Changes to the qualifying company rules and introduction of look-through company rules

2010 changes to the qualifying company rules and introduction of look-through company rules.

Subparts HA and HB, and sections CB 32B, 32C, CX 63, DV 21 to DV 24, GB 25B, GB 29, HZ 4B to HZ 4D and YA 1 of the Income Tax Act 2007

Changes to the qualifying company rules and the introduction of look-through company rules were added to the Taxation (GST and Remedial Matters) Bill by Supplementary Order Paper No. 187. The changes are part of Government announcements made in Budget 2010 aimed at improving the integrity of the tax system by preventing people from claiming losses against their personal income.

Specifically, the changes:

- provide transparent income tax treatment for electing closely held companies, which will be known as look-through companies (LTCs);

- allow existing qualifying companies (QCs) and loss-attributing qualifying companies (LAQCs) to continue to use the current QC rules without the ability to attribute losses, pending a review of the dividend rules for closely held companies; and

- allow existing QCs and LAQCs to transition into the new LTC rules or change to another business vehicle such as a partnership, without a tax cost during the period 1 April 2011 to 31 March 2013.

Background

As part of tax integrity measures introduced in Budget 2010, the Government announced reforms to the tax rules for qualifying companies. Feedback on the proposals was sought in the officials' issues paper, Qualifying companies: implementation of flow-through tax treatment published the day after the Budget announcement.

Based on this feedback, new rules providing an elective look-through income tax treatment for closely held companies apply from 1 April 2011.

Under the look-through rules, the company's tax treatment is integrated with the tax treatment of the owners, on the basis that entities are agents for their owners. It ensures that shareholders who use a company's losses also pay tax on any company profit at their marginal tax rate. This removes the tax disincentive faced by the owners of closely held businesses who wish to operate through a company. They can attain the benefits of limited liability afforded by a familiar corporate form, as well as the ability to be taxed at the level of the owner.

In addition, in response to feedback from small businesses, the Government decided to allow existing QCs and LAQCs to continue to use the current qualifying company rules, but without the ability to attribute losses, while a review of the tax rules for dividends from closely held companies is carried out.

As a result of the changes to the qualifying company rules, a special set of transitional rules have been developed, to allow existing QCs and LAQCs to transition into the new LTC rules or change to another business vehicle such as a partnership or sole trader, without a tax cost.

An early draft of this legislation was made available for public comment on 15 October 2010, accompanied by an explanatory note. The final legislation is different from the earlier draft, reflecting feedback received during consultation. Some of these changes are fairly substantial while others are more technical in nature. The earlier draft legislation and explanatory note have therefore been superseded by the enacted rules and should not be relied upon.

Key features

Look-through company rules

The new LTC rules are available for income years starting on or after 1 April 2011. The rules apply only to companies which are resident in New Zealand.

The main features of the new LTC rules are:

- An LTC must have five or fewer owners (the ownership interests of relatives are combined).

- All owners must elect for the LTC rules to apply initially. LTC elections are to be made prospectively.

- Once a company becomes an LTC it will remain so unless one of the owners decides to revoke the LTC election, or the company ceases to be eligible.

- Only a natural person, trustee or another LTC may hold shares in an LTC. All the company's shares must be of the same class and provide the same rights and obligations to each shareholder.

- An LTC's income, expenses, tax credits, rebates, gains and losses are passed on to its owners. These items will generally be allocated to owners in proportion to the number of shares they have in the LTC. Owners are also able to deduct expenditure incurred by the LTC before they became a member, subject to the other deductibility tests in the Act.

- Any profit is taxed at the owner's marginal tax rate. The owner can use any losses against their other income, subject to the loss limitation rule.

- The loss limitation rule ensures that the losses claimed reflect the level of an owner's economic loss in the LTC. An anti-avoidance rule also prevents an artificially high basis around the year-end being used to increase any loss flow-through. Owners' excess losses are carried forward to future income years, subject to the application of the loss limitation rule in those years. There are certain rules about the use of these losses if the LTC ceases to be an LTC, or if the owner sells their shares.

- When owners sell their shares they are treated as disposing of their share of the underlying LTC property. Owners may have to pay any tax associated with the deemed disposal of this property. Exiting owners are generally required to account for tax on disposing of their shares in the LTC only if the amount of the disposal proceeds derived from their LTC interest exceeds the total net tax book value of their share of LTC property by more than $50,000.

- Even if this $50,000 threshold is exceeded, exiting owners will not have to account for tax on things such as trading stock in certain circumstances. When exiting owners account for tax on their share, incoming owners must take on a cost basis in the LTC's assets and liabilities that is equal to the deemed disposal under the disposal provisions.

- The disposal thresholds do not apply if the company is liquidated, or ceases to use the LTC rules but otherwise continues in business. In these situations, the owner is deemed to have disposed of their shares at market value on the date of exit.

- Look-through treatment applies for income tax purposes only. An LTC retains its corporate obligations and benefits, such as limited liability, under general company law.

- An LTC is still recognised separately from its shareholders for certain other tax purposes, including GST, PAYE and certain administrative or other withholding tax purposes under the Income Tax Act 2007.

Qualifying company rules

The changes effectively "grandparent" the QC rules for existing QCs and LAQCs only. The revised QC rules will continue to apply to existing QCs and LAQCs unless they choose to revoke their QC election, and/or use one of the transition options.

The main effect of the changes is to:

- remove the ability of an LAQC to attribute losses. This means that existing LAQCs will effectively be taxed in the same way as ordinary QCs; and

- prevent companies that are not already QCs from entering the QC rules for income years starting on or after 1 April 2011.

Transitional rules for existing QCs and LAQCs

Special transitional rules allow existing QCs and LAQCs to transition into the new LTC rules or change to another business vehicle, without a tax cost.

If an existing QC or LAQC chooses not to transition they will remain in the QC rules, but cannot attribute losses to shareholders.

The transitional rules provide for the following:

- Transition can take place in either one of the first two income years starting on or after 1 April 2011; the year chosen for transition is called the "transitional year".

- QCs and LAQCs have six months from the start of their transitional year to advise Inland Revenue of their transition.

- If transitioning to a new business structure, the partnership or sole tradership must consist of the same person(s) who owned the QC or LAQC. The transition into the new business form must be completed by the end of the transitional year.

- The appropriate tax treatment (LTC, partnership or sole trader) will apply from the start of the transitional year.

- All of the QCs assets, liabilities, tax balances and other obligations will automatically transfer to the new LTC, partnership or sole trader with no tax cost.

- Any carried forward loss balances of a QC or an LAQC can be used in future but are effectively ring-fenced for owners of the LTC, or partners in the partnership, to use against future income from that LTC or that partnership.

Application dates

The application date for both the new LTC rules and the qualifying company reforms is the income year starting on or after 1 April 2011. The LTC election filing rules apply from 21 December 2010.

Companies with an early balance date, for example, a company with a balance date of 31 December, can start using the LTC rules from their income year from 1 January 2012 to 31 December 2012.

LAQCs with an early balance date of, for example, 31 December 2011, choosing not to transition but to use the QC rules will have loss attribution for their income year ended 31 December 2011 but will no longer be able to attribute losses for their income year starting on 1 January 2012.

Companies with a late balance date, for example, a company with a balance date of 31 May, can start using the LTC rules from their income year from 1 June 2011 to 31 May 2012.

To use the grandparented QC regime, QCs and LAQCs must have used the QC regime for their income year immediately before the income year starting on or after 1 April 2011. If transitioning in the second of the possible transitional years, they must also have met the QC criteria for the whole of the first possible transitional year.

Detailed analysis

Look-through company rules

New subpart HB of the Income Tax Act 2007 contains the main LTC rules. It introduces the principle that LTCs are transparent for income tax purposes, and contains the LTC election requirements and rules on the tax treatment following an owner's disposal of interests in an LTC.

Section YA 1 introduces several defined terms, including "LTC", "owner's interest", "look-through interest" and "working owner".

Amendments have been made to income and deduction provisions and, in particular, to sections CB 32B and 32C, CX 63, DV 22 and GB 25B, as well consequential changes to the Tax Administration Act 1994 and the KiwiSaver Act 2006.

Definition of "look-through company"

Sections HB 1(1), HB 13(4) and YA 1

A company that elects to use the LTC rules must be a company (that is a body corporate or entity with a legal existence separate from that of its members) that is resident in New Zealand under domestic law and under any relevant double tax agreement. The company residence rules in section YD 2 apply for these purposes; in other words, it is the residence of the company and not its shareholders that is determinative.

A company using the LTC rules must have only one class of shares. All the shares must have the same rights to vote concerning company distributions, the company constitution, capital variation and director appointments, and to receive distributions of profits and net assets. This requirement prevents streaming of income or deductions under the LTC rules.

The shareholders of a company using the LTC rules must be either natural persons or trustees (including corporate trustees). An ordinary company cannot hold shares in an LTC. An LTC may be the "parent" of another LTC. The sub-LTC's income and expenses will ultimately be attributed to the owners of the parent LTC, and it is these owners who are included in the look-through counted owner test.

An LTC must have five or fewer "look-through counted owners".

To become an LTC, a company must meet all the eligibility criteria and must continue to meet it for the whole of the income year. If an LTC breaches the eligibility criteria its LTC status is lost from the first day of the income year in which the breach occurs. It cannot then use the LTC rules in the year in which the breach occurs or either of the following two income years.

A company that has elected to use the LTC rules is thereafter excluded from the definition of "company" in the Income Tax Act. This means that most of the rules that apply to companies, such as the requirement to keep memorandum accounts and the rules governing payments of dividends, do not apply to LTCs. However, for the following provisions there is no look-through treatment and the company, rather than its owners, is the relevant entity:

- PAYE

- FBT

- RWT

- NRWT

- ESCT

- RSCT

- Subpart FO (Amalgamation of companies).

The "look-through counted owners" test

Section YA 1

An LTC must have five or fewer "look-through counted owners". This term applies for this count test only, and although related to shareholdings it is not always transposable with the term "owner" or "shareholder", such as when an LTC is the parent company of another LTC.

For many LTCs it will be clear that they meet the count test, for example, if the company has only three individual shareholders it clearly has fewer than five shareholders and so fewer than five "look-through counted owners". However, for companies that have more than five individual shareholders, or shareholders that include trustees, the look-through counted owner test needs to be considered.

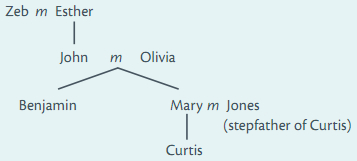

The look-through counted owner test determines the number of look-through owners the company has for the purposes of the LTC rules by identifying the relationships between individual shareholders. Shareholders related by blood relationships (second degree), marriage, civil union or de facto relationship, or adoption are counted as a single "owner" for the purposes of this test.

The relationship between a step-parent and a step-child is a second-degree relationship.

Death or dissolution of marriage between the shareholders does not break the two-degree test, provided the company was an LTC and the shareholders were counted as "one" before the event.

Example 1: Natural person shareholders

In the example above, if Zeb, Esther, Benjamin, Mary, Jones and Curtis all held shares in a company they would be counted as a single look-through counted owner because they are related to each other (via Mary) within two degrees.

If only Jones, Esther and Curtis held shares they would be counted as two look-through counted owners because although Jones, as his stepfather, is related to Curtis within two degrees, neither of them are related to Esther within two degrees, as she is Curtis's great grandmother and Jones's grandmother-in-law.

The look-through counted owner test must also be applied if a trustee holds shares in an LTC. Here the test will "look through" to the natural person beneficiaries of the trust (which includes looking through any corporate beneficiaries to its natural person shareholders), if those beneficiaries are allocated income from the LTC as beneficiary income in that income year, or in any of the three preceding income years.

The trustees of a trust are counted as one look-through counted owner for an income year if any income the trust was allocated from the LTC in that income year, and in each of the preceding three income years, was retained by the trust and not paid out as beneficiary income.

Example 2: Trustee shareholder

All the shares in Mountain Design Ltd, an LTC, are held by Walton Trust.

Walton Trust is managed by a corporate trustee. It distributes all of the income from Mountain Design Ltd to the following beneficiaries:

| 20X1, 20X2 and 20X3 | Cora and Emily |

| 20X4 | Elizabeth, Emily and Mamie (Emily's sister) |

| 20X5 | Rosemary, Erin and Aimee (Cora's daughter) |

In 20X1, 20X2 and 20X3 there are two look through counted owners as between them Cora and Emily derived all of the LTC's income as beneficiary income.

In 20X4 there are three look-through counted owners, Cora, Elizabeth and Emily/Mamie. Because Mamie is Emily's sister (a two-degree blood relative) they are counted as one owner.

In 20X5 there are five look-through counted owners, because the test considers who received beneficiary income in the current income year (20X5), and any of the three preceding income years (20X2, 20X3 and 20X4). The look-through counted owners are:

- Cora/Aimee (counted as one)

- Elizabeth

- Mamie/Emily (counted as one)

- Rosemary

- Erin.

If a company (including a qualifying company) is the beneficiary of a trust and has received income from the LTC as beneficiary income in that income year, or in any of the three preceding income years, then the company itself is not regarded as a look-through counted owner. Instead the test counts all natural persons who have a voting interest in relation to that company, whether directly or otherwise.

Look-through company elections

Sections HB 1 and HB 13

The LTC regime is elective. A company can only use the LTC rules if it continuously meets all the eligibility criteria, and has filed a valid election with Inland Revenue.

Making an election

All owners must sign an LTC election in order for a company to first become an LTC. A guardian or legal representative must sign for owners aged under 18, or any other owner without legal capacity. The director or other authorised company agent should send the election form to Inland Revenue, and confirm that all the owners have signed it.

An LTC election may also be signed by a person holding shares as a nominee or as a bare trustee for the beneficial owner, acting on instructions and on behalf of the beneficial owner under section YB 21.

The LTC election must be received by Inland Revenue before the start of the income year in which the company wishes to be an LTC. Elections relate to the income year of the company electing to become an LTC; so the due date for the election depends upon its balance date.

Newly incorporated or non-active companies must file the LTC election by the date for filing their first income tax return.

If an LTC election is received after the start of the year to which it was intended to apply, or if it is discovered to be invalid because, for example, not all the shareholders signed the election, it may still be accepted as a valid election. However, the Commissioner's discretion will be exercised only if exceptional circumstances, such as a severe illness, caused the omission or lateness, and if any omission in the election is rectified in that income year.

A company will remain an LTC without any further LTC election. It will cease to be an LTC only if it breaches the eligibility criteria, or the LTC election is revoked.

Revoking an election

Any owner may revoke the LTC election. It does not matter whether they were one of the initial owners who signed the election or not. The revocation notice must be received by Inland Revenue before the start of the income year to which it applies. A copy should be sent to the director of the LTC, to ensure that all owners are aware of the change in status.

If a revocation notice is received after the start of the income year to which it relates, the Commissioner may still accept it, if it was late due to exceptional circumstances.

A revocation may be ignored if the owner issuing the revocation notice disposes of all their interests in the LTC, and the person(s) who acquire these interests advise Inland Revenue before the start of the relevant income year that the previous owner's revocation notice is to be reversed.

To protect the integrity of the new rules, if an owner revokes the LTC election the company cannot use the LTC rules in the year for which the revocation is made, or in either of the following two income years.

Becoming a look-through company

Sections CB 32C and HB 3

Any loss balance of a company from income years before becoming an LTC is cancelled when it becomes an LTC.

If a company becomes an LTC after its first year of trading, its reserves are regarded as held by the owners in proportion to their look-through interest. So when a company first becomes an LTC, each owner will be deemed to have an amount of income arising on the first day of the income year the company becomes an LTC. This is necessary because under the LTC rules these reserves may be distributed or drawn down upon without the owners being subject to tax upon distribution; this treatment is not intended to apply to previously accumulated company reserves.

Similar rules apply if a company that is not an LTC amalgamates with an LTC.

The amount of each owner's income is equal to their proportion (based on look-through counted interests) of the amount of the company's reserves that would be taxable if the company was liquidated and assets distributed to shareholders. The formula to determine the amount of these reserves, which applied to the company immediately before it became an LTC, is:

| ( | a | + | c | − | b | − | c | ) | − | e |

| d |

Where:

a is the amount that would be taxable dividends of the company on distribution following a deemed winding up.

b is the assessable income, less allowable deductions, that would be derived by the company on a deemed winding up. This includes items such as depreciation recovered, bad debts and loss on sale of assets.

c is balances on the company's ICA and FDP account immediately before becoming an LTC, plus any unpaid income tax for earlier years, less any income tax refunds due from these earlier years.

d is the company tax rate in the income year before the income year in which the company becomes an LTC.

e is the exit dividends that, if the company had previously been an LTC and is now re-entering the LTC rules, would be attributed to any retained reserves from the previous LTC period that have not since been distributed.

Each owner is subject to tax on their proportion of these reserves, which are regarded as an income amount to them. This income amount is deemed to arise to owners in the income year the company becomes an LTC, and each owner pays income tax on the amount at their personal tax rate.

Slightly different rules apply to existing QCs or LAQCs who choose to transition to the LTC rules in either the first or second income year that starts on or after 1 April 2011.

Ceasing to be a look-through company

Sections CD 43 and CX 63

If a company ceases to be an LTC but continues in existence, it will be taxed as an ordinary company. Any retained revenue profits held by the company would have been previously allocated to owners who would have been subject to tax on this income in the year the income was derived.

To prevent any double taxation of this income, dividends paid by the company in income years after it ceases to be an LTC will be regarded as paid firstly from this retained revenue profit until an amount of dividends equal to the amount of retained profit has been paid. This applies whether the dividends are paid to the same shareholders that held shares while the company was an LTC or to new shareholders.

Dividends regarded as paid from this retained revenue profit are excluded income in the hands of the shareholder recipients.

The available subscribed capital formula is adjusted to reflect capital distributions made while the company is an LTC, taking into account both equity subscriptions and returns on that equity.

A look-through company is transparent

Sections CB 32B, DV 22, GB 23(2), GB 25B, GB 29, HB 1(4) to (5) and HB 2

With some exceptions, for the purposes of the Income Tax Act, owners are generally treated as carrying on activities and having the status, intention and purpose of the LTC. While the LTC is treated as not carrying on these activities or having such an intention or purpose. The exceptions to look-through are for the purposes of the PAYE rules, the FBT rules, the RWT and NRWT rules, the ESCT rules, the RSCT rules and subpart FO (which deals with the amalgamation of companies).

Generally though, LTCs are transparent for income tax purposes. Owners are treated as holding property in proportion to their effective look-through interest, and as parties to an arrangement, and doing or being entitled to a thing, through their capacity as owner, unless the context requires otherwise.

An owner's effective look-through interest in an LTC is measured by the percentage of decision-making rights carried by their shares in the company in relation to dividends or other distributions, the company constitution, variation of the company's capital and director appointments or elections.

Methods for allocation of income and deductions

Income, expenses, tax credits, rebates, gains and losses are passed through to owners. These items are generally allocated in accordance with an owner's effective look-through interest in the company, and will usually be allocated according to their average yearly interests, as if each item occurred uniformly throughout the year.

If the voting interest or market value interest varies during the year, owners may use the weighted average basis to determine their effective look-through interest, as shown in Example 3a.

If the company has a market value circumstance in the year, the owner's effective look-through interest is calculated as the average of their voting interest and the market value interest in the company for the income year.

Example 3a: Income and deduction allocation - average yearly interests

Walnut Ltd is an LTC with a standard balance date.

For the first nine months of the year Charles holds 60% of the shares, and his wife Caroline holds 40%. On 31 December Caroline sells all her shares to Laura.

Caroline and Laura have been shareholders for nine months (275 days) and three months (90 days) respectively.

Walnut Ltd's income statement for the year shows:

| $ | |

| Trading income | 500,000 |

| Allowable expenses | (300,000) |

| 200,000 | |

| Gross interest | 10,000 |

| RWT (28%) | (2,800) |

The income and deductions are regarded as accruing evenly throughout the year, and are allocated to each shareholder based on their yearly average as follows:

Charles's allocation is determined as:

| $ | ||

| Trading income | 0.6 × 500,000 | 300,000 |

| Allowable expenses | 0.6 × 300,000 | (180,000) |

| 120,000 | ||

| Gross interest | 0.6 × 10,000 | 6,000 |

| RWT (28%) | (1,680) | |

Caroline's allocation is determined as:

| $ | ||

| Trading income | (275/365) × 0.4 × 500,000 | 150,000 |

| Allowable expenses | (275/365) × 0.4 × 300,000 | (90,000) |

| 60,000 | ||

| Gross interest | (275/365) × 0.4 × 10,000 | 3,000 |

| RWT (28%) | (840) | |

Laura's allocation is determined as:

| $ | ||

| Trading income | (90/365) × 0.4 × 500,000 | 50,000 |

| Allowable expenses | (90/365) × 0.4 × 300,000 | (30,000) |

| 20,000 | ||

| Gross interest | (90/365) × 0.4 × 10,000 | 1,000 |

| RWT (28%) | (280) | |

Alternatively, if the voting interest or market value interest varies during the year owners can use their actual look-through interest in each period during the income year. This is applied to the income, expenses and other flow-through items from each period, and then added together. This requires accurate accrual accounts to be prepared for each period of ownership within the income year.

Example 3b: Income and deduction allocation - accounts method

If, in Example 3a, Walnut Ltd had drawn up a full accounts and a profit and loss statement for the period before and after Caroline disposed of her shares it would have shown:

| 1 Apr to 31 Dec |

1 Jan to 31 Mar |

Annual | |

| $ | $ | $ | |

| Trading income | 100,000 | 400,000 | 500,000 |

| Allowable expenses | (100,000) | (200,000) | (300,000) |

| Nil | 200,000 | 200,000 | |

| Gross interest | 7,500 | 2,500 | 10,000 |

Charles's allocation for the year is the same as in Example 3a.

Caroline's allocation for the 1 April to 31 December period is determined as:

| $ | ||

| Trading income | 0.4 × 100,000 | 40,000 |

| Allowable expenses | 0.4 × 100,000 | (40,000) |

| Nil | ||

| Gross interest | 0.4 × 7,500 | 3,000 |

| RWT (28%) | (840) | |

Laura's allocation for the 1 January to 31 March period is determined as:

| $ | ||

| Trading income | 0.4 × 400,000 | 160,000 |

| Allowable expenses | 0.4 × 200,000 | (80,000) |

| 80,000 | ||

| Gross interest | 0.4 × 2,500 | 1,000 |

| RWT (28%) | (280) | |

The Commissioner may require the LTC to use this accounts method if its taxable income in a 12-month period is $3 million or more, and if the Commissioner considers that the accounts method would result in a more equitable and reasonable measure of effective look-through interest in an income year.

Excessive effective look-through interests

The Commissioner may adjust the effective look-through interests of owners and consequently the income and deduction allocation if he considers that the current application provides excessive income allocations to an owner aged under 20.

This is an anti-avoidance provision, and aims to prevent income being unduly diverted to owners under the age of 20. It applies when two or more owners of an LTC are relatives, and one of them is under 20 years. In reallocating income and deductions for an income year, the Commissioner will consider the value of the contributions by way of service or capital rendered by the owner aged under 20, together with any other relevant matters.

Excessive remuneration to relatives

Section GB 25B

The Commissioner may adjust the allocation of income and deductions from the LTC to its owners if the LTC employs a relative of the owner, and the Commissioner considers that the remuneration paid to the relative for their services is excessive.

This is an anti-avoidance provision, to prevent income being unduly diverted to an owner's relatives. In reallocating income and deductions for an income year, the Commissioner will consider the nature and extent of services rendered by the relative, and any other relevant matters.

This provision does not apply if the relative is aged over 20 at the date of entering into a written contact of employment with the LTC, providing they have real control over the income paid to them under the contract.

Income from personal services

Section GB 29

For the purposes of applying the attribution rule for income from personal services (section GB 27), an LTC is treated as the associated entity, and is not treated as transparent.

ACC levies

For the purposes of ACC levies for natural person owners, a working owner is regarded as an employee and will pay the employee's levy while the LTC will pay the employer's levy. Other owners may receive a deduction for that expense.

An owner who is not a "working owner" but who personally exerts themselves in the LTCs income generating activities will be regarded as self-employed for ACC purposes and will pay the ACC levies as a self-employed person.

An owner who plays no active part in the LTC's business is regarded as a passive investor for ACC purposes, and is not subject to ACC levies on income attributed to them from the LTC. This includes any LTC income attributed to a natural person as beneficiary income via a trustee owner.

Each owner is responsible for assessing if their income from the LTC's business activities is of an active or passive nature, and declaring it accordingly in their individual income tax return.

Tax Information Bulletin Vol 13, No 3 (March 2001) has detailed information on the classification of ACC levies in partnerships. The same principles apply to LTCs and owners. For further details, please refer to that article, taking references to partners and partnerships as references to owners and LTCs as necessary.

Loss limitation

Sections HB 11 and HB 12

New section HB 11 ensures that owners' deductions are restricted if the amount of their deductions exceeds the adjusted tax book value of their investment in the LTC (the "owner's basis"). In that event, the deductions an owner can claim are limited to an amount equal to their owner's basis.

This is an anti-avoidance provision and will generally only apply if a company's tax losses are not matched by the owner's contributions. The rule aims to ensure that owners can offset tax losses only to the extent these reflect their economic losses. This reflects the fact that owners of a company enjoy limited liability under the corporate veil.

The owner's basis is calculated for each owner using the following formula:

- investments − distributions + income − deductions − disallowed amounts

Where:

investments is the sum of the equity, goods or assets introduced or services provided to the LTC, or any amounts paid by the owner on behalf of the LTC. This includes any loans, including shareholder current account credit balances, made by the owner to the LTC and their share of any LTC debt which they, or their associate, have guaranteed (or provided indemnities for).

distributions is anything paid out to the owner by the LTC, including dividends and loans, including shareholder current account debit balances. It does not include any salary or wages received by a working owner.

income is the owner's share of the LTC's income (including exempt and excluded income) and capital gains from the current and any preceding tax years (in which the company was an LTC).

deductions is the owner's share of the LTC's deductions and capital losses in the preceding tax years (in which the company was an LTC).

disallowed amount is the amount of investments made by an owner within 60 days of the last day of the LTC's income year if these are distributed or reduced within 60 days after the last day of the income year. This is to prevent the creation of an artificially high basis around the end of the year. To allow for normal operational cashflow, if the reduction of investments within 60 days of the balance sheet date is less than $10,000, it may be ignored.

Example 4: Loss limitation

Oleson Ltd, an LTC, starts to operate a plant hire business in 20X1. It has three owners, Eleanor, William and Harriet, with shareholdings of 20%, 30% and 50% respectively.

Oleson Ltd is given a non-repayable business grant by a local entrepreneurial fund of $50,000. Its owners contribute a further $100,000, each contributing in proportion to their shareholding. Oleson Ltd also has a $100,000 interest-only loan from the bank, which Harriet has personally secured by guarantee against her residential property.

| $ | |

| Plant | 250,000 |

| Shareholder capital | 100,000 |

| Entrepreneur grant | 50,000 |

| Bank loan | 100,000 |

The plant is depreciable at 20% pa = $50,000

Repair and maintenance costs = $20,000 pa

Interest costs = $10,000 pa (10% interest rate pa)

The plant produces hire income of $60,000 a year. Oleson Ltd pays total dividends of $30,000 each year. For the first five years of trading Oleson Ltd's accounts will show:

| $ | |

| Income | 60,000 |

| Repairs | (20,000) |

| Interest | (10,000) |

| Depreciation | (50,000) |

| Net loss | (20,000) |

The owner's basis (there are no disallowed amounts in this example) determines the amount of their share of the $80,000 deductions that each owner can claim as follows:

| $ | Investment | Distribution | Income | Prior year deductions | Owner's basis | Current year deductions allowed | Restricted deductions c/f |

|---|---|---|---|---|---|---|---|

| 20X1 | |||||||

| Eleanor | 20,000 | 6,000 | 12,000 | 0 | 26,000 | 16,000 | 0 |

| William | 30,000 | 9,000 | 18,000 | 0 | 39,000 | 24,000 | 0 |

| Harriet | 150,000 | 15,000 | 30,000 | 0 | 165,000 | 40,000 | 0 |

| 20X2 | |||||||

| Eleanor | 20,000 | 12,000 | 24,000 | 16,000 | 16,000 | 16,000 | 0 |

| William | 30,000 | 18,000 | 36,000 | 24,000 | 24,000 | 24,000 | 0 |

| Harriet | 150,000 | 30,000 | 60,000 | 40,000 | 140,000 | 40,000 | 0 |

| 20X3 | |||||||

| Eleanor | 20,000 | 18,000 | 36,000 | 32,000 | 6,000 | 6,000 | 10,000 |

| William | 30,000 | 27,000 | 54,000 | 48,000 | 9,000 | 9,000 | 15,000 |

| Harriet | 150,000 | 45,000 | 90,000 | 80,000 | 115,000 | 40,000 | 0 |

| 20X4 | |||||||

| Eleanor | 20,000 | 24,000 | 48,000 | 38,000 | 6,000 | 6,000 | 20,000 |

| William | 30,000 | 36,000 | 72,000 | 57,000 | 9,000 | 9,000 | 30,000 |

| Harriet | 150,000 | 60,000 | 120,000 | 120,000 | 90,000 | 40,000 | 0 |

| 20X5 | |||||||

| Eleanor | 20,000 | 30,000 | 60,000 | 44,000 | 6,000 | 6,000 | 30,000 |

| William | 30,000 | 45,000 | 90,000 | 66,000 | 9,000 | 9,000 | 45,000 |

| Harriet | 150,000 | 75,000 | 150,000 | 160,000 | 65,000 | 40,000 | 0 |

Any deductions that an owner does not claim in an income year due to the operation of the loss limitation rule are carried forward and may be claimed in future years, subject to the application of the loss limitation rule in those years.

If the company ceases to be an LTC but continues in business as an ordinary company, the owner may use any "restricted deductions" against any future dividends he or she receives from the company.

If the owner ceases to hold shares in the company and so ceases to have an effective look-through interest in the LTC, the "restricted deductions" cannot be used unless the owner later reacquires shares in the same company.

Disposal of look-through interests

Sections FB 1(3), FB 10B, FC 1(2) and HB 4 to HB 10

Disposal of shares is disposal of underlying LTC property

The owners of an LTC are treated as holding LTC property directly, in proportion to their effective look-through interest. When owners sell their shares in the LTC they are treated as disposing of their share in the underlying LTC property, and will bear any tax consequences associated with the disposal.

However, sections HB 5 to HB 10 remove the requirement for the owner selling the shares (the exiting owner) to account for tax on this disposal of underlying property when the tax adjustment that would otherwise be required is below certain thresholds.

When a look-through interest is transferred as part of a settlement of relationship property, and the rules in subpart FB apply, there is no disposal of shares under the LTC rules. Instead, the transferee is treated as having acquired the look-through interests on the date they were acquired by the transferor, and will take on the transferor's cost basis. This only applies in relation to the disposal provisions. For the purposes of allocating an LTC's income or deductions in the year of transfer, the weighted average basis or the accounts method will apply to the transferor and transferee's periods of actual ownership in the year.

Deemed disposal of underlying LTC property

If the company ceases to use the LTC rules, but otherwise continues, the owner is deemed to have disposed of the underlying property at market value on the date of exit. The company is deemed to have immediately reacquired the property at the same market value.

For the purposes of the land provisions in subpart CB, the associated person rule in section CB 15 applies. This means that the "date" on which the company is regarded as acquiring land is the same date on which the "owners" (via the LTC) acquired the land. The owners are effectively regarded collectively as the transferor, and the company as the transferee.

If an owner ceases to hold interests in the LTC because it permanently ceases to exist as a company, for example, through liquidation or Court order, there is a deemed disposal of the shares, at market value.

An owner's interest may also be reduced by cancellation or repurchase of their shares by the LTC. This is a deemed disposal of the shares for their market value, unless it is part of a pro-rata cancellation applied to all owners, and so does not actually alter each owner's effective look-through interest.

In the case of permanent cessation or share repurchase, any actual consideration received by the owner is ignored and the disposal is deemed to occur at market value.

The disposal threshold provisions in sections HB 5 to HB 10 do not apply in these deemed disposal circumstances.

Disposals thresholds

Sections HB 5 to HB 10 remove the requirement for the owner selling the shares (the "exiting owner") to account for tax on the disposal of underlying property when the tax adjustment that would otherwise be required is below certain thresholds.

When these provisions apply, the new owner (the "entering owner") is treated as acquiring their interests in the LTC's underlying property for the same cost that the exiting owner had acquired them.

The thresholds are:

- $50,000 threshold -

Exiting owners are required to account for tax on sale of shares only if the amount of the disposal proceeds exceeds the total net tax book value of the owner's share of the LTC property (less any liabilities under generally accepted accounting practice) by more than $50,000. When shares in the same LTC have been sold within a 12-month period, all sales are taken into account for the purposes of the threshold.

- Trading stock -

Exiting owners do not have to perform a revenue account adjustment for trading stock if the LTC's total annual turnover is $3 million or less.

- Depreciable tangible property -

Exiting owners do not have to account for depreciation recovery or loss on their share of any depreciable tangible asset if the historical cost of the asset is $200,000 or less.

- Financial arrangements -

Exiting owners are not required to perform a base price adjustment for their interest in a financial arrangement if:- the LTC is not in the business of deriving income from financial arrangements; and

- the financial arrangement has been entered into as a necessary and incidental purpose of the LTC's business.

- Short-term sale and purchase agreements -

When exiting owners dispose of some or all of their look-through interests in a short term sale and purchase agreement, the consideration received is excluded income.

- Livestock -

If the LTC property consists of livestock that includes female breeding livestock that is valued using the national standard cost scheme (section EC 22) or the cost price method (section EC 25), the entering owner may furnish a return of income choosing to apply section EC 26B. The entering owner is treated as if they had originally purchased and held the livestock, not the exiting owner. This is designed to reduce compliance costs for the LTC.

Working owners

Sections DC 3B, HB 11(6), RD 5(3) and YA 1 of the Income Tax Act 2007; section 14(1) of the KiwiSaver Act 2006

A working owner is an owner who is employed by the LTC under a written contract of employment and who personally and actively performs the duties of their employment for the LTC under that contract. This does not apply if the LTC is wholly or mainly engaged in investing money or in holding or dealing in shares, securities, investments, estates or interests in land.

An LTC's payments to a working owner are included in that owner's salary or wages, and the PAYE rules will apply. When computing their owner's basis, these wages or salaries are excluded from the distributions element of the formula.

An expense deduction is available to all owners of an LTC for wage and salary payments made to working owners.

The rules for automatic enrolment of employees into KiwiSaver do not apply to an owner in receipt of salary or wages only because they are a working owner in an LTC.

Interests in livestock

Section EC 12(4)

For the purposes of making a valuation election for specified livestock, a person's interests in an LTC that owns livestock is treated separately from any other interest that person may have in livestock. Separate elections are needed for each set of livestock, and different valuation methods may be applied to each.

Excepted financial arrangements

Section EW 5(11B)

A look-through interest for an LTC is an excepted financial arrangement.

Associated persons

Section YB 13

The LTC and an owner who is an employee or a director of the LTC are associated.

The LTC and an owner who has effective look-through interests of 25% or more are associated.

The look-through interests of owners associated under sections YB 2 to YB 11 and YB 14 are aggregated. A slightly modified aggregation rule applies for the purposes of land provisions.

Tax administration

Sections 42B, 89C(ka), 89D(1), 89DA, 138B and 141B(8) of the Tax Administration Act 1994

An LTC must file a return of income, ignoring the look-through requirements. The return must specify the amount of income and deductions allocated to each owner.

Only the LTC may propose adjustments to the tax position taken in its return, which the Commissioner may reject by written notice. The LTC may also reject any adjustments proposed by the Commissioner. An owner is entitled to challenge any assessment in relation to their interests in the look-through company by commencing proceedings in a hearing authority only after the disputes process in Part 4A is completed.

The Commissioner may issue an assessment to an owner on their tax position in relation to their look-through interests without issuing a notice of proposed adjustment if the LTC and the Commissioner have completed the disputes process for the return of income and that tax position.

For the purposes of applying shortfall penalties, and for determining a tax shortfall amount, the amounts returned on the tax return of the LTC are treated as if they were the amounts returned by each owner.

Changes to the qualifying company rules

Grandparented qualifying company rules

Section HA 5, HA 7B

Existing QCs and LAQCs may continue to use the qualifying company rules in subpart HA, without the ability to attribute losses. This will be the default option for all existing QCs and LAQCs for income years starting on or after 1 April 2011.

The definition of an LAQC and the various provisions in subpart HA which provided for an LAQC to attribute losses to its shareholders have been repealed.

The grandparenting rules apply only to companies that are QCs or LAQCs in the income year immediately before the income year starting on or after 1 April 2011; this is called the "grandparenting income year".

Existing QCs and LAQCs include companies already registered with Inland Revenue as QCs or LAQCs, and companies such as newly incorporated companies, for whom the grandparenting income year is the first year for which they are required to submit a return of income, and who send their valid election to Inland Revenue within the timeframe allowed in section HA 30(3).

Transitional rules for existing QCs and LAQCs

Section HZ 4B to section HZ 4D

The transitional rules apply only to companies that are QCs or LAQCs in the income year immediately before the income year starting on or after 1 April 2011. If they are transitioning in the second of the possible "transitional" years they must also have met the QC criteria for the whole of the first possible transitional year.

Transition can take place in either one of the first two income years starting on or after 1 April 2011. The year chosen for transition is called the "transitional year".

The transitional rules are designed to provide a smooth transition for existing QCs and LAQCs to leave the QC rules and start using the LTC rules if they wish to do so.

They also provide an option for existing QCs and LAQCs to transition their business structure into a partnership, limited partnership or sole trader, with no tax cost. This transition will require the setting up of the alternative business structure, and the transfer of assets, liabilities, legal titles and so forth from the QC to the chosen structure. These changes will be completed under the relevant general law. They are not dealt with in the transitional rules, which are concerned solely with tax matters arising from, during or after the transfer.

The transitional rules are deliberately outcome focused. The exact process each QC will need to complete in order to transition will vary according to its existing structures and governance. Any interim measures necessary to transition will generally be ignored for tax purposes, as long as the new business structure is in place by the end of the chosen transitional year.

All of the necessary transfers of assets and liabilities, plus all other legal documentation necessary in the new business structure must be completed by that date. However the tax treatment of the new business structure (that is a partnership or sole tradership) will be applied from the start of the transitional year. This effectively provides a QC or LAQC with up to 12 months to reconstitute its business structure.

Transitioning to the LTC rules

All the shareholders of the existing QC or LAQC must complete the LTC election within six months of the start of the transitional income year. Making the LTC election revokes the previous QC and LAQC elections with effect for, and from the beginning of, that transitional income year.

When an existing company becomes an LTC its owners are usually treated as having an amount of taxable income equal to their proportion of the amount of the company's reserves that would be taxable if the company were to be liquidated and its assets distributed. However, under the transitional provision no income amount will arise, and so no tax will be paid by owners when an existing QC or LAQC transitions to become an LTC.

The carried forward loss balance of a QC, and any controlled foreign company (CFC) or foreign investment fund (FIF) losses carried forward by an LAQC, may be used by the owners of the LTC in future years against their share of net income from that LTC. For CFC or FIF losses carried forward, the normal country ring-fencing rules in subpart IQ will apply too.

The LTC loss limitation rules do not affect an owner's claim to these brought-forward losses.

For the purposes of the LTC loss limitation rules, there are two options for determining an owner's basis:

- the market value or the accounting book value of the amounts used to determine a owner's basis for the loss limitation rules. These values should be taken at the last day of the transitional year; and

- the historic basis, as if the LTC rules had always applied and the LTC had always existed.

If the application of the loss limitation rules calculates an owner's basis at less than zero, the owner's basis is treated as zero.

Transition to a partnership or limited partnership

Existing QCs and LAQCs may transition to become a partnership or a limited partnership during their transitional year under the "QCP transitional process".

This means that during the transitional year, the QC or LAQC must notify Inland Revenue that it intends to become a partnership or limited partnership under the QCP transitional process. Notification should be made within six months of the start of the transitional year. This notification will revoke its QC status from the start of that transitional year.

The partners of the partnership that emerges following the transition should be the same as the shareholders of the QC. One exception to this is a limited partnership, when a company may be used as the general partner with the shareholders of the QC being the limited partners.

Each partner should have the same relative interests in the partnership as in the QC. If several QCs transition into one partnership it is the net position of the partners following transition that should be compared.

Example: Transition into partnership

Mr A and Mr B each own 50% of AB Ltd, an LAQC with net assets of $3,000.

Mr X and Mr Y each own 50% of XY Ltd, a QC with net assets of $12,000.

They form a new limited partnership which has partnership net assets of $15,000. Each individual is a limited partner and Alphabet Ltd is incorporated to become the general partner.

Mr A and Mr B will each hold a 10% partnership share ($1,500 of the partnership's assets).

Mr X and Mr Y will each hold a 40% partnership share ($6,000 of the partnership's assets).

Alphabet Ltd is the general partner, but holds no partnership share.

The carried forward loss balance of a QC, and any CFC or FIF losses carried forward by a LAQC, may be used by the partners of the partnership in future years, against their share of net income from that partnership. In the case of CFC or FIF losses carried forward, the normal country ring-fencing rules in subpart IQ will also apply.

The limited partnership loss limitation rules do not affect a limited partner's claim to these brought-forward losses.

For the purposes of the limited partnership loss limitation rules, there are two options for determining the partners' basis of a limited partnership:

- the market value or the accounting book value of the amounts used to determine a member's basis for the loss limitation rules. The values are taken at the last day of the transitional year; and

- the historic basis, as if the limited partnership rules had always applied and the limited partnership had always existed.

If the application of the loss limitation rules calculates a partner's basis as less than zero, the partner's basis is treated as zero.

Transition to sole trader

Existing QCs and LAQCs with only one natural person shareholder may transition to become a sole tradership during their transitional year under the "QCST transitional process".

This means that during the transitional year, the owner of the QC or LAQC must notify the Commissioner that he or she intends to operate as a sole trader, and transition the business under the QCST transitional process. Notification should be made within six months of the start of the transitional year. This notification will also revoke the company's QC status from the start of that transitional year.

The carried forward loss balance of a QC, and any CFC or FIF losses carried forward by an LAQC, may be used by the sole trader in future years. In the case of CFC or FIF losses carried forward, the normal country ring-fencing rules in subpart IQ will apply.

Tax outcomes of completing the QCP or QCST transitional process

As long as the QCP or QCST transitional process is completed by the end of the chosen transitional year any income and expenses during the transitional year will be treated as arising to the partnership or the sole trader from the start of the transitional year, even if, as a matter of fact, they actually arose during a part of the transitional year when the business was still in a corporate form. For example, a written contract of service for a working partner may be "deemed" to be in place from the start of the transitional year, and the partnership and working partner taxed accordingly, even though in reality that contract will not have been in place until mid-way through the year, after the partnership had been established.

Other adjustments to accommodate tax paid by the QC or LAQC during the early part of a transitional year may also be necessary, and any reallocations or repayments should be discussed with Inland Revenue when the transition has been completed. Partners or sole traders will also need to consider any implications for their own tax position, including the need to complete personal tax returns or make provisional tax payments on their own account.

If the QCP or QCST transitional process is not completed by the end of the transitional year the company will be taxed as an ordinary company for that year, as its QC status will have been revoked. There may also be tax consequences from the parts of the incomplete transition that have already been carried out.

Under the QCP and QCST transitional process there is no tax cost arising from the transfer of assets, liabilities and any relevant rights and obligations from the QC to the partnership or sole trader. The historical tax position of the QC instead transfers to the partnership or sole trader. This means any future adjustments to income or deductions relating to the QC period will be dealt with through the partnership or the sole trader.

The memorandum account balances and other related tax accounts (such as ASC) for a company that was a QC or LAQC before the transition are extinguished. The company effectively becomes a "shell" company, and may be liquidated or removed from the New Zealand Companies Office Register.