Applying FIF calculation methods to indirect interests in foreign companies

2012 Order in Council covers applying FIF calculation methods to indirect interests in foreign companies.

Sections EX 50(6), EX 50(7) and EX 50(7B)

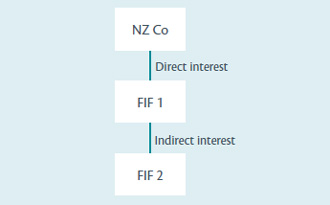

In many cases, a person will own shares in a foreign company which itself owns shares in a second foreign company.

If the shares represent an interest in a CFC, the person is always required to "look-through" that CFC to determine if the second foreign company is a CFC (in which case the investor would apply the CFC rules), or an attributing interest in a FIF (for which the investor would apply a FIF calculation method).

However if the first company is not a CFC, the requirement to "look-through" to the second foreign company depends on whether the person uses the attributable FIF income method for that company and whether an exception to the "look-through" rule applies.

If the fair dividend rate, cost, comparative value or deemed rate of return method is used for a FIF, any foreign shares held by that FIF are not subject to the FIF rules (as in most cases the FIF rules only apply to direct interests in foreign companies. (See section EX 29(2).)

If the attributable FIF income method is used for a foreign company, the default position is to "look-through" this foreign company and apply the FIF rules to any shares that the company holds in other foreign companies. This is achieved by the formula in sections EX 50(6) and (7) and is consistent with the previous rules that applied under the branch equivalent method.

Example

NZ Co uses the attributable FIF income method for FIF 1. NZ Co will generally have to "look-through" their direct interest in FIF 1 and apply a FIF calculation method to their indirect interest in FIF 2.

However, there are several important exceptions to the "look-through" rule in section EX 50(6). These are listed in section EX 50(7B).

Consider a person with an interest in a FIF for which they use the attributable FIF income method. The FIF holds shares in a second foreign company. The person will need to consider if any of the exceptions in section EX 50(7B) apply. If, so they will not need to apply the FIF rules to the second foreign company.

One case where the FIF rules do not apply is when the person's indirect interest in the second foreign company would satisfy the requirements of the section EX 35 exemption for foreign companies that are resident and subject to tax in Australia (see section EX 50(7B)(c)). For example, this condition could be met when a person owns 20% of a US company that owns 50% of an Australian company (a 10% indirect income interest).

Another case is when the person can demonstrate that the second foreign company is able to apply and pass the active business test (see section EX 50(7B)(a)(i)). Note that the second foreign company would have to satisfy the requirements for applying the attributable FIF income method and applying the active business test.

Alternatively, a person will not need to apply a FIF attribution method to a second-tier company if that company has been included in the same test group as another FIF which has applied and passed the active business test when that test is applied on a test group basis (see section EX 50(7B)(a)(ii)). For the FIF and the second foreign company to be part of the same FIF test group the FIF would have to have a more than 50% voting interest in the second foreign company as well as meet several other requirements (see the previous section on the "Requirements for applying the active business test to a FIF test group").

In cases where a FIF has less than a 50% voting interest in a second foreign company, the person will not be able to include the FIF and the second foreign company in the same FIF test group. However, section EX 50(7B) allows the person to apply a modified version of the active business test to the FIF, which includes additional amounts relating to the FIF's shareholdings in other foreign companies. If the FIF passes both the ordinary active business test and the modified test, then the person will not need to attribute FIF income from any foreign companies whose amounts have been included in the modified test.

The FIF must first pass the active business test, excluding these additional amounts. It then performs the accounting-based active test in section EX 21E a second time, this time including the additional amounts that are reported in the FIF's accounts and that relate to the FIF's non-controlling interests in other foreign companies. More specifically, for the second test, the following amounts are included in the "added passive" and "reported revenue" items:

- Amounts which are recognised in the FIF's profit or loss accounts under the equity method in accordance with New Zealand Equivalent to International Accounting Standard 28 (NZIAS 28) or an equivalent IFRSE, or an equivalent US GAAP standard or principle. These amounts should show up in the accounts as the share of the associate's profit.

- Amounts which are recognised in the FIF's profit or loss accounts under proportionate consolidation in accordance with NZIAS 31 or an equivalent IFRSE, or an equivalent US GAAP standard or principle. These standards may apply when the FIF has income from a joint venture investment.

- Any dividends and net fair value changes are recorded under NZIAS 39 or an equivalent IFRSE, or equivalent US GAAP standard or principle. Note that because the definition of NZIAS 39 includes an equivalent standard issued in its place, this reference will include NZIFRS 9 when this standard replaces NZIAS 39. Note also that, when a taxpayer includes a dividend as part of the "added passive" item, this dividend cannot also be included in the "removed passive" item. (Normally, most dividends can be included in the removed passive item and therefore ignored for the purpose of the active business test.) This is achieved by section EX 50(4B)(l).

The above amounts will be net amounts (so they could be negative). The active business test usually only considers gross amounts.

Example

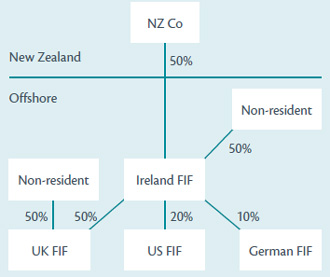

NZ Co invests into a 50/50 joint venture in Ireland (Ireland FIF) which holds 50% of the shares in a UK FIF, 20% of the shares in a US FIF and 10% of the shares in a German FIF.

The Ireland FIF has $1,000 of sales income and $20 of interest income and so has a result of 2% after applying the formula in section EX 21E(5). This means the Ireland FIF passes the active business test as an independent company. As a consequence, NZ Co does not attribute income from the Ireland FIF.

| Ireland FIF accounts | |

|---|---|

| Income | |

| Sales | 1,000 |

| Less cost of goods sold | 800 |

| Profit | 200 |

| Other income | |

| Interest | 20 |

| Active business test | |

| Reported Passive | 20 |

| Added Passive | 0 |

| Total Passive | 20 |

| Total Revenue | 1,000 |

| % Total Passive to Total Revenue | 2.00 |

NZ Co must now determine whether it needs to apply FIF calculation methods with respect to its indirect shareholdings in the UK FIF, US FIF and German FIF.

It does this by performing the active business test a second time, but this time it adds the amounts that appear in the Ireland FIF's accounts that relate to profits from the UK FIF, the US FIF and the German FIF.

| Ireland FIF accounts | UK FIF | US FIF | German FIF | ||

|---|---|---|---|---|---|

| Ireland FIF's shareholding | 50% | 20% | 10% | ||

| Sales | 1,000 | ||||

| Profit | 70 | -100 | 100 | ||

| Interest | 20 | - | |||

| Share of associates profit (calculated under the equity method | 15 | 35 | -20 | ||

| Change in net fair value of investments | 8 | 8 | |||

| Dividend received | 2 | 2 | |||

| Reported Passive Added Passive | 20 25 | ||||

| Total Passive | 45 | ||||

| Total Revenue | 1,045 | ||||

| % Total Passive to Total Revenue | 4.31 |

The amounts that go into the formula are total passive of $45 and total revenue of $1,045. This results in a passive income to revenue ratio of 4.31%. Because this result is less than 5%, section EX 50(7B)(b) applies and the investor would not apply a FIF calculation method to the UK FIF, the US FIF or the German FIF.

If this result had been 5% or greater, the NZ Co would be required to apply FIF calculation methods in respect of its indirect interests in the UK FIF, the US FIF and the German FIF. This result only applies for the look-through rule in section EX 50(7B). It does not disqualify the Ireland FIF from being an active non-attributing FIF, so NZ Co would not attribute income from the Ireland FIF.

Alternatively, NZ Co could choose to use a different FIF calculation method for the Ireland FIF (other than the attributable FIF income method). This would mean that income would be attributed from the Ireland FIF, but not from the indirect interests in the UK FIF, the US FIF or the German FIF because the look-through rule in section EX 50(7B) would not come into play.