Residential investment property or properties in Australia owned by New Zealand resident - NRWT treatment of interest paid to Australian financial institution

QB 09/05 considers Australian residential investment properties owned by NZ residents and the NRWT treatment of interest paid to Australian financial institutions.

Income Tax Act 2007, sectionYD4(11)(b)(i) - Interest deemed to be derived from New Zealand

Double Taxation Relief (Australia) Order 1995, Schedule, Article 11 - Taxation of interest

All references are to the Income Tax Act 2007, unless otherwise stated.

Background

The Commissioner has been asked to clarify Inland Revenue's position on whether New Zealand residents who borrow money from Australian financial institutions to purchase residential investment properties in Australia are liable for non-resident withholding tax (NRWT) on the interest payable. Articles have appeared in the media regarding this issue over recent years, and there has been uncertainty as to how the domestic legislation and the double tax agreement ("DTA") with Australia apply.

Question

If you own one or more residential investment properties in Australia and you have borrowed money from an Australian financial institution to purchase the property or properties, do you have to pay NRWT on the interest paid to the Australian financial institution?

Different fact situations could arise in respect of this question. This item considers the two most common situations, where:

- you manage the property or properties yourself (situation A); and

- a property manager in Australia manages the property or properties for you (situation B).

Answer

In every case, you will need to consider your own particular fact situation. However, in general terms the following applies.

- If the Australian financial institution to which you pay interest has a branch in New Zealand, in both situations A and B the NRWT rules will not apply to the interest because the financial institution has a fixed establishment in New Zealand.

It is important to note that some Australian financial institutions that operate in New Zealand do so through subsidiaries rather than through branches. The NRWT rules will apply if the Australian financial institution from which you borrowed money in Australia operates in New Zealand only through a subsidiary, i.e. it does not also have a branch in New Zealand. If you borrow from a New Zealand subsidiary of an Australian financial institution no NRWT issues will arise, however, because the interest is not paid to a non-resident. If you wish to check which financial institutions operate as branches in New Zealand go to the Reserve Bank website (www.rbnz.govt.nz/nzbanks).

- If the Australian financial institution to which you pay interest does not have a branch in New Zealand, the outcomes between situations A and B may differ.

Situation A

Under situation A, if you manage the property or properties in Australia from New Zealand, you will have to pay NRWT on the interest whether or not you are in the business of leasing, because you will not have a fixed establishment or a permanent establishment in Australia.

Situation B

Under situation B, if you have more than one residential investment property in Australia, you may have a fixed establishment in Australia. If you do have a fixed establishment in Australia, then you will not have to pay NRWT on the interest.

If you employ a property manager who:

- works as a property manager only for you; and

- has and habitually exercises the authority to enter contracts on your behalf

then you will not have to pay NRWT on the interest because the property manager will be a dependent agent and you will be deemed to have a permanent establishment in Australia. As you borrowed the funds to purchase the property or properties, there is sufficient connection between the permanent establishment and the indebtedness and the DTA will apply.

If the property manager acts for you in the ordinary course of their business and is able to act independently of you, it is likely the property manager will be an independent agent and you will have to pay NRWT on the interest because you will not have a permanent establishment in Australia.

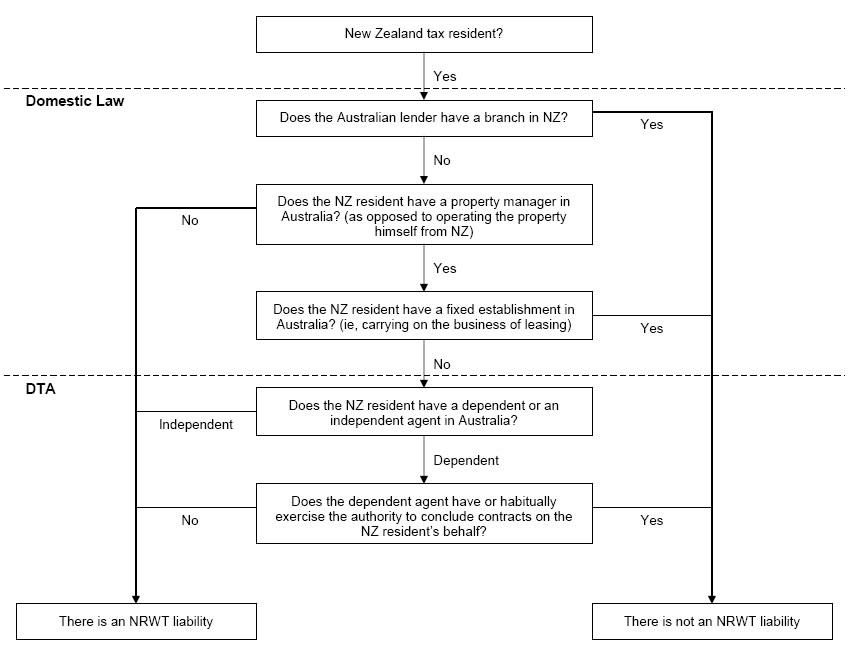

The following flowchart sets out the questions that need to be answered to determine NRWT liability.

For further information on the payment of NRWT, see the two Inland Revenue guides Non-resident withholding tax - payer's guide (IR291) and Non-resident withholding tax reconciliation statement guide (IR67SG).

Transitional residents

If you have become a New Zealand resident since 1 April 2006 and were non-resident here for a continuous period of at least ten years prior to becoming resident, you may qualify as a "transitional resident" under section HR 8 of the Income Tax Act 2007.

If you qualify as a transitional resident and you pay interest in relation to money borrowed when you were not a New Zealand resident, the amount of NRWT you need to withhold is zero.

You are a transitional resident for four years after you become resident in New Zealand. After that four-year period, you must withhold NRWT at the generally applicable rate (currently 10%).

You may make an irrevocable election not to be a transitional resident (see section HR 8(4) of the Income Tax Act 2007).

Penalties and interest

As the person who pays the interest to the Australian financial institution, you are required to withhold the NRWT and pay it to the Commissioner of Inland Revenue. If you fail to do so, use of money interest, late payment penalties and/or shortfall penalties ranging from 20% to 150% could be imposed on you.

For more information on these penalties, see the Inland Revenue guides Late payment and late filing penalties (IR741) and Taxpayer obligations, interest and penalties (IR240).

Approved issuer levy

If you are liable to pay NRWT, for the future you could request approval from Inland Revenue to become an approved issuer and have the loan treated as a registered security. You then pay the approved issuer levy of 2% instead of NRWT at 10%.

You will be granted approved issuer status if you have complied with your requirements under all of the Inland Revenue Acts during the two years before you made your application. You must then register all relevant securities with Inland Revenue. Approved issuer status cannot be backdated.

For further information, see the Inland Revenue guide Approved issuer levy: A guide for payers (IR395).

Analysis

The NRWT rules apply to gross income deemed to be derived from New Zealand that consists of interest (see section RF 2(1) of the Income Tax Act 2007).

Section YD 4(11)(b)(i) of the of the Income Tax Act 2007 provides that interest derived from money lent outside New Zealand to a New Zealand resident is derived from New Zealand unless the resident borrows the money for a business carried on through a fixed establishment outside New Zealand.

However, in three instances NRWT will not be payable. The first two are provided by the domestic legislation. Section RF 2(1) of the Income Tax Act 2007 provides that if the Australian financial institution to which the interest is paid operates through a fixed establishment (i.e. a branch) in New Zealand, the NRWT rules do not apply. Section YD 4(11)(b)(i) of the of the Income Tax Act 2007 provides a further exception that applies if the resident borrows the money for a business carried on through a fixed establishment outside New Zealand. The third instance where NRWT will not be payable is if relief is provided by the DTA. The Australian DTA provides no NRWT will be payable if the New Zealand resident has a permanent establishment in Australia.

Section YD 4(11)(b)(i) applies to you even if you were not a New Zealand resident when you borrowed the money in respect of which you now pay interest from New Zealand. This is because the underlying policy of the provision is that the money used to pay the interest is raised through economic activity in New Zealand - the country in which the payer of the interest now resides - and the person is using public facilities here as a resident, so therefore the interest should be taxed in New Zealand. There is an exception to this general rule though, which is that if you borrowed the money for a business carried on through a fixed establishment outside New Zealand, then the interest is not considered to be sourced in New Zealand. In those circumstances, there is an economic link with the other country through the use of the money in the business carried on there. This is consistent with international treaty practice and is reflected in the DTA provisions discussed in this item.

The transitional residents provisions (referred to above) were introduced to mitigate the effect of the requirement for new New Zealand residents to withhold NRWT in relation to interest paid on money borrowed prior to gaining residency. The provisions were one of the legislative amendments that resulted from the Government Discussion Document Reducing Tax Barriers to International Recruitment to New Zealand published in November 2003.

Terminology

The term "fixed establishment" is used in New Zealand's domestic legislation and is defined in section YA 1 of the Income Tax Act 2007.

The term "permanent establishment" is defined in Article 5 of the DTA.

The two terms are used to describe types of business arrangements and can affect a person's tax position, including whether or not the interest paid to an Australian financial institution is subject to the NRWT rules in New Zealand.

A fixed establishment and a permanent establishment have similar features but a fixed establishment requires a substantial business to be carried on.

Australian financial institution has a branch in New Zealand - situations A and B

If the Australian financial institution to which the interest is paid operates through a fixed establishment (i.e. a branch) in New Zealand, the NRWT rules will not apply to the interest (see section RF 2(1) of the Income Tax Act 2007).

Australian financial institution has no branch in New Zealand - situation A

In terms of the definitions of "fixed establishment" and "permanent establishment", a property or properties managed by a New Zealand resident ("the New Zealand owner") from New Zealand cannot constitute a "fixed place of business". The property (i.e. an apartment or house) is a fixed place but the business of leasing is not carried on through or in that place. All the management of the business takes place in New Zealand. The property itself is not where the business is carried on, rather it is the subject of the business.

If the lessee carries on a business from the rental property, then the property is the lessee's fixed place of business, not the lessor's. The property is not available to the lessor (the New Zealand owner) throughout the period of the lease, so cannot constitute a fixed establishment or a permanent establishment of the New Zealand owner. The business of leasing is carried on elsewhere; that is, on the facts described above, in New Zealand. This means the exception to NRWT provided by the domestic legislation does not apply.

If the New Zealand owner makes regular trips to Australia to carry out management activities in respect of the residential investment property but carries out those activities from a motel or hotel, there is no fixed place of business - a rented room in such circumstances lacks the required permanence to be a "fixed" place of business. In addition, the business of leasing is not limited to the period when the New Zealand owner is operating in Australia, the New Zealand owner is still required to deal with management issues from New Zealand from time to time.

Australian financial institution has no branch in New Zealand - situation B

Fixed establishment

If a fixed establishment exists, section YD 4(11)(b)(i) of the Income Tax Act 2007 will not apply and the interest will not be deemed to be derived from New Zealand. Therefore, the New Zealand owner will not be liable for NRWT on interest paid.

Unlike the permanent establishment definition in the DTA (discussed below), the definition of "fixed establishment" does not include any provisions relating to the use of dependent or independent agents. However, general principles of agency can still be applied. A fixed establishment will be found to exist only if there is a fixed place of business in Australia through which a substantial business is carried on. The residential property is not itself a fixed place in which the business is carried on; rather it is the subject of the business.

If the property manager is working for the New Zealand owner as their agent and has a fixed place in Australia from where that activity takes place, it could be considered that the business of leasing is carried on through that place and that the New Zealand owner has a fixed establishment in Australia.

However, if the New Zealand owner owns only one property that a property manager manages in Australia, a fixed establishment will generally not exist, as the leasing of one property will generally not amount to a "substantial business". However, this will depend on the nature of the single property: for example, if the single property is an apartment block, the leasing of it may be a substantial business.

If the New Zealand owner owns more than one property, whether there is a substantial business (and therefore a fixed establishment) will depend on the particular facts. It is more likely that there will be a substantial business of renting (and hence a fixed establishment) where several properties are rented out.

While the decided cases (such as American Leaf Blending Co Sdn Bhd v Director-General of Inland Revenue [1978] 3 All ER 1185 (PC) and L D Nathan Group Properties Ltd v CIR (1980) 4 NZTC 61,602) do indicate that a business may be more readily found to exist where a rental property or properties is owned by a company (rather than an individual), this will still depend upon the particular circumstances of the case. In addition, for there to be a fixed establishment any such business must be a substantial business.

Permanent establishment

If the property manager is a "dependent agent" (see Article 5(7) of the DTA), a permanent establishment will exist and NRWT will not be payable by the New Zealand owner provided the indebtedness is attributable to the permanent establishment and the interest is deductible in determining the profits of the permanent establishment (see Article 11(5) of the DTA).

A dependent agent of the New Zealand owner is one who is acting solely for the New Zealand owner and who has and habitually exercises the authority to enter contracts on the New Zealand owner's behalf. Such an agency makes it likely that the New Zealand owner will be deemed to have a permanent establishment under the DTA.

If a permanent establishment exists, the DTA requires that there be a connection between the permanent establishment and the indebtedness in respect of which the New Zealand owner pays interest. As the New Zealand owner borrowed the funds to purchase the property or properties, and the property manager works for the New Zealand owner in respect of that property, a sufficient connection exists between the permanent establishment and the indebtedness, so the DTA will apply.

However, if the property manager is acting in the ordinary course of their own business of managing properties and is independent of the New Zealand owner legally and economically, the New Zealand owner will likely not be deemed to have a permanent establishment. This is so because the property manager will be an independent agent and any interest will be subject to NRWT.

If the property manager acts solely for the New Zealand owner in respect of the rental property but also owns another business unrelated to the property management business, the manager could still be considered a dependent agent of the New Zealand owner. The DTA expressly excludes an agent who acts for the New Zealand owner in the ordinary course of the agent's own property management business from being a dependent agent. However, a person who operates a business of their own (which is not related to property management) and who acts for the New Zealand owner outside the ordinary course of that business is able to be considered a dependent agent of the New Zealand owner, if such person has and habitually exercises the authority to enter into contracts on behalf of the New Zealand owner.

Note also that the New Zealand owner is not deemed to have a permanent establishment in Australia under Article 5(4)(c) of the DTA. A residential property does not constitute substantial equipment within the meaning of this provision.

Examples

Example 1

Mr Acorn, a New Zealand resident, purchases a residential property on the Gold Coast in Australia as an investment. To finance the purchase, Mr Acorn takes out a loan with the Commonwealth Bank of Australia that is secured by a mortgage over the residential property.

The Commonwealth Bank of Australia operates in New Zealand through a branch. Consequently, the bank is considered to have a fixed establishment in New Zealand and the NRWT rules will not apply to require Mr Acorn to deduct a withholding payment from the interest paid on the loan to the bank.

Example 2

Mr Smith, a New Zealand resident, purchases a residential property on the Gold Coast in Australia as an investment. To finance the purchase, Mr Smith takes out a loan with the National Australia Bank that is secured by a mortgage over the residential property.

Mr Smith manages the residential property from his home in New Zealand and organises for maintenance work to be carried out as necessary when advised by his tenants. He does not engage the services of any person to act on his behalf in Australia in relation to the property.

National Australia Bank does not operate through a branch in New Zealand, so does not have a fixed establishment here. Mr Smith will have to deduct NRWT from the interest payments that he makes to the bank and pay them to Inland Revenue.

Mr Smith could request Inland Revenue's approval to become an approved issuer and have his mortgage accepted as a registered security. If accepted, Mr Smith would pay a 2% levy in place of NRWT at 10% from the date of acceptance.

Example 3

Ms Worth, a New Zealand resident, purchases 10 apartments in a high-rise apartment tower on the Gold Coast in Australia. She finances the purchases by borrowing funds from National Australia Bank. The loans are secured by mortgages over each of the properties.

Ms Worth does not have time to manage the properties herself from New Zealand, so she engages an acquaintance, Mr Donald, who lives on the Gold Coast, to manage them on her behalf. Mr Donald is retired and undertakes this management role only for Ms Worth. She authorises him to enter into contracts (i.e. tenancy agreements and maintenance contracts) on her behalf, and he does so regularly.

National Australia Bank does not operate through a branch in New Zealand, so does not have a fixed establishment here. However, because Mr Donald has and habitually exercises the authority to enter contracts on behalf of Ms Worth and works as a property manager only for her Mr Donald will be considered a dependent agent. Therefore, Ms Worth will have a permanent establishment in Australia and will not have to deduct NRWT from the interest payments made to National Australia Bank.

Example 4

Mrs King, a New Zealand resident, purchases two apartments in a high-rise apartment tower on the Sunshine Coast in Australia. She finances the purchases by borrowing funds from National Australia Bank. The loans are secured by mortgages over each of the properties.

Mrs King does not have time to manage the properties herself from New Zealand so she engages a professional property manager, Mr James, to manage the properties on her behalf. Mr James runs his own property management business on the Sunshine Coast, catering to non-resident owners of property in his area. Mrs King authorises Mr James to enter into contracts (i.e. tenancy agreements and maintenance contracts) on her behalf, and Mr James does so regularly.

National Australia Bank does not operate through a branch in New Zealand, so does not have a fixed establishment here. Mr James operates his own property management business and acts for Mrs King in the ordinary course of that business. Therefore, Mr James is an independent agent. Mrs King will not have a permanent establishment in Australia. Mrs King will not have a fixed establishment either, because, even if she could be considered to be in business through the activities of her agent, the leasing of two properties does not amount to a substantial business. Mrs King will have to deduct NRWT from the interest paid to the bank and pay the NRWT to Inland Revenue.

Previous legislation

The Commissioner considers that the legal position outlined in this item was the same under the previous income tax legislation.

Other countries

This item, and the underlying analysis, may also apply to the NRWT liability of New Zealand residents who own investment properties in countries other than Australia, where the purchase of such properties has been financed by a loan from a financial institution in that country. The general principles relating to New Zealand's domestic legislation will apply. However, it is important to note that the outcome may differ because the relevant provisions of New Zealand's double tax agreement with that country may not be the same as those considered in this item.