AIL and associated persons remedial

2012 amendment to legislation relating to the approved issuer levy, definition of associated persons and trusts.

In 2009 a change was made to the associated persons definition. This had the unintended consequence of making some bond issuers and bond holders associated persons when they were only associated through the use of a bond trust.

This meant that bond issuers were required to pay non-resident withholding tax (NRWT) on interest payments to non-resident bond-holders. Prior to the 2009 changes, they were able to pay the approved issuer levy which applies at a lower rate than NRWT.

Key features

Section RF 12(1)(a)(ii) has been amended so that a zero rate of NRWT is still available in cases when the approved issuer and the non-resident are associated only due to the use of a trust which has been established for the principal purpose of protecting and enforcing the rights which the beneficiaries of a trust have under the registered security.

Note that if the non-resident is also associated with the issuer for another reason (for example if the non-resident owns 50% of the shares in the issuer) they are not eligible for a zero rate of NRWT.

Application date

The amendments apply for the 2010-11 and later income years. This is consistent with the date on which the new associated persons definition in subpart YB began to apply.

Detailed analysis

Section RF 12(2) provides a zero rate of NRWT if the conditions in section RF 12(1) are met.

Section RF 12(1)(a) sets out three requirements, for the zero rate of NRWT. These are that that AIL has been paid, that the bond-holder and bond issuer are not associated and that the interest is not jointly derived by a resident.

The Act amends section RF 12(1)(a)(ii) so that, if the approved issuer and the non-resident person who receives the interest are associated only due to the use of a trust which has been established for the principal purpose of protecting and enforcing the rights which the beneficiaries of a trust have under a debt security, then a zero rate of NRWT is still available if AIL is paid.

Example

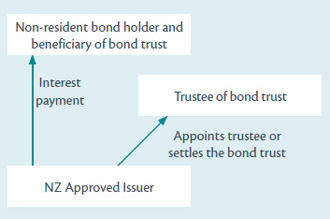

In the above example the non-resident bond holder could be associated in several ways with the New Zealand approved issuer because of the bond trust.

The non-resident bond holder is a beneficiary of the bond trust so would be associated with the trustee of the bond trust under section YB 6.

If the approved issuer appointed the trustee of the bond trust they would be associated with the bond trust under section YB 11. Alternatively, in some cases the approved issuer could potentially qualify as a settlor of the trust and be associated with the trustee under section YB 8. In either case the tri-partite rule in section YB 14 would come into play and deem the approved issuer and the non-resident bond holder to be associated with each other because they are each associated with the trustee of the trust.

If the approved issuer and the non-resident bond holder are associated only due to one of the above circumstances, that is they are associated only because of the existence of the bond trust, then they will still be able to get a zero rate of NRWT in cases where AIL was paid (and the interest was not jointly derived by a resident).

If the non-resident bond holder was associated for a reason that is not due to the existence of the bond trust, such as holding 50% of the shares in the approved issuer, then they would not qualify for a zero rate of NRWT under section RF 12.