GST treatment of certain emissions unit transactions

Amendment to the GST Act covers treatment of certain emissions unit transactions. Applies from 1 Jul 2010.

Section 10(2)(b) and (2B) of the Goods and Services Tax Act 1985

Amendments are made to enable fully taxable parties to agree the value of emissions units supplied in the future when those emissions units are part of the consideration for another taxable supply.

Background

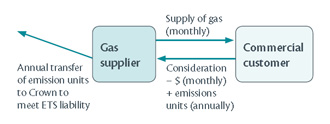

A number of businesses with liabilities under the Emissions Trading Scheme (ETS) require their large commercial customers to pay for supplies received with a combination of monetary consideration and the agreement to transfer emissions units in the future.

This is illustrated by the diagram below, which uses the example of the supply of gas:

The Goods and Services Tax Act 1985 values a supply by reference to the market value of the consideration paid for it. This would be straightforward if the emissions units were supplied straight away - the value of the supply of gas would be the cash paid and the value of the emissions units. Under previous law, valuation difficulties arose here because the emissions units are to be supplied in the future - potentially as long as 15 months after invoicing for the supply of gas. The value of emissions units fluctuates in accordance with supply and demand so future prices are unpredictable.

Key features

The parties to a transaction can agree the value of goods and services supplied between them where that transaction involves the right to receive emissions units in the future, and some other key tests are met.

Application date

The amendments apply from 1 July 2010.

Detailed analysis

Section 10(2) is amended to add a new provision which in certain circumstances overrides the default position that where a barter transaction takes place, the value of a supply is the open market value of the consideration for that supply. Under the amendment, the supplier and the recipient can agree any value for the supply when all of the following tests are met:

- the supply is of a right to receive a specified number of emissions units at a future date;

- the supplier and the recipient are not associated;

- each of the supplier and the recipient, in the transaction of which the supply is a part;

- makes a taxable supply; and

- acquires a taxable supply for use in making taxable supplies.