Attributable income

2012 changes to the FIF rules around attributable income.

No income or loss attributable from active FIFs and certain Australian FIFs

Subsections CQ 5(1)(c) and DN 6(1)(c)

No income is attributable from a FIF if it applies the attributable FIF income method and passes the active business test. This is provided for by section CQ 5(1)(c)(xv). An equivalent provision in section DN 6(1)(c)(xv) ensures that no loss is attributable if a loss-making FIF passes the active business test.

Similar provisions in sections CQ 5(1)(c)(v) and DN 6(1)(c)(v) prevent income or loss arising from interests in FIFs that satisfy the requirements of the Australian exemption in section EX 35.

Attributing income under the attributable FIF income method

If a person uses the attributable FIF income method for a FIF, and they are required to attribute income from that FIF (because it fails the active business test), they must apply section EX 50 in conjunction with sections EX 20B to EX 21 to work out their net attributable FIF income or loss from that FIF.

In general, the attribution rules are identical to those that were introduced in 2009 for CFCs. However, the Taxation (International Investment and Remedial Matters) Act 2012 makes some small modifications to the attribution rules which are detailed below.

Dividends

Subsection EX 20B(3)(a)

Section EX 20B(3)(a) mirrors section CW 9(2) by attributing income from CFCs and FIFs which use the attributable FIF income method in respect of those dividends that would be taxable if they were received directly by a New Zealand company. The previous section on the foreign dividend exemption has more detail on how section CW 9(2) operates.

Attributable telecommunications income

Subsection EX 20B(3)(m)(ii)

Subsection EX 20B(3)(m)(ii) of the Income Tax Act 2007 deems certain telecommunications services income to be attributable income to the extent to which the equipment is owned by "the CFC or by another CFC that is associated with the CFC". This subsection has been amended so it also covers situations when a CFC (or a FIF using the attributable FIF income method) is associated with any CFC or FIF. In the absence of this change it would be possible to reduce a foreign company's attributable income by dealing with an associated FIF that is not a CFC.

Exemption for intra-group payments

Sections EX 50(4B)(a), (b) and (c) and EX 50(4C)

Under the existing CFC rules, there is an exemption for interest, rent and royalty payments between associated CFCs so long as both CFCs are in the same jurisdiction and the CFC that makes the payment is a non-attributing active CFC (in other words, it passes the active business test).

A slightly different exemption applies under the attributable FIF income method.

While the CFC rules require the two CFCs to be associated companies, the attributable FIF income method requires both FIFs to be commonly controlled by a group of persons that hold more than 50% voting interests in both companies. This is achieved by section EX 50(4C) in conjunction with sections EX 50(4B)(a) to (c).

Section EX 50(4C)(a) requires the foreign company that makes the payments to be a FIF for which the person uses the attributable FIF income method. It is implicit that the FIF that receives the payments must also be using the attributable FIF income method, otherwise section EX 50(4C) would not apply.

Section EX 50(4C)(b) requires the foreign company that makes the payment to be a company that would be a non-attributing CFC or FIF. When determining whether the CFC or FIF is non-attributing, the exclusions in sections EX 20B(5)(c)(i), EX 20B(7)(c), and EX 20B(12)(a) as modified by section EX 50(4C) are ignored. This is necessary to avoid a circularity problem whereby the status of the paying company cannot be determined, because that company itself needs to apply the same exclusions.

Section EX 50(4C)(ab) requires there to be a group of persons with more than 50% voting rights in both foreign companies.

Section EX 50(4C)(c) requires both foreign companies to be resident and subject to tax in the same jurisdiction.

Examples

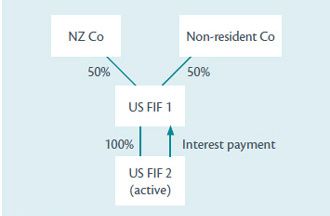

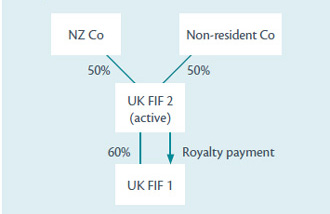

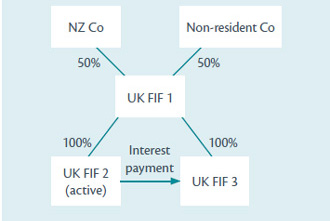

Interest, rent or royalty payments in examples 1, 2 and 3 would be not be attributable income of the FIFs that receive those payments.

Example 1

Example 2

Example 3

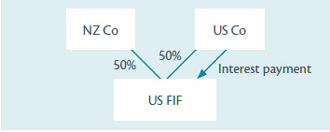

The payment in Example 4 would be attributable income of the US FIF as the person (NZ Co) does not use the attributable FIF income method in relation to the US company that pays the interest, rent or royalty (in fact they do not even have an income interest in the company that makes the payment).

Example 4

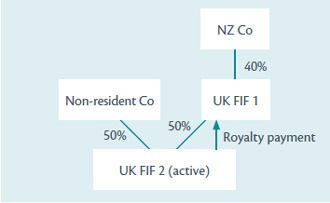

The payment in Example 5 would be attributable income of UK FIF 1 as UK FIF 2 is not controlled by the same persons as UK FIF 1.

Example 5

Rules for deducting certain non-ordinary dividends

Sections EX 20C and EX 20D

Section EX 20C includes rules that limit the deductibility of interest payments. Similar rules limit the deductibility of payments made in respect of fixed rate foreign equity or deductible foreign equity.

These rules have been modified to reflect the fact that such payments may now be deductible when paid by a FIF for which the person uses the attributable FIF income method.

Whether section EX 20C provides a deduction for a fixed-rate foreign dividend or a deductible foreign dividend depends on the following principles:

- A deduction is generally provided when the recipient could face New Zealand tax on the dividend. This occurs when the dividend is paid to a New Zealand company, a CFC or a FIF that uses the attributable FIF income method (see section EX 20C(6)(a)(ii)).

- However, the deduction is limited, based on the payer's ratio of passive to total assets (for example, if the paying CFC or FIF has 100% passive assets they will be entitled to a full deduction. If the paying CFC or FIF has 50% passive assets, they will only be able to claim half the deduction).

- An on-lending concession is provided which allows a full deduction when the dividend is paid to an associated CFC or to an associated FIF for which the person uses the attributable FIF income method (see section EX 20C(6)(c)(i) and (7)(b)(i)).

Sections EX 20D and EX 20E restrict interest deductions if some CFCs are excessively debt-funded relative to other CFCs in the group. More specifically, if the CFC has a debt-to-asset ratio determined under section EX 20D(4) of more than 0.75, and also has a relative debt-asset ratio determined under section EX 20E of more than 1.10, a portion of their interest deductions is non-deductible. The portion is determined by the formula in section EX 20C(8).

For the purposes of working out these ratios, fixed-rate foreign equity and deductible foreign equity issued by the CFC or FIF to New Zealand residents, CFCs or FIFs for which the attributable FIF income method is used, count towards the CFC or FIF's total debt.