Taxation of share-lending transactions

2006 amendments give greater consistency to the treatment of share-lending transactions with that of other commercial transactions such as finance leases.

Sections CD 9, CD 10B, CD 10C, CD 43, CH 1, CX 44B, DB 12B, DB 12C, DB 40, EA 1, ED 1, ED 2, EW 5, EW 52B, GC 14F, GC 14S, GD 1, LB 2, LD 3, LD 8, LD 9, ME 4, ME 5, ME 6B, ME 11, ME 12, MG 4, MG 5, MG 14, MG 15, NF 1, NF 2, NF 2A, NF 2B, NF 2D, NF 3, NF 4, NF 8B, OD 8, Schedule 14 and a number of definitions in section OB 1 of the Income Tax Act 2004 and sections 30B and 30C of the Tax Administration Act 1994

The tax treatment of share-lending transactions has been clarified and reformed by:

- introducing specific share-lending rules to allow the taxation of "qualifying" share-lending transactions on the basis of economic substance; and

- strengthening the tax rules to ensure that nonqualifying share-lending transactions do not give rise to an unintended fiscal cost.

These changes give greater consistency to the tax treatment of share-lending transactions with the treatment of other commercial transactions such as finance leases and hire-purchase agreements. The amendments also give taxpayers more certainty about how these transactions are taxed. Finally, the changes protect the tax base by preventing taxpayers from using sharelending transactions to effectively transfer the receipt of imputation credits to gain a tax advantage.

Background

Share-lending involves the lending of shares to another party for a fee and allows brokers to transact in securities in which they have a shortfall. Share-lending also provides a relatively risk-free way for larger holders of shares, such as banks, insurance companies and funds managers, to increase their overall portfolio returns. Internationally, share-lending represents a substantial part of the daily settlement value in many transaction systems and can play an important role in facilitating market liquidity.

Historically, New Zealand has not had an onshore share-lending market, at least in part because of the tax treatment of these transactions. New Zealand, unlike many other jurisdictions, did not have special tax rules for share-lending. For New Zealand tax purposes, these transactions were taxed on the basis of legal form (a sale of shares) rather than economic substance (a loan), meaning that entering into a share-lending transaction was a taxable event.

The previous New Zealand tax treatment of share-lending transactions was out of line with international trends. It was inconsistent with the treatment of other commercial transactions and the economic and accounting treatment of share-lending transactions. There were also base maintenance concerns, with evidence that share-lending transactions were being used to effectively transfer the receipt of imputation credits and take advantage of the absence of specific tax rules in this area in New Zealand.

The changes to the tax treatment of share-lending were set out in the government discussion document, Taxing securities lending transactions: substance over form, released in November 2004.

Key features

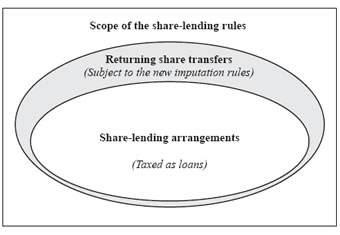

The amendments to the Income Tax Act 2004 introduce share-lending rules to tax "qualifying" share-lending transactions on the basis of economic substance rather than legal form. They also strengthen the imputation rules to ensure that non-qualifying share-lending transactions do not give rise to a fiscal cost.

The new rules revolve around the definition of a returning share transfer.

A returning share transfer is an arrangement:

- when a share (the original share) is transferred from a share supplier to a share user;

- when the original share is listed on an official list of a recognised exchange;

- where it is conditionally or unconditionally agreed that the share user (or associate) will pay a replacement payment to the share supplier (or associate) if a dividend is payable on the original share; and

- where it is conditionally or unconditionally agreed that the original share or an identical share may be transferred from the share user to the share supplier (or associate); and

- that is not a warrant or instalment receipt.

Returning share transfers which meet a number of criteria (known as share-lending arrangements) will be taxed on the basis of their economic substance rather than legal form. This means that they will not be treated as a taxable disposal.

A "share-lending arrangement" is defined as a returning share transfer entered into on or after 1 July 2006 where:

- the agreed term of the transaction is one year or less;

- the terms are ordinary commercial conditions which are consistent with those that would apply between parties negotiating at arm's-length;

- the amount of resident withholding tax required under section NF 2(1)(g), if any, is paid;

- the share user disposes of an original share or an identical share to the share supplier during the agreed term of the arrangement, or within a further period allowed by the Commissioner; and

- the share user issues a credit transfer notice in relation to the dividend paid on the original share or establishes and maintains an imputation credit account (ICA) if a dividend is payable on the original share.

An identical share is a share that confers the same rights and imposes the same obligations on the holder as the original share.

A share supplier is a person described as such in the definition of a returning share transfer, from whom the share user acquires an original share under a returning share transfer.

A share user is a person described as such in the definition of a returning share transfer, who acquires an original share under a returning share transfer.

For the purposes of the share-lending rules, the definition of "associated person" is contained in section OD 8(3).

Treatment of returning share transfers which are not share-lending arrangements

The second key part of the share-lending rules is the introduction of new imputation rules. The share-lending rules are designed to ensure that imputation credits remain with the economic owner of the shares. However, because the rules only apply to qualifying transactions, taxpayers could structure transactions outside the qualification criteria in order to gain a tax advantage. Therefore amendments to the imputation rules have been made to bolster the share-lending rules.

The rules governing the treatment of returning share transfers are designed to complement existing antiavoidance provisions. They apply when a share user (or associate) receives imputation credits attached to a dividend as part of a returning share transfer that is not a tax benefit obtained will be cancelled by a debit to the ICA account of the share user. The share user is not allowed a credit of tax for the imputation credit. In addition, a transfer of shares under a returning share transfer which is not a share-lending arrangement will still be treated as a disposal for tax purposes.

Application date

The share-lending amendments apply from 1 July 2006.

Detailed analysis

A number of changes have been made to the Income Tax Act 2004.

Structure of the new rules

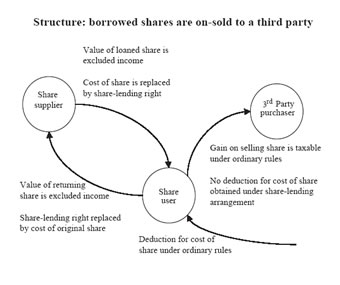

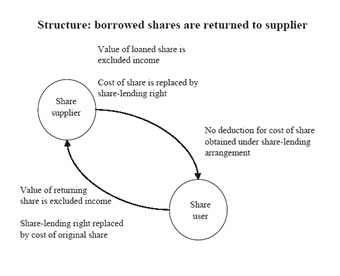

One of the aims of the share-lending rules is to tax these transactions like loans. To achieve this, a number of existing provisions have been "switched off" as illustrated in the following diagrams.

Under new section CX 44B, any share-lending collateral derived by a person under a share-lending arrangement will be excluded income. This covers any consideration received by the share supplier on lending the shares or by the share user on returning the original or an identical share.

Share-lending collateral is defined as an amount (or an adjustment to an amount) that is related to the market value of the original share under a share-lending arrangement and is paid to a person by a share user (or associate) to secure the transfer of the original share or by a share supplier (or associate) for the re-transfer of the original or an identical share. It does not include any amount of replacement payment. What is market value should be determined using normal commercial practice.

| Example 1 The Kiwi Unit Trust (KiwiTrust) holds a number of Greenstone Limited shares in its portfolio. These were purchased at a cost of $2 per share and are listed on the New Zealand stock exchange. On 1 July 2006, KiwiTrust lends 1,000 Greenstone Limited shares to NZ Broker Limited on normal commercial terms. NZ Broker Limited agrees to pay a cash lending fee and a compensation payment (or replacement payment) to KiwiTrust if any dividend is payable on Greenstone Limited shares over the term of the lending arrangement. As part of agreeing to make the compensation payment, NZ Broker Limited agrees to either transfer imputation credits or pay any resident withholding tax required. Legal title in the Greenstone Limited shares is transferred to NZ Broker Limited and it is agreed that identical Greenstone Limited shares will be transferred back to KiwiTrust in 30 days' time. KiwiTrust maintains an imputation credit account. The above transaction meets the definition of a returning share transfer and a share-lending arrangement. At the time of entering into the lending agreement, the market price for Greenstone Limited shares was $5 and NZ Broker Limited transferred $5,000 to KiwiTrust as collateral for borrowing the shares. The $5,000 payment meets the definition of sharelending collateral as it is based on the market value of the shares lent and was paid by NZ Broker Limited to secure the transfer of the Greenstone Limited shares under the lending arrangement. Under section CX 44B, the $5,000 received from NZ Broker Limited will be excluded income for KiwiTrust. |

| Example 2 KiwiTrust lends a further 1,000 Greenstone Limited shares to NZ Broker Limited. At the time of entering into the lending agreement, the market price for Greenstone Limited shares was $5 and the broker transfers Weka Company Limited shares with an equivalent value to KiwiTrust as collateral for borrowing the Greenstone Limited shares. The Weka Company Limited shares meet the definition of share-lending collateral. Under section CX 44B, the value of the Weka Company Limited shares received from NZ Broker Limited will be excluded income for KiwiTrust. |

If no collateral is paid for borrowing a share, then there will be no amount treated as income on the lending or returning of shares under a share-lending arrangement. This is because a share-lending arrangement is an excepted financial arrangement (refer to section EW 5(11B)). The lowest price clause which would otherwise apply to tax the market value of the borrowed share does not apply to shares under a share-lending arrangement. The same is true for sections GD 1 (Sale or other disposition of trading stock for inadequate consideration) and ED 2 (Transfers of certain excepted financial arrangements within wholly-owned groups), which can operate to tax a deemed market value and which do not apply to share-lending arrangements.

A question arises as to the impact of share-lending on the general tax status of an investor's shareholding. Under the disposal and dealing in property sections (sections CB 3 and 4), an amount is income if the property was acquired for the purpose of disposal. If property is acquired for more than one purpose, income will only be taxable if the purpose of resale was the dominant purpose, as determined at the time of acquisition. For these sections, each item of personal property must be looked at separately (each individual share transaction) and not on a global basis. Therefore, the fact that certain shares have been lent should not impact on the taxable status of other shares in the same portfolio. Determining whether a person is carrying on a business of share-trading is a more difficult analysis and will depend on the facts of the particular situation. This could include other transactions within the person's share portfolio.

Treatment of borrowed shares

As a share-lending transaction is legally a disposal of shares, tax adjustments would normally result through the operation of the revenue account property rules. A number of adjustments have therefore been made to these rules to treat a share-lending transaction as a loan.

Lending the shares

Section CH 1 has been amended to ensure that entering into a share-lending arrangement does not result in a tax adjustment from a change in the value of excepted financial arrangements "on hand". When a share supplier enters into a share-lending arrangement the lending of the shares (a disposal) would normally result in a reduction in the closing value of excepted financial arrangements and a net tax deduction for the cost of the shares.

This has been countered by allowing the share supplier to include in the closing value of excepted financial arrangements the value of a share-lending right.

A share-lending right is defined to mean a conditional or unconditional right to acquire an original share or an identical share under a share-lending arrangement. Section ED 1 provides that a share-lending right is valued at the cost of the original share. This ensures that there is no movement in the value of revenue account property.

Section DB 40 has been similarly amended to include the value of a share-lending right in the opening value of excepted financial arrangements and section EA 1 has been amended to include a share-lending right in the transactions covered by the revenue account property matching rules.

| Example 3 KiwiTrust enters into a share-lending arrangement on 15 March 2007 to lend 5,000 NZ Fern Limited shares to NZ Broker Limited for one month. The shares cost $2.00 each and have a current market price of $4.00 per share. KiwiTrust has a 31 March balance date. Because the lending transaction is a legal disposal, the value of the NZ Fern Limited shares ($10,000) will no longer be included in the closing value of excepted financial arrangements at 31 March 2007. However, as KiwiTrust has a right to acquire NZ Fern Limited shares, KiwiTrust will include the closing value of a share-lending right in income. Section ED 1 provides that the share-lending right is valued at the cost of the original shares ($10,000). This ensures that there is no movement in the closing value of excepted financial arrangements which would otherwise result in a tax adjustment. The share-lending right is also included in the opening value of excepted financial arrangements for the 2007-08 income year, with KiwiTrust able to take a deduction for the value of the share-lending right at 31 March 2007, being $10,000. |

Borrowing the shares

The share user is not allowed a tax deduction for the cost of acquiring the borrowed share as new section DB 12B prohibits a tax deduction for any amount of collateral paid in exchange for the share. This is consistent with the fact that the share user will not be taxed when they return the shares. New section DB 12B overrides the general permission for a tax deduction and sections DB 17 to DB 19.

| Example 4 As part of entering the share-lending arrangement with KiwiTrust, NZ Broker Limited transfers $20,000 cash to KiwiTrust as collateral for borrowing the shares. No tax deduction is permitted for this amount as section DB 12B prohibits a tax deduction for any amount of collateral paid in exchange for the borrowed shares. This overrides any tax deduction that would generally be permitted. This would also be the position if no collateral was provided. The borrowed shares have no cost so no tax deduction would be available. This is because the transaction is an excepted financial arrangement. The lowest price clause which would otherwise apply a market value to the shares does not apply. Similarly, no deemed purchase price arises under sections GD 1 or ED 2, as these do not apply to share-lending arrangements. |

| Example 5 Instead of transferring cash to KiwiTrust, NZ Broker Limited transfers $20,000 of Weka Company Limited shares to KiwiTrust as collateral for borrowing the shares. No tax deduction is permitted for this amount as section DB 12B prohibits a tax deduction for any amount of collateral paid in exchange for the borrowed shares. |

Returning the shares

If the share user purchases an identical share to return to the share supplier, a tax deduction will be available under the ordinary provisions.

| Example 6 On 15 April 2007, NZ Broker Limited purchases NZ Fern Limited shares on the share market at $3.80 per share to return to KiwiTrust. As the shares will produce excluded income when they are returned, they will qualify as revenue account property. Therefore, a tax deduction should be available under section DB 17 for the cost of the shares ($19,000 in total). |

Reacquiring the shares

The share-lending right disappears once a share supplier has received either the original share or an identical share. No tax deduction is allowed for any amount of collateral paid in exchange for the returning share (new section DB 12B). However, as excepted financial arrangements, the original share or identical share will be automatically included in the opening and closing value of revenue account property. Under section ED 1 they will be valued at the cost of the original share immediately before the share supplier entered the share-lending arrangement. This ensures that there is no movement in the value of revenue account property.

| Example 7 On 15 April 2007, KiwiTrust receives 5,000 NZ Fern Limited shares back from NZ Broker Limited. The current market price for the shares is $3.80. KiwiTrust returns the collateral of $20,000 less the agreed lending fee. As KiwiTrust no longer has a right to receive NZ Fern Limited shares, the share-lending right ceases to exist. KiwiTrust is not allowed a tax deduction for the net amount of collateral returned to NZ Broker Limited (section DB 12B). The NZ Fern Limited shares will be included in the closing value of excepted financial arrangements. Under section ED 1 they will be valued at the cost of the original share immediately before the share supplier entered the share-lending arrangement ($10,000). This ensures that there is no movement in the value of revenue account property. The lending fee will be income under ordinary rules for KiwiTrust. |

New section EW 52B has been inserted to ensure that any movement in the value of shares over the term of a share-lending arrangement is not "picked up" under the financial arrangement rules.

It should also be noted that the values used for revenue account property for tax purposes may differ from those adopted for accounting purposes.

Treatment of distributions

Income and deductions

If a distribution is paid on the original share during the term of the share-lending arrangement, the share supplier must receive a "replacement payment" from the share user. The aim of the replacement payment is to place the share supplier in the same position (as far as possible) as if they had received the actual distribution. The entity which issued the shares and any third-party purchaser of the shares should not be affected by the tax treatment of the share-lending arrangement.

A replacement payment is a payment economically equivalent to a dividend or part of a dividend for an original share. It is increased by the value of any imputation credits attached to the dividend. The new share-lending rules do not specify the level of cash payment to be made as a replacement payment. However, if a share user chooses to make a $100 cash replacement payment in respect of a $100 underlying dividend (rather than $67 plus the $33 of imputation credits) the level of resident withholding tax that may be payable will reflect the higher cash payment.

Under new section CD 43 the amount of any replacement payment derived is income of the recipient. A person who pays a replacement payment is allowed a tax deduction under new section DB 12C for the amount of expenditure incurred as a replacement payment under a share-lending arrangement. The deduction includes the amount of any imputation credits attached to the replacement payment under new sections ME 6B or NF 8B.

Share users who pay a replacement payment are required to provide a statement to share suppliers similar to a dividend statement. The requirements for the statement are set out in new section 30B of the Tax Administration Act 1994.

| Example 8 During the term of the share-lending agreement entered into by KiwiTrust, a dividend of 10 cents per share is paid on the NZ Fern Limited shares. The dividend is fully imputed. NZ Broker Limited makes a compensation payment of $500 to KiwiTrust. Imputation credits of $246.27 are deemed to be attached as a result of resident withholding tax paid by NZ Broker Limited (as they do not attach the underlying imputation credits). The total value of the replacement payment is $746.27. Under section CD 43, this is income to KiwiTrust who is able to use the imputation credits in the normal way. NZ Broker Limited is allowed a tax deduction for the total cost of the replacement payment ($746.27). NZ Broker Limited must also provide KiwiTrust with a statement setting out details of the replacement payment including imputation credits under section NF 8B. |

The definition of "pay" for a replacement payment (and share-lending collateral) has been amended to include distribution, crediting or dealing with on the recipient's behalf. The definition of payment has been similarly amended. Therefore, when payments are netted together - for example, through being credited against another amount - the share-lending rules will apply to the gross payments.

Imputation credits

The share-lending rules aim to keep any imputation credits with the economic owner of the share, being the share supplier. This is achieved by transferring imputation credits to the share supplier and denying the share user a credit of tax under section LB 2.

A share user is required to maintain an ICA in order to attach imputation credits to replacement payments where a dividend is paid on the original share over the term of the lending transaction. This is unless they issue a credit transfer notice.

The share user can fund replacement payment imputation credits either out of imputation credits received on the underlying dividend (new section ME 6B), or when they have not received sufficient imputation credits, by paying resident withholding tax (new section NF 8B).

Imputation credits can also be transferred using the voluntary tax credit transfer system (without the need to maintain an ICA). This is based on the Australian system whereby relevant imputation credits are derived by the share supplier if the share user and share supplier notify Inland Revenue of the share-lending arrangement.

A credit transfer notice is a notice issued under section 30C of the Tax Administration Act 1994. New section 30C allows a share user to issue a credit transfer notice under a share-lending arrangement when a dividend is paid on an original share. Such a notice can be issued by the share user only when they have received the underlying dividend.

A credit transfer notice must:

- be in a form approved by the Commissioner;

- show the amount of imputation credits attached to the dividend;

- state that the imputation credit is to be transferred to the share supplier;

- attach a copy of the shareholder dividend statement for the dividend; and

- be given to the share supplier and the Commissioner when the dividend is paid or as soon as possible thereafter.

Any imputation credit transferred under a credit transfer notice is excluded from the taxable income of a share user (new section CD 10B). Instead, the amount of the imputation credit is income of the share supplier. This overrides the general rule in section CD 9 (Tax credits linked to dividends). A taxpayer who is issued with a credit transfer notice is also entitled to a credit of tax equal to the amount of the imputation credit shown in the notice.

| Example 9 KiwiTrust lends Koru Corporation shares to a resident share user (borrower). During the period of the lending arrangement, a $100 fully imputed dividend is paid on the shares. At the time of payment, the shares are still held by the share user. The share user makes a cash replacement payment of $100 to KiwiTrust and elects to transfer the $49.25 of imputation credits using a credit transfer notice. The imputation credits are excluded from the share user's taxable income (section CD 10B). Instead, the $49.25 of imputation credits is income of KiwiTrust. KiwiTrust is also entitled to a credit of tax equal to the amount of the imputation credit shown in the notice. |

| Example 10 KiwiTrust lends Koru Corporation shares to a nonresident share user (borrower). During the period of the lending arrangement, a $100 fully imputed dividend is paid on the shares. At the time of payment, the shares are still held by the share user. The share user receives an ordinary dividend of $100, supplementary dividend of $17.64 and imputation credits of $31.61. The share user makes a cash replacement payment of $117.64 to KiwiTrust and elects to transfer the $31.61 of imputation credits using a credit transfer notice. The $31.61 of imputation credits is income of the KiwiTrust. KiwiTrust is also entitled to a credit of tax equal to the amount of the imputation credit shown in the notice. |

Imputation credit account

A number of amendments have been made to the imputation rules to reflect the fact that the share-lending rules keep any tax credits with the economic owner of the share, being the share supplier.

Imputation credits received by a share supplier on a replacement payment are subject to the same treatment as normal imputation credits. An amendment has therefore been made to section ME 4 to allow imputation credits attached to a replacement payment (either from being passed on under new section ME 6B or from the share user paying resident withholding tax under new section NF 8B) to be entered into a share supplier's ICA. A credit will also arise if a person has been issued with a credit transfer notice transferring imputation credits.

For imputation credits arising under new sections ME 6B or NF 8B, the credit arises on the date that the replacement payment is paid. For credits transferred using a credit transfer notice, the credit arises on the date that the credit transfer notice is issued.

There are also new debit imputation entries. Under section ME 5, a debit must now be recorded in a share user's ICA if they have attached imputation credits to a replacement payment under new section ME 6B, transferred imputation credits using a credit transfer notice or received imputation credits on shares borrowed under a returning share transfer that is not a share-lending arrangement.

Debits arising from to a credit transfer notice or as a result of the returning share transfer anti-avoidance rules (discussed below), arise on the date that the relevant dividend is paid. Debits arising under new section ME 6B, arise on the date that the replacement payment is paid.

The changes for individual ICAs are replicated in the consolidated ICA rules.

| Example 11 KiwiTrust lends 1,000 Black Limited shares to NZ Broker Limited. A $100 fully imputed dividend is paid on the shares, held at that time by NZ Broker Limited. NZ Broker Limited makes a cash contribution payment of $100 to KiwiTrust and attaches $49.25 of imputation credits to the replacement payment under section ME 6B. It records a credit in its ICA for $49.25, being the imputation credits attached to the dividend received. A corresponding debit for $49.25 will be recorded, on the date that the replacement payment is paid, for the imputation credits attached to the replacement payment. NZ Broker Limited does not receive a credit of tax for the imputation credits as they are a share user under a returning share transfer (section LB 2(1B)). Instead, NZ Broker Limited claims a tax deduction for the replacement payment, including the imputation credits (section DB 12C). KiwiTrust will record a credit in its ICA on the day that the replacement payment is paid for $49.25, being the imputation credits attached to the replacement payment. The replacement payment, including the imputation credits, is income to KiwiTrust under section CD 43. Under section LB 2, as the imputation credit is included in KiwiTrust's assessable income, a credit of tax is allowed for imputation credits attached to the replacement payment. |

| Example 12 KiwiTrust also lends 1,000 Rimu Corporation shares to NZ Broker Limited. During the period of the lending arrangement, a $100 fully imputed dividend is paid on the shares. At the time of payment, the shares are no longer held by NZ Broker Limited as they have been sold to a third party. NZ Broker Limited makes a cash contribution payment of $100 to KiwiTrust. As NZ Broker Limited did not receive the underlying dividend, it cannot transfer imputation credits under section ME 6B or use a credit transfer notice. Instead, NZ Broker Limited is required to pay resident withholding tax of $49.25 as calculated under section NF 2(1). This resident withholding tax converts to imputation credits of $49.25 under section NF 8B. NZ Broker Limited claims a tax deduction for the replacement payment, including the imputation credits (section DB 12C). KiwiTrust will record a credit in its ICA for $49.25 on the day that the replacement payment is paid, being the imputation credits attached to the replacement payment under section NF 8B. The replacement payment, including the imputation credits, is income to KiwiTrust under section CD 43. Under section LB 2(1), as the imputation credit is included in KiwiTrust's assessable income, a credit of tax is allowed for the $49.25 of imputation credits attached to the replacement payment. No credit of tax is available for the resident withholding tax as section LD 3 does not apply to replacement payments. |

Dividend withholding payment credits

To a lesser extent, the share-lending rules also provide for the transfer of dividend withholding payment (DWP) credits to a share supplier under a share-lending arrangement.

Under the share-lending rules, DWP credits are only able to be transferred using a credit transfer notice. This operates in the same way as for imputation credits, with the requirements set out in new section 30C of the Tax Administration Act 1994. For the purposes of the credit transfer notice, a DWP credit is an imputation credit.

The amount of any DWP credit shown in a credit transfer notice issued to a share supplier is a credit under section MG 4 to the share supplier's DWP account. The credit arises on the date that the credit transfer notice is issued.

Under section MG 5, the amount of any DWP credit shown in a credit transfer notice issued by a share user is a debit to the share user's DWP account. The debit arises on the date that the related dividend is paid.

Any DWP credit transferred under a credit transfer notice is excluded from the taxable income of a share user (new section CD 10B). Instead, the amount of the DWP credit is income of the share supplier. Section LD 8 has been amended so that a taxpayer who receives a DWP credit transfer notice is entitled to a credit of tax rather than the taxpayer who issues the notice. Section LD 9 has also been amended to allow the Commissioner to refund DWP credits to the share supplier.

If a share user does not use a credit transfer notice, any DWP credits will convert to imputation credits in the hands of the share supplier. This occurs because a share user is required to pay resident withholding tax under new section NF 2(1)(g). The resident withholding tax liability is 33% of the replacement payment less any imputation credits attached to the payment or DWP credits transferred using a credit transfer notice. This means that for a dividend with DWP credits attached (which have not been transferred using a credit transfer notice), a share user will be required to pay resident withholding tax. Under new section NF 8B, this resident withholding tax is treated as an imputation credit attached to the replacement payment.

The above entries are replicated for DWP accounts of consolidated groups in section MG 14 for credits and section MG 15 for debits.

| Example 13 KiwiTrust lends 1,000 Tui Limited shares to NZ Broker Limited. During the period of the lending arrangement, a $100 dividend with $49.25 of DWP credits attached is paid to NZ Broker Limited. NZ Broker Limited makes a cash contribution payment of $100 to KiwiTrust and elects to transfer the $49.25 of DWP credits using a credit transfer notice. The DWP credits are excluded from NZ Broker Limited's taxable income (section CD 10B). Instead, the DWP credits are income of KiwiTrust. NZ Broker Limited records a credit in its DWP account for $49.25, being the DWP credits attached to the dividend received. A corresponding debit for $49.25 is also recorded, on the date that the dividend is paid, for the DWP credits transferred in the credit transfer notice. NZ Broker Limited does not receive a credit of tax for the $49.25 of DWP credits (section LD 8(1B)). NZ Broker Limited records dividend income of $100 and a deduction for the replacement payment of $100. KiwiTrust records a credit in its DWP account for $49.25, being the credits transferred in the credit transfer notice. This is recorded on the day that the credit transfer notice is issued. KiwiTrust is also entitled to a credit of tax equal to the amount of the DWP credits shown in the credit transfer notice (section LD 8(1C)). KiwiTrust records taxable income of $149.25 and a tax credit of $49.25. |

| Example 14 KiwiTrust also lends 1,000 Matai Limited shares to NZ Broker Limited. During the period of the lending arrangement, a $100 dividend with $49.25 of DWP credits attached is paid on the shares. At the time of payment, the shares are no longer held by NZ Broker Limited as they have been sold to a third party. NZ Broker Limited makes a cash contribution payment of $100 to KiwiTrust. As NZ Broker Limited did not receive the underlying dividend, it cannot transfer DWP credits using a credit transfer notice. Instead, NZ Broker Limited is required to pay resident withholding tax of $49.25 as calculated under section NF 2. This resident withholding tax converts to imputation credits of $49.25 under section NF 8B. NZ Broker Limited claims a tax deduction for the replacement payment of $149.25 (section DB 12C). KiwiTrust records a credit in its ICA for $49.25, being the imputation credits attached to the replacement payment under section NF 8B. This is recorded on the day that the replacement payment is paid. The replacement payment, including the imputation credits, is income of $149.25 to KiwiTrust under section CD 43. Under section LB 2, as the imputation credits are included in KiwiTrust's assessable income, a credit of tax is allowed for the imputation credits attached to the replacement payment. No credit of tax is available for the resident withholding tax as section LD 3 does not apply to replacement payments. |

Share-lending withholding tax

The share-lending rules allow imputation and DWP credits to be transferred from a share user to a share supplier to put the share supplier in the same situation as if they had continued to hold the original share. However, a direct transfer is only possible where the share user receives the underlying dividend with the imputation or DWP credits attached. Where the shares have been on-sold to a third party it is not possible to transfer imputation or DWP credits. Therefore, the share-lending rules include a withholding tax obligation to fund imputation or DWP credits. This is set out in the definition of a share-lending arrangement, which requires a share user to pay the amount of tax required by new section NF 2(1)(g).

To reduce compliance and administration costs, the withholding tax obligation operates as part of the resident withholding tax (RWT) rules. The RWT rules have been amended to apply to replacement payments made under share-lending arrangements. Section NF 1 has been amended so that resident withholding income now includes a replacement payment. Section NF 4(4) has been amended so that people required to make RWT deductions in respect of replacement payments must pay all such deductions to the Commissioner on a monthly basis, no later than the 20th of the following month.

A new formula has been inserted into section NF 2 to calculate the amount of RWT payable on share-lending arrangements. The formula effectively requires RWT to be paid for any amount of replacement payment not fully imputed by credits from the underlying dividend (either through attachment to the replacement payment or credit transfer notice).

The amount of RWT payable is calculated as follows:

| a × b/(1 - a) - c - d - e | ||

| a | = | the rate of RWT specified in schedule 14, clause 2. |

| b | = | the amount of the replacement payment (net of imputation credits). |

| c | = | the amount of imputation credits attached to the replacement payment under section ME 6B. |

| d | = | the amount of imputation credits shown in any related credit transfer notice. |

| e | = | the amount of dividend withholding payment credits shown in any related credit transfer notice. |

The rate of RWT is 33%. This is set out in Schedule 14, clause 2 which now applies to replacement payments. Amendments have been made to sections NF 2A, NF 2B and NF 2D so that a person cannot use another rate of RWT.

Share-lending RWT is a final tax. It does not give rise to a credit of tax for the share supplier (amendment to section LD 3). Instead, it will give rise to an imputation credit attached to the replacement payment (new section NF 8B).

Finally, as a share user is required to pay any RWT in order for a share-lending transaction to be a qualifying arrangement, section NF 3(2) has been amended so that agents and trustees are not required to make RWT deductions on receipt of payments which are replacement payments under a share-lending arrangement.

| Example 15 KiwiTrust lends 1,000 Pipi Corporation shares to NZ Broker Limited. During the period of the lending arrangement, a $100 dividend with no imputation credits attached is paid to NZ Broker Limited. NZ Broker Limited makes a cash replacement payment of $67 to KiwiTrust. As NZ Broker Limited did not receive any imputation credits it is required to pay RWT of $33 as calculated under section NF 2: 0.33 × 67/(1 - 0.33) - 0 - 0 - 0 = $33 The RWT converts to imputation credits of $33 under section NF 8B. NZ Broker Limited returns the dividend received and claims a tax deduction for the replacement payment, including the $33 of imputation credits (section DB 12C). KiwiTrust records a credit in its ICA for $33, being the imputation credits attached to the replacement payment under section NF 8B. This is recorded on the day that the replacement payment is paid. The replacement payment, including the imputation credits, is income to KiwiTrust under section CD 43. Under section LB 2, a credit of tax is allowed for the imputation credit included in KiwiTrust's assessable income. No credit of tax is available for the RWT as section LD 3 does not apply to replacement payments. If a cash replacement payment of $100 was made, NZ Broker Limited would be required to pay RWT of $49.25. 0.33 × 100/(1 - 0.33) - 0 - 0 - 0 = $49.25 The RWT converts to imputation credits of $49.25 under section NF 8B. NZ Broker Limited would return the dividend received and claim a tax deduction for the replacement payment, including the $49.25 of imputation credits (section DB 12C). KiwiTrust records a credit in its ICA for $49.25, being the credits attached to the replacement payment under section NF 8B. This is recorded on the day that the replacement payment is paid. The replacement payment, including the imputation credits, would be income to KiwiTrust under section CD 43. Under section LB 2, a credit of tax would be allowed for the imputation credits included in KiwiTrust's assessable income. No credit of tax would be available for the RWT as section LD 3 does not apply to replacement payments. |

Impact of not qualifying

Ceasing to qualify

Taxpayers are required to determine whether a transaction qualifies as a share-lending arrangement at the start of the transaction.

If an arrangement fails to qualify at some point during its term (for example, because an identical share is no longer available) then it fails to qualify from the start of the transaction and the normal tax rules must be applied.

Taxpayers entering share-lending transactions are subject to the normal self-assessment rules. Therefore, if a taxpayer mistakenly treats a transaction as qualifying for the share-lending rules when they should not have done so, then they will need to restate the tax treatment of the transaction. Use-of-money interest and penalties could apply depending on the particular circumstances that gave rise to an incorrect treatment being adopted.

| Example 16 A share supplier enters into a lending agreement to lend Paua Limited ordinary shares. Over the period of the lending arrangement, Paua Limited merges with Kea Corporation. The share user (borrower) returns shares in the merged entity at the end of the lending arrangement. This would not qualify as a share-lending arrangement as the original or identical shares are not returned to the share supplier. Similarly, if Paua Limited preference shares or bonds were returned, the arrangement would not qualify as a share-lending arrangement. |

Returning securities transfers which are not sharelending arrangements

The share-lending rules are designed to ensure that imputation credits remain with the economic owner of the shares. For returning share transfers which are not share-lending arrangements, this is achieved through an additional imputation debit. Under section ME 5(1)(ac), a debit will arise for the amount of any imputation credit attached to a dividend that is paid to the person as a share user or associate in a returning share transfer that is not a share-lending arrangement.

| Example 17 Overseas Pension Fund lends some of its listed New Zealand shares to NZ Investment Limited in exchange for a cash payment. The term of the agreement is three years. NZ Investment Limited agrees to make compensation payments equivalent to 85% of any dividends paid on the underlying shares. Over the term of the arrangement fully imputed dividends are paid on the underlying shares. The arrangement is a returning share transfer but is not a share-lending arrangement as it has a term longer than one year. As NZ Investment Limited is the legal owner of the shares, it receives the dividends including the imputation credits. However, under section ME 5(1), a debit arises in NZ Investment Limited's ICA for the value of these imputation credits on the day that the dividend is paid. This is because NZ Investment Limited is a share user who has received imputation credits paid to NZ Investment as a share user in a returning share transfer that is not a share-lending arrangement. |

Because the above imputation debit only applies to transactions which meet the definition of a returning share transfer, taxpayers could structure transactions outside the qualification criteria. Therefore, a new specific anti-avoidance provision has been included as part of the rules. New section GC 14G applies where a person enters into an arrangement that has an effect of avoiding a requirement of the returning share transfer definition so as to defeat the intention and application of the Income Tax Act. Where this is the case, the Commissioner may treat the arrangement as a returning share transfer and a person affected by the arrangement as a share user or share supplier.