Reduction of shortfall penalties for previous behaviour (June 2006)

SPS 06/03 sets out IR's practice for reducing shortfall penalties for previous behaviour.

This statement also appears in Tax Information Bulletin Vol 18, No 6 (July 2006).

Introduction

- This Standard Practice Statement (SPS) sets out Inland Revenue's practice for reducing shortfall penalties for previous behaviour.

- In particular, this SPS discusses the reduction for previous behaviour of:

- shortfall penalties imposed for evasion under section 141E(1), and

- other shortfall penalties imposed under any of sections 141A to 141D.

- shortfall penalties imposed for evasion under section 141E(1), and

Contents

| Heading | Paragraph number | |

|---|---|---|

| Introduction | 1 to 2 | |

| Contents | 3 | |

| Application | 4 to 11 | |

| Summary | 12 to 18 | |

| Background | 19 to 24 | |

| Legislation | 25 | |

| Discussion | ||

| General | 26 to 29 | |

| Reduction for shortfall penalties for evasion imposed under section 141E(1): | 30 | |

| Disqualifying offence | 31 to 32 | |

| Meaning of when a conviction is entered | 33 to 35 | |

| Tax types | 36 to 37 | |

| Satisfactory behaviour period | 38 to 40 | |

| Disqualifying penalty | 41 to 42 | |

| Impacts of voluntary disclosure in the context of a current penalty for evasion | 43 | |

| Effects of imposing a shortfall penalty for evasion under section 141E(1) | 44 to 45 | |

| Reduction for current penalties imposed under any of sections 141A to 141D | 46 | |

| Disqualifying offence | 47 to 49 | |

| Disqualifying penalty | 50 to 52 | |

| Tax shortfalls arising from a single investigation or voluntary disclosure - section 141FB(5) | 53 to 55 | |

| Standard Practice | 56 to 57 | |

Application

- This SPS sets out Inland Revenue's position on the application of the law in this area.

- The SPS applies to shortfall penalties imposed on or after 21 December 2004.

- This SPS replaces SPS INV 295 Reduction of Shortfall Penalties for Previous Behaviour originally published in Tax Information Bulletin Vol 16, No 3 (April 2004). SPS INV 295 applies to shortfall penalties imposed before 21 December 2004.

- Please refer to the following SPSs:

- INV 251 Voluntary Disclosures,

- INV 260 Notification of a Pending Audit or Investigation,

and the following Interpretation Statements:

- IS0053 Shortfall penalty for not taking reasonable care,

- IS0055 Shortfall penalty - unacceptable interpretation and unacceptable tax position,

- IS0060 Shortfall penalty for gross carelessness, and

- IS0061 Shortfall penalty for taking an abusive tax position,

for further details on Inland Revenue's practice on imposing and reducing shortfall penalties. These statements were published in Tax Information Bulletins and are available on Inland Revenue's website, www.ird.govt.nz. SPS INV 260 has expired, but still generally indicates current practice.

- INV 251 Voluntary Disclosures,

- Unless specified otherwise, all legislative references in this SPS refer to the Tax Administration Act 1994 (TAA).

- For the purpose of this SPS, the term "current penalty" refers to the shortfall penalty for which a previous behaviour reduction under section 141FB is being considered.

- The term "satisfactory behaviour period", as used in this SPS, is not defined in the TAA but refers to the specified period under section 141FB(4) for the purpose of the definitions of "disqualifying offence" (ie an offence under sections 143 and 144) and "disqualifying penalty" (ie where the current penalty is not imposed for evasion under section 141E(1)). The term "satisfactory behaviour period" and the legislative terms "disqualifying offence" and "disqualifying penalty" will be discussed later in the SPS.

- All taxpayers start with a "clean slate" for the purpose of section 141FB. If a taxpayer has had a shortfall penalty imposed or a conviction entered before 26 March 2003 (when section 141FB was originally enacted), that penalty or conviction is not taken into account in determining whether a current penalty will be reduced for previous behaviour.

Summary

- Inland Revenue reduces a current penalty under section 141FB(1) or (2) for previous behaviour depending on the type of shortfall penalty.

- Pursuant to section 141FB(1) and (2), the current penalty will be reduced by 50% if the taxpayer is not:

- convicted of a "disqualifying offence", and/or

- liable for a "disqualifying penalty".

- convicted of a "disqualifying offence", and/or

- Generally, section 141FB applies separately to each tax type, such as PAYE, income tax and fringe benefit tax (FBT).

- However, if the taxpayer is convicted of a "disqualifying offence" pursuant to paragraph (a) of that term's definition in section 141FB(3), then a later shortfall penalty for any tax type cannot be reduced by 50%. The "satisfactory behaviour period" does not apply (see paragraphs 38 to 40 of this SPS for details).

- Where a taxpayer is liable to pay a current penalty for evasion imposed under section 141E(1) and the penalty is not reduced for voluntary disclosure, any later shortfall penalty for evasion for the same tax type cannot be reduced by 50% under section 141FB(1). The "satisfactory behaviour period" does not apply in these cases (see paragraphs 44 to 45 of this SPS for details).

- Nevertheless, a shortfall penalty that is reduced for voluntary disclosure is not a "disqualifying penalty". It will not affect the taxpayer's eligibility to the 50% reduction of any later shortfall penalty imposed.

- For the purpose of section 141FB(2), when separate current penalties are imposed under any of sections 141A to 141D for different tax shortfalls identified in the same investigation or voluntary disclosure, each penalty will be treated as if the taxpayer was not liable for the other penalty provided the taxpayer:

- takes both tax positions on the same date, and/or

- is not liable for a shortfall penalty during the "satisfactory behaviour period" (as defined in paragraph 38 of this SPS) that ends on the earliest date on which the taxpayer takes the tax position relating to the tax shortfall.

- takes both tax positions on the same date, and/or

Background

- The August 2001 discussion document titled Taxpayer compliance, standards and penalties: a review (the discussion document) identified the following benefits from applying the previous behaviour reduction provision to all current penalties:

- Taxpayers perceive those taxpayers who repeatedly offend to be more harshly penalised, reflecting their failure to begin complying voluntarily.

- A concern that the shortfall penalty rates are excessive is addressed. (Especially in relation to voluntary disclosures where the rules are seen as penalising taxpayers who are attempting to comply.)

- The shortfall penalty rate for first time evasion is aligned with the evasion rate in Australia and Canada.

- Taxpayers perceive those taxpayers who repeatedly offend to be more harshly penalised, reflecting their failure to begin complying voluntarily.

- Section 141FB was originally enacted to implement the recommendations outlined in the discussion document including that a taxpayer's past compliance should be taken into account when imposing shortfall penalties.

- Since the publication of SPS INV 295 Reduction of Shortfall Penalties for Previous Behaviour, section 141FB has been amended in respect of shortfall penalties imposed on or after 21 December 2004.

- The new section 141FB contains a policy change in that offences under sections 143 to 145 are now considered when determining whether a taxpayer has a satisfactory record of previous compliance.

- The term "disqualifying offence" has been inserted into the new section 141FB. A taxpayer may not be eligible for a reduction of a current penalty if convicted of a "disqualifying offence". The term "disqualifying penalty" is retained in the new section 141FB.

- The term "satisfactory behaviour period" (see paragraph 38 of this SPS for details) is designed to be sufficiently long to demonstrate that the taxpayer's behaviour has changed, yet brief enough to not excessively burden the taxpayer.

Legislation

- The relevant legislative provisions are:

- the definition of "tax position" in section 3, and

- sections 141A to 141E, 141FB, 143, 143A, 143B, 143F to 143H, 144 and 145.

- the definition of "tax position" in section 3, and

Discussion

General

- Section 141FB was replaced pursuant to the Taxation (Annual Rates, Venture Capital and Miscellaneous Provisions) Act 2004. The new provision permits two types of previous behaviour reduction for shortfall penalties. Section 141FB(1) establishes the grounds for a 50% reduction of a shortfall penalty imposed for evasion under section 141E(1). Section 141FB(2) establishes the grounds for a 50% reduction of any other type of shortfall penalty imposed under sections 141A to 141D.

- Both subsections (1) and (2) of section 141FB refer to a "disqualifying offence" and a "disqualifying penalty" as the relevant criteria for determining eligibility to the 50% reduction.

- The term "disqualifying offence" is defined in section 141FB(3) to mean:

- An offence under section 143A, 143B, 143F, 143G, 143H or 145 for which a conviction is entered-

- On or after 26 March 2003; and

- Before the taxpayer takes the tax position to which the current penalty relates:

- On or after 26 March 2003; and

- An offence under section 143 or 144 that relates to the type of tax to which the current penalty relates and for which a conviction is entered-

- On or after 26 March 2003; and

- After the date that precedes, by the period specified in subsection (4), the date on which the taxpayer takes the tax position to which the current penalty relates; and

- Before the taxpayer takes the tax position to which the current penalty relates:

- On or after 26 March 2003; and

- An offence under section 143A, 143B, 143F, 143G, 143H or 145 for which a conviction is entered-

- The term "disqualifying penalty" is defined in section 141FB(3) to mean:

- For the purpose of subsection (1), a shortfall penalty that-

- Relates to the type of tax to which the current penalty relates; and

- Is for evasion or a similar act; and

- Is not reduced for voluntary disclosure by the taxpayer; and

- Relates to a tax position that is taken on or after 26 March 2003 and before the date on which the taxpayer takes the tax position to which the current penalty relates:

- For the purpose of subsection (2), a shortfall penalty that-

- Relates to the type of tax to which the current penalty relates; and

- If the current penalty is-

- For gross carelessness or taking an abusive tax position, is a shortfall penalty for evasion or a similar act or for gross carelessness or taking an abusive tax position:

- For not taking reasonable care or taking an unacceptable tax position, is a shortfall penalty of any sort; and

- For gross carelessness or taking an abusive tax position, is a shortfall penalty for evasion or a similar act or for gross carelessness or taking an abusive tax position:

- Is not reduced for voluntary disclosure by the taxpayer; and

- Relates to a tax position that is taken-

- On or after 26 March 2003; and

- After the date that precedes, by the period specified in subsection (4), the date on which the taxpayer takes the tax position to which the current penalty relates; and

- Before the date on which the taxpayer takes the tax position to which the current penalty relates.

- On or after 26 March 2003; and

- Relates to the type of tax to which the current penalty relates; and

Reduction for shortfall penalties for evasion imposed under section 141E(1)

- Pursuant to section 141FB(1), a current penalty for evasion imposed under section 141E(1) will be reduced by 50% if the taxpayer is not:

- convicted of a "disqualifying offence", and/or

- liable for a "disqualifying penalty".

- convicted of a "disqualifying offence", and/or

Disqualifying offence

- A current penalty, ie a shortfall penalty for evasion imposed under section 141E(1), will not be reduced for previous behaviour when a taxpayer is convicted:

- on or after 26 March 2003, and

- before the taxpayer takes the tax position to which the current penalty for evasion relates,

for:- a knowledge offence under section 143A, or

- an offence for evasion or a similar act under section 143B, or

- an offence in relation to inquiries made by Inland Revenue under section 143F, or

- an offence in relation to court orders under section 143G, or

- obstruction under section 143H, or

- other offences with no specified penalty under section 145.

- a knowledge offence under section 143A, or

- on or after 26 March 2003, and

- Furthermore, when the taxpayer is convicted:

- on or after 26 March 2003, and

- within the relevant "satisfactory behaviour period" (see paragraph 38 of this SPS), and

- before the taxpayer takes the tax position to which the current penalty for evasion relates,

for:

- an absolute liability offence under section 143, or

- certain offences under section 144 in relation to the Stamp and Cheque Duties Act 1971,

a current penalty relating to the same tax type as the offence for which the conviction is entered will not be reduced for previous behaviour. However, any later shortfall penalty for the same tax type will be reduced for previous behaviour if the conviction does not fall within the relevant "satisfactory behaviour period" for that shortfall penalty. - an absolute liability offence under section 143, or

- on or after 26 March 2003, and

Meaning of when a conviction is entered

- Generally, a conviction is entered after the final determination of the case, when the defendant is sentenced. Note that a guilty plea, per se, will not be a conviction. In particular, a judge may permit a guilty plea to be withdrawn before sentencing.

- If a taxpayer enters a guilty plea that is later ratified by the judge, the conviction is entered at the date of ratification. However ratification will not occur until sentencing.

- If a taxpayer is convicted but discharged, the taxpayer will still be treated as convicted. However, if the taxpayer is discharged without conviction, then a conviction has not been entered and there is no "disqualifying offence" for the purpose of section 141FB.

Tax types

- Generally, section 141FB applies separately to each tax type, such as PAYE, income tax and FBT. Therefore, a penalty imposed in relation to one tax type does not preclude a previous behaviour reduction for a later shortfall penalty relating to a different tax type.

- However, if the taxpayer is convicted of a "disqualifying offence" pursuant to paragraph (a) of that term's definition in section 141FB(3), then a later shortfall penalty for any tax type cannot be reduced by 50%.

Satisfactory behaviour period

- For the purpose of the definitions of "disqualifying offence" (ie an offence under sections 143 and 144) and "disqualifying penalty" (ie where the current penalty is not imposed for evasion under section 141E(1)), pursuant to section 141FB(4), the "satisfactory behaviour period" means:

- two years preceding the date on which the taxpayer takes the tax position to which the current penalty relates for the following tax types:

- the taxpayer's application of the PAYE rules,

- FBT,

- goods and services tax (GST), and

- resident withholding tax, or

- the taxpayer's application of the PAYE rules,

- four years preceding the date on which the taxpayer takes the tax position to which the current penalty relates for all other tax types (including income tax).

- two years preceding the date on which the taxpayer takes the tax position to which the current penalty relates for the following tax types:

- The commencement date of the "satisfactory behaviour period" is calculated by retrospectively applying the relevant period defined in paragraph 38 from the date that the taxpayer takes the tax position relating to the current penalty.

- However, if the taxpayer is convicted of a "disqualifying offence" pursuant to paragraph (a) of the term's definition in section 141FB(3) (see paragraph 31 of this SPS), then a later shortfall penalty for any tax type cannot be reduced under these rules, regardless of the period elapsed. That is, there is no relevant "satisfactory behaviour period".

Disqualifying penalty

- If a taxpayer has not been convicted of a "disqualifying offence" and is not liable for a "disqualifying penalty", a current penalty for evasion under section 141E(1) will be reduced by 50%.

- However, a current penalty for evasion will not be reduced by 50% pursuant to section 141FB(1) if the taxpayer is liable to pay an earlier shortfall penalty for evasion that:

- relates to the same tax type, and

- is not reduced for voluntary disclosure, and

- relates to a tax position taken on or after 26 March 2003 and before the date of the tax position to which the current penalty relates.

- relates to the same tax type, and

Impacts of voluntary disclosure in the context of a current penalty for evasion

- An earlier shortfall penalty for evasion that is reduced for voluntary disclosure is not a "disqualifying penalty". Therefore, it will not affect the taxpayer's eligibility to the 50% reduction of the current penalty for evasion.

Effects of imposing a shortfall penalty for evasion under section 141E(1)

- The imposition of a shortfall penalty for evasion will affect the taxpayer's eligibility to the 50% reduction of later shortfall penalties in some cases. That is, if the shortfall penalty for evasion is not reduced for voluntary disclosure, any later shortfall penalty for evasion for the same tax type will not be reduced by 50% under section 141FB(1). There is no "satisfactory behaviour period" in respect of a shortfall penalty for evasion in these cases.

- However, the "satisfactory behaviour period" will apply in cases where the later shortfall penalty is imposed under any of sections 141A to 141D (also see paragraphs 46 to 52 of this SPS). For example, a later penalty imposed for lack of reasonable care under section 141A for an income tax shortfall will be reduced by 50% under section 141FB(2) if the previous shortfall penalty for evasion, that is not reduced for voluntary disclosure, relates to an income tax position taken outside the four-year "satisfactory behaviour period".

Reduction for current penalties imposed under any of sections 141A to 141D

- Pursuant to section 141FB(2), a current penalty imposed under any of sections 141A to 141D will be reduced by 50% if the taxpayer is not:

- convicted of a "disqualifying offence", and/or

- liable for a "disqualifying penalty" within the "satisfactory behaviour period."

- convicted of a "disqualifying offence", and/or

Disqualifying offence

- Section 141FB(2) applies to a current penalty that may be imposed for:

- not taking reasonable care under section 141A, or

- taking an unacceptable tax position under section 141B, or

- gross carelessness under section 141C, or

- taking an abusive tax position under section 141D.

- not taking reasonable care under section 141A, or

- Pursuant to section 141FB(2), a current penalty, ie imposed under any of sections 141A to 141D, will not be reduced by 50% for previous behaviour when:

- a taxpayer is convicted of a "disqualifying offence" listed under paragraph (a) of that term's definition in section 141FB(3) (see paragraph 31 of this SPS),

- on or after 26 March 2003, and

- before the date of taking the tax position to which the current penalty relates.

- on or after 26 March 2003, and

- a taxpayer is convicted of a "disqualifying offence" listed under paragraph (a) of that term's definition in section 141FB(3) (see paragraph 31 of this SPS),

- Furthermore, a current penalty (ie imposed under any of sections 141A to 141D) will not be reduced by 50% for previous behaviour when:

- a taxpayer is convicted of a "disqualifying offence" listed under paragraph (b) of that term's definition in section 141FB(3) (see paragraph 32 of this SPS),

- on or after 26 March 2003, and

- before the date of taking the tax position to which the current penalty relates, and

- within the relevant "satisfactory behaviour period".

- on or after 26 March 2003, and

- a taxpayer is convicted of a "disqualifying offence" listed under paragraph (b) of that term's definition in section 141FB(3) (see paragraph 32 of this SPS),

Disqualifying penalty

- A current penalty, ie a shortfall penalty imposed under any of sections 141A to 141D, will not be reduced for previous behaviour if the taxpayer is liable to pay a "disqualifying penalty".

- Where a current penalty is imposed for gross carelessness under section 141C or for taking an abusive tax position under section 141D, a "disqualifying penalty" is a shortfall penalty that:

- relates to the same tax type as the current penalty, and

- is imposed for gross carelessness, taking an abusive tax position or evasion or a similar act, and

- is not reduced for voluntary disclosure, and

- relates to a tax position taken on or after 26 March 2003 that is within the "satisfactory behaviour period" (see paragraph 38 of this SPS) and before the date of the taxpayer's tax position to which the current penalty relates.

- relates to the same tax type as the current penalty, and

- Where a current penalty is imposed for not taking reasonable care under section 141A or for taking an unacceptable tax position under section 141B, a "disqualifying penalty" is a shortfall penalty of any sort that:

- relates to the same tax type as the current penalty, and

- is not reduced for voluntary disclosure, and

- relates to a tax position taken after 26 March 2003 which is within the "satisfactory behaviour period" and before the date of the taxpayer's tax position to which the current penalty relates.

- relates to the same tax type as the current penalty, and

Tax shortfalls arising from a single investigation or voluntary disclosure - section 141FB(5)

- For the purpose of this SPS, an "investigation" means any examination of a taxpayer's financial affairs verifying that the taxpayer has paid the correct amount of tax and is complying with the tax laws.

- Clear wording will be used in any communication to taxpayers when a decision to investigate has been made. Requests for information to enable the Commissioner to decide whether to investigate are not themselves part of an investigation. Examples of investigation activities include:

- income tax, GST and payroll checks (for example, capital/revenue discrepancies and GST on real property transactions),

- payroll, GST and FBT registration checks, and

- any other types of review by Inland Revenue.

- income tax, GST and payroll checks (for example, capital/revenue discrepancies and GST on real property transactions),

- For the purpose of section 141FB(2), when separate current penalties are imposed under any of sections 141A to 141D for different tax shortfalls identified in the same investigation or voluntary disclosure, each penalty will be treated as if the taxpayer was not liable for the other penalty provided the taxpayer:

- takes both tax positions on the same date, and/or

- is not liable for a shortfall penalty during the "satisfactory behaviour period" (as defined in paragraph 38 of this SPS) that ends on the earliest date on which the taxpayer takes the tax position relating to the tax shortfall.

- takes both tax positions on the same date, and/or

Standard Practice

- This SPS discusses the application of section 141FB. In particular, it describes the grounds for reducing a current penalty for evasion under section 141E(1) and for other grounds under sections 141A to 141D.

- Inland Revenue's standard practice in relation to the application of the previous behaviour reduction is illustrated by the following examples:

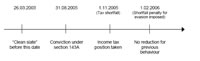

Example 1: disqualifying offence and current penalty for evasion

On 31 August 2005, a conviction is entered against a taxpayer for a knowledge offence under 143A. On 1 November 2005, the taxpayer takes a tax position that the taxpayer's income tax liability for the 2005 tax year is nil. Following an Inland Revenue investigation, a current penalty for evasion is imposed on 1 February 2006 for an income tax shortfall for the 2005 tax year. The taxpayer is not liable for another shortfall penalty.

The current penalty will not be reduced by 50% pursuant to section 141FB(1) because the taxpayer is convicted of a "disqualifying offence" after 26 March 2003 and before the taxpayer takes the tax position to which the current penalty for evasion relates.

[ Larger version of image for Example 1: | ]

Example 2: disqualifying offence occurs after the tax position taken

Applying the same facts as example 1 but a conviction is entered against the taxpayer under section 143A on 30 November 2005. The current penalty for evasion will be reduced by 50% pursuant to section 141FB(1) because the conviction is entered after the taxpayer has taken the tax position to which the current penalty relates and therefore is not a "disqualifying offence". Furthermore, the taxpayer is not liable for a "disqualifying penalty".

[ Larger version of image for Example 2: | ]

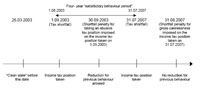

Example 3: disqualifying penalty and current penalty for evasion

A taxpayer takes a tax position on 1 May 2005. Following an Inland Revenue investigation, a current penalty for evasion is imposed on 1 August 2005 for an income tax shortfall for the 2004 tax year. The taxpayer has not been convicted of a "disqualifying offence". However, the taxpayer was liable to pay a shortfall penalty for evasion for an income tax position taken on 1 June 2003.

The shortfall penalty for evasion for the tax position taken on 1 June 2003 is a "disqualifying penalty" because:

- it is for the same tax type as the current penalty.

- it is not reduced for voluntary disclosure by the taxpayer.

- it relates to a tax position taken after 26 March 2003 and before the date on which the taxpayer takes the tax position to which the current penalty relates, ie 1 May 2005.

The current penalty will not be reduced by 50% under section 141FB(1) because the taxpayer is liable to pay a "disqualifying penalty".

[ Larger version of image for Example 3: | ]

Example 4: disqualifying penalty for a different tax type

Applying the same facts as example 3 but the current penalty relates to an FBT shortfall. The current penalty will be reduced by 50% under section 141FB(1). The earlier shortfall penalty is not a "disqualifying penalty" because it relates to a different tax type from the tax shortfall relating to the current penalty.

[ Larger version of image for Example 4: | ]

Example 5: disqualifying offence and current penalty for gross carelessness

On 1 April 2003, a conviction is entered against a taxpayer for a knowledge offence under section 143A. Following an Inland Revenue investigation a current penalty for gross carelessness under section 141C is imposed for an FBT shortfall in relation to the tax position taken on 5 April 2005. The current penalty is imposed on 1 July 2005. The taxpayer is not liable for another shortfall penalty.

The current penalty will not be reduced by 50% pursuant to section 141FB(2) because the taxpayer is convicted of a "disqualifying offence" after 26 March 2003 and before the taxpayer has taken the tax position to which the current penalty relates, ie 5 April 2005. This is notwithstanding the fact that the conviction under section 143A was entered against the taxpayer over two years before the current penalty is considered. The "disqualifying offence" also means that the taxpayer will not be eligible for a 50% reduction of any later shortfall penalty for any tax type.

[ Larger version of image for Example 5: | ]

Example 6: disqualifying offence occurs after tax position taken

Applying the same facts as example 5 but a taxpayer pleads guilty to an offence on 1 April 2005 and a judge ratifies the guilty plea and enters conviction against the taxpayer for a knowledge offence under section 143A on 15 April 2005. The guilty plea on 1 April 2005 does not amount to a conviction. Therefore, there is no "disqualifying offence" because the conviction is entered (ie on 15 April 2005) after the taxpayer has taken the tax position to which the current penalty relates (ie 5 April 2005). The current penalty will be reduced by 50% pursuant to section 141FB(2).

[ Larger version of image for Example 6: | ]

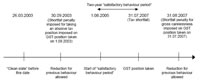

Example 7: disqualifying penalty and current penalty for gross carelessness

A taxpayer takes an income tax position on 31 July 2007 and a current penalty for gross carelessness under section 141C is imposed on 31 August 2007. Following a previous Inland Revenue investigation the taxpayer is liable to pay a shortfall penalty for taking an abusive tax position imposed under section 141D on 30 September 2003 for an income tax position taken on 1 September 2003. The shortfall penalty was not reduced for voluntary disclosure but was reduced for previous behaviour. The taxpayer is not convicted of a "disqualifying offence".

The shortfall penalty for taking an abusive tax position is a "disqualifying penalty" because:

- it is for the same tax type as the current penalty.

- it is not reduced for voluntary disclosure by the taxpayer.

- it relates to a tax position taken after 26 March 2003, within the 4-year "satisfactory behaviour period" (1 August 2003 to 31 July 2007) and before the date of the taxpayer's tax position to which the current penalty relates, ie 31 July 2007.

[ Larger version of image for Example 7: | ]

Example 8: shortfall penalty outside satisfactory behaviour period

Applying the same facts as example 7 but the current penalty and earlier shortfall penalty relate to a GST position. In these circumstances the earlier shortfall penalty is not a "disqualifying penalty" because the tax position to which it relates does not fall within the two-year "satisfactory behaviour period" (1 August 2005 to 31 July 2007). The current penalty will also be reduced by 50% pursuant to section 141FB(2).

[ Larger version of image for Example 8: | ]

Example 9: voluntary disclosure by the taxpayer

A taxpayer files an income tax return and omits income from a particular source. After filing the return, the taxpayer voluntarily discloses the income omission and a shortfall penalty for lack of reasonable care is imposed on 7 August 2005 which is reduced by 75% for the voluntary disclosure and a further 50% for previous behaviour.

In the next two returns the taxpayer omits income and later discloses the omission. On both occasions the shortfall penalty for gross carelessness under section 141C is reduced by 75% for the voluntary disclosure and a further 50% for previous behaviour. As the shortfall penalties imposed on 7 August 2005 and 7 August 2006 are both reduced for voluntary disclosure, neither penalty is a "disqualifying penalty" and the additional 50% previous behaviour reduction is available for both the shortfall penalties imposed on 7 August 2006 and 7 August 2007 respectively. It is also noted that the shortfall penalty for taking lack of reasonable care imposed on 7 August 2005 cannot be a "disqualifying penalty", where the current penalty is for gross carelessness.

[ Larger version of image for Example 9: | ]

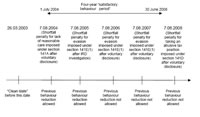

Example 10: Inland Revenue's investigation subsequent to the taxpayer's voluntary disclosure

A taxpayer files an income tax return and omits income from a particular source. After filing the return, the taxpayer voluntarily discloses the income omission and a shortfall penalty for lack of reasonable care is imposed on 7 August 2004 which is reduced by 75% for the voluntary disclosure and 50% for previous behaviour.

Inland Revenue decides to investigate the period following the first voluntary disclosure and a current penalty for evasion is imposed on 7 August 2005. This current penalty is reduced by 50% for previous behaviour under section 141FB(1), as the previous shortfall penalty was reduced for voluntary disclosure by the taxpayer and also was not imposed for evasion or a similar act. Therefore, the previous shortfall penalty is not a "disqualifying penalty".

On 7 August 2006, the taxpayer makes a voluntary disclosure of an income tax shortfall and the shortfall penalty is reduced by 75%. This shortfall penalty is not reduced for previous behaviour, as the previous shortfall penalty for evasion imposed on 7 August 2005 is a "disqualifying penalty". The previous shortfall penalty for evasion related to income tax and was not reduced for voluntary disclosure.

The following year, Inland Revenue again investigates the period following the voluntary disclosure and a shortfall penalty for evasion is imposed on 7 August 2007. This shortfall penalty will not be reduced for previous behaviour under section 141FB(1), as the previous shortfall penalty for evasion imposed on 7 August 2005 is a "disqualifying penalty". The previous shortfall penalty for evasion related to income tax and was not reduced for voluntary disclosure.

Note: the "satisfactory behaviour period" does not apply to the "disqualifying penalty" for the purpose of section 141FB(1).

In a later period (on 7 August 2008) the taxpayer voluntarily discloses omitted income and a shortfall penalty for taking an abusive tax position is imposed under section 141D. The voluntary disclosure relates to an income tax position taken on 30 June 2008. This shortfall penalty will not be reduced for previous behaviour under section 141FB(2). The previous shortfall penalty for evasion imposed on 7 August 2005 is a "disqualifying penalty" because it is not reduced for voluntary disclosure and relates to an income tax position taken on a date falling within the four-year "satisfactory behaviour period" for the current penalty (ie 1 July 2004 to 30 June 2008).

[ Larger version of image for Example 10: | ]

Example 11: tax shortfalls arising from a single investigation

Separate shortfall penalties for gross carelessness are imposed in respect of a bad debt deduction and a depreciation claim respectively. The tax shortfalls are identified in a single investigation. Both tax positions are taken on the same date. The taxpayer is not liable for a previous shortfall penalty. Under section 141FB(5), in considering whether the current penalties can be reduced for previous behaviour, each penalty would be determined as if the taxpayer was not liable for the other penalty.

This Standard Practice Statement is signed on 8 June 2006.

Graham Tubb

National Manager, Technical Standards