Working for Families Tax Credits: Definition of "family scheme income"

2010 amendment broadens the definition of 'family scheme income' used to determine entitlements to Working for Families Tax Credits.

Sections MB 1, MB 7 to MB 13, YA 1, schedule 38 of the Income Tax Act 2007; sections 31C and 57B of the Tax Administration Act 1994

The definition of "family scheme income" in the Income Tax Act 2007, which is used for determining entitlements to Working for Families (WFF) tax credits, has been broadened. The amendments are intended to improve the fairness and integrity of WFF by, for example, countering arrangements that have the effect of inflating entitlements beyond what people's true economic circumstances justify, and filling in gaps in the definition of "family scheme income".

This broader definition of "family scheme income" will also apply to people with dependent children who apply for the community services card. The Government has also announced that the broader definition will be used in the parental income test for student allowances.

Background

In Budget 2010, the Government announced that the integrity of certain social assistance programmes, namely WFF, student allowances and the community services card, would be improved.

As a first step to addressing integrity concerns around these social assistance programmes, the Government excluded investment losses such as rental losses for the purpose of determining WFF tax credits. This was included in the Taxation (Budget Measures) Act 2010.

The current definition of "family scheme income" is based on "net income" for income tax purposes, with certain adjustments. The legislation broadens the definition of "family scheme income" in the Income Tax Act 2007 to more closely reflect the income available for the family's day-to-day living needs. This ensures the rules support the original intention of targeting assistance to people in genuine need.

Proposals to broaden the definition of family scheme income were set out in an officials' issue paper Social assistance integrity: defining family income in August 2010.

The new legislation was added to the Taxation (GST and Remedial Matters) Bill by Supplementary Order Paper No. 187.

Key features

The definition of "family scheme income" in the Income Tax Act 2007 has been amended to include the following additional types of income:

- trust income (including attributed income from trust-controlled companies) that is attributed to a person who is a settlor of the trust;

- fringe benefits that are attributable fringe benefits if received by a company employee who, with their associates, controls the company;

- passive income such as interest and dividends over $500 derived by dependent children;

- income from a portfolio investment entity (PIE) that is not sufficiently locked in until retirement;

- foreign-sourced income of non-resident spouses;

- tax-exempt salary and wages;

- main income equalisation scheme deposits;

- 50% of non-taxable private pensions and annuities; and

- other payments (besides those already included in the definition of family scheme income) used to replace income or to meet a family's living expenses if the total exceeds $5,000 a year per family.

The broader definition of family scheme income applies when determining entitlements for WFF tax credits. This change automatically flows through to people with dependent children who apply for the community services card because the definition of family scheme income also applies for this purpose. The broader definition will also be used in the parental income test for student allowances.

Application dates

The broader definition of "family scheme income" applies for WFF tax credits and community services cards for those with dependent children from 1 April 2011.

For the parental income test for student allowances, an application date will be set separately by Order in Council.

Detailed analysis

"Net income" as defined in the Income Tax Act 2007 is used as the basis for calculating "family scheme income". Family scheme income, which is used to determine entitlements for WFF tax credits, is defined to include a number of adjustments to a person's net income.

Details of the additional types of income that will be included in family scheme income are discussed below.

Trust income (section MB 7)

Trustee income distributed to beneficiaries of the trust tax-free is not included in the taxable income of beneficiaries. Consequently, under the previous rules, the amount of distributed trustee income was not included in family scheme income even though it could have been available to meet a family's living expenses. This had the effect of increasing their WFF tax credit entitlements.

The new rule includes the net income of a trust (less beneficiary income) in a person's family scheme income if they are a settlor of the trust. Beneficiary income received by the person is already included in their family scheme income. The new rule also includes the net income of trust-controlled companies.

Scope of attribution rule

The rule attributes the net income of a trust to a person who is a settlor of the trust.

A person is treated as a settlor if they meet the definition of "settlor" in sections HC 27 and HC 28. This means that the term "settlor" has a wide meaning and is defined broadly as a person who transfers value to a trust. For example, the extended definition of settlor in section HC 28 provides that:

- when a company makes a settlement, any shareholder with an interest of 10% or more in that company is treated as a settlor in relation to that settlement as well as the company itself;

- when a trustee of a trust (the first trust) settles another trust (the second trust), the settlor of the second trust is treated as including any person who is a settlor of the first trust; and

- when a person has any rights or powers in relation to a trustee or settlor of a trust which enables the person to require the trustee to treat them (or a nominee) as a beneficiary of the trust, the person is treated as a settlor of that trust.

The definition of settlor, in conjunction with the nominee look-through rule in section YB 21, does not include professional advisors acting on behalf of clients and other persons such as friends and family members who simply allow their name to be listed as the settlor on a trust deed. The main focus of the definition is on persons who provide the trust property. It is therefore the client of the professional advisor, or the person the friend or family member is acting for, who would be treated as the settlor.

Section MB 7 also excludes persons who provide personal services for free in relation to a trust's administration or the maintenance of the trust's property from the definition of settlor. For example, if a person undertakes general repairs and maintenance work on the trust's assets for free, such as repainting a dwelling owned by the trust, these services will not be treated as a settlement for the purposes of these rules.

If there is more than one settlor for a trust, the trust income is attributed to the settlors of the trust proportionally based on the number of settlors. However, if a settlor arranges for friends or relatives to be settlors to artificially dilute the attribution rule, the original settlor is treated as the sole settlor of the trust. This is a result of the existing settlor definition (including the nominee look-through rule) and the anti-avoidance rule.

The focus of the attribution rule is on closely held situations where integrity concerns can arise. The following trusts have therefore been excluded from the trust income rule:

- charitable trusts that are registered as a charitable entity under the Charities Act 2005;

- trust settlements for the benefit only of local authorities;

- funeral trusts under section CW 45;

- trustees for registered superannuation schemes; and

- trusts where neither the settlor nor any member of the settlor's family can be a beneficiary without a Court order.

Calculation of amount attributed

Under the rule, the amount of trust income included in family scheme income is calculated according to the following formula:

| trustee + company − dividends |

| settlor number |

"Trustee" in the formula represents the net income of the trust less income distributed as beneficiary income. This amount cannot be less than zero. This income includes income of a trust earned directly by the trust carrying on a business or receiving investment income such as dividends or interest.

"Company" in the formula represents the net income of a trust-controlled company. A trust-controlled company is defined as a company in which the trustees and their associates hold 50% or more of the voting interests or market value interests (if there is a market value circumstance). The amount of income of the trust-controlled company that is attributed is calculated by multiplying the company's net income for the income year by the trust's voting interests (or market value interests) in the company.

The attribution of a company's net income is restricted to trust-controlled companies only. For example, if a trust is a shareholder in a widely held company, only the dividends from that company are included in trust income.

"Dividends" in the formula represents the total amount of dividends that are derived by the trust from a trust-controlled company. This amount cannot be greater than the net income of the company. Dividends are subtracted in the formula because they are already included as a part of the trust income.

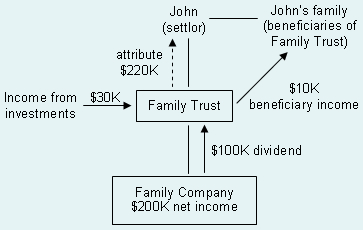

Example: Application of attribution rule to single company

In this example, John is the sole settlor of Family Trust. Family Company is wholly owned by Family Trust. Family Company's net income is $200,000 and it pays an imputed dividend of $100,000 to Family Trust. Family Trust also earns income of $30,000 from investments. Family Trust distributes $10,000 as beneficiary income to John's family.

John's family scheme income for the income year is calculated as follows:

| Trustee | $100,000 dividend + $30,000 debt investment income less $10,000 beneficiary income = $120,000 |

| Company | $200,000 net income |

| Dividend | $100,000 |

| trustee + company − dividends |

| settlor number |

| = | $120,000 + $200,000 − $100,000 |

| 1 |

Total = $220,000

Therefore, $220,000 is included in John's family scheme income for the income year.

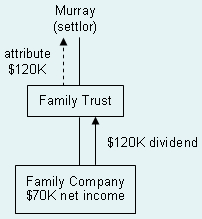

Example: Application of attribution rule when dividend exceeds net income

In this example, Murray is a sole settlor of the Family Trust. Family Company is wholly owned by Family Trust.

Family Company has $70,000 net income and it pays an imputed dividend of $120,000 to Family Trust. Murray's family scheme income for the income year is calculated as follows:

| Trustee | $120,000 dividend |

| Company | $70,000 net income |

| Dividend | $70,000 (capped) |

| trustee + company − dividends |

| settlor number |

| = | $120,000 + $70,000 − $70,000 |

| 1 |

Total = $120,000

Therefore, $120,000 is included in Murray's family scheme income for the income year.

If there is more than one trust-controlled company, the "net income" of each company is calculated separately and then added together. This means that if one of the trust-controlled companies has a "net loss", the amount cannot be offset against the net income of another company (section BC 4(3) provides that if a person has a net loss, their net income for the year is zero).

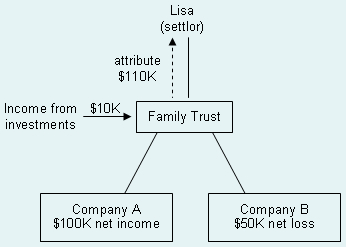

Example: Application of attribution rule to multiple companies

In this example, Lisa is a sole settlor of the Family Trust. Company A and B are wholly owned by Family Trust.

Company A has $100,000 net income; it pays no dividend to Family Trust. Company B has a $50,000 net loss. Family Trust also earns income of $10,000 from investments. Lisa's family scheme income for the income year is calculated as shown below:

| Trustee | $10,000 debt investment income |

| Company | $100,000 (Company A's net income) + $0 (B's net loss) |

| Dividend | $0 (Company A) + $0 (Company B) |

| trustee + company − dividends |

| settlor number |

| = | $10,000 + $100,000 − $0 |

| 1 |

Total = $110,000

Therefore, $110,000 is included in Lisa's family scheme income for the income year.

Fringe benefits (section MB 8)

Under the previous rules, fringe benefits were not included in family scheme income because they are taxed to the employer rather than included in the employee's taxable income.

New section MB 8 includes fringe benefits in a person's family scheme income if it is received by a shareholder-employee of a company. A person is treated as a shareholder-employee of a company if they and their associates hold 50% or more of the voting interests or market value interests (if a market value circumstance exists) in the company. The inclusion of interests held by associates means this rule applies to an individual who settles a family trust which owns a company of which the individual is an employee. The reason for limiting this rule to shareholder-employees as defined is because they can influence the nature of fringe benefits they receive as part of their employment.

The rule is also limited to include only attributable fringe benefits in a person's family scheme income. Attributable fringe benefits are significant fringe benefits, many of which are easily substitutable for cash. Such benefits are attributable to individual employees for the purposes of the fringe benefit tax rules. Section RD 47 provides a list of attributable fringe benefits which are:

- motor vehicles;

- low-interest employee loans;

- subsidised transport (when the employer is in the business of transporting the public) above a threshold of $1,000 per annum;

- contributions to sickness, accident or death funds (and funeral trusts) above a threshold of $1,000 per annum;

- payments to insurance schemes above a threshold of $1,000 per annum;

- employer contributions to superannuation schemes as defined in the Income Tax Act 2007 above a threshold of $1,000 per annum (this excludes superannuation schemes registered under the Superannuation Schemes Act 1989 and the KiwiSaver Act 2006); and

- undefined benefits above a threshold of $2,000 per employee per annum.

The rule also provides that the amount of the fringe benefit to be included in a person's family scheme income is equivalent to the gross cash value of the fringe benefit, comprising:

- the taxable value of the fringe benefit that the company must attribute to the person under sections RD 47 to RD 49 for the income year; and

- the company's fringe benefit liability in relation to the person's fringe benefit under section RD 50 (employer's liability for attributed benefits) for the income year.

Example

Chris is an employee of a company controlled by a trust which he settled. Chris is married and has three children under 13 years of age. His partner is not in paid employment. Chris receives a salary of $70,000 and is provided with a motor vehicle (with a cost price of $60,000 including GST) which is available at all times for private use.

Under the previous definition of family scheme income, Chris's situation would have been as follows:

| Cash salary | $70,000 |

| WFF income | $70,000 |

| WFF tax credits | $7,427 ($143 per week) |

Under the new rule, his situation becomes:

| Cash salary | $70,000 |

| Attributed income from fringe benefit (motor vehicle) |

$17,909 |

| WFF income | $87,909 |

| WFF tax credits | $3,846 ($74 per week) |

From 1 April 2011, Chris's entitlement to WFF tax credits decreases by $3,581 for the year.

Passive income derived by dependent children (section MB 11)

New section MB 11 includes passive income over $500 per child in a person's family scheme income. Parents are able to allocate income directly to their children through family trusts and companies or place their investments directly under their children's names. This income can then be used to meet the family's living expenses.

The rule includes in a person's family scheme income amounts derived by a dependent child which consists of:

- resident passive income (such as interest, dividends, and taxable Māori authority distributions);

- a royalty;

- rent;

- certain beneficiary income;

- attributed income from a portfolio investment entity that is not a superannuation fund or retirement savings scheme; and

- a distribution from a listed portfolio investment entity.

Beneficiary income of dependent children is counted even though the beneficiary income of a person who is under 16 years old is taxed as trustee income. However, beneficiary income that is an amount referred to in section HC 35(4)(b)(i), (ii) and (v) is not counted. These exceptions relate to trusts such as testamentary trusts, or trusts established by a Court order or for child disability.

A minimum threshold of $500 has been introduced to exclude modest amounts of passive income earned by children, and which is unlikely to be put towards the family's living expenses.

Income from unlocked portfolio investment entities (section MB 1(5))

New section MB 1(5) includes income from unlocked portfolio investment entities (PIEs) in a person's family scheme income. Unlocked PIEs include all PIEs other than superannuation schemes that are registered with the Government Actuary, such as KiwiSaver schemes or retirement savings schemes. These schemes are excluded on the basis that the income is sufficiently locked-in until a person's retirement.

The rationale for including unlocked PIE income is because this income can be accessed by investors at any time and is readily available to meet a family's living expenses. Examples of unlocked PIEs include cash PIEs, which are similar to on-call bank accounts, and listed PIEs.

Consequential to this change, sections 31C and 57B of the Tax Administration Act 1994 have been amended to bring forward the notification and return requirement dates for unlocked PIEs by one month from 30 June to 31 May.

Non-residents' foreign-sourced income (section MB 12)

New section MB 12 includes the foreign-sourced income of a person's non-resident spouse, civil union partner, or de facto partner in the person's family scheme income.

Under the previous rules, only the New Zealand-sourced income of a non-resident was included in family scheme income. This is despite the offshore income being available and often used to support the children resident in New Zealand.

This rule means that a non-resident parent's income is included in family scheme income. It is intended to ensure equitable treatment with families where both spouses live in New Zealand where both New Zealand and overseas income is taken into account.

Section MB 1(2) already includes any maintenance payments made by a non-resident parent to the resident parent in family scheme income if the parents are separated.

Exempt income - salary or wages (section MB 1(2)(b) and schedule 38)

Section MB 1(2) has been amended to include an amount of salary or wages that is exempt from income tax under specific international agreements in a person's family scheme income. Previously, this income was not included in family scheme income as it was exempt from income tax, even though it is available to meet the family's living expenses. An example of these types of income is salaries received by employees of international organisations such as the United Nations or the Organisation for Economic Co-operation and Development.

New schedule 38 lists Acts that exempt salary or wages under specific international agreements. They are:

- the Arbitration (International Investment Disputes) Act 1979;

- the Consular Privileges and Immunities Act 1971;

- the Diplomatic Privileges and Immunities Act 1968;

- the International Finance Agreements Act 1961; and

- the Pitcairn Trials Act 2002.

Salary or wages that are exempt from income tax under these Acts, or under a regulation or Order in Council made under these Acts, are included in a person's family scheme income.

Main income equalisation scheme deposits (sections MB 1(5D) and MB 9)

New section MB 9 includes the amount of deposits to main income equalisation accounts in a person's family scheme income.

The main income equalisation scheme is intended to allow persons carrying on an agricultural, fishing or forestry business to smooth their incomes when there are large fluctuations of income over several years. Currently, section DQ 1 allows a deduction for a deposit made to a main income equalisation account for income tax purposes. Under the previous rules, the reduction in a person's net income resulting from deposits in these schemes could also reduce their family scheme income.

The rule includes deposits to these schemes made on or after 1 April 2011 in a person's family scheme income if the deposit was for a business of:

- the person;

- a company that meets the requirements of section MB 4;

- a trustee of a trust that meets the requirements of section MB 7; or

- a company controlled by a trust referred to above.

Regardless of who makes the deposits to these schemes, the amount of deposit is included in a person's family scheme income.

To prevent double counting, new section MB 1(5D) excludes refunds (excluding interest payable under section EH 6) from main income equalisation accounts (under sections EH 8 to EH 26) from a person's family scheme income.

This amendment does not apply to deposits made to the adverse event income equalisation scheme and the thinning operations income equalisation scheme.

Pensions and annuities (section MB 10)

New section MB 10 includes 50% of distributed non-taxable private pensions and annuities in a person's family scheme income. This would cover a pension from a superannuation fund that is a defined benefit scheme such as the Government Superannuation Fund or an annuity from a New Zealand-resident life insurer. It would not cover a lump-sum payment from a defined contribution scheme, such as KiwiSaver. Only 50% of pensions and annuities is included to reflect that some portion of these payments represents the return of the original capital investment rather than income.

Other payments (section MB 13)

New section MB 13 includes certain other payments that a person may receive (other than those already included or specifically excluded) in a person's family scheme income.

Under the previous rules, section MB 1(6) stated that the Commissioner must have regard to income from all sources known to the Commissioner in calculating family scheme income. There was some uncertainty over what section MB 1(6) actually captured. New section MB 13 clarifies this.

"Other payments" include the value of payments paid or provided to the person from any source and used by the person to:

- meet usual living expenses of the person or the person's family; or

- replace lost or diminished income of the person or the person's family.

What constitutes "usual living expenses" will depend on the particular circumstances of the person or the person's family.

Examples of other payments include:

- distributions of trust income from a trust where the person is not the settlor of the trust;

- regular cash payments from family members to supplement income;

- soft loans which are non-commercial loans with a discounted interest rate and/or lenient options for repayment; they are usually between related parties such as family members or family-controlled entities;

- payments from an income-related insurance policy, other than life insurance, to cover loss of employment income;

- payments received to meet living costs such as rent, servicing a mortgage, food, power and clothing or to pay hire purchase accounts, or insurance payments; or

- payments of expenses by a third person, such as paying utility bills directly.

Any payments with specific purposes other than usual living expense purposes, or any capital payments are excluded. New section MB 13(2) specifically excludes the following types of payments and benefits:

- a loan under ordinary commercial terms and conditions;

- an amount that is proceeds of the disposal of property and not assessable income of the person disposing of the property;

- a payment on behalf of the person by a local authority or public authority;

- a forgiveness of debt by a public authority;

- a charitable distribution from a charitable entity registered under the Charities Act 2005;

- an educational scholarship;

- a student loan under the Student Loan Scheme Act 1992;

- a grant for the payment of expenses relating to medical treatment or a funeral;

- a payment under an insurance contract, other than a payment for a loss of income;

- compensation for a loss other than a loss of income;

- lump sum compensation under the Accident Compensation Act 2001;

- a monetary benefit under the Social Security Act 1964 that is exempt income;

- a pension or allowance under the War Pensions Act 1954 that is exempt income;

- a payment that is exempt income under section CW 33(1)(c), (e), or (f) (allowances and benefits);

- an amount that is declared not to be income for the purposes of the Social Security Act 1964 by a regulation under section 132 of that Act;

- an amount included in the family scheme income of the person under another section; and

- an amount expressly excluded from the family scheme income of the person under another section.

Given there are separate rules including company income in closely held situations in family scheme income, company drawings are not counted under this category.

A threshold of $5,000 year has been introduced to exclude small payments received in a year. If the value of payments exceeds $5,000 for the income year, the whole amount is included in a person's family scheme income.