Income Tax Amendment Act (No. 4) 1986 (Apr 1987)

Archived legislative commentary on the Income Tax Amendment Act (No. 4) 1986 from PIB vol 162 Apr 1987.

This commentary item was published in Public Information Bulletin Volume 162, April 1987

More information about Public Information Bulletins.

This Act (which prior to being passed was part of the Taxation Reform Bill (No. 2) 1986) received the Governor-General's assent on 15 December 1986.

The Act gives effect to:

- The changes to the income tax provisions dealing with primary sector taxation first announced in the Economic Statement of 12 December 1985 and set out in the Consultative Document on Primary Sector Taxation. Many of the original proposals were modified as a result of the Report of the Consultative Committee on Primary Sector Taxation.

- The changes to the income tax treatment of Bloodstock Breeders, first announced in the 1986 Budget and outlined in the "Discussion Paper on the Taxation of Bloodstock Breeders". The Act reflects the changes made as a result of the subsequent consultation process.

Other important measures contained in the Amendment Act are:

- New legislation which deals with information requisitions by the Commissioner in respect of offshore payments, as announced in the 1986 Budget.

- New legislation which codifies the income tax treatment of GST.

- The imposition of income tax on the new State-owned Enterprises, the Energy Trading Operators and Harbour Boards, as announced in the Statement on Government Expenditure Reform 1986.

- The restriction on the offset of losses sustained by Special Partnerships, as announced in the 1986 Budget.

- Amendments to provide for the payment of provisional tax in three equal instalments.

- Amendments to provide for the payment of terminal tax by the 11th month of a taxpayer's accounting year and no later than the following 7 February for taxpayers with balance dates falling on or after 31 March.

- The abolition of the one month's grace period after the due date for payment of both provisional tax and terminal tax before a late payment penalty is imposed.

Application

As many of the amendments apply from dates other than from the income year commencing 1 April 1986 particular attention should be given to the application dates of the various sections.

Part I - Introduction/Summary of Provisions

Part I of the Amendment Act gives effect to the income tax changes in respect of:

- Taxation of Livestock.

- Taxation of Bloodstock.

- Development Expenditure.

- Forestry.

- Other Primary Sector Provisions.

The changes in relation to "A", "C", "D" and "E" were first announced in the Economic Statement of 12 December 1985 and outlined in full in the Consultative Document on Primary Sector Taxation, with many of the original proposals being modified as a result of the Report of the Consultative Committee on Primary Sector Taxation. The changes in relation to "B" are a result of the proposals outlined in the "Discussion Paper on the Taxation of Bloodstock Breeders" issued on Budget night and the subsequent consulting process.

A. Taxation of Livestock

Section 3 inserts new definitions relating to livestock in section 2 of the Income Tax Act.

Section 5 outlines the different sections under which a taxpayer may elect to value livestock. The section also provides limitations for livestock valuation elections in respect of certain partnerships.

Section 6 outlines the method by which taxpayers can elect to adopt the various schemes for valuing livestock. The section provides that notification of a change in valuation methods must be given to the Commissioner at least 12 months prior to the income year in which the change is to take effect.

Section 7 outlines the new trading stock scheme for livestock valuation and outlines the circumstances in which a write-down to standard values must be spread over three income years.

Section 8 inserts new sections in the Income Tax Act which set out how livestock will be valued under the new schemes and how the income write-off and income spread is to be calculated:

| Section 86A | details the new herd scheme. |

| Section 86B | details the cost option. |

| Section 86C | details the high-priced livestock scheme |

| Section 86D | provides for the determination of average market values for livestock. |

| Section 86E | provides for the write-off of part of the livestock revaluation income. |

| Section 86F | provides for the spread of the balance of revaluation income. |

| Section 86G | provides for a number of transitional provisions. |

Section 9 deals with minor consequential amendments.

The changes outlined below apply only to "specified livestock", namely:

- Sheep

- Cattle

- Deer

- Goats

- Pigs

Any livestock other than of these livestock types will continue to be subject to the existing valuation provisions. That is, taxpayers can adopt cost price, market value, replacement price or an approved standard value in respect of such livestock.

Taxpayers owning "specified livestock" are required to revalue their livestock on hand at the end of the 1987 income year and all (in most cases) of the income resulting from the revaluation will be written-off for tax purposes.

Any revaluation income not written-off is eligible to be spread forward over 5 income years.

Taxpayers who cease farming after 12 December 1985 and prior to the end of the 1987 income year are also eligible for an income write-off.

For the 1988 and future income years taxpayers have the choice of 3 schemes for valuing livestock. They are -

- the trading stock scheme

- the herd scheme

- the cost option

A separate valuation scheme applies to high-priced purchased livestock.

Election

Taxpayers may elect which scheme they want each type of livestock to be valued under. That is, they may elect that their sheep be valued under the Trading Stock Scheme and that their cattle be valued under the Herd Scheme. Where a taxpayer makes no election in respect of a particular livestock type they will be valued under the Trading Stock Scheme.

Announcement of Standard Values

The Governor-General will, by Order in Council, declare an average market value each income year in respect of each class of specified livestock. Those values will be used for the purposes of valuing livestock under the trading stock scheme and herd scheme.

Trading Stock Scheme

Under the trading stock scheme livestock will be valued at 70 percent of an average of the market values declared for the previous three years. Under this scheme the value of livestock will fluctuate from year to year according to movements in the market value. Any increase from year to year will be taxable and any decreases tax deductible.

Herd Scheme

Under the herd scheme livestock will be valued at the declared market value for the income year. Under this scheme any increases in value from year to year will not be taxable at any stage (i.e. effectively an inflation-proofing of livestock). Conversely, any reductions in value between income years will not be tax deductible at any stage.

Immature livestock (e.g. ewe hoggets) or livestock kept only for meat production (e.g. steers) are not able to be valued under the herd scheme.

Cost Option

Under the cost option livestock will be valued, at the taxpayer's option, at either its cost, its market value or the price for which it can be replaced. Taxpayers electing to value livestock at cost will be required to keep detailed records of stock movements and returns so that an accurate cost can be determined.

Under all three schemes all income from sales of livestock will be taxable and the cost of all purchases deductible. The new schemes simply alter the method of determining the opening and closing values of livestock.

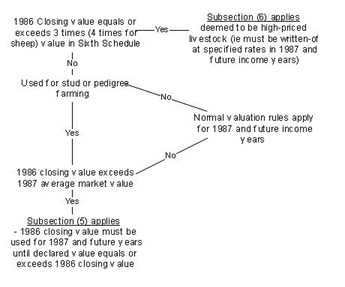

High Priced Livestock

High-priced purchased livestock will be subject to a separate valuation regime. "High-priced livestock" are defined as livestock that are purchased for not less than 3 times (or, for sheep, 4 times) the average market value declared for the income year prior to the year in which they were purchased.

The cost of high-priced livestock will be written-off at specified rates over the expected economic life of the animal. The specified rates are as follows:

| % of cost price | |

|---|---|

| Sheep | 25 |

| Cattle | 20 |

| Stags | 20 |

| Deer (other than stags) | 15 |

| Goats | 20 |

| Pigs | 33 1/3 |

Immature high-priced livestock purchases must be valued at purchase price until they reach 2 years of age, or in relation to pigs, 1 year of age. After that time the annual write-down may commence.

B. Bloodstock

This Amendment Act introduces new provisions into the Tax Act to govern the tax treatment that is to apply to thoroughbred and standardbred horses for 1988 and future years. With effect from the income year commencing 1 April 1987 new rules will apply in relation to the valuation of bloodstock, the treatment of racing expenses and the treatment of horses raced by a stud. In addition, the legislation introduces a new provision to enable profits on sale of breeding stock or on insurance recoveries to be offset against the cost of the replacement animal. Briefly, the new treatment is as follows.

Valuation of Stock on Hand

For 1988 and future years, bloodstock must be valued at its cost price. The only exception to this rule will be in cases where an accident, birth deformity or infertility reduces the market value of a horse by more than 50 percent. In these cases market value may be used.

The cost of breeding stock may be written-down to $1 over a set period that commences in the year in which the animal is first used by the stud for breeding purposes. For stallions, the write-down takes place over a 5 year period at the rate of 20 percent of cost price per annum. For broodmares the write-down is spread evenly over a period that enables the cost to be reduced to $1 in the year in which the mare attains the age of 14 years. For a broodmare first used by a stud for breeding purposes in the year she attains an age of 12 or more years, the write-down must be spread over a three year period.

Transitional rules have been inserted in the legislation for horses owned by the stud at the end of the 1987 tax year. The value at which these horses are brought into account as stock in hand at the end of that year is deemed to be their cost price at the commencement of the 1988 tax year. For horses which commenced to be used for breeding before the end of the 1987 tax year, the legislation enables their 'cost' as at the commencement of the 1988 tax year to be written-off evenly over the remainder of the 5 year period (for stallions) or over the remainder of the period that would have applied had the broodmare been first used for breeding purposes in the 1988 year.

The new legislation applies equally to those thoroughbred horses that are used in the sport horse breeding industry. This industry will be required to value its thoroughbred horses under the new section 84H, with its other horses being required to be valued at cost price, market value or replacement value under section 86(1A).

Horses Raced by the Stud

For 1988 and future years expenses incurred by a stud in racing a horse will not be allowable as a deduction for tax purposes. An amendment has been made to section 106 to provide that the expenses incurred in preparing a horse for racing, the expenses of racing a horse, and all other racing expenses will not be deductible. The exemption from income tax for stake earnings will continue to apply.

The Amendment Act also introduces a new section 212A to deal with the situation where horses are raced by a breeder other than for business purposes. It treats horses that are incapable of being used for future breeding as being raced as a hobby and all other horses as being raced for business purposes. There is provision in the legislation for breeders who race a horse otherwise than for the reason provided in the legislation to apply to the Commissioner to have that reason recognised for tax purposes. For example, a breeder who races a colt could apply to the Commissioner to recognise that the horse is raced as a hobby rather than for business purposes. The application must be made in writing within the period of one month following the date on which the horse is first prepared for racing by the stud and good reasons will need to be supplied for approval to be granted. Wholesale treatment of stud horses as hobby interests will not be accepted.

Horses treated as being raced for business purposes will remain in the stud accounts at cost price and any sale while racing will be taxable income. Any horse treated as being raced as a hobby will be treated as having been sold by the stud at market value at the time that treatment commences to apply. Any income on the sale of the horse while it is being raced as a hobby will not be taxable. If the breeder decides that the horse should be used as a stud animal when it retires from racing it will be treated as a purchase by the stud at market value.

Transitional provisions contained in the legislation provide that horses held outside the stud accounts in a racing account at the end of the 1987 tax year will be required to remain there for the duration of their racing career. If the horse is subsequently used by the stud for breeding, it will be able to be treated as a purchase by the stud using the same basis of valuation as was previously used on its transfer out of the stud accounts.

Purchases of Replacement Breeding Stock - Sales and Insurance Recoveries

Section 117(2) and (3) enable depreciation recovered on the sale of fixed assets or on insurance recoveries to be offset against the cost of replacement assets. A new section, 212B, will enable similar treatment to apply to profits on sale of breeding stock and to insurance recoveries on the death of, or permanent injury to, such bloodstock. Breeding stock is defined as being:

- in the case of any sales of bloodstock, stock that has previously been used for breeding purposes;

- in the case of any insurance recoveries, bloodstock that has previously been used for breeding purposes or bloodstock that was purchased for breeding purposes.

Where the breeding stock is sold and replacement stock purchased within 6 months after the end of the income year of sale, the profit on sale is not assessable in the year of sale but is instead applied in reduction of the cost price of the replacement animal. Where an insurance recovery is involved, and the replacement animal is purchased within 2 years following the end of the income year in which the loss or damage to the breeding stock occurred, the assessment for the year of recovery will be re-opened to exclude the profit element, and that amount will be applied in reduction of the cost price of the replacement animal. The same conditions as apply for the purposes of section 117(2) and 93) have been incorporated into section 212B.

C. Development Expenditure

SECTIONS 11 and 12: Farming and Forestry Development Expenditure

These sections give effect to the announcement that the current year deduction in respect of farming, aquacultural and forestry development expenditure will be phased-out.

The present deduction for such expenditure is replaced with a depreciation regime which allows depreciation of land improvements to be written-off against assessable income.

The respective rates of depreciation are set out in the Thirteenth Schedule (Third Schedule of Amendment Act).

Forestry development expenditure that is incurred pursuant to a binding contract entered into on or before 12 December 1985 will continue to be fully deductible until the end of the 1997 income year. This ten-year extension applies also to forestry development expenditure in relation to forests planted by 31 December 1986, but only if the land on which the forest is planted was acquired on or before 12 December 1985.

Under the new depreciation regime, instead of claiming the total amount of such development expenditure as a deduction only the percentage of that expenditure specified in the Thirteenth Schedule can be claimed as a deduction. In the next year the same percentage of the diminished value of that expenditure can be claimed as a deduction, in the same manner as plant and machinery is depreciated at present.

When farm or forestry land is sold, the balance of any development expenditure that has not been deducted by the vendor (by way of depreciation) can be deducted by the purchaser on the same basis as the vendor would have deducted the expenditure had he retained the land. In other words, the purchaser takes over the asset at it's [sic] diminished value (the vendor's book value) and continues to claim depreciation each year, at the rate specified, in relation to that asset.

The new treatment outlined will generally apply to all the categories of farming and forestry expenditure deductible under the existing development expenditure provisions, but in addition will apply to the cost of planting horticultural trees and vines. Any plantings of such trees or vines prior to the commencement of the 1 April 1987 income year will not be eligible for depreciation.

D. Forestry

SECTION 4: Forestry Planting and Maintenance Expenditure

This section gives effect to the announcement that the current year deduction for most forestry planting and maintenance expenditure is to be phased-out so that in the 1992 income year the total amount of such expenditure must be capitalised to a "cost of forest" account and deductible only when income is derived from the forest.

Where such expenditure is incurred pursuant to a binding contract entered into on or before 12 December 1985, that expenditure will continue to be deductible until the end of the 1997 income year. This 10-year extension will apply also to forestry planting and maintenance expenditure in relation to forests planted by 31 December 1986, but only if the land on which the forest is planted was acquired on or before 12 December 1985.

The following categories of expenditure will continue to be deductible in the year in which they are incurred -

- rent, rates, land tax, insurance premiums, administrative overheads or other like expenses.

- weed control (excluding releasing) or pest control or disease control undertaken subsequent to the planting of the forest.

- interest.

- repairs and maintenance on plant and machinery.

- repairs and maintenance on land improvements e.g. roads, fences, dams, etc..

E. Other Primary Sector Provisions

SECTION 13: Interest and Development Expenditure Recovery Provisions (Section 129)

This section gives effect to the announcement that the section 129 "claw-back" provisions will not apply to sales of land used by the taxpayer for the business of farming, agriculture, horticulture, viticulture, aquaculture or forestry, made after 12 December 1985.

The section also amends the "stepping-stone farmer" provision of section 129. Any replacement property purchased will no longer be required to be retained for 10 years in order to exempt the previous sale, notwithstanding that the previous sale may have occurred prior to 12 December 1985.

SECTION 14: Farmers Expenditure on Tree Planting

This section phases-out the deduction in respect of all but the first $7,500 of expenditure incurred by farmers in relation to tree planting.

The present requirement that the trees must be planted for shelter or erosion control purposes has been abolished.

Where such expenditure is incurred pursuant to a binding contract (other than with a relative) entered into on or before 12 December 1985, that expenditure will continue to be deductible until the end of the 1997 income year.

SECTION 15: Losses Incurred In Specified Activities

This section gives effect to the announcement that the $10,000 loss limitation provisions of section 188A will no longer apply to losses incurred in the 1987 or future income years by taxpayers in relation to primary sector specified activities.

Specifically, the exemption will apply to:

- Livestock farming

- Poultry-keeping

- Bee-keeping

- The breeding of horses

- The growing of annual flowers

- Horticulture

Any losses in relation to such activities that were incurred prior to the 1987 income year will continue to be subject to the $10,000 per annum offset of such losses.

F. Other Provisions

Section 17

This section empowers the Commissioner to disallow a deduction claimed by a taxpayer for an offshore payment where:

- the Commissioner gives an information requisition in respect of the offshore payment to the taxpayer (or some other person) and

- the taxpayer (or other person) fails to respond to the requisition within 90 days of the mailing of the requisition.

Where the taxpayer responds to the requisition within the time period, the only evidence admissible in any proceedings under Part III of the Act in relation to questions asked in the requisition concerning the offshore payment is

- evidence provided in the person's response to the requisition if such evidence can be verified by the Commissioner, or

- evidence provided by the taxpayer where the requisition was given to a person other than the taxpayer.

Section 18 - Rates to be fixed by Annual Taxing Act

Section 18 amends section 39 of the Income Tax Act to provide that the rates of income tax need not be annually fixed in specific Acts passed by Parliament for that purpose, but can be fixed by Income Tax Amendment Acts.

Section 19 - Principal Income Earner Rebate

This section amends section 50B of the Income Tax Act by adding a new proviso to restrict the amount of rebate claimed by any taxpayer who received an income tested benefit or specified war pension to the difference between the tax assessed and the PAYE deductions made from the benefit or war pension payments.

Section 20 - Transitional Tax Allowance

Section 20 amends the provisions of the transitional tax allowance which under section 50C of the principal Act is claimable as a tax rebate.

The effect of the amendment is to reduce from 30 to 20 the number of hours a person must be engaged in remunerative work each week to qualify for the transitional tax allowance.

Section 21 - Family Rebate

This section amends section 53C of the Act by adding a new proviso to restrict the amount of family rebate claimed by any taxpayer who received an income-tested benefit or specified war pension to the difference between the tax assessed and the PAYE deductions made from the benefit or war pension payments.

Section 22 - Incomes Wholly Exempt From Income Tax

This section amends section 61 of the principal Act by -

- removing the reference to the "Cook Islands" from subsections (9) and (48) of that section. The reference to "Niue" remains.

- making exempt from income tax Jurors' and Witness' fees (other than expert witnesses fees) paid by the Crown.

Section 23 - Niue Development Projects

This section substitutes a new section 62 in the principal Act and continues the exemption from tax of New Zealand companies deriving income from development projects in Niue.

Section 24 - Items included in Assessable Income

This section amends section 65 of the principal Act by substituting and inserting a new subsection (1B). The purpose of this amendment is to correct a drafting point to make it clear that one-off gratuitous payments made to spouses or relatives of deceased employees are non-taxable.

Section 25 - Retiring Allowances Payable to Employees

This section amends section 68 of the principal Act to enable redundancy payments made to seasonal workers to come within the provisions of the section and therefore receive the concessional tax treatment.

Section 26 - Power to Exempt Expenditure on Account of an Employee

A new section has been introduced allowing the Commissioner to exempt from Income Tax certain amounts which are deemed under section 2 to be expenditure on account of an employee and assessable for income tax.

This exemption only applies where, had the expenditure been discharged by the employee, it would have been deemed to have been incurred in the gaining or producing of assessable income.

Section 27 - Supplementary Depreciation Allowance for Plant and Machinery used in Two and Three Shift Industries

This section amends section 113A of the principal Act to allow the supplementary allowance to be claimed in year one, in addition to years two to five, for qualifying plant and machinery in cases where the first year depreciation allowance cannot be claimed.

Section 28 - Recovery of Depreciation

This section amends section 117 of the principal Act to allow a deduction against depreciation recovered on the disposal of an asset for the costs attributable to the disposal.

Section 29 - Accounting for the Income Tax Implications of GST

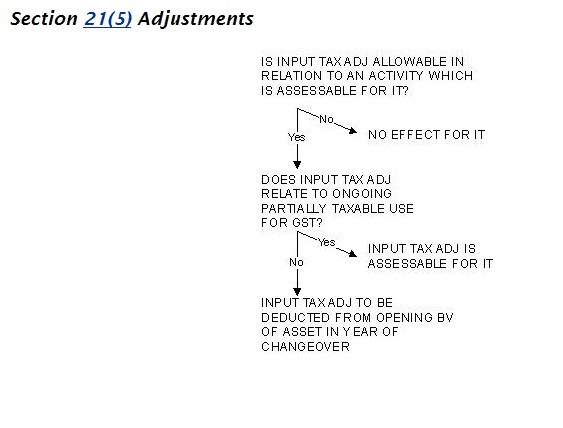

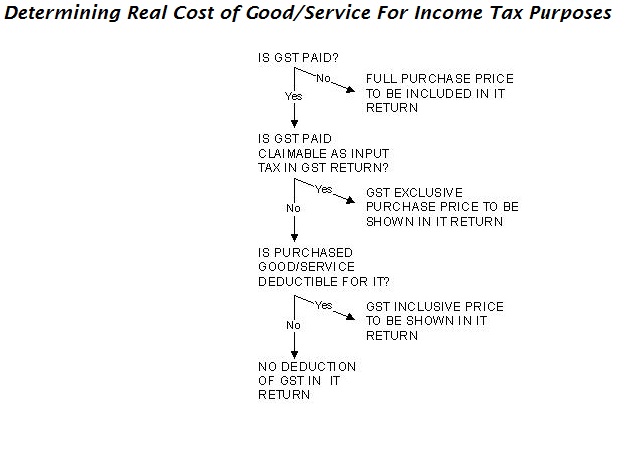

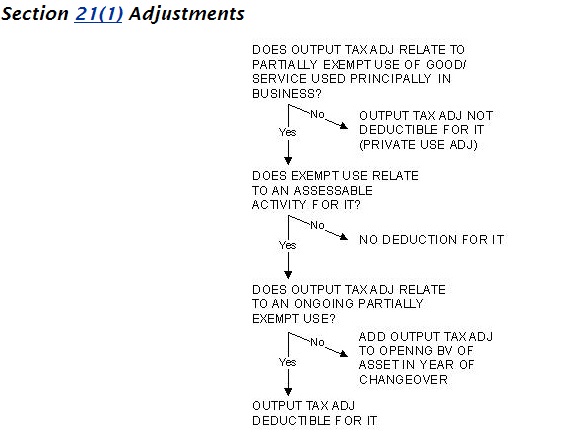

Section 29 adds a new section 140B to the Income Tax Act which codifies the income tax treatment of GST. In general, GST is not taken into account in calculating assessable income except where a deduction of input tax cannot be made by the taxpayer, and except in respect of GST adjustments which arise from the operation of section 21(1), 21(3) and 21(5) of the GST Act.

Section 30 - Retiring Allowances Payable to Employees

This section amends section 152 of the principal Act and is consequential to the amendment made to section 68 - refer to section 25 of the Amendment Act. Section 152 governs the deductibility of retiring allowances and redundancy payments in calculating the assessable income of employers making such payments.

Section 31 - Export-Market Development and Tourist-promotion Incentive

Section 31 amends section 156F of the principal Act to exclude from the export-market development expenditure and tourist-promotion expenditure tax incentives credit, any expenditure incurred on or after 1 December 1986, in relation to the Republic of South Africa. Provision is made for any such expenditure incurred on or after 1 December 1986 under a binding contract entered into on or before 18 August 1986 to qualify under the section.

Section 32 - Export-Market Development Activities Incentive for Self-Employed Taxpayers

Section 32 amends section 156G of the principal Act to exclude export-market development activities (value of time) incurred by a self-employed taxpayer on or after 1 December 1986 in relation to the Republic of South Africa.

It will mean that a self-employed taxpayer cannot claim a tax credit for any export-market development activities performed on or after 1 December 1986, other than any performed pursuant to a binding contract entered into on or before 18 August 1986, where that expenditure is in respect of the promotion of export of goods or services to the Republic of South Africa.

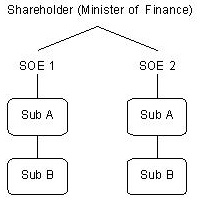

Section 33 - State-owned Enterprises, Energy Trading Operators and Harbour Boards

Section 33 inserts 3 new sections into the Income Tax Act namely -

- Section 197B - State-owned Enterprises

- Section 197C - Energy Trading Operators

- Section 197D - Harbour Boards

This gives effect to the Government's policy that the above organisations are to be subject to income tax as separate entities.

Section 34 - Insurance effected with persons not carrying on business in New Zealand

Section 34 amends section 209 of the principal Act to ensure that any insurance premium or any payment that is reimbursement of an insurance premium paid to any person not carrying on business in New Zealand by -

- any person resident in New Zealand, or

- any person not resident in New Zealand in respect of assets or risks situated in New Zealand,

is subject to tax in terms of section 209.

Section 35 - Special Partnerships

This section provides that where a special partnership sustains a partnership loss in any income year no partner shall be allowed a deduction for any outgoing of the partnership nor shall any partner derive any income of the partnership.

The section shall apply to those special partnerships registered

- on or after 1 August 1986 or

- prior 1 August 1986 where the partnership obtains additional capital from any source on or after 1 August 1986. (Subject to two exceptions explained in the detailed analysis contained in this circular).

Section 36 - Application of Excess Retention Tax

Section 36 amends section 248 of the principal Act to ensure that a New Zealand privately controlled investment company whose income is derived exclusively or principally from the Cook Islands or a company in respect of which an Order in Council has been made under section 62 of the principal Act, is no longer specifically exempt from the application of Part V (Excess Retention Tax) of the Act.

Section 37 - Value of Fringe Benefit

This section substitutes the method of valuing subsidised transport benefits provided to employees of transport operators. As from 1 April 1987 such benefits are to be valued at the greater of 25 percent of the highest priced fare for that class of travel provided or the price payable by the employee to the benefit provided.

Section 38 - Regulations - Prescribed Rate of Interest

This section provides that the prescribed rate of interest used to calculate the value of low interest loan fringe benefits can be set quarterly as opposed to annually. The amended section requires that if the rate is to be changed the regulations changing the rate must be made one month prior to the commencement at the next quarter.

Section 39 - Payment of Provisional Tax by Instalments

Section 39 amends section 385 of the principal Act to provide for the payment of provisional tax in three equal instalments due on the 7th day of the months set out in the new Eighth Schedule introduced by this section. Special transitional arrangements are included for the first year of the new instalment system.

Section 40 - Payment of Terminal Tax

This section provides for:

- the payment of terminal tax on the 11th month of a taxpayer's accounting year for taxpayers with balance dates on or before 31 March. Other taxpayers must pay terminal tax on 7 February each year.

- the abolition of the one month's grace after the due date for payment before a late payment penalty is imposed. This one month's grace is removed in respect of both provisional and terminal tax payments.

The provisions will apply equally in respect of individuals and companies.

Section 41 - Relief from Additional Tax

This section amends section 413(4) of the principal Act which provides for the Minister of Finance to approve cases for remission of tax where the amount exceeds a certain limit.

The amendment increased the limit, which was last reviewed in 1977, from $1,000 to $5,000 and applies from 15 December 1986, the date this Amendment Act received the Governor-General's assent.

Section 42 - Relief in Cases of Serious Hardship

This section amends section 414(5) of the principal Act and increases the limit under which cases have to be referred to the Minister of Finance for remission of tax in cases of serious hardship, from $1,000 to $5,000.

This section will apply from 15 December 1986, the date this Act received the Governor-General's assent.

Section 43 - Publication of Names of Tax Evaders

Section 43 amends section 427 of the principal Act which requires the Commissioner to publish from time to time, in the Gazette, particulars of offenders against the Act.

The section has been amended to ensure:

- the names of persons convicted of aiding, abetting, or inciting tax deduction offences are published in the Gazette; and

- the names of persons convicted of certain offences relating to the Family Support Tax Credit scheme are published in the Gazette; and

- the names of persons who have penal tax imposed under section 374O of the Act (Family Support Tax Credit) are published in the Gazette.

Section 44 - Dates for Payment of Income Tax and Provisional Tax

This section substitutes a new Eighth Schedule into the principal Act. This new Eighth Schedule contains, for each balance date, the months for payment of provisional tax instalments and the month for payment of terminal tax.

Part II - Livestock Valuation Provisions

1. Outline

- 1.1

- The Amendment Act contains a number of provisions which give effect to the new methods for valuing livestock. The relevant sections are:

- Section 3 - Inserts definitions into section 2 of the principal Act.

- Section 5 - Sets out the various sections under which livestock can now be valued.

- Section 6 - Sets out the method by which taxpayers can elect to adopt the various valuation schemes.

- Section 7 - "Trading Stock Scheme/Standard Values Scheme".

- Section 8 - Inserts 8 new sections -

- Section 86A - "Herd Scheme"

- Section 86B - "Cost Option"

- Section 86C - "High-Priced Livestock Scheme"

- Section 86D - Determination of Average Market Values

- Section 86E - Income Write-off

- Section 86F - Income Spread

- Section 86G - Transitional Provisions

- Section 86H - Bloodstock

- Section 9 - Consequential Amendments

- First Schedule - Livestock Classes

- Sixth Schedule - High-Priced Livestock Values

- The provisions relating to bloodstock are covered in Part III of this publication.

- The Amendment Act contains a number of provisions which give effect to the new methods for valuing livestock. The relevant sections are:

- 1.2

- This Part:

- summarises the old valuation scheme:

- explains the new valuation schemes:

- details the transitional provisions that apply in respect of the move from the old to the new schemes.

- This Part:

2. Old Valuation Schemes

- 2.1 Prior to the enactment of the Amendment Act. farmers had two basic options for valuing livestock on hand at the end of any income year. They were:

- either cost price, market selling value or replacement price (the methods by which all other taxpayers must value their trading stock) (Section 84(5)); or

- a standard value (section 86).

- By far the majority of farmers elected to adopt a standard value in respect of their livestock. The advantage for the farmer of the standard values scheme was that, once adopted, those values were fixed for the term of the farming business. For example, a farmer who adopted the $20 standard value for cattle in 1968 could still use that value in 1986 even though the market value for cattle may then be ten times that standard value.

- 2.2 One of the effects of the disparity between the farmer's book value and the market value was that when a substantial number of the farmer's livestock were sold a large income tax liability arose. This led to a number of provisions being enacted which minimised the tax liability in such cases. They are:

-

Section 89 - Allows a farmer to transfer livestock to a child at standard value thereby avoiding any tax liability. Section 93 - Allows the income from the sale of a substantial number of livestock to be spread back over three income years (or forward over 3 income years in the case of retirement from farming). Section 94 - Deferment of income arising from livestock sold as the result of an adverse event (e.g. flood,drought). Section 95 - Deferment from income of livestock sold where a sharemilker or lessee farmer quits his farm and purchases another farm. - As well as the standard values scheme farmers could adopt a nil value for increases in livestock numbers (section 86).

3. New Valuation Scheme

- 3.1

- As part of the Government's moves to restructure the primary sector it was announced in the Economic Statement of 12 December 1985 that the old standard values and nil values scheme would be abolished. They would be replaced with new livestock valuation schemes which would value the trading stock of farmers more in line with the valuation of trading stock in other sectors. Transitional provisions were announced that would minimise the tax consequences of the movement from the old scheme to the new schemes.

- A general overview of the new schemes and the transitional provisions is contained in Part I of this publication.

- A detailed section by section analysis of the legislation relating to the new livestock valuation schemes follows.

- 3.2

- Section 1 - Short Title

- This section provides the title of the Amendment Act and provides that the Amendment Act shall form part of the Income Tax Act 1976.

- 3.3

- Section 2 - Application

- This section provides that, except where otherwise stated, Part I of the Act applies in respect of the income year that commenced on 1 April 1986 and every subsequent income year.

- This means that the livestock provisions introduced in this Amendment Act first apply in the 1987 income year unless any of the relevant provisions have an alternate application date.

- 3.4

- Section 3 - Interpretation

- This section inserts three new definitions into section 2 of the Principal Act.

- "Bloodstock" (refer to Part III of this publication)

- "Herd livestock" in relation to any taxpayer, means any animal (being specified livestock) that is, -

- "(a) In relation to any of the classes of livestock set out in column (3) of the Twelfth Schedule to this Act, an animal of that class; and

- "(b) Owned by that taxpayer primarily for the purposes of production of progeny or wool or milk or velvet or fibre or primarily for any combination of those purposes:

- "'Specified livestock' means any animal that is, in relation to any of the types of livestock set out in the column (1) of the Twelfth Schedule to this Act, an animal of that type:"

Specified Livestock Definition

- Looking at the definition of "specified livestock", it is important to note that the definition relates to "types of livestock".

- Column (1) of the Twelfth Schedule (as inserted by the First Schedule to the Act) lists the following types of livestock:

- Sheep

- Cattle

- Deer

- Goats

- Pigs

- It will be seen from the ensuing analysis of the other relevant sections that the new valuation schemes apply only to the "specified" types of livestock as listed above, with separate rules applying to non-specified livestock types such as fitches and llamas.

- Herd Livestock Definition

- In relation to the definition of "herd livestock" the definition is limited to "specified livestock" with parts (a) and (b) of the definition further limiting the definition.

- Paragraph (a) provides that the following classes of livestock (as set out in column (3) of the Twelfth Schedule) are herd livestock.

Type Herd Livestock Sheep Two-tooth ewes Mixed-age ewes Five-year and six-year ewes Mixed-age wethers Breeding rams Cattle Rising two-year and older heifers (maiden/first calving) Mixed-age cows (second and subsequent calving) Breeding bulls Deer Rising two-year and older hinds (maiden/first fawning) Mixed-age hinds (second and subsequent fawning hinds) Rising two-year and older stags (non-breeding) Breeding stags Goats Rising two-year does * Mixed-age does * Bucks (non-breeding)/wethers over one year Breeding bucks Pigs Breeding sows over one year of age Breeding boars - It has been decided that these two classes should be combined and referred to as "rising two-year and mixed-aged does". It is intended that an amendment to the Twelfth Schedule will be made to incorporate this decision.

- From the above list it can be seen that only "mature" livestock classes can be classified as herd livestock which means, for example, ewe hoggets are not herd livestock. It is not necessary that the livestock be breeding livestock (mixed-age wethers are herd livestock), but they must be of an age where, were they breeding stock, they would be capable of breeding.

- Paragraph (b) of the definition provides that to be herd livestock they must be owned by the taxpayer primarily for the production of any of, or any combination of, the following products:

- progeny (all types)

- wool (sheep)

- milk (dairy cattle/milking goats)

- velvet (deer)

- fibre (goats)

- In effect, this means that only animals farmed principally for the production of meat are not herd livestock. The obvious example of non-herd livestock is steers. They are not capable of producing progeny and do not produce any by-product. Other examples are bulls which are purchased for fattening and resale rather than for the production of progeny, and sheep that are fattening stock only.

- The purpose of the limitations imposed by paragraphs (a) and (b) is to ensure that only animals which are purchased other than primarily for the purposes of trading are eligible for the herd scheme. The rationale of this distinction is explained in detail in the Consultative Document on Primary Sector Taxation. Briefly, the herd scheme recognises that herd livestock are more in the nature of a "machine" than trading stock. They are held for the production of progeny (e.g. lambs) or a by-product (e.g. wool) rather than for the purposes of sale as trading stock. In recognition of this difference a different method of valuation applies to livestock included in the herd scheme. Details of the method of valuation are outlined in full later in this publication.

3.5 Section 5 - Livestock Valuations - Controlling Section

This section amends section 85 of the Principal Act by inserting new subsections (4A) to (4D).

Section 85 sets out the rules for valuing trading stock (including livestock). Before discussing the new subsections it is necessary to summarise the effect of the principal existing subsections.

- Subsection (2) provides that a taxpayer in business must take into account the value of his trading stock at the beginning and end of every income year for the purposes of determining that taxpayer's assessable income. Hobby farmers (farmers who do not meet the "business test" requirements) are therefore not affected by any of the amendments discussed in this publication dealing with the valuation of livestock.

- Subsection (3) provides that the value of opening stock shall be the value of the closing stock for the previous income year.

- Subsection (4) provides that the value of closing stock shall be, at the taxpayer's option, its -

- cost price;

- market value;

- or replacement price.

Additional subsections now inserted -

Subsection (4A) - Valuation of Livestock

- This subsection overrides subsection (4) in relation to the valuation of closing livestock and is the controlling subsection for the various livestock valuation schemes available. Because of the lead-in words "Notwithstanding anything in subsection (4)" the new subsection (4A) is not simply an alternative to subsection 4, but it means that subsection (4) can no longer apply to livestock.

- Note also in the lead-in that subsection (4A) applies to all livestock (not just specified livestock), but the subsection does not apply to "livestock used in dealing operations". Therefore taxpayers buying and selling livestock as a business, rather than farming the livestock, are limited to the valuation options outlined in subsection (4). Livestock dealers were excluded also from the old standard values scheme.

- Each of paragraphs (a) to (e) of subsection (4A) deal with a separate valuation scheme and state how the closing value of livestock included in that scheme is to be determined. The various schemes are explained in detail later in this publication.

- Paragraph (a) provides that all livestock other than specified livestock (e.g. fitches, llamas) are to be valued under the appropriate provisions of section 86 (the "standard values scheme").

- Paragraph (b) provides that, unless the taxpayer elects otherwise, specified livestock are to be valued under the appropriate provisions of section 86 (the "trading stock scheme").

- Paragraph (c) provides that, where the taxpayer so elects (explained later), specified livestock are to be valued under section 86A (the "herd scheme").

- Paragraph (d) provides that, where the taxpayer so elects, specified livestock are to be valued in accordance with section 86B (the "cost option").

- Paragraph (e) provides that "high-priced livestock", as defined in section 86C, are to be valued under that section (the "high-priced livestock scheme").

- Note the effect of paragraph (b). Unless the taxpayer elects otherwise, the trading stock scheme will apply automatically.

- Note also that paragraphs (b) to (d) state they do not apply to high-priced livestock, meaning that such livestock cannot be valued under any scheme other than the "high-priced livestock scheme".

Subsection (4B) - Partnership Restriction

- This new subsection overrides subsection (4) and the new subsection (4A) of section 85 in relation to livestock owned by certain new partnerships. It provides that where a new partnership is formed in any income year and:

- the new partnership owns a type of specified livestock (e.g. cattle): and

- more than 50 percent of the property of the new partnership is owned by partners that own or owned, either in that income year or in the preceding income year, all the property of another partnership; and

- the other partnership owned the same type of specified livestock (i.e. cattle), then the new partnership must value that type of livestock under the same valuation scheme as the other partnership.

The purpose of this provision is to ensure that taxpayers in partnerships cannot change valuation schemes (and thus circumvent the 2 years notice requirement - see commentary under section 6) simply by forming another partnership of principally the same partners.

Example

Husband/wife partnership own sheep which are in the trading stock scheme. They decide it would be more profitable to have their mature sheep in the herd scheme but do not want to give the required two years notice. They dissolve the partnership and form a new partnership with their son, each having a one-third interest. The new partnership owns sheep and cattle.

As more than 50 percent of the property of the new partnership is owned by taxpayers who owned all the property of another partnership, the new partnership must adopt the trading stock scheme in respect of its sheep. As the previous partnership did not own cattle the new partnership can adopt any scheme it wishes in respect of its cattle.

Note the following features of this provision:

- The "other partnership" would need to be dissolved more than one income year prior to the income year in which the new partnership is formed in order for the new partnership to be exempted from this provision;

- It will apply only where all of the partners of the other partnership form part of the new partnership;

- It applies only to the type of specified livestock owned by the other partnership in the income year the new partnership is formed or in the preceding income year.

- It applies regardless of whether the other partnership is dissolved, the only requirement being that the new partnership is formed after the other partnership.

Subsection (4C) - Valuation of Livestock at Date of Death

- This new subsection overrides the other provisions of section 85 to provide that, where a taxpayer dies, the closing value of livestock in the tax return to date of death shall be the value determined for the purposes of the Estate and Gift Duties Act 1968. Generally this is a market value determined by a livestock valuer and is known as the probate value. If the livestock is then transferred to the trustee of the estate who continues the farming business, being a new taxpayer the estate will be subject to the other provisions of section 85 in relation to the valuation of livestock. The livestock would enter the books of the estate at probate value and would be valued at balance date according to the valuation scheme adopted by the estate.

Subsection (4D) - Death of a Partner

- This new subsection provides that, where a partner of a farming partnership dies and the executor carries on the business in partnership with the surviving partner, the partnership livestock will be valued at probate value (market value at date of death) for the purposes of determining the assessable income of the deceased in the return to date of death. It should be noted that any increase or decrease in the value of livestock as a result of the application of this provision is treated as partnership income rather than the income of the deceased partner only. That is, the total partnership livestock is valued at probate value in the partnership accounts to date of death and the deceased's share of the partnership income reflected in those accounts is included in the deceased's return to date of death. However, this adjustment has no net effect on the income of the surviving partner who continues in partnership with the executor, as at the end of that income year the closing livestock will be valued according to the valuation scheme the partnership had previously adopted. The partnership income for that year would then be calculated on the basis of those values rather than probate values.

Subsection (2) - Valuation of Bloodstock

- Subsection (2) of section 5 of the Amendment Act adds another valuation method to section 85(4A) of the principal Act, and applies to bloodstock (refer to Part III of this publication).

Schedule Inserted

Subsection (3) of section 5 of the Amendment Act inserts a Twelfth Schedule into the principal Act. The Twelfth Schedule (First Schedule to the Amendment Act) sets out the various -

- types of livestock (column 1)

- classes of livestock (column 2)

- herd livestock classes (column 3)

As explained earlier in this publication, the types of livestock listed are the types that come within the definition of specified livestock, and the herd livestock classes are the classes eligible to be valued under the herd scheme.

Column (2) of the Twelfth Schedule lists the following various livestock classes for which values will be set each year:

| Type of Livestock | Classes of Livestock |

|---|---|

| Sheep | Ewe hoggets |

| Ram and wether hoggets | |

| Two-tooth ewes | |

| Mixed-age ewes (three-year and four-year old ewes) | |

| Five-year and six-year ewes | |

| Mixed-age wethers | |

| Breeding rams | |

| Cattle | Beef breeds and beef crosses: |

| Rising one-year heifers heifers (maiden/first calving) | |

| Rising two-year and older | |

| Mixed-age cows (second and subsequent calving) | |

| Rising one-year steers and bulls | |

| Rising two-year and older steers and bulls | |

| Breeding bulls | |

| Friesian and related breeds: | |

| Rising one-year heifers | |

| Rising two-year and older heifers (maiden/first calving) | |

| Mixed-age cows (second and subsequent calving) | |

| Rising one-year steers and bulls | |

| Rising two-year and older steers and bulls | |

| Breeding bulls | |

| Jersey and other dairy breeds | |

| Rising one-year heifers | |

| Rising two-year and older heifers (maiden/first calving) | |

| Mixed-age cows (second and subsequent calving) | |

| Rising one-year steer and bulls | |

| Rising two-year and older steers and bulls | |

| Breeding bulls | |

| Deer | Red Deer |

| Rising one-year hinds | |

| Rising two-year and older hinds (maiden/first fawning) | |

| Mixed-age hinds (second and subsequent fawning hinds) | |

| Rising one-year stags | |

| Rising two-year and older stags (non-breeding) | |

| Breeding stags | |

| Wapiti, Elk, and related crossbreeds: | |

| Rising one-year hinds | |

| Rising two-year and older hinds (maiden/first fawning) | |

| Mixed-age hinds (second and subsequent fawning hinds) | |

| Rising one-year stags | |

| Rising two-year and older stags (non-breeding) | |

| Breeding stags | |

| Other breeds: | |

| Rising one-year hinds | |

| Rising two-year and older hinds (maiden/first fawning) | |

| Mixed-age hinds (second and subsequent fawning hinds) | |

| Rising one-year stags | |

| Rising two-year and older stags (non-breeding) | |

| Breeding stags | |

| Goats | Angora and Angora Crosses - Purebred and G1 to G4: |

| Rising one-year does | |

| Mixed-age does | |

| Rising one-year bucks (non-breeding) and wethers | |

| Bucks (non-breeding) and wethers over one year | |

| Breeding bucks | |

| Other fibre and meat-producing goats: | |

| Rising one-year does | |

| Mixed-age does | |

| Rising one-year bucks (non-breeding) and wethers | |

| Bucks (non-breeding) and wethers over one year | |

| Breeding bucks | |

| Milking (dairy) goats: | |

| Rising one-year does | |

| Does over one year | |

| Breeding bucks | |

| Other dairy goats | |

| Pigs | Breeding sows less than one year of age |

| Breeding sows over one year of age | |

| Breeding boars | |

| Weaners less than 10 weeks of age (excluding sucklings) | |

| Growing pigs 10 to 17 weeks of age (porkers/baconers) | |

| Growing pigs over 17 weeks of age (baconers) |

Classification in Tax Returns

- For the 1987 income year and subsequent income years farmers will be required to classify their livestock (for income tax purposes) according to these classes. However, farmers may, if they wish, further break down their livestock schedules although this will not affect the values that will be placed on the livestock. For example, a sheep farmer may wish to show three-year and four-year old ewes as separate categories, but both categories will have the same value for income tax purposes (the value announced for mixed-age ewes).

- Note that in the preceding list of livestock classes there is a lesser number of categories and classes for goats than shown in the Twelfth Schedule. This reduction results from a decision to consolidate the angora goat categories and include rising two-year does as mixed-age does. It is intended that the Twelfth Schedule will be amended in the next legislative round to give effect to this decision, although there will be no effect on the livestock values to be announced in respect of the 1987 income year. Each of the classes which are to be amalgamated will simply be given the same value which will be struck on the basis of the average of all those classes.

Application

- Subsection (4) of section 5 of the Amendment Act provides that the section applies from the income year commencing on 1 April 1987 (i.e. the 1988 income year). This means that for the 1987 and prior years the new valuation schemes are not available. However, as discussed later, transitional provisions apply in respect of the 1987 income year.

3.6 Section 6 - Livestock Valuation Elections

- Section 6 of the Amendment Act inserts a new section 85A into the Principal Act which allows a taxpayer to elect to adopt any of the various livestock valuation schemes, and sets out the procedure to be followed when doing so.

- Right of Election

- Subsection (1) is the operative subsection which gives taxpayers the right to elect to adopt a particular valuation scheme.

- "Any taxpayer who is required to take into account the value of any specified livestock ... (exclusive of any high-priced livestock ...) on hand at the end of any income year ..."

- The right of election applies only to taxpayers who are required to take into account the value of closing stock. As discussed earlier in this publication, only taxpayers in business are required to value opening and closing stock. This means that taxpayers not in business (e.g. hobby farmers) do not have the rights of election available under section 85A. Referring back to section 85(4A) (as inserted by section 5 of the Amendment Act), paragraph (b) provides that, where a taxpayer has not made an election in accordance with section 85A, the closing value of that taxpayer's specified livestock is to be determined under section 86 (trading stock scheme). Therefore one of the effects of subsection (1) of section 85A is that the herd scheme and the cost option are not available to taxpayers not in the business of livestock farming.

Election Irrevocable

- "... (which election shall, after the end of the income year in which it is made, be irrevocable) ...."

- The election can be revoked at any time during the income year in which it is made but after that time it cannot be revoked. Any revocation of an election should be given in writing and must be in the hands of the Inland Revenue Department prior to the end of the income year in which the election was received by the Department.

Effect of Election

- Subsection (2) determines what livestock of a taxpayer the election applies to. Paragraph (a) provides that where the election requests that a type of livestock be valued under section 86 (trading stock scheme) or section 86B (cost option), that election shall apply to all livestock of that type owned by that taxpayer other than herd livestock in relation to which the taxpayer has separately elected to have valued under section 86A (herd scheme). For example, if a taxpayer elects to value his sheep under the trading stock scheme all the sheep owned by that taxpayer must be valued under that scheme. However if he has made a separate election to value his "herd livestock" (as defined) in relation to sheep under the herd scheme, then only the remaining classes of sheep would be valued under the trading stock scheme.

- Paragraph (b) states the same requirement in respect of an election to value a type of livestock under the herd scheme. Any election must apply to all "herd livestock" of that type. For example, a taxpayer who owns both dairy and beef cattle cannot elect to adopt the herd scheme in respect of, for example, dairy cattle only. The election would apply to all "herd livestock" that are cattle.

Election Procedure

- Subsection (3) sets out the procedure for the making of an election to adopt a particular livestock valuation scheme. It provides that the notice of election -

- shall be in writing:

- shall state the income year in relation to which it is to first apply:

- shall state the section of the Act (i.e. the scheme) in relation to which it applies.

Time Limits for Election

- Paragraph (d) sets out the time by which the election must be given to the Department.

- Subparagraph (i) relates to the situation where the election first applies in a year in which a taxpayer commences to derive income from a type of livestock which the taxpayer has not owned in either of the two preceding income years. In those situations the notice of election must be filed with the Department by the time in which the taxpayer is required to file the return of income for the year in respect of which the election applies, "or within such further time as the Commissioner, in his discretion, may allow". This means that new farmers or farmers commencing (or recommencing) to farm a particular type of livestock in any year can include their notice of election with the income tax return for that year and the election will apply from that year so long as the return is filed by the due date (which includes any extension of time). Any notice of election made after that time may still be accepted if the Commissioner exercises the discretion given to him to do so. Any decision to allow a late election can only be made on a case by case basis after consideration of the reasons given for the late notice.

- Subparagraph (ii) relates to existing farmers who are not commencing to farm a new type of livestock (i.e., all taxpayers other than those covered by subparagraph (i)). It provides that, where subparagraph (i) does not apply, the notice of election must be given to the Department "prior to the end of the income year that precedes, by one income year and one day," the first day of the income year in which the election is to apply.

Example

- If a taxpayer wishes to adopt the herd scheme for cattle in the 1990 income year, and the taxpayer has owned cattle in one of the two preceding income years, the notice of election must be given to the Department prior to the end of the 1988 income year. If the taxpayer operates a 30 June balance date the notice of election would have to be furnished on or before 30 June 1988. However, if the taxpayer had not previously owned cattle the notice of election could be forwarded with the 1990 income tax return.

- Note that the notice of election can be furnished in any number of years prior to the year to which it first relates. However, as previously outlined, the notice cannot be revoked after the end of the income year in which it is made.

Application Life of Election

- Subsection (4) provides that an election shall continue to apply (as stated by the taxpayer in the notice of election) up until, but not including, the income year in which a subsequent election first applies.

Election by Partnership

- Subsection (5) provides rules for elections by partnerships. Paragraph (a) states that where any specified livestock are owned by two or more persons Jointly, the valuation of that livestock shall not be affected by an election made by one of those persons in relation to livestock owned in that person's own right.

Example

- A farmer owns 200 deer in his own right and 100 in partnership, all of which are valued under the trading stock scheme. If the farmer elects to adopt the herd scheme in respect or the 200 deer the 100 deer owned in partnership are not affected by that election.

- Paragraph (b) provides that partnerships, or any other taxpayers who jointly own livestock, are entitled to make a joint election in respect of that livestock.

Election Must Have Consent Of All Partners

Paragraph (c) provides that the Commissioner can disregard a joint election if he is not satisfied that at the time the election is made, "it is made by all the persons who, at that time, Jointly own the specified livestock". This means every partner of the partnership or every co-owner of livestock under any arrangement must agree to the election. Note that the unanimous agreement must be from the persons who are the owners of the livestock at the time the election is made. Therefore, if subsequent to the election one partner sells his share of the livestock to a new partner the consent of the new partner is not required in order for the election to continue to apply.

The purpose of paragraph (c) is to ensure that one partner of a partnership cannot make an election in respect of partnership livestock without the consent of the other partners. Although subsection (1) of section 85A provides that an election becomes irrevocable after the end of the income year in which it is made, that provision would have no effect if the Commissioner is not satisfied that all partners consented to the election. This unanimous consent requirement will be applied also in relation to a notice asking for a prior notice of election to be revoked. If the Commissioner is not satisfied that the notice of revocation is consented to by all the co-owners then the original election will stand.

Generally, any notice of election in respect of partnership livestock will be accepted by the Department as being made by all the partners unless information is presented to the contrary. This policy will ensure elections by partnerships are not subject to additional compliance requirements but at the same time allows any partner who was not party to the election to apply to the Commissioner to have it disregarded.

Subsection (6) is the normal accounting year provision which provides that references in the new section 85A to an income year will be deemed to refer to an accounting year where the taxpayer has other than a 31 March balance date.

Examples of the effect of Section 85A

From the preceding commentary it can be seen that the only scheme that requires no initial notice of election is the trading stock scheme. New farmers, or farmers who commence to farm a new type of livestock, are required to give notice of the scheme they wish to adopt and if they don't they will automatically be subject to the trading stock scheme. Once any scheme is adopted, including the automatic adoption of the trading stock scheme, an election must be made to adopt any alternative scheme. It is of no consequence what scheme was being applied, and what scheme is being adopted - the election requirements are the same in each case. The following are examples of the effects of section 85A:

Example 1

- New farmer - first year 1990.

- Owns sheep only.

- Wishes to adopt trading stock scheme.

- No election required - trading stock scheme applies automatically.

Example 2

- New farmer - first year 1990.

- Owns sheep and cattle

- Wishes to adopt

- trading stock scheme for sheep

- herd scheme for "herd class" cattle

- trading stock scheme for other cattle

- No election required for sheep or 'non-herd class" cattle.

- Election to adopt herd scheme for herd class cattle to be filed by the time within which the 1990 return of the taxpayer is required to be furnished (taking into account any extension of time given).

- Herd scheme will apply from and including the 1990 income year and until the taxpayer makes a subsequent election to adopt an alternative scheme (i.e. cost option or trading stock scheme).

Example 3

- Existing farmer

- Sheep included in trading stock scheme

- Commences to farm deer in 1991 income year

- Wishes to adopt cost option for deer for 1991 and future years

- Election to adopt cost option for deer to be filed by 1991 return filing date. Provided that, if farmer has owned deer in either of two preceding income years election to be filed by end of 1989 income year.

Example 4

- Existing farmer

- Owns deer which are valued under cost option

- Wishes to adopt herd scheme for herd class deer and trading stock scheme for other

- Election to first apply in 1992 income year.

- Two notices of election required both of which must be filed by end of 1990 income year.

3.7 Section 7 - Standard Value of Livestock

This section repeals the whole of section 86 of the Principal Act, which provided for a standard values system of livestock valuation, and substitutes a new section which:

- introduces a trading stock scheme in respect of specified livestock:

- retains the old standard values scheme in respect of other types of livestock.

Under the trading stock scheme livestock will be valued at a "standard value" which (in effect) will be determined each year by Order in Council.

In relation to livestock that are not specified livestock they also can be valued using a standard value system. However the value will not be revised each year and will be determined by the Commissioner (i.e. the old standard values system continues to apply where appropriate).

Subsection (1) of the replacement section 86 contains two definitions.

- "Deductible Excess" (see commentary under subsection (2) on page 35)

- "Standard Value"

Definition of Standard Value

Paragraph (a) of the definition of "standard value" relates to specified livestock and provides that, in relation to any income year, the "standard value" is to be determined by the following formula.

| VALUE | x | 100 |

| 70 | 3 |

- Value =the sum of

- the average market value declared for that income year for that class of livestock.

- the average market value declared for the previous income year for that class of livestock.

- the average market value declared for the income year immediately preceding that previous income year for that class of livestock.

For example, say the following average market values have been declared in respect of two-tooth ewes:

| 1988 | $20 |

| 1989 | $23 |

| 1990 | $23 |

| Sum | $66 |

The "standard value" of two-tooth ewes for 1990 is calculated as follows:

- $66/3 x 70/100

- = $22 x 70%

- = $15.4

The effect of the formula is to determine a standard value based on 70 percent of a three-year average market value.

If in the above example the 1991 average market value declared for two-tooth ewes was $29 the standard value for that year would be calculated as follows:

| 1988 | $23 |

| 1990 | $23 |

| 1991 | $29 |

| $75 |

| 75 | x | 70 | =$25 x 70% | = $17.50 |

| 30 | 10 |

Note that an average market value will be declared in respect of each of the livestock classes listed in the Twelfth Schedule, and therefore a separate calculation will be required for each of those classes. However, each year when the values are declared two sets of values will be announced in respect of each class of specified livestock:

- the average market value (100%)

- the standard value (70% of 3 year average)

Taxpayers operating the trading stock scheme will then only need to ensure their closing livestock are classified into the correct livestock classes and multiply the number of closing livestock in each class by the appropriate standard value.

Paragraph (b) of the definition of "standard value" provides that, in respect of livestock that are not specified livestock, the standard value is "such value as is agreed to by the Commissioner".

The effect of paragraph (b) is that taxpayers farming livestock other than sheep, cattle, deer, goats or pigs can apply to the Commissioner for a standard value for their livestock which, rather than being adjusted each year according to market changes, will, like the old standard values system, remain as a static standard value. Rather than set national minimal standard values for such types of livestock as fitches and llamas, until the farming of such livestock becomes more established, it is more appropriate that the standard value be set on a taxpayer by taxpayer basis. Such taxpayers who are not already operating a standard value for their "non-specified" livestock but wish to do so, should make application to the Department.

Standard Value for Non-Specified Livestock

Subsection (1A) is the operative subsection for the valuation of "non-specified" livestock. It gives taxpayers the option of valuing such livestock at either

- cost price;

- market value;

- replacement price; or

- standard value.

That is, such taxpayers have the same option available to all other traders with the addition of the option of using a standard value.

Standard Value for Specified Livestock

Subsection (2) is the operative section for the valuation of specified livestock on hand at the end of any income year and in respect of which the taxpayer has elected to value under the trading stock scheme (or has made no election at all and therefore is automatically subject to the trading stock scheme).

Paragraph (a) provides that specified livestock (other than pigs) which are less than 12 weeks of age at the end of the income year shall be valued at 50 percent of the standard value of such livestock for that income year. Paragraph (b) provides that pigs and other types specified livestock which are 12 weeks of age or more at balance date shall be valued at the standard value of such livestock for that income year.

The age distinction ensures that taxpayers who have very young stock on hand at balance date, are not required to value such livestock at values which are set for more mature livestock. Examples of farmers who may have livestock of less than 12 weeks of age on hand at balance date are farmers who have October to December balance dates and town milk supply dairy farmers who have autumn-born calves on hand at a 31 May balance date. The distinction is not required for pigs as there is a separate valuation class for weaners less than 10 weeks of age.

3-Year Write-Down

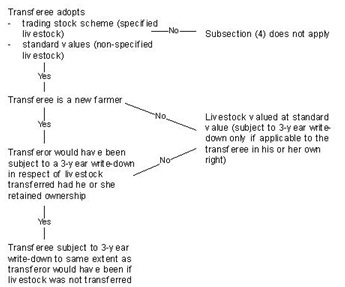

Subsections (2) and (3) provide for a 3-year write-down to standard value in certain circumstances. A similar provision applied under the old standard values scheme and the replacement subsections now modify that provision. Subsection (2) relates to non-specified livestock and subsection (3) to specified livestock with both subsections essentially having the same effect.

The intent of the 3-year write-down is to spread over 3 years the tax deduction that may arise from writing livestock down from the purchase price to standard value.

Example

If a herd of 20 deer is purchased for $1,000 per head and the standard value is $500 the taxpayer would receive a tax deduction of $10,000 calculated as follows:

| Purchase price (deductible) | 20 x $1,000 = | $20,000 |

| Closing value (taxable) | 20 x $ 500 = | $10,000 |

| Deduction | $10,000 |

The effect of subsections (2) and (3) is to ensure that, in certain circumstances, the deduction is spread over 3 income years.

The following commentary explains subsection (3). which applies to specified livestock, however, paragraphs (a), (b) (e) and (f) apply equally to non-specified livestock (subsection (2)). The provision outlines four situations (paragraph (a) to (d)) where the 3-year write-down will be applied.

- (a)

- Where a taxpayer "commences or recommences during an income year to derive income from specified livestock"

- The word "commences" relates to taxpayers who commence farming for the first time.

- The word "recommences" contemplates a situation where a farmer, having derived income from livestock, takes up some other occupation and then at a later date decides to return to farming. Each situation will be considered separately taking into account the facts of the case. However, it is not intended that the 3-year write-down apply where a taxpayer may not derive income from livestock in any one year but the taxpayer's principal occupation does not change from that of a farmer. For example, a farmer decides to reduce the size of his farming operations, sells his farm, takes a 1-year overseas holiday and purchases a small farm unit on his return. The 3-year write-down would not be applied in such situations.

- (b)

- Where a taxpayer -

- "(i) Brings into production or substantially increased production any land for the purpose of deriving income from specified livestock; or

- "(ii) Acquires any additional land for that purpose."

- The term "brings into production" means that the existing farmer develops, and thereby facilitates the farming of, land that he already owns but has not, for some reason such as the existence of native bush or lupin, farmed previously.

- The term "brings into substantially increased production" means that the existing farmer develops, and thereby facilitates substantially more intensive farming of, land that he already owns but has previously farmed only to minimal capacity.

- For Example: -

- Swampland that previously was virtually waste land is drained, ploughed, and sown in grass.

- Land that over a period of years has reverted to scrub is cleared and resown.

- In either of the situations covered in paragraphs (a) and (b) the 3-year write-down applies to purchases of livestock in the year that situation occurs, and purchases in the 3 succeeding income years. However the provision excludes replacement livestock meaning that it applies only to increased livestock numbers in those years.

- For Example: -

- Where a taxpayer -

- (c)

- Where a taxpayer purchases any type of specified livestock which that taxpayer did not own in either of the two preceding income years.

- For example, a sheep farmer who diversifies into deer will be subject to the 3-year write-down in respect of the deer unless the taxpayer owned deer in either of the two preceding income years.

- (d)

- Where a taxpayer values specified livestock under the trading stock scheme and in the previous year that livestock was valued under a different scheme (i.e. herd scheme or cost option).

- For example, where a taxpayer operated the herd scheme for herd class sheep and then elects to have them valued under the trading stock scheme, the 3-year write-down will apply.

- Paragraphs (e) and (f) determine how the 3-year write-down applies in respect of the livestock it applies to as outlined in paragraphs (a) to (d).

- Paragraph (e) provides that the value of such specified livestock to be taken into account at the end of the year of purchase (or where paragraph (d) applies, at the end of the year in which the change of valuation scheme occurs) shall be the value that would otherwise be determined under the section (i.e. the standard value) "increased by an amount equal to the deductible excess in relation to that specified livestock".

- Paragraph (f) provides that the value of that specified livestock to be taken into account at the following income year shall be the standard value for that income year increased by one-half of the deductible excess in relation to that specified livestock.

Definition of "Deductible Excess"

Deductible excess is defined in subsection (1) as,

- (a)(i) In relation to specified livestock purchases:

- (purchase price - standard value) x 2/3

- (a)(ii) In relation to specified livestock that were, in the preceding income year, valued otherwise than under the trading stock scheme:

- (opening value - standard value) x 2/3

- Note that this calculation does not apply to opening livestock that is not on hand at the end of the year (the provision does not apply to replacement stock purchased during that year).

- (b) In relation to livestock other than specified livestock:

- (purchase price - standard value) x 2/3

Examples of 3-year write-down

Example 1