GST treatment of supplies of telecommunications services

OS 06/01 sets out IR's operational practice and guidelines for the GST treatment of cross-border supplies of telecommunications services.

This statement also appears in Tax Information Bulletin Vol 18, No 3 (April 2006).

Introduction

- This Operational Statement (OS) sets out Inland Revenue's operational practice and provides guidelines as to the Goods and Services Tax (GST) treatment of cross-border supplies of telecommunications services under the Goods and Services Tax Act 1985 (the GST Act). In particular, it provides operational guidelines on the ordering rule that determines the person who initiates a supply of telecommunications services.

Application

- This OS sets out Inland Revenue's position on the application of the law in this area.

- Unless specified otherwise, all legislative references in this OS refer to the GST Act.

Background

Background to the GST legislation in the context of telecommunications services

- Before 2003, the general "place of supply" rule and zero-rating provisions in the GST Act were not easily applied to cross-border supplies of telecommunications services. This led to uncertainty as to when supplies of telecommunications services were subject to GST in New Zealand.

- Besides the need for certainty, an important GST principle in the context of telecommunications services is neutrality. A different GST treatment between resident and non-resident telecommunications suppliers would be undesirable because it would distort the behaviour of consumers and suppliers of telecommunications services. For example, if GST did not apply to imported telecommunications services, New Zealand consumers would be encouraged to substitute these services for the services supplied by local telecommunications suppliers.

- The New Zealand Government published a discussion document, GST and Imported Services - a challenge in an electronic commerce environment in June 2001. The discussion document considered the GST treatment of telecommunications services.

- The GST treatment of cross-border telecommunications services was clarified in the Taxation (Maori Organisations, Taxpayer Compliance and Miscellaneous Provisions) Act 2003 by inserting into the GST Act specific "place of supply" rules, zero-rating provisions and definitions relating to the context of telecommunications services.

Legislation

- The relevant legislative provisions in the GST Act are:

- the definitions of "content", "non-resident", "resident", "telecommunications services" and "telecommunications supplier" in section 2, and

- sections 8, 8A, 11A, 11AB and 51.

- For the purpose of the definitions of "non-resident" and "resident" in the GST Act, sections OE 1 and OE 2 of the Income Tax Act 2004 (the ITA 2004) are also relevant.

Discussion

"Telecommunications services" for GST purposes

- It is important to distinguish "telecommunications services" from other services. As discussed later, "telecommunications services" are subject to specific "place of supply" and zero-rating rules for GST purposes. Suppliers of telecommunications services are also subject to a specific GST registration exception (see section 51(1)(e)).

- The term "Telecommunications services" is defined in section 2(1):

"Telecommunications services" means the transmission, emission or reception, and the transfer or assignment of the right to use capacity for the transmission, emission, or reception, of signals, writing, images, sounds or information of any kind by wire cable, radio, optical or other electromagnetic system, or by a similar technical system, and includes access to global information networks but does not include the content of the telecommunication.

- Based on this definition, examples of "telecommunications services" include a telephone call, accessing the internet via an internet service provider, a video conference, or a facility such as a leased lines agreement, website hosting or server hosting.

- "Telecommunications services" exclude the content of the telecommunication. The term "content" is further defined in section 2(1):

"Content" means the signals, writing, images, sounds or information of any kind that are transmitted, emitted or received by a telecommunications service.

- Examples of telecommunications content include information obtained via an 0800 toll free number and images downloaded from an internet server. These do not form part of the "telecommunications services".

Telecommunications supplier

- The term "telecommunications supplier" is defined in section 2(1):

"Telecommunications supplier" means a person whose principal activity is the supply of telecommunications services.

- Examples of telecommunications suppliers include landline and mobile phone service providers and internet service providers.

Residency rules for GST purposes

- The residency rules for GST purposes are relevant to the determination of the GST treatment of cross-border supplies of telecommunications services. As discussed later, the application of the general "place of supply" rule in section 8(2) and the specific GST rules on supplies of telecommunications services depends upon the GST residency of the supplier.

- Section 2 defines the terms "resident" and "non-resident" for GST purposes. These terms make cross-references to sections OE 1 and OE 2 of the ITA 2004, so that a taxpayer resident in New Zealand for income tax purposes under sections OE 1 and OE 2 of the ITA 2004 will also be resident in New Zealand for GST purposes.

- Section OE 2 applies to companies. The discussion in this OS is limited to the GST residency rules that apply to companies, as most suppliers of telecommunications services are companies, rather than natural persons.

- In addition to section OE 2, a company may be treated as a resident in New Zealand if paragraph (a) of the proviso to the definition of "resident" in section 2 applies. The company is deemed by paragraph (a) of the proviso to be resident in New Zealand to the extent that:

- the company carries on a taxable activity or any other activity in New Zealand, and

- it has a fixed or permanent place in New Zealand which relates to that taxable activity or other activity.

- the company carries on a taxable activity or any other activity in New Zealand, and

- Paragraph (a) of the proviso contemplates apportionment. A company can be a resident to the extent that paragraph (a) of the proviso applies. The company can also be a non-resident to the extent that paragraph (a) of the proviso does not apply (but only if it is not otherwise a New Zealand resident under section OE 1 or OE 2 of the ITA 2004).

GST treatment of supplies of telecommunications services made by a resident in New Zealand

- Section 8(2) states the general "place of supply" rule for GST purposes. That legislative provision treats services (including telecommunications services) provided by a person, who is a New Zealand resident, as services supplied in New Zealand.

- If the person, being a New Zealand resident, is GST-registered and makes supplies in the course or furtherance of their taxable activity, the supplies are prima facie subject to GST at 12.5% under section 8(1).

- However, telecommunications services can be zero-rated under section 11AB if they are made to:

- an overseas telecommunications supplier (see section 11AB(a)), or

- a person who is not an overseas telecommunications supplier for a telecommunications service that is initiated outside New Zealand (see section 11AB(b)).

- an overseas telecommunications supplier (see section 11AB(a)), or

- The term "overseas telecommunications supplier" is not defined in the GST Act. The term refers to a telecommunications supplier who is a non-resident in New Zealand for GST purposes.

- It should be noted that under section 11A(5), other GST zero-rating rules do not apply to supplies of telecommunications services.

GST treatment of supplies of telecommunications services made by a non-resident in New Zealand

- The general "place of supply" rule in section 8(2) treats supplies of telecommunications services made by a person, who is non-resident in New Zealand, as services supplied outside New Zealand. Prima facie, these supplies are not subject to GST under section 8(1).

- However, section 8(6) overrides the general "place of supply" rule under section 8(2). The provision treats telecommunications services as being supplied in New Zealand if:

- the supplier is a non-resident of New Zealand, and

- a person, who is physically in New Zealand, initiates the supply of telecommunications services from a telecommunications supplier.

- the supplier is a non-resident of New Zealand, and

- Section 8(6) applies notwithstanding that the person may initiate the supply of telecommunications services on behalf of another person. Section 8(9) determines the person who initiates the supply of telecommunications services. It also determines whether the specific "place of supply" rule in section 8(6) applies. (Please refer to paragraphs 34 to 39 for details.) Section 8(6) is subject to a number of exceptions however (as set out in paragraph 33 below).

- Where the specific "place of supply" rule in section 8(6) applies (i.e. the telecommunications services are initiated in New Zealand under section 8(9)), the telecommunications services supplied by a non-resident supplier are treated as being supplied in New Zealand and are therefore subject to GST at 12.5% under section 8(1) if the non-resident supplier is registered or required to be registered for GST.

- Where a non-resident telecommunications supplier makes supplies of telecommunications services that are treated as supplied in New Zealand and the total value of supplies exceed $40,000 (GST exclusive) in any 12-month period, the supplier must register for GST under section 51.

- However, GST registration is not required, where the $40,000 registration threshold is exceeded solely as a result of making supplies of telecommunications services to non-residents, who are physically in New Zealand, or to persons whose physical location cannot be determined, but whose billing address (excluding post office boxes) is in New Zealand. For example, non-resident telecommunications companies do not have to register for GST in New Zealand solely because they make supplies to non-resident customers who use "roaming" services while staying in New Zealand (see example 11 in this OS).

Exceptions to the application of the specific "place of supply" rule section 8(6)

- Where a non-resident telecommunications supplier makes supplies of telecommunications services, the specific "place of supply" rule in section 8(6) does not apply in the following three situations:

- supplies between telecommunications suppliers: where a non-resident telecommunications supplier makes a supply of telecommunications services to another telecommunications supplier, section 8(7) provides that the supply is not treated as being made in New Zealand under section 8(6). Accordingly, the supply will not be subject to GST. This result applies even if the supply is initiated in New Zealand.

- telecommunications services supplied by a non-resident to a GST-registered person for the purposes of carrying on that registered person's taxable activity: section 8(8) provides that unless the supplier and the recipient of the supply agree otherwise, the services are treated as being supplied outside New Zealand and will not be subject to GST.

- subject always to the rules in paragraphs (a) and (b) above, where it is impractical for the telecommunications supplier to determine the physical location of the initiator due to the type of service or class of customer: section 8A(1) provides that the services must be treated as being supplied in New Zealand if the person's address for receiving invoices from the telecommunications supplier (excluding a post office box) is in New Zealand.

- supplies between telecommunications suppliers: where a non-resident telecommunications supplier makes a supply of telecommunications services to another telecommunications supplier, section 8(7) provides that the supply is not treated as being made in New Zealand under section 8(6). Accordingly, the supply will not be subject to GST. This result applies even if the supply is initiated in New Zealand.

The ordering rule under section 8(9)

- Determining which party has initiated a supply of telecommunications services is fundamental to the operation of the specific GST rules on telecommunications services. It determines whether a supply made by a non-resident telecommunications supplier is treated as being made in New Zealand under section 8(6). It is also relevant for determining whether a supply of telecommunications services can be zero-rated pursuant to section 11AB(b).

- Section 8(9) sets out the ordering rule to determine the person who initiates a supply of telecommunications services:

For the purposes of subsection (6) and section 11AB, the person who initiates a supply of telecommunications services is the person who-

- Is identified by the supplier of the services as being-

- The person who controls the commencement of the supply:

- The person who pays for the services:

- The person who contracts for the supply; and

- The person who controls the commencement of the supply:

- If more than 1 person satisfies paragraph (a), is the person who appears highest on the list in that paragraph.

- Is identified by the supplier of the services as being-

- In order to apply the ordering rule, it is first necessary to determine what is being supplied. Is it a telecommunications service and what is the telecommunications service?

- Once the supply has been identified as a telecommunications service, the next step is for the telecommunications supplier to determine who initiates the supply. Where the service supplied is a discrete voice, data or other telecommunications transmission, a telecommunications supplier may be able to identify a person who controls commencement by undertaking an action that clearly enables the service to be provided such as dialling the telephone number or accepting a reverse charges call. It is likely that this person also pays for the service and has organised for the service to be provided.

- However, in other situations, there may be no clear action or person that can be identified by the telecommunications supplier as controlling commencement. This may occur particularly where the service supplied is the facility to make or receive voice, data or other telecommunications transmissions (which may also include such transmissions).

- Where the telecommunications supplier cannot identify the person who controls the commencement, the initiator of the supply will be the person who pays for the telecommunications services. The contractual arrangements between the parties need to be considered when it is not possible to ascertain the payer for the telecommunications services. In this situation, the person who contracts for a supply of telecommunications services is the person who initiates the supply.

GST treatment of regional telecommunications services arrangements

- Regional telecommunications services arrangements may exist where a telecommunications supplier supplies telecommunications services to a company, which has branches and/or subsidiaries in a number of countries. The company receives only one invoice covering all branches and/or subsidiaries to which telecommunications services are supplied. The company then recharges the cost of telecommunications services to its branches and/or subsidiaries. (Please note that a recharge is a separate supply for the purpose of the "reverse charge" provisions and is discussed below in paragraph 104.)

- The telecommunications services supplied under the regional telecommunications services arrangements will be subject to the specific "place of supply" and zero-rating rules in sections 8, 11A and 11AB as discussed above.

- As a consequence of the regional telecommunications services arrangements, the company may supply recharge/cost allocation services to its branches and/or subsidiaries. The cost allocation services are not "telecommunications services".

- However, the recharge/cost allocation services may be subject to the reverse charge mechanism under section 8(4B). This is because under section 8(4C), a recharge/cost allocation from a non-resident to a resident is treated as a supply of services that satisfy section 8(4B)(a) and (c).

- The GST treatment of supplies of telecommunications services under regional billing arrangements is explained further in example 8 of this OS.

Operational Practice

- Inland Revenue's operational practice in relation to the application of the ordering rule and the GST rules on telecommunications services is illustrated in the examples below.

Examples

Example 1: international toll call from New Zealand

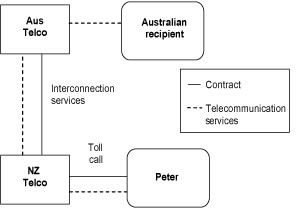

- Peter, a New Zealand resident, uses his New Zealand home telephone to call a friend in Australia. Peter is charged by his telecommunications supplier, NZ Telco, for making the call. NZ Telco (a New Zealand resident company) routes the call to the international destination, via Aus Telco's network. Aus Telco charges NZ Telco an interconnection fee.

[ ]

International toll call - supply by NZ Telco to Peter

- The supply is an international toll call and is supplied by NZ Telco to Peter. As NZ Telco is a New Zealand resident, section 8(2) deems this to be a supply made in New Zealand. The supply is subject to GST at 12.5% under section 8(1) and cannot be zero-rated under section 11AB because:

- There is no supply of telecommunications services to an overseas telecommunications supplier.

- The supply of telecommunications services is not initiated outside New Zealand. Peter controls the commencement of the supply by dialling the international telephone number in New Zealand (being the action which clearly enables the service to be provided) and therefore initiates the supply under section 8(9).

- There is no supply of telecommunications services to an overseas telecommunications supplier.

Interconnection services - supply by Aus Telco to NZ Telco

- Aus Telco is a non-resident for GST purposes. Therefore, the interconnection services supplied by Aus Telco to NZ Telco are deemed to be a supply outside New Zealand under section 8(2). As interconnection services fall within the definition of "telecommunications services", the additional place of supply rules in sections 8(3), (4) and (4B) do not apply (see section 8(5)). Furthermore, the specific telecommunications "place of supply" rule in section 8(6) does not apply, as both Aus Telco and NZ Telco are telecommunications suppliers (see section 8(7)). Therefore, the supply of interconnection services is not subject to GST in New Zealand.

Example 2: using the internet

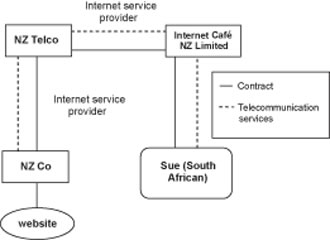

- Sue is a South African resident. She is on holiday in New Zealand and uses a computer in an internet café ($2 per hour) to download rugby results from a New Zealand website (NZ Co). The internet service provider (ISP) for the New Zealand website is NZ Telco, a New Zealand resident company. NZ Telco charges NZ Co a hosting fee and also charges Internet Café NZ Limited a monthly internet connection fee.

[ ]

Internet access - supply by Internet Cafe; NZ Limited to Sue

- The supply is hourly access to the internet (a global information network) and, accordingly, is a telecommunications service under section 2(1). Internet Café NZ Limited is a New Zealand resident company. Therefore, under section 8(2), the supply of telecommunications services is deemed to be made in New Zealand.

- The supply is subject to GST at 12.5% under section 8(1) and cannot be zero-rated under section 11AB(b) because the supply of telecommunications services is not initiated outside New Zealand. Sue controls the commencement of the supply by connecting to and accessing the internet (being the actions which clearly enable the service to be supplied). Therefore, Sue initiates the supply in New Zealand under section 8(9).

ISP service - supply by NZ Telco to Internet Café NZ Limited

- An ISP service, being the provision of access to the internet, falls within the definition of "telecommunications services" in section 2(1). As NZ Telco is a New Zealand resident company, the service is deemed to be supplied in New Zealand under section 8(2).

- The supply is subject to GST at 12.5% under section 8(1). It cannot be zero-rated under section 11AB because it is not a supply to an overseas telecommunications supplier and the supply is not initiated outside New Zealand. Both NZ Telco as the provider of the service and Internet Café NZ Limited as the recipient could be considered to control commencement of the supply. Accordingly, there is no clear action or person that can be identified by NZ Telco as controlling commencement. Therefore, Internet Café NZ Limited is the initiator as they pay for the service.

ISP hosting service - supply by NZ Telco to NZ Co

- The supply is the provision of an ISP hosting service and is supplied by NZ Telco to NZ Co. This is a telecommunications service, being access to a global telecommunications network. NZ Co is charged a hosting fee.

- As NZ Telco is a New Zealand resident, the ISP hosting service is deemed to be supplied in New Zealand under section 8(2).

- The supply is not zero-rated under section 11AB because NZ Co is not an overseas telecommunications supplier and the supply is initiated in New Zealand. Both NZ Telco as the provider of the service and NZ Co as the recipient could be considered to control commencement of the supply. Accordingly, there is no clear action or person that can be identified by NZ Telco as controlling commencement. Therefore, NZ Co is the initiator as they pay for the service.

Example 3: call to a person using an international roaming service

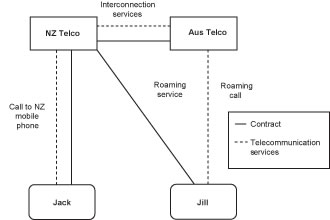

- Jack, a New Zealand resident, uses his New Zealand home telephone to call Jill's mobile phone. Jill is a New Zealand resident and is on holiday in Australia. As her mobile phone has international roaming capability, she answers the call in Australia. Jack is charged by his telecommunications supplier, NZ Telco, for making a call to a New Zealand mobile phone number. The call is routed by NZ Telco to Aus Telco and then to Jill's mobile phone. NZ Telco charges Jill a roaming charge for delivering the call to her in a foreign destination. Aus Telco charges NZ Telco an interconnection fee.

[ ]

Mobile phone call - supply by NZ Telco to Jack (New Zealand resident)

- The supply by NZ Telco to Jack is a call to a New Zealand mobile phone. As NZ Telco is a New Zealand resident, section 8(2) deems this supply to be made in New Zealand.

- The supply is subject to GST at 12.5% under section 8(1). It cannot be zero-rated under section 11AB because it is not a supply to an overseas telecommunications supplier and the supply is not initiated outside New Zealand. Jack controls the commencement of the supply when he dials the mobile phone number. The supply is therefore initiated in New Zealand under section 8(9).

Roaming service - supply by NZ Telco to Jill (New Zealand resident roaming in Australia)

- The supply is an international roaming service (connecting Jack's call to Jill) and is supplied by NZ Telco to Jill. As NZ Telco is a New Zealand resident, section 8(2) deems this supply to be made in New Zealand.

- The supply is zero-rated under section 11AB(b). This is because Jill, who is not an overseas telecommunications supplier, initiates the supply of a telecommunications service (international roaming) outside New Zealand. Although Jill does not make the mobile phone call, she controls commencement of the international roaming service. This is through answering the call in Australia, having taken her mobile phone to Australia and connected to the overseas network (being actions which enable Jack's call to be connected to Jill.)

- It is important to note in applying the ordering rule under section 8(9), that contractual arrangements do not determine who controls the commencement of the supply. The contractual arrangements are relevant to the determination of who initiates the supply only when it is not clear as to who controls the commencement of the supply and who pays for the telecommunications services.

- In this example, Jill has entered into a contract with NZ Telco in New Zealand. The contract allows international roaming while Jill is overseas. This, however, does not mean that the international roaming service is initiated in New Zealand.

Interconnection services - supply by Aus Telco to NZ Telco

- As Aus Telco is a non-resident, the interconnection services are deemed to be a supply outside New Zealand under section 8(2).

- As interconnection services fall within the definition of "telecommunications services", the additional place of supply rules in sections 8(3), (4) and (4B) do not apply (see section 8(5)). Furthermore, the specific telecommunications "place of supply" rule in section 8(6) does not apply, as both Aus Telco and NZ Telco are telecommunications suppliers (see section 8(7)). Therefore, the supply of interconnection services is not subject to GST in New Zealand.

Example 4: international call-backs

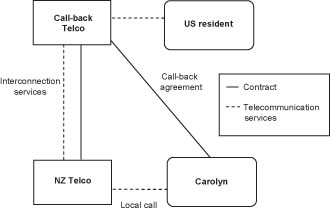

- Carolyn, who is New Zealand resident and not GST-registered, enters into a contract with a non-resident "call-back" telecommunications company (Call-back Telco) to make international telephone calls from New Zealand. Carolyn dials Call-back Telco's New Zealand local number and enters the details of a USA telephone number. Carolyn then hangs up her telephone. The non-resident call-back operator, using favourable international calling rates, places the call to the USA telephone number advised by Carolyn and then calls back Carolyn's original phone number to complete the call circuit between New Zealand and the USA.

[ ]

Interconnection services - supply by NZ Telco to Call-back Telco

- Call-back Telco contracts with NZ Telco to enable it to supply a calling service in New Zealand. Carolyn is not a party to this contract. The supply is the provision of interconnection services by NZ Telco to Call-back Telco. As NZ Telco is a New Zealand resident, section 8(2) deems this supply to be made in New Zealand. However, as it is supplied to an overseas (i.e. non-resident) telecommunications supplier, the service can be zero-rated under section 11AB.

Call-back service - supply by Call-back Telco to Carolyn (a NZ caller)

- The supply is the provision of a call-back service which is supplied by Call-back Telco to Carolyn. As Call-back Telco is a non-resident for GST purposes, section 8(2) deems this supply to be made outside New Zealand.

- As the call-back service falls within the definition of "telecommunications services", the additional place of supply rules in sections 8(3), (4) and (4B) do not apply (see section 8(5)). However, under the specific telecommunications "place of supply" rule in section 8(6), the supply will be deemed to be made in New Zealand if it is initiated by a person in New Zealand.

- Although Call-back Telco dials the USA telephone number, Carolyn controls the commencement of the call-back service. This is through making the original telephone call and providing the USA telephone number (being actions which clearly enable the service to be supplied). Therefore, Carolyn initiates the supply of the call-back service under section 8(9).

- Consequently, section 8(6) applies and the supply of the call-back service is treated as being made in New Zealand. Section 8(8) does not apply because Carolyn is not GST-registered. The supply is not zero-rated under section 11AB because it is not made to an overseas telecommunications supplier or initiated outside New Zealand.

- Therefore, Call-back Telco will be required to register for GST under section 51 and charge GST on the supply of the call-back service, if their supplies exceed the registration threshold of $40,000 (GST exclusive) in a 12-month period.

Example 5: video conference

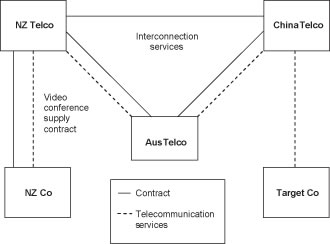

- NZ Co contacts a New Zealand resident telecommunications company (NZ Telco) to arrange a video conference between its sales staff in New Zealand and a potential customer in China (Target Co). NZ Co arranges the video conference for a set time and is the registered contact and chairperson for the video conference. In order to provide the video conferencing service between New Zealand and China, NZ Telco obtains access to a bridge (a facility using interconnection software that is part of the overall telecommunications service) supplied by Aus Telco in Australia. In addition, NZ Telco's video conferencing facilities and China Telco's facilities are used to provide the service. NZ Co's sales staff in New Zealand dials the bridge and the customer in China dials the bridge to start the video conference. NZ Co pays for the video conferencing service (including the related video conferencing facilities).

[ ]

Video conferencing service - supply by NZ Telco to NZ Co

- The supply is the provision of a video conferencing service (including necessary facilities), and is supplied by NZ Telco to NZ Co. As NZ Telco is a New Zealand resident, the service is deemed to be supplied in New Zealand under section 8(2).

- Under section 11AB, the supply will be zero-rated if it is made to an overseas telecommunications supplier or initiated outside New Zealand.

- The video conference service is provided following a number of steps, including:

- negotiation between NZ Co and NZ Telco,

- communication of arrangements for the video conference,

- NZ Co's sales staff dialling the bridge to start the video conference, and

- the customer in China dialling the bridge to start the video conference.

- As both NZ Co and Target Co dial the bridge to start the video conference, there is no clear action or person that can be identified by NZ Telco as controlling commencement. Therefore, NZ Co is the initiator as they pay for the service. The supply cannot be zero-rated under section 11AB(b) and will be subject to GST at 12.5%.

Interconnection services - supplies by Aus Telco and China Telco to NZ Telco

- In respect of the interconnection services from Aus Telco and China Telco to NZ Telco, the suppliers are non-residents. Under section 8(2) both supplies are deemed to occur outside New Zealand.

- Pursuant to section 8(7), the "place of supply" is not altered by section 8(6) as the supplies of interconnection services are made between telecommunications suppliers. The supplies of interconnection services by Aus Telco and China Telco to NZ Telco are not subject to GST.

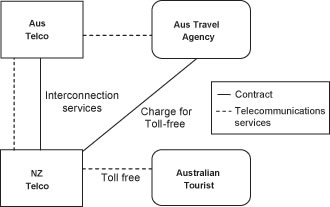

Example 6: toll-free calling service

- An Australian travel agency (Aus Travel Agency) has entered into an agreement with a New Zealand resident telecommunications company (NZ Telco) for a toll-free calling service. The arrangement allows customers of Aus Travel Agency, Australians on holiday in New Zealand, to call the toll-free number and be put through to Aus Travel Agency. Aus Travel Agency pays all charges for this service which may include a charge for setting up the toll-free arrangement, a monthly fee and any additional usage charges.

[ ]

Toll-free service - supply by NZ Telco to Aus Travel Agency

- In setting up and providing the service, NZ Telco is supplying a toll-free calling service to Aus Travel Agency. Under section 8(2), as NZ Telco is a resident, the supply is deemed to occur in New Zealand.

- The toll-free calling service is provided following a number of steps, including:

- negotiation between Aus Travel Agency and NZ Telco,

- allocation of a toll-free number,

- setting up a call-centre, and

- advertising the toll-free number.

- Both Aus Travel Agency's customers and Aus Travel Agency could be considered to control commencement of the toll-free service. Accordingly, there is no clear action or person that can be identified by NZ Telco as controlling commencement. Therefore, it is necessary to determine who pays for the service. In this example, Aus Travel Agency pays for the service and, therefore, also initiates the supply.

- As Aus Travel Agency initiates the supply outside New Zealand, NZ Telco will be able to zero-rate this supply under section 11AB(b).

Interconnection services - charge by Aus Telco to NZ Telco

- The supply of interconnection services by Aus Telco to NZ Telco is deemed to be a supply outside New Zealand under section 8(2) as the supplier is a non-resident. Under section 8(7), as the supply is between telecommunications suppliers, section 8(6) does not apply. Accordingly, the supply by Aus Telco is not subject to GST.

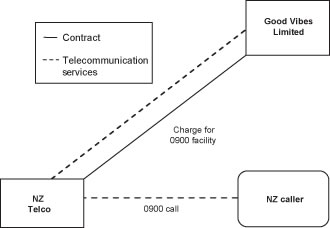

Example 7: 0900 service

- An Australian clairvoyant (Good Vibes Limited) has entered into an agreement with a New Zealand resident telecommunications company (NZ Telco) for an 0900 number service. The service allows New Zealand callers to dial an 0900 number to access a message or speak to a Good Vibes Limited's employee for clairvoyant advice. Good Vibes Limited pays all the charges for this service which may include a charge for setting up the 0900 service, a monthly fee, and any additional usage charges. Good Vibes Limited charges the New Zealand caller, often using NZ Telco as an agent. The New Zealand caller is not registered for GST.

[ ]

0900 service - supply by NZ Telco to Good Vibes Limited

- The supply is the provision of an 0900 service and is supplied by NZ Telco to Good Vibes Limited. Under section 8(2), as NZ Telco is a New Zealand resident, the supply is deemed to be made in New Zealand.

- Under section 11AB, the supply can be zero-rated if it is made to an overseas telecommunications supplier or initiated outside New Zealand.

- The establishment of the 0900 service involves a number of steps, including:

- negotiation between Good Vibes Limited and NZ Telco,

- allocation of an 0900 number,

- setting up a call-centre, and

- advertising the 0900 number.

- In setting up and providing the service, NZ Telco is supplying an 0900 service to Good Vibes Limited. Both Good Vibes Limited's customers and Good Vibes Limited could be considered to control commencement of the supply of the 0900 service. Accordingly, there is no clear action or person that NZ Telco can identify as controlling commencement. Therefore, it is necessary to determine who pays for the service. In this example, Good Vibes Limited pays for the service and therefore, initiates the supply.

- Consequently, as Good Vibes initiates the supply outside New Zealand, NZ Telco will be able to zero-rate this supply under section 11AB(b).

Clairvoyant advice via an 0900 service - charge by Good Vibes Limited to the New Zealand caller (via NZ Telco as agent)

- The 0900 service enables the New Zealand caller to access a message or speak to a Good Vibes Limited employee for clairvoyant advice. Thus, the supply of services is the provision of clairvoyant advice via an 0900 service.

- The clairvoyant advice is "the content of the telecommunications service". This is specifically excluded under the definition of "telecommunications services" in section 2(1). Accordingly, the general "place of supply" rules in the GST Act apply to these services.

- As Good Vibes Limited is a non-resident, the supply is deemed to be made outside New Zealand under section 8(2). As the services are not physically performed by a person in New Zealand, section 8(3)(b) does not apply. Section 8(4) also does not apply as the New Zealand caller is not registered for GST.

- However, the 0900 service supplied by Good Vibes Limited to the New Zealand caller may still be treated as being made in New Zealand and subject to GST if section 8(4B), commonly known as the "reverse charge" mechanism, applies. In the present case, as the New Zealand caller is not currently registered for GST, section 8(4B) will not apply to treat the 0900 service as supplied in New Zealand unless the New Zealand caller's acquisition of the 0900 services causes it to exceed the GST registration threshold.

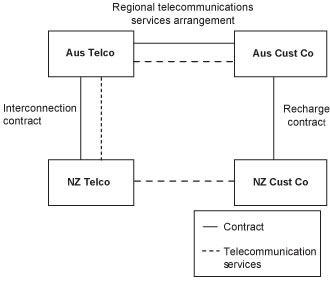

Example 8: regional telecommunications services arrangements

- Aus Telco enters into an arrangement with an Australian customer (Aus Cust Co) for the provision of trans-Tasman telecommunications services. These services typically allow the transmission of voice and data and also include other regional telecommunications services for use by Aus Cust Co and NZ Cust Co (a New Zealand resident member of the Aus Cust Co Group). Under the arrangement, Aus Cust Co is to be billed for the trans-Tasman telecommunications services. Aus Telco subcontracts with a New Zealand resident telecommunications company (NZ Telco) to provide the necessary New Zealand telecommunications services. Aus Cust Co recharges a portion of the services back to its New Zealand resident subsidiary, NZ Cust Co. NZ Cust Co is GST registered. (Please note that a recharge is a separate supply for the purpose of the "reverse charge" provisions and is discussed below in paragraph 104.)

[ ]

Regional telecommunications services - supply by Aus Telco to Aus Cust Co

- The supply is a regional telecommunications service which allows the parties to make or receive voice, data or other telecommunications transmissions. The regional telecommunications service is supplied by Aus Telco to Aus Cust Co. These supplies are treated as being made outside New Zealand under section 8(2), as Aus Telco is a non-resident for GST purposes.

- The additional place of supply rules in sections 8(3), (4) and (4B) do not apply to telecommunications services (see section 8(5)). However, under the specific telecommunications "place of supply" rule in section 8(6), the supply will be deemed to be made in New Zealand if it is initiated by a person in New Zealand.

- The provision of the regional telecommunications service involves a number of steps, including:

- negotiation between Aus Telco to Aus Cust Co

- negotiation between Aus Telco and NZ Telco,

- advising the Aus Cust Co Group of the new regional telecommunications service, and

- telephone calls and transmission of data by Aus Cust Co Group staff.

- Aus Telco must, as always, start by considering whether it can accurately establish who controls commencement of the supply. The regional telecommunications service is organised by Aus Cust Co and also includes the services supplied to the Aus Cust Co group. As such, both Aus Cust Co and staff of Aus Cust Co group could be considered to control commencement of the regional telecommunications service. Accordingly, there is no clear action or party that can be identified by Aus Telco as controlling commencement. Therefore, it is necessary to determine who pays for the regional telecommunications service. In this example, Aus Cust Co pays for the service, and therefore, initiates the supply.

- As Aus Cust Co initiates the supply outside New Zealand, section 8(6) does not apply and the supply is not subject to GST in New Zealand.

Outsourcing services - supply by NZ Telco to Aus Telco

- The supply of the outsourcing services is deemed to be made in New Zealand, as NZ Telco is a New Zealand resident under section 8(2). However, the supply is zero-rated under section 11AB(a) because it is made by a resident telecommunications supplier (NZ Telco) to an overseas telecommunications supplier (Aus Telco).

Recharge agreement - supply by Aus Cust Co to NZ Cust Co

- Aus Cust Co recharges a portion of the services back to NZ Cust Co. The recharge is a cost allocation and not the supply of telecommunications services.

- The reverse charge mechanism in section 8(4B) needs to be considered if the supplies are not physically performed in New Zealand. Pursuant to section 8(4C), a cost allocation is a deemed supply of services that satisfies paragraphs (a) and (c) of section 8(4B).

- If NZ Cust Co makes a total value of taxable supplies less than 95% of all supplies in the last 12 months, section 8(4B) would treat the supply as being made in New Zealand. NZ Cust Co must then pay GST on the supply at the rate of 12.5%.

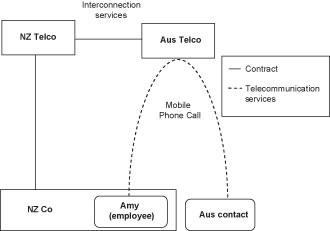

Example 9: international roaming

- A New Zealand resident company (NZ Co) has a mobile phone agreement with a New Zealand telecommunications supplier (NZ Telco). Amy, an employee of NZ Co, uses her work mobile phone outside New Zealand to call an Australian business contact (Aus contact). The call is made using a foreign telecommunications supplier (Aus Telco) who has an interconnection agreement with the NZ Telco.

[ ]

Mobile roaming call - supply by NZ Telco to NZ Co

- The supply is the provision of an international mobile roaming call by NZ Telco to NZ Co. As NZ Telco is a New Zealand resident, the international mobile roaming call service is deemed to be supplied in New Zealand under section 8(2).

- However, the supply is zero-rated under section 11AB(b). Amy, initiates the supply of the international mobile roaming call service under section 8(9). She controls the commencement of the supply in Australia by taking her mobile phone to Australia, connecting to the international network and dialling the Australian telephone number (being actions which clearly enable the service to be supplied.)

- Similarly, if Amy calls someone in New Zealand while staying in Australia, the charge to NZ Co for the call will be zero-rated. Furthermore, if NZ Co is charged in respect of a call by someone to Amy while overseas, the charge will be zero-rated. Amy controls commencement by answering the call in Australia, having taken her mobile phone to Australia and connecting to the international network. These are the actions which enable the service to be supplied.

- Amy controls commencement of the supply notwithstanding that the contractual relationship in respect of the international mobile roaming call service is between NZ Telco and NZ Co.

Interconnection services - supply by Aus Telco to NZ Telco

- Aus Telco is a non-resident for GST purposes. Therefore, the interconnection services supplied by Aus Telco to NZ Telco are deemed to be a supply outside New Zealand under section 8(2).

- As interconnection services fall within the definition of "telecommunications services", the additional place of supply rules in sections 8(3), (4) and (4B) do not apply (see section 8(5)). Furthermore, the specific telecommunications "place of supply" rule in section 8(6) does not apply, as both Aus Telco and NZ Telco are telecommunications suppliers (see section 8(7)). Therefore, the supply of interconnection services is not subject to GST in New Zealand.

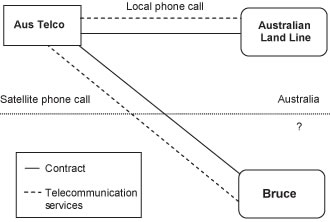

Example 10: satellite telephone

- Aus Telco supplies Bruce, a New Zealand resident, with a satellite phone for use on his private yacht. Bruce uses the satellite phone to call a friend in Australia while on a trans-Tasman crossing. While Aus Telco is able to identify Bruce as the person controlling the commencement and initiating the supply of the satellite telephone call, it is unable to identify his physical location when the service is initiated. The billing address for the satellite phone service is Bruce's home address in Auckland.

[ ]

Satellite phone call - supply by Aus Telco to Bruce

- Under section 8(2), the supply of the satellite phone call is deemed to be made outside New Zealand because Aus Telco is a non-resident.

- However, if Bruce initiated the supply of the satellite phone call while he was physically in New Zealand, section 8(6) would deem the supply to be made in New Zealand.

- In this example, it is impractical for Aus Telco to identify the location at which Bruce initiates the supply of the satellite phone call. Pursuant to section 8A(1), as Bruce's billing address for the service is a physical address in New Zealand (and not just a post office box), the service is treated as being supplied in New Zealand. The supply of the satellite phone call will be subject to New Zealand GST at 12.5% if Aus Telco is registered or required to be registered for GST.

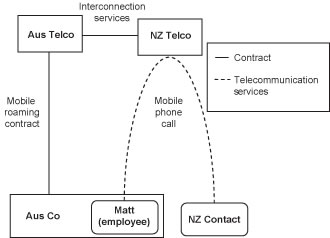

Example 11: international roamer in New Zealand

- An Australian resident company (Aus Co) has a mobile phone agreement with an Australian telecommunications supplier (Aus Telco). Matt, an employee of the Australian company, while on business in New Zealand, uses his work mobile phone to call a New Zealand business contact. He accesses telecommunications services via a New Zealand resident telecommunications supplier (NZ Telco) who has an interconnection agreement with Aus Telco.

[ ]

Mobile roaming service - supply by Aus Telco to Aus Co

- Matt, who is an employee of Aus Co, initiates the supply of the mobile roaming service from a telecommunications supplier when he is physically in New Zealand. Matt controls the commencement of the supply by dialling the New Zealand telephone number after taking his mobile phone to New Zealand and connecting to the New Zealand network (being the actions which clearly enable the service to be provided.) As such, section 8(6) applies and the supply of the mobile roaming service by Aus Telco to Aus Co is treated as being made in New Zealand. Prima facie, the supply is subject to GST at 12.5% under section 8(1). The supply is not zero-rated under section 11AB because it is not made to an overseas telecommunications supplier or initiated outside New Zealand.

- Similarly, if Matt calls someone in Australia while staying in New Zealand, the charge to Aust Co for the call is treated as being made in New Zealand and prima facie subject to GST at 12.5% under section 8(1). Furthermore, if Aus Co is charged in respect of a call by someone to Matt while in New Zealand, the charge will also be treated as being made in New Zealand and prima facie subject to New Zealand GST at 12.5%.

- Normally this would require Aus Telco to register for and charge GST in New Zealand. However, under section 51(1)(e), if the sole reason for exceeding the $40,000 registration threshold is the supply of telecommunications services to non-residents who are physically present in New Zealand, the supplier of these services is not required to register for GST in New Zealand.

- Assuming that Aus Telco has no other taxable activities in New Zealand, they fall under section 51(1)(e) and therefore, no New Zealand GST is required to be charged on the mobile roaming call.

Interconnection services - supply by NZ Telco to Aus Telco

- The supply of interconnection services by NZ Telco to Aus Telco is deemed to be made in New Zealand under section 8(2), as NZ Telco is a New Zealand resident for GST purposes.

- However, the supply would be zero-rated under section 11AB(a) because it involves a supply of telecommunications services by a resident telecommunications supplier (NZ Telco) to an overseas telecommunications supplier (Aus Telco).

This Operational Statement is signed on 14 March 2006.

Graham Tubb

National Manager, Technical Standards