $1 in 10 years and permit access to the Beta Club's facilities which are held by Beta II Ltd. Beta I Ltd treats the supply of the membership share as a GST-exempt supply of financial services. Beta II Ltd charges shareholder members an annual fee of $45 (including GST) to cover maintenance costs. The GST consequences arising from the different pricing structures between the competing facilities are as follows: | ||||

| Alpha Club | Beta Club | |||

| Taxable supplies | $1,350 | Exempt supplies | $1,160 | (allocated each year) |

| GST collected | ($150) | Taxable supplies | $45 | |

| Net amount | $1,200 | GST collected | ($5) | |

| Net amount | $1,200 | |||

| GST savings | $145 each year | |||

| Note: The value of the share is determined by subtracting the nominal annual charge ($40 excluding GST) from the amount required each year from the members ($1,200). Therefore $1,200 - $40 = $1,160. $1,160 x 10 years = $11,600. | ||||

- The application of section 14(1)(a), which exempts the supply of financial services, has been modified. Former sections 14(1)(a)(i) and (ii) have been moved to section 14(1B)(a) and (c) respectively. Section 14(1B) also includes a new paragraph (b) (which will apply to financial services supplied on and after the date of enactment) that excludes from the financial services exemption supplies that come within paragraph (b) of the definition of "associated supply" – that is, the supply of rights to goods and services under an equity or participatory security.

Other changes include:

- Consequential amendments have been made to sections 9(2)(a) and 10(3) to incorporate the new definition of "associated supply". Section 10(3) requires associated supplies to be made at "open market value". Section 9(2)(a) determines the time of supply for "associated supply" transactions as being the earlier of when:

- an invoice is issued;

- payment is made in respect of the supply;

- the goods are removed by the recipient or made available to the recipient;

- the services are performed.

- Section 3(3)(b) has been repealed. The section previously removed from the definition of "financial services" debt, equity and participatory securities to the extent that they include an interest in land. The section has been removed as the exclusion for these securities will be covered by the definition of "associated supply", section 5(14B) and section 14(1B)(b). The repeal of this section applies to securities that are supplied on and after the date of enactment.

Application date

The changes will apply from the date of enactment, 3 April 2006.

Detailed analysis

General application

Paragraph (b) of the definition of "associated supply" and section 10(3) will require the supply of a right under an equity or participatory security to be valued at market if it allows the security holder or another person to receive, for no consideration or a consideration less than the open market value, a supply of goods and services.

These provisions, in combination with sections 5(14B) and 14(1B), attempt to remove any GST advantages that may arise as a result of:

- substituting the supply of otherwise taxable goods and services for a supply of GST-exempt financial services; or

- substituting the consideration that would otherwise be payable for a supply of taxable goods and services for the consideration payable for the supply of GST-exempt financial services.

The GST advantages are removed as the supplier of the equity or participatory security will be required to attribute the consideration received for a GST-exempt security to the supply of the goods and services to the extent of the open market value of those goods and services.

| Example 1: Marina berth Travis pays $59,000 for a GST-exempt participatory security offered by a company, Construction Ltd, which is constructing a new marina. Once the marina is completed, the security entitles Travis to berth a yacht at the facility. Travis is not required to make any further payments for using the marina facilities. Under the new rules the supplier of the marina will have to attribute to the marina berth, to the extent of its open market value, some or all of the $59,000 received for the GST-exempt security. |

Limits to the term "associated supply"

There are two exclusions from paragraph (b) of the definition of "associated supply". The exclusions apply if the equity security or participatory security:

- gives a right to exempt supplies of goods and services, such as dividends, bonus share issues or residential accommodation; or

- provides rights in relation to the control of the issuer, such as voting rights.

These exclusions attempt to remove rights that would be exempt from GST or that are inherently associated with equity investment from the definition of "associated supply". The limitations also ensure that the definition of "associated supply" is solely directed at situations where the ownership of an otherwise taxable supply of goods and services is, in substance, transferred without participation in the investment vehicle's capital or assets (or where such participation is merely ancillary).

| Example 2: Company shareholder Maude purchases shares in a company for $20,000. The shares entitle Maude to dividends and supplies of goods and services. Under the new rules the company will have to recognise a liability for GST on the market value of the goods and services supplied to Maude if those goods and services are supplied under the rights given by the shares. Any dividends that are paid to Maude from holding the shares will continue to be treated as GST-exempt. |

| Example 3: Unit trust Regan purchases units in a unit trust. The purpose of the units is to participate in a number of property development projects. The units entitle Regan to a share of income produced by the development projects. The units also give a beneficial interest in the underlying assets and, if the unit trust is liquidated or wound up, Regan is entitled to receive a share of the physical assets. Although the units give Regan beneficial rights to receive a share of the physical assets, the purpose of the units is to allow participation in any earnings produced by the property development projects. An "associated supply" is not considered to be created at the time the units are supplied because the intent of the units is not directed at transferring any project assets for Regan's use. An "associated supply" may be created at a later date if any assets belonging to the property development projects are subsequently transferred to Regan. |

Market value

The objective of the amendments is to ensure that GST applies to supplies of taxable goods and services that arise as a result of a final consumer holding an equity or participatory security. Although the amendments apply to "associated supplies" to both consumer and business security holders, the valuation rules in sections 10(3) and 10(3A) mean that the requirement to value at open market value any goods and services treated as separately supplied under section 5(14B) generally arises only in respect of final consumers.

The open market value rules also do not apply if the consideration for the "associated supply" equals or is greater than the open market value of the supply. Section 4, which defines "open market value", uses a "willing buyer/willing seller" test to determine the open market value of a supply. Inland Revenue has made a number of observations about the terms used in the definition of "open market value". 3 The terms "similar circumstances" and "freely offered" in section 4 are particularly relevant for the treatment of goods and services that are supplied to the security holder for a discount.

If an "associated supply" arises as a result of a discount because a security holder holds a security in the GSTregistered person supplying the relevant goods and services, whether the discounted price may be treated as the open market value will depend on the circumstances under which the discount is offered. The discounted price could equate to open market value if, for example, it was comparable to a discount offered to the general public.

| Example 4: Company shareholder Cally pays $11,000 for a parcel (5,000) of shares in Global Retail Ltd. The shares allow shareholders to vote at shareholder meetings and receive dividends. Shareholders of Global Retail Ltd are also entitled to acquire goods and services from Global Retail's subsidiary company Local Retail Ltd for a discounted amount. The discount is 5% and is equivalent to discounts offered under Local Retail's frequent shopper programme once the shopper has spent more than $500 in three months. The membership security is GST-exempt when supplied. However, if Cally purchases goods from Local Retail Ltd for a discount, consideration should be given at the time of supply as to whether GST should be returned on the full purchase price of the goods rather that the discounted price. As the discount offered by Local Retail Ltd is comparable to the discount it offers its customers under its frequent shopper programme, Local Retail is not required to return GST on the full price. |

1 (2004) 21 NZTC 18,915

2 See Riverside Country Club v The Queen 2001 CanLII 778 TCC.

3 See Tax Information Bulletin Vol. 6, No. 14 (June 1995).