"Associated persons" definition - tripartite test

2013 legislative amendment prevents overreach of the tripartite test by treating a limited partnership as a company for the purposes of the test.

Section YB 14 of the Income Tax Act 2007

The amendment to section YB 14 of the Income Tax Act 2007 prevents overreach of the tripartite test by treating a limited partnership as a company for the purposes of the tripartite test.

Background

The tripartite test in section YB 14 associates two persons if they are each associated with the same third person under different associated persons tests. The tripartite test acts as an important buttress to the other associated persons tests and makes the associated persons definition as a whole more difficult to circumvent.

The requirement that the two persons have to be associated with the same third person under different associated persons tests in section YB 14(1)(b) ensures that the tripartite test does not apply more widely than is necessary to protect the tax base.

Previously, there was an overreach of the tripartite test in relation to a limited partnership.

Key features

New section YB 14(4) treats a limited partnership as a company for the purposes of applying the tripartite test in section YB 14(1). This remedial amendment is intended to prevent the overreach of the tripartite test in relation to limited partnerships.

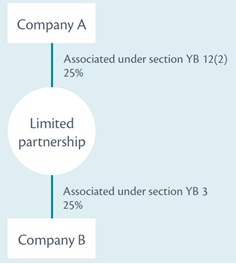

| Example 1 | |

|---|---|

| Company A holds 25% of a limited partnership, which holds 25% of Company B.

Under the associated persons definition, Company A is associated with the limited partnership under the limited partnership test in section YB 12(2). The limited partnership is associated with Company B under the company and person other than a company test in section YB 3. Previously, the tripartite test applied to associate Company A and Company B (the limited partnership being the common third person). This was the case even though Company A only had an effective 6.25% interest in Company B (by multiplying Company A's 25% interest in the limited partnership by the limited partnership's 25% interest in Company B). Company A and Company B have no other common shareholders. New section YB 14(4) treats a limited partnership as a company for the purposes of applying the tripartite test. As a consequence, Company A and Company B are now not associated under the tripartite test. | |

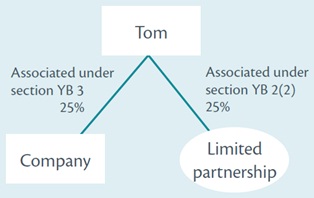

| Example 2 | |

|---|---|

| Tom holds 25% of a company and 25% of a limited partnership.

Under the associated persons definitions, Tom is associated with the company under the company and person other than a company test in section YB 3. Tom is also associated with the limited partnership under the limited partnership test in section YB 12(2). Previously, the tripartite test applied to associate the company and the limited partnership (Tom being the common third person). This was the case even though Tom, the common owner in the entities, only held a 25% interest in each entity. The company and the limited partnership are now not associated under the tripartite test. This is because under that test, Tom is associated with the company and the limited partnership (which is treated as a company under section YB 14(4)) under the same associated persons test - the company and person other than a company test in section YB 3. | |

Application date

The application date for this amendment is the same as the date when the current associated persons definition came into force.

The general application date for the amendment (excluding those applying for the land provisions) is the 2010-11 income year.

For the purposes of the land provisions (as defined in section YA 1) other than section CB 11 (which relates to disposal of land within 10 years of completing improvements), the amendment applies to land acquired on or after 6 October 2009.

For the purpose of section CB 11, the amendment applies to land on which improvements began on or after 6 October 2009.